- Why choosing business setup in Hong Kong

- How to set up a company in Hong Kong

- Step 1: Choose the right company type

- Step 2: Pick a company name

- Step 3: Choose the Registered Address

- Step 4: Decide on personnel and capital structure

- Step 5: Register your company in Hong Kong

- Step 6: Obtain business licenses and permits

- Step 7: Set up business bank account

- Step 8: Ensure annual compliance

- Cost of setting up a Hong Kong limited company

- Hong Kong government grants available for SMEs

- Conclusion

Starting a company in Hong Kong can be an exciting and promising venture. Hong Kong stands out as a premier destination for entrepreneurs and businesses globally, thanks to its vibrant business landscape, attractive tax system, and strategic geographic location.

How to set up a company in HK can be intricate, involving numerous steps and requirements.

This article aims to simplify the process. We will offer a step-by-step roadmap to help you successfully establish your business presence in this pro-business city.

Whether you’re an experienced entrepreneur or a first-time business owner, our goal is to demystify the process and provide you with the knowledge you need to turn your business dreams into reality.

Why choosing business setup in Hong Kong

Below are some benefits of setting up a company in Hong Kong, making it a favored choice for entrepreneurs and businesses!

Ease of setting up a company

Foreigners are permitted to take complete ownership of their Hong Kong-based corporations.

Requirements for incorporating in Hong Kong are simple, and the registration procedure can be done shortly online within 24 hours.

Open-oriented market

As one of the freest economies, Hong Kong accepts almost all legal business categories. The flexibility extends to money transfer and currency exchange, allowing for seamless transactions across all business types.

Also, the government does not limit Hong Kong companies to having bank accounts in any location.

Business-friendly tax system

The corporate tax rates in Hong Kong are competitive as they follow a territorial principle system that exempts tax for many profit types earned outside of Hong Kong.

The income derived from Hong Kong is charged marginally from 8.25% to 16.5% for the year of assessment 2018/19 onwards.

Furthermore, capital gain tax, dividend tax, VAT/sales tax, withholding tax on dividens and interests are not applicable.

Accessible gateway to Mainland China and Asian countries

Hong Kong has a significant location advantage in that it is possible to travel to China within one day and to most Asian destinations with a five-hour flight.

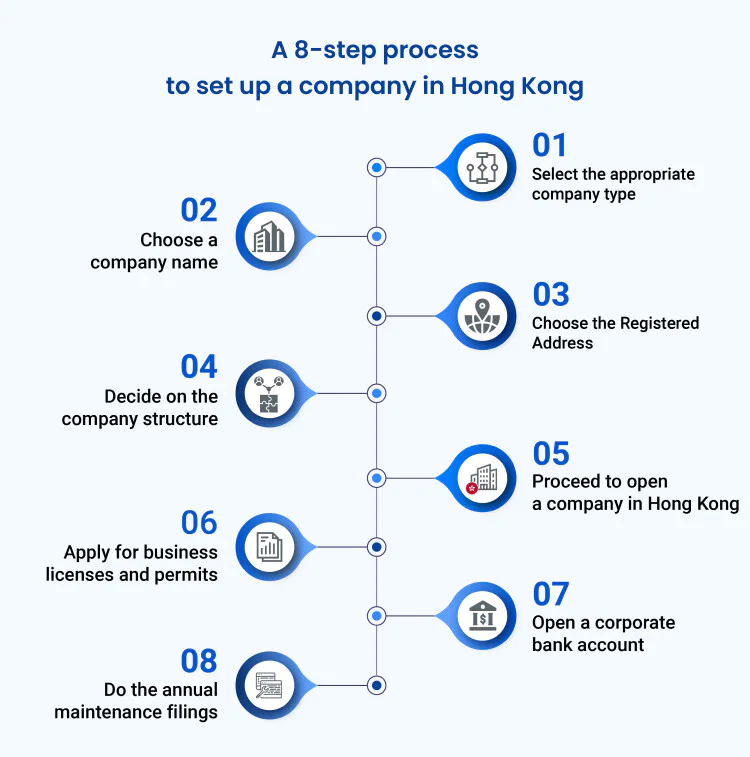

How to set up a company in Hong Kong

Setting up a company in Hong Kong involves several steps and requirements. Here’s a general overview of the process:

Step 1: Choose the right company type

Tips: Before establishing in Hong Kong, don’t forget to: assess your company’s needs, size, and financial capacity. Also considering the characteristics of different business entity types in Hong Kong for a successful process.

In Hong Kong, business entity options are typically categorized as follows:

- Sole Proprietorship

- Partnership

- Limited Liability Company (LLC): Private Company Limited by Shares, Public Company Limited by Shares, or Company

- Limited by Guarantee

- Branch Office or Representative Office (Liaison Office)

This guide primarily focuses on setting up a Hong Kong limited company—specifically, the Private Company Limited by Shares. This popular choice appeals to both local and foreign entrepreneurs.

Step 2: Pick a company name

When selecting a company name in Hong Kong, it’s important to note that the process differs from some other offshore jurisdictions like BVI, Seychelles, and Belize.

In Hong Kong, the Companies Registry (CR) doesn’t provide provisional approval or reservation of company names.

Here are some key points to consider:

Types of names

A company name in Hong Kong can be in English (must end with “Limited”), in traditional Chinese (must end with “有限公司”), or a separate English name and Chinese name. However, names with a combination of English and Chinese characters are not accepted.

Possible rejection

Your proposed name may be declined if it

- Matches or closely resembles a name already listed in the Companies Registry’s “Index of Company Names”;

- Matches the name of an existing body corporate incorporated or registered under an Ordinance;

- Infringes upon trademarks; or

- Is considered offensive or against public interest, as determined by the Registrar’s opinion.

Special approval

If your company name includes words or expressions like ‘Council,’ ‘Department,’ ‘Bureau,’ ‘Commission,’ ‘Government,’ etc., it must be sent for approval by the Government of the Hong Kong Special Administrative Region (HK SAR).

Branch or Representative Office

If you’re registering a branch or representative office, its name must match that of the parent company.

For a more detailed description of the eligibility criteria for your company names, you can refer to the company name registration requirement.

To expedite the process and avoid delays in incorporation, it’s advisable to check the availability of your chosen name with a company registration agency before proceeding. This can help ensure that your desired company name meets the necessary criteria and is available for use.

BBCIncorp supports your Hong Kong company incorporation right from the preparation stage. Our resources can help you ascertain your selected country among some countries in your consideration list, and suggest you the best banking option to suit your business size and industry. You can also check the eligibility of your desired company name. And estimate your cost before starting your HK business in minutes.

Explore the role of a holding company to see how it manages assets, subsidiaries, and tax planning strategies.

Step 3: Choose the Registered Address

The Registered Address is the location to be utilized for all official company documents and communication.

When deciding on your Registered Address, several key factors need to be taken into account:

- It must be a physical address situated within Hong Kong, and not a P.O. Box or virtual office.

- The address must be publicly accessible during regular business hours.

- Residential addresses are not permissible.

- Ideally, the address should be within a commercial or industrial building, rather than a private residence or apartment.

Step 4: Decide on personnel and capital structure

When establishing a private company in Hong Kong, it’s essential to adhere to specific requirements for your business entity:

Directors: You need at least one director, who can be either

- An individual (aged 18 or older)

- A corporate entity (only in strict cases)

- Directors can be Hong Kong residents or non-residents, and you can also appoint nominee directors. There’s no limit to the maximum number of directors your company can have.

Shareholders: You must have at least one shareholder, who can be either

- An individual (aged 18 or older)

- A corporate entity

- Shareholders can be Hong Kong residents or non-residents. Nominee shareholders are allowed, and it’s possible for the sole director to also act as a shareholder.

Company Secretary: You are required to appoint a company secretary who can either be a Hong Kong local individual or a legal entity. This role is mandatory by law, and the sole director cannot serve as the company secretary.

Share capital: Your company needs to have a minimum share capital of HKD 1.00, with no maximum limit. Bearer shares are not permitted.

Step 5: Register your company in Hong Kong

The process of a Hong Kong company’s registration includes:

- Begin by submitting an application for the approval of your chosen company name to the Companies Registry (CR).

- Compile and submit all the necessary documents as listed below:

- Completed Hong Kong application form.

- A copy of the Articles of Association.

- Copies of passports and residential address proof for foreign shareholders.

- Copies of Hong Kong ID cards for local shareholders.

- Copies of all company documents for corporate shareholders.

If your company has corporate shareholders, the CR will require a completed form NNC1, signed by the directors. This form is typically returned to them physically. This part of the process usually takes about 4 to 5 working days.

Once your application is approved, the Companies Registry will issue a Certificate of Incorporation for your company.

Depending on how your incorporation documents were submitted, you can either receive this certificate online or in person at the CR’s office.

After registering your company, you need to apply for a Business Registration Certificate from the Inland Revenue Department. This certificate is required under the Business Registration Ordinance and is necessary for conducting any business in Hong Kong. You will need to pay the applicable business registration fee.

Step 6: Obtain business licenses and permits

Depending on the nature of your business activities, you may need to obtain specific licenses or permits. These can include things like food licenses, entertainment licenses, import or export licenses, and more. The requirements for these licenses can vary widely based on your industry and business activities.

It’s essential to register for these licenses or permits within one month of establishing your company. The process typically takes between 2 to 8 weeks from the registration date.

Please be noted that not all businesses in Hong Kong are subject to these licensing requirements. Only certain sectors necessitate the application for a business license. You can find detailed guidance on this matter in our article licenses and permits in Hong Kong.

Step 7: Set up business bank account

For your Hong Kong company’s corporate bank account, consider selecting a top banking option. Especiallly if you plan to integrate with established payment gateways like PayPal and Stripe.

The essential documents required for opening a bank account in Hong Kong typically include:

- Account application forms;

- Corporate registration documents;

- Copies of passports for key members;

- Personal resumes;

- Bank reference letters for each key member;

- Bank statements for each key member or any related corporate entity; and

- Proof of business activities (agreements, invoices, contracts, etc) for your current company or any related entities.

Please note that this list is not exhaustive, and additional documents may be requested by the bank during their compliance check. All documents provided must be in English or Chinese for Hong Kong banks.

Worried about your Hong Kong bank account application facing rejection? Explore our case study: 3 reasons why Hong Kong banks may reject your application.

You should prepare your application with as much detail as possible to avoid confusion and potential issues. Most banks prioritize transparency. So, the clearer and more comprehensive the information you provide, the higher the likelihood of a successful application.

Step 8: Ensure annual compliance

To maintain an active status and avoid unexpected fines from the government, it is crucial for your Hong Kong company to meet annual compliance requirements.

Some key ongoing compliance tasks for your Hong Kong company:

Annual Renewal of the Business Registration Certificate: Apply for the renewal at least one month before the expiry date.

Annual General Meeting (AGM): Hold the AGM within 18 months from the company’s establishment date and no later than 15 months for subsequent meetings.

Annual Return with the Companies Registry (CR): File the annual return with the CR within 42 days of the company’s incorporation anniversary.

Annual Tax Return with the Inland Revenue Department (IRD): Submit a profits tax return along with audited accounts in the 18th month from the company’s formation date and subsequently every 12 months.

Employer’s Return with the IRD: File the required forms within the specified prescribed period.

COMPLYMATE

Tired of sifting through endless paperwork to understand jurisdictions’ compliance requirements? Our guide can help!

Try Now

Failure to comply with these annual requirements can result in penalties or even the cancellation of your business. You can stay on top of your compliance schedule by monitoring government notices and calendars.

Explore what a trust company does and how it manages assets, fiduciary services, and regulatory compliance.

Cost of setting up a Hong Kong limited company

Setting up business in Hong Kong incurs varying expenses based on factors like business nature, size, and specific requirements.

To give you a clearer picture, here are some typical costs you might encounter:

- Business registration fee (BR fee): To register your business with the government, you’ll need to pay a fee of HK$2,150.

- Government and license fee: Depending on the nature of your business activities, you may need to pay additional government fees or obtain specific licenses. These fees can vary but typically amount to around HK$2,000.

- Registered office address fee: It’s a requirement to have a registered office address in Hong Kong. This could involve expenses related to renting physical office space or utilizing virtual office services, which can start at approximately HK$2,000 per year.

- Corporate secretary fee: Every company in Hong Kong must have a corporate secretary. You have the option to hire an individual or engage a corporate services provider for this role. The cost of a corporate secretary can vary but usually begins at around HK$1,500 to HK$3,000 annually.

- Business bank account fee: There may be initial deposit requirements and potential fees associated with maintaining the account. The cost for opening an account can vary, but it might start at around HK$500 or more.

Looking to start a Hong Kong business without breaking your budget?

Consider our cost-effective Hong Kong company formation package, which covers all the essentials to kickstart your dream venture. Reach out to us for further details!

Hong Kong government grants available for SMEs

The Hong Kong government provides various support programs for small and medium-sized enterprises (SMEs), including:

- SME Financing Guarantee Scheme

- SME Export Marketing Fund

SME Financing Guarantee Scheme

Initially established by Hong Kong Mortgage Corporation Limited on January 1, 2011, the SME Financing Guarantee Scheme has been managed by HKMC Insurance Limited since May 1, 2018.

It aims to assist Hong Kong-based SMEs in obtaining financing for their growth. Under this scheme, SMEs can receive guarantees of up to 80% on loans obtained from financial institutions.

This financial support can be instrumental in helping SMEs expand their businesses. If you are an SME based in Hong Kong seeking financing opportunities, consider exploring the SME Financing Guarantee Scheme.

To learn more and apply, visit the official HKMC website.

SME Export Marketing Fund

Launched in 2001, the SME Export Marketing Fund is designed to offer financial assistance to Hong Kong-based SMEs looking to participate in international trade fairs and exhibitions.

To qualify for this fund, companies must:

- Be registered and operating in Hong Kong

- Not have received any other government funding for the same purpose.

In response to current economic challenges, the scope of the SME Export Marketing Fund has expanded as of April 30, 2021. It now covers not only large-scale exhibits but also online exhibitions aimed at the local market.

Additionally, eligibility for the fund has been extended to non-SMEs for a period of two years. The maximum funding available per enterprise is HKD$1,000,000.

To learn more and apply, visit the official SMElink website.

Conclusion

Not only the attractive tax regime, and the world-class financial market, Hong Kong company formation’s simplicity also make this country one of the largest business centers for startups and businesses of all sizes.

This article clarifies how to set up a company in Hong Kong. At BBCIncorp, we take pride in offering a swift and hassle-free incorporation service to enhance your convenience.

Reach out to us via service@bbcincorp.com or use the chat box to connect with our team for guidance on setting up your Hong Kong company today.

Frequently Asked Questions

What is IRD?

IRD stands for Inland Revenue Department, which is the Hong Kong government’s tax authority. It is responsible for collecting a variety of taxes, including income tax, property tax, and stamp duty.

How many types of business structure in Hong Kong?

The business entities in Hong Kong can be classified into

- Private company

- Public company

- Limited by shares or guarantees

- Sole proprietorship

- Partnership

- Branch

- Representative office

You can read more about pros and cons of each type here.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- Why choosing business setup in Hong Kong

- How to set up a company in Hong Kong

- Step 1: Choose the right company type

- Step 2: Pick a company name

- Step 3: Choose the Registered Address

- Step 4: Decide on personnel and capital structure

- Step 5: Register your company in Hong Kong

- Step 6: Obtain business licenses and permits

- Step 7: Set up business bank account

- Step 8: Ensure annual compliance

- Cost of setting up a Hong Kong limited company

- Hong Kong government grants available for SMEs

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.