Navigating property transactions in Hong Kong can be complex, especially for buyers and investors trying to understand their financial obligations to the government. A key part of this is the Hong Kong stamp duty, an important aspect of the real estate industry.

This guide simplifies the intricacies of stamp duty in Hong Kong, covering what it includes, who is responsible, the main types of stamp duty, and methods for stamping.

The basics of stamp duty Hong Kong

Stamp duty in Hong Kong is a tax imposed by the government on certain documents, known as “instruments”, that facilitate the sale, transfer, and lease of immovable property like real estate, and the transfer of stock in Hong Kong companies.

The Stamp Duty Ordinance (Cap. 117) is the main law that regulates stamp duty in Hong Kong. By mandating stamp duty payments on certain documents, the Hong Kong courts not only regulate the property market but also create a secure space for investors and residents. This legal framework plays a crucial role in upholding a stable tax system in Hong Kong.

Instruments subject to stamp duty

This duty applies to various instruments, including but not limited to the following:

- Conveyance of sale of immovable property in Hong Kong (i.e., legal assignment): This document is used to legally transfer the ownership of the property from the seller to the buyer.

- Agreement for sale and purchase of immovable property: This is a preliminary contract between the buyer and seller of the property, outlining the terms and conditions of the sale, including the price, property details, and obligations of both parties.

- Lease agreement of immovable property (e.g., tenancy agreement): This document outlines the terms under which the property is leased to the tenant, including rent, duration of the lease, and responsibilities of both landlord and tenant.

- Instrument of stock transfer: The contract notes for the sale or purchase of any Hong Kong stock, or the transfer document (in cases of shares transferred as gifts), are liable to stamp duty.

Person liable for stamping

The person liable for stamping, which means paying the stamp duty, varies according to the nature of instruments and transactions:

- For the conveyance on sale or agreement for sale of immovable property: The buyer and the seller are jointly responsible for paying stamp duty.

- For lease agreement: The landlord, tenant, and any other persons signing the agreement are liable for the payment of stamp duty.

- For the transferring of Hong Kong stock:

- The person liable is typically the agent. If there is no agent involved in the transaction, then the principal affecting the sale or purchase is responsible for paying the stamp duty; and

- Both the transferor (the person who is transferring the stock) and the transferee (the person who is receiving the stock) are also liable for the payment of stamp duty.

Types of Hong Kong property stamp duty

There are 4 main types of Hong Kong stamp duty applicable in the context of property transactions, including Ad Valorem Stamp Duty, Buyer’s Stamp Duty, Special Stamp Duty, and Stamp Duty for Tenancy Agreements.

Cancellation of certain types of stamp duty from February 28, 2024

Starting February 28, 2024, special stamp duty (SSD), buyer’s stamp duty (BSD), and new residential stamp duty (NRSD) will no longer apply to residential property transactions in Hong Kong.

Instead, both sellers and buyers will be subject to ad valorem stamp duty (AVD) based on Scale 2 rates (ranging from HK$100 to 4.25% of the consideration).

For detailed information, refer to our Hong Kong Budget 2024/25 update.

We still keep the overview of stamp duty types in the section below for your reference, but please be aware of the new changes that come into effect after February 28, 2024.

Ad Valorem Stamp Duty (AVD)

The Ad Valorem Stamp Duty (AVD) is a tax levied on any instruments for the sale or transfer of property in Hong Kong, and the amount payable is based on the consideration or market value of the property, whichever is higher.

The tax is calculated using either Scale 1 or Scale 2. Initially, Scale 1 was divided into two parts:

- Part 1 for residential property; and

- Part 2 for non-residential property.

However, in November 2016, the government merged Scale 1 into a single scale with higher rates.

Important update

Starting from February 28, 2024, Hong Kong eliminates differential treatment based on property type (residential vs. non-residential) or the buyer’s status (Permanent residents vs. Non-permanent residents or corporate buyers) for AVD.

All parties involved in property transactions will now follow the applicable rates for Scale 2.

Scope of application

Scale 1 applies to the agreement for the sale of residential property executed on or after 5 November 2016 (unless the sale agreement was executed before that date).

Please note that Scale 1 does not apply when the buyer is a Hong Kong Permanent Resident (HKPR) purchasing a residential property for the first time. However, if that first-time buyer purchases more than one residential property under a single instrument, Scale 1 will still be applicable.

Scale 2 applies to the following scenarios:

- For non-residential property:

- Applicable on any instrument executed on or after 26 November 2020 for the sale and purchase of non-residential property.

- For residential property:

- Applicable when a single residential property is purchased by Hong Kong Permanent Resident(s) (HKPR) who do not own any other residential property in Hong Kong SAR at the time of purchase, and

- Some other specified circumstances.

Applicable rates

The applicable rates for Scale 1 are as follows:

- For instruments of residential property executed between 5 November 2016 and 24 October 2023: A flat rate of 15% of the consideration or value of the property (whichever is the higher).

- For instruments of residential property executed on or after 25 October 2023: A flat rate of 7.5% of the consideration or value of the property (whichever is the higher).

The applicable rates for Scale 2 are as follows:

| Consideration or value of the property (whichever is higher) | Scale 2 rates |

|---|---|

| Up to $3,000,000 | $100 |

| $3,000,000 to $3,528,240 | $100 + 10% of the excess over $3,000,000 |

| $3,528,241 to $4,500,000 | 1.50% |

| $4,500,001 to $4,935,480 | $67,000 + 10% of the excess over $4,500,00 |

| $4,935,481 to $6,000,000 | 2.25% |

| $6,000,001 to $6,642,860 | $135,000 + 10% of the excess over $6,000,000 |

| $6,642,861 to $9,000,000 | 3.00% |

| $9,000,001 to $10,080,000 | $270,000 + 10% of the excess over $9,000,000 |

| $10,080,001 to $20,000,000 | 3.75% |

| $20,000,001 to $21,739,120 | $750,000 + 10% of the excess over $20,000,000 |

| $21,739,121 and above | 4.25% |

Liability of AVD payment

Both the seller and buyer are equally responsible for paying the AVD, regardless of whether it’s calculated at Scale 1 or Scale 2 rates.

If AVD was charged at Scale 2 based on the buyer’s declaration as a HKPR without beneficial ownership of other residential properties in Hong Kong, and the declaration was later found incorrect, only the buyer is liable for paying the difference between the AVD charged at Scale 2 and what would have been charged at Scale 1.

Exemption of AVD

The cases below are exempt from AVD:

- Nomination of a close relative (whether they are HKPRs or not) who does not own any other residential property in Hong Kong when nominated.

- Transfer of a property to the beneficiary of the estate of a deceased person as outlined in a will or the laws of intestacy; or acquisition of the property through the right of survivorship.

- Acquisition of residential property by a body corporate from an associated body corporate.

- Acquisition or transfer of properties by the Government.

- Receipt of property gifts by charitable institutions exempt from tax under section 88 of the Inland Revenue Ordinance (Cap. 112).

Buyer’s Stamp Duty (BSD)

Important update

Under the implementation of the Hong Kong Budget 2024/25, buyer’s stamp duty (BSD) will no longer apply to residential property transactions after February 28, 2024.

You can still refer to the below information for reference, but please keep in mind it will no longer apply after February 28, 2024.

In addition to AVD, there is also a Buyer’s Stamp Duty (BSD) that is payable by the buyer. BSD applies to sales or transfers of residential properties purchased by non-Hong Kong Permanent Residents. Introduced in 2012, BSD aims to stabilize the property market and regulate foreign buyers’ impact.

Scope of application

Unless exempted from BSD, any agreement for sale or conveyance on sale for acquisition of any residential property executed on or after 27 October 2012 will be subject to BSD, in addition to the current Ad Valorem Stamp Duty and the Special Stamp Duty, if applicable.

BSD stamp duty rates

BSD is charged at a flat rate on the consideration or the market value of the property (whichever is higher).

- 15% BSD rate applies to non-Hong Kong Permanent Resident (non-HKPR) buyers who entered into a Provisional Agreement for Sale and Purchase (PASP) for the purchase of a residential property on or after 27 October 2012 but before 25 October 2023.

- 7.5% applies to non-HKPR buyers who entered into a PASP for the purchase of a residential property on or after 25 October 2023.

These changes reflect the Hong Kong government’s adjustments to stamp duty rates over time, possibly in response to the real estate market conditions and policy objectives related to housing affordability and market stability.

Exemption of BSD

BSD is not applicable if the buyer is a Hong Kong permanent resident acquiring the property on his/her own behalf (i.e. the person is both a legal and beneficial owner) or if the following exemption applies:

- Acquisition of a residential property by (1) a HKPR jointly with a close relative or close relatives who is/are not HKPR and (2) each of the purchasers is acting on his/her own behalf.

- Transfer of residential property to (1) close relative(s) who is not a HKPR, and (2) each of the transferee is acting on his/her own behalf.

- Nomination of (1) a non-HKPR close relative(s), of the original purchaser(s) to take up the assignment of a residential property and (2) each of the nominees is acting on his/her own behalf.

- Addition/deletion of name(s) of non-HKPR person(s) to/from a chargeable agreement/conveyance for sale if the person(s) is/are a close relative(s) of the original purchaser(s) and each of the persons is acting on his/her own behalf.

- Acquisition or transfer of a residential property through a court order or under a court order.

- Transfer/vesting of a mortgaged residential property under a conveyance to/in its mortgagee that is a financial institution, or a receiver appointed by the mortgagee.

- Transactions involving the sale or transfer of residential properties among associated corporate entities.

- Acquisition of a residential property by a person acting on his/her own behalf to replace another residential property that was owned by that person and that has fallen under certain circumstances.

- Purchase or transfer of residential properties by or to the Government.

- Gift of residential property to charitable institutions exempted from tax under section 88 of the Inland Revenue Ordinance.

Special Stamp Duty (SSD)

Important update

Under the Hong Kong Budget 2024/25, special stamp duty (SSD) will not apply to residential property transactions after February 28, 2024. You can still read the information below for reference.

The Special Stamp Duty (SSD) applies to residential properties that are sold or transferred within a certain time frame after acquisition.

Properties resold within 24 months (or a shorter period) after acquisition are subject to SSD, with the rates decreasing progressively the longer the property is held. The aim is to discourage rapid buying and selling which can lead to property price volatility.

Scope of application

Unless the transaction is exempted, SSD is applicable if all of the following conditions are met:

- The transaction entails buying, selling, or transferring a residential property;

- The property is acquired by the seller or transferor on or after 20 November 2010 and is disposed of (which includes a resale or transfer) by the seller or transferor within 24 months (if the property was acquired and disposed of on or after 25 October 2023) from the date of acquisition.

SSD stamp duty rates

The SSD rate in respect of a residential property acquired and disposed of on or after 25 October 2023 is as follows:

- 20% if the property has been held for 06 months or less.

- 15% if the property has been held for more than 06 months but for 12 months or less.

- 10% if the property has been held for more than 12 months but for 24 months or less.

Liability of SSD payment

- The seller and the buyer of the property transaction and any person who uses the instrument are jointly and severally liable for paying the SSD.

- The seller and buyer should, by consent, specify in the Provisional Agreement for Sale and Purchase (PASP) and the Agreement for Sale and Purchase (ASP) which party shall pay the SSD.

Exemption of SSD

The following property transactions are exempted from SSD:

- Nomination of close relative(s) of the original purchaser(s) to take up the assignment of the residential property; and sale or transfer of the residential property to a close relative(s).

- Addition/deletion of name(s) of a person(s) to/from a chargeable agreement/conveyance for/on sale if the person(s) is the close relative(s) of the original purchaser(s).

- Sale or transfer of residential properties through a court order or under a court order.

- Sale of mortgaged residential properties by a mortgagee which is a financial institution, or by a receiver appointed by such a mortgagee.

- Sale or transfer of residential properties after demolishing the original residential properties thereon for constructing redeveloped ones.

- Sale of a deceased person’s estate, which involves residential property, by the executor or personal representative, and sale or transfer of a residential property by a person whose property is inherited/passed (under a will or law/tights of intestacy/survivorship) from a deceased person’s estate.

- Transactions involving the sale or transfer of residential properties among associated corporate entities.

- The residential property sold relates solely to a bankrupt’s estate or the property of a company that is being wound up by the court because of the inability to pay the debt.

- Sale of transfer of residential properties to the Government.

- Donation of residential properties to tax-exempted charitable institutions.

Tenancy Agreement Stamp Duty

This form of rental stamp duty Hong Kong applies specifically to the tenancy agreements for leasing property, It is calculated based on the property’s annual rent, with the following rate structure:

- Lease term up to 1 year: 0.25% of total rent.

- Lease term 1-3 years: 0.5% of total rent.

- Lease term over 3 years: 1% of total rent.

- For additional payments like key money and construction fees mentioned in the lease: 4.25% of consideration or the same as property sale duty.

- Duplicate agreement: $5 per counterpart of the tenancy agreement.

Upon receipt of the signed Tenancy Agreement (TA) from the tenant, the landlord must ensure the TA is stamped within 30 days. Subsequently, the landlord should provide the tenant with a counterpart of the stamped tenancy agreement signed by both parties. Failure to return the counterpart entitles the tenant to withhold rent payments until the landlord fulfills this obligation.

Stamp duty for transferring of Hong Kong stock

Stamp duty applies to transactions involving the transfer of Hong Kong stock. For these transactions, contract notes are required to be executed (prepared and signed) by both the transferor and the transferee.

In cases where shares are transferred as gifts (i.e., without any consideration being exchanged), the transaction does not require a contract note but still needs to be documented through an instrument of transfer (i.e., transfer document). For such transfers, a fixed duty of HK$5 is charged.

Applicable rates

| Nature of instruments | Rates |

|---|---|

| Contract notes for the transfer (i.e., sale or purchase) of Hong Kong stock | 0.13% of the amount of the consideration or its value on every sold note and every bought note |

| Transfer operating as a voluntary disposition inter vivos (transfer as gifts) | $5 + 0.26% of the value of the stock |

| Transfer of any other kind | $5 |

Timeline for stamping in Hong Kong

According to the Stamp Duty Ordinance (Cap. 117), taxpayers in Hong Kong are required to stamp the instruments within a specific time frame.

- Conveyance on sale of immovable property: within 30 days after the date of execution (prepared and signed).

- Agreement for the sale of residential property: within 30 days after the agreement date, or the earliest agreement date by the same parties on the same terms if there are prior agreements unless stated otherwise by the Ordinance.

- Lease agreement of immovable property: within 30 days after the date of execution.

- Contract notes for the transfer (i.e., sale or purchase) of Hong Kong stock:

- within 2 days of completing the sale or purchase in Hong Kong.

- within 30 days of completing the sale or purchase outside Hong Kong.

- Transfer of Hong Kong stock instruments (excluding gifts):

- prior to the execution date, if executed in Hong Kong.

- within 30 days post-execution, if executed outside Hong Kong.

- Transfer of Hong Kong stock instruments (gifts)

- within 7 days post-execution, if executed in Hong Kong.

- within 30 days post-execution, if executed outside Hong Kong.

Methods for stamping and payment of stamp duty

The stamping of instruments can be performed through electronic means or in person at the Stamp Office.

Conventional stamping

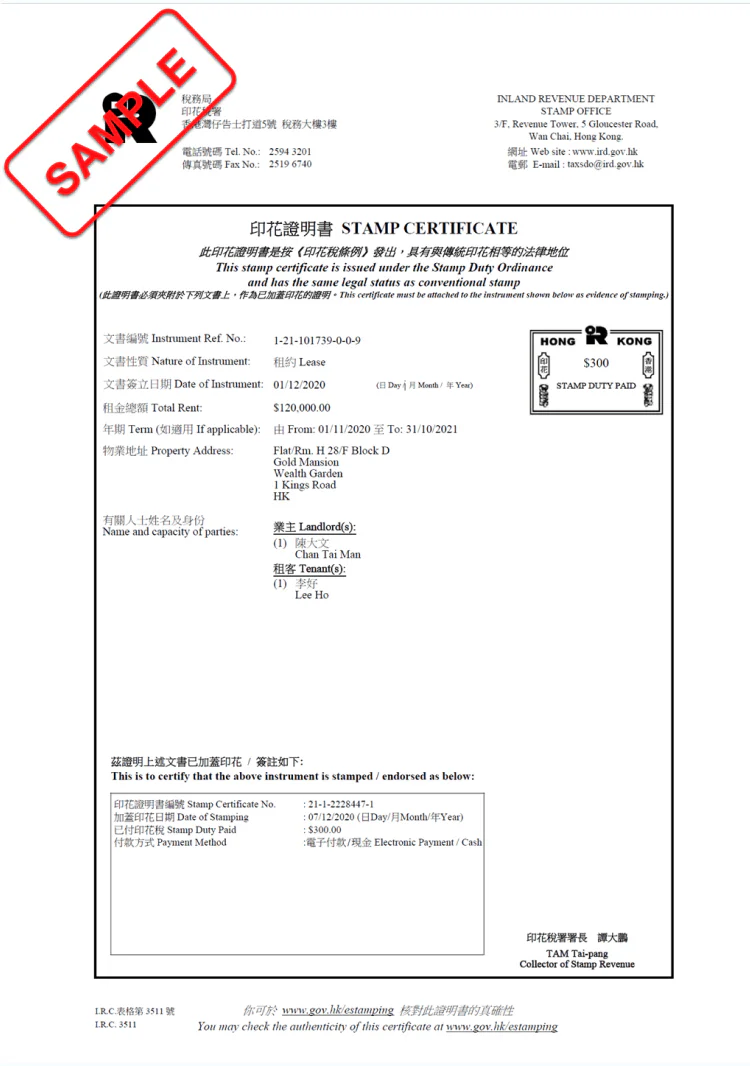

To stamp any instrument (such as property or stock-related documents), bring the original document, a stamping request, and supporting papers to the Stamp Office Counter. Once you submit these, along with the required payment, the Stamp Office will provide a stamp certificate or stamp the original document.

Below is a sample of a Tenancy Agreement stamp certificate (source: IRD Hong Kong).

E-stamping (electronic stamping application)

This involves printing a stamp certificate online for attachment to the instrument. These stamp certificates hold equal legal validity as conventional stamps imprinted on instruments.

Paper application of documents

For agreements, assignments, and tenancy agreements, you can submit an application in paper forms at the Stamp Office Counter for stamping without needing to present the original instrument. Once the stamping request is received and payment is made, the Stamp Office will provide a stamp certificate for the instrument.

Payment of stamp duty can be made electronically, by bank or cashier’s order, or in cash over the counter.

Conclusion

Stamp duty plays a crucial role in Hong Kong’s legal landscape, so grasping the diverse types and payment methods is key!

If you are planning on executing any instruments related to property or stock transactions in Hong Kong, be sure to consult with a legal professional to ensure compliance with all stamp duty requirements.

In case you’re considering company incorporation in Hong Kong or have any related queries, don’t hesitate to reach out to our support team at service@bbcincorp.com for expert guidance. We’re here to help you every step of the way!

Frequently Asked Questions

What stamp duty is required for first-time home buyers in Hong Kong?

When purchasing a property as an individual for the first time, you will need to pay the Ad Valorem Stamp Duty (AVD), which can go up to 4.25% of your property’s value. This rate falls under Scale 2 of the AVD, tailored for first-time buyers of residential properties.

Do non-residents need to pay stamp duty when purchasing residential property in Hong Kong?

Non-residents must pay stamp duty when purchasing residential property in Hong Kong. They face higher rates, as the Buyer’s Stamp Duty (BSD) is added to the standard Ad Valorem Stamp Duty (under Scale 1). The BSD stands at a fixed 7.5% for residential property purchases made on or after 25 October 2023.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.