About how to start a business to understand the essential steps for launching your venture successfully.

What is the system known as the Hong Kong Standard Industrial Classification Code? Like many other prosperous nations, Hong Kong has established a comprehensive classification system to manage its diverse business sectors efficiently.

Before commencing operations in this dynamic jurisdiction, you must understand and register your Hong Kong company’s code. This article will tell you all about the importance of this system and specify how to pick the correct category for your business.

Definition of the Hong Kong Standard Industrial Classification Code

The Hong Kong Standard Industrial Classification (HSIC) Code is a system used to classify business activities in Hong Kong. It provides a standardized method for categorizing economic activities for statistical and administrative purposes.

The current iteration of the HK Standard Industrial Classification Code is HSIC V2.0, which employs a 5-level hierarchical structure with the primary category known as the “Industry Section.” HSIC V2.0 aligns with the International Standard Industrial Classification (ISIC) of All Economic Activities Revision 4, established by the United Nations Statistics Division.

This classification system is often used by government agencies, businesses, researchers, and policymakers for various purposes. For businesses, the objectives shall encompass:

- Business categorization: The HSIC code helps businesses accurately represent the nature of their economic activities for tax purposes and for reporting to various government agencies.

- Administrative requirements: When registering a company in Hong Kong, providing the appropriate HSIC code is essential as it accurately reflects the primary business activities of the company.

- Data collection: The code system helps identify the data on various economic indicators such as GDP, inflation, consumer spending, etc. Based on the data collected, business strategists can assess the performance, trends, and health of the targeted economy and form improving solutions.

- Business planning: Businesses employ HSIC codes to ascertain their industry classification. This enables businesses to identify opportunities, mitigate risks, optimize operations, and develop sustainable growth strategies.

- Legal compliance: Regulatory requirements often vary depending on industry classification. Therefore, HSIC codes play a crucial role in assisting businesses to stay compliant with pertinent legal requirements.

Levels of HSIC classification: From industry section to class

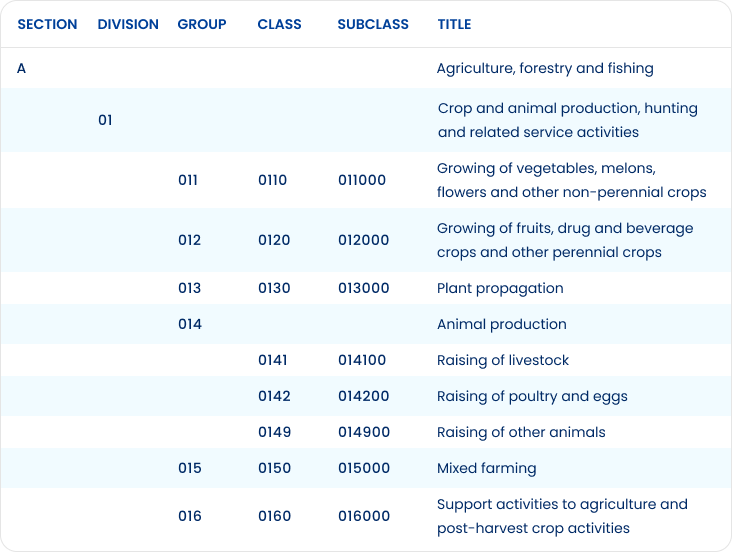

In general, the HSIC Code is organized into 5 levels of classification, with each level representing a broader or more detailed category of economic activity. The levels are divided into the following:

Example of 5 levels of classification

1st level: Industry Section

This is the broadest level of classification, dividing economic activities into 21 major sectors, namely from A to U as below:

- A: Agriculture, forestry, and fishing

- B: Mining and quarrying

- C: Manufacturing

- D: Electricity and gas supply

- E: Water supply; sewerage, waste management and remediation activities

- F: Construction

- G: Import & Export, wholesale and retail trades

- H: Transportation, storage, postal and courier services

- I: Accommodation and food service activities

- J: Information and communications

- K: Financial and insurance activities

- L: Real estate activities

- M: Professional, scientific, and technical activities

- N: Administrative and support service activities

- O: Public administration

- P: Education

- Q: Human health and social work activities

- R: Arts, entertainment, and recreation

- S: Other service activities

- T: Work activities within domestic households

- U: Activities of extraterritorial organizations and bodies

2nd level: Industry Division

Within each sector, activities are further divided into smaller divisions, numbered by 2-digit numeral codes. For example, within the Manufacturing sector, division 10 signifies “Manufacture of food products”.

3rd level: Industry Group

To further break down divisions into groups, three-digit numbers are assigned to each group. For instance, within the Manufacture of food products division, 106 is the group for “Manufacture of grain mill products, starches, and starch products”.

4th level: Industry Class

A further classification level is the class level, which specifies particular types of products or services within each group. Each class is identified by a 4-digit number. To exemplify, the system uses 1061 to mark the “Manufacture of grain mill products”.

5th level: Industry Sub-class

The last level of HSIC categorization for Hong Kong businesses is the sub-class, which is designated by 6-digit codes. As an example, 106101 represents a minor class within the retail sector, specifically for businesses engaged in the “Manufacture of bean curd”.

See more

Tips for determining the HSIC code for your business

Deciding which Hong Kong Standard Industrial Classification code your business uses involves a systematic approach to accurately reflect the nature of your core activities. To save you from the challenges, here are several useful tips for choosing a code that fosters future growth!

Tip 1: How to search for your code in the index

As aforementioned, the HSIC code is determined based on the core activities and products of your business. Accordingly, the search for your code will revolve around these details.

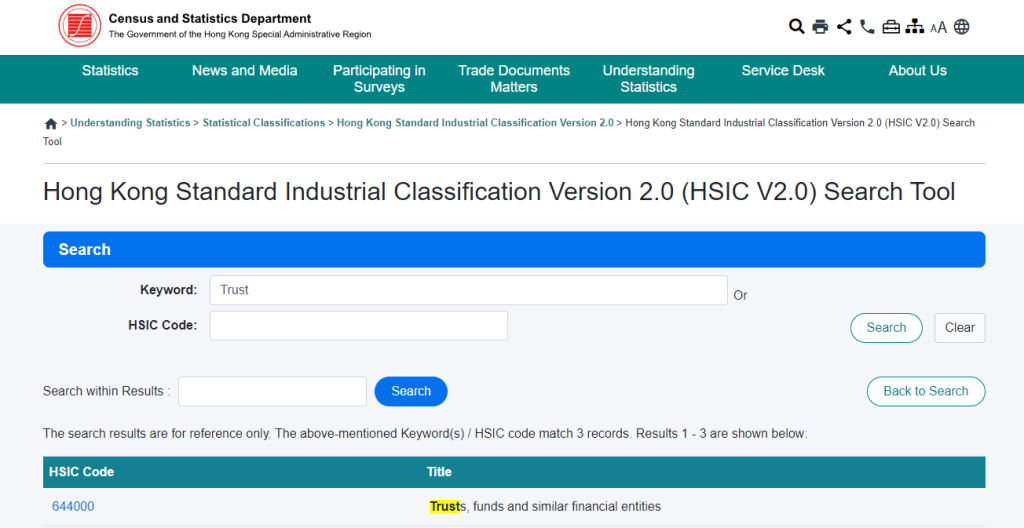

Conveniently, the Census and Statistics Department has developed an online tool for HSIC code suggestions. After deciding on what products or services you will offer and the corresponding industry, you can simply visit the official HSIC code search tool and type in the relevant keywords for suggestions.

HSIC V2.0 Search Tool (source: https://www.censtatd.gov.hk/)

For instance, if you’re opening a Hong Kong trust company, it shall fall under class 6440, sub-class 644000 for “Trusts, funds, and similar financial entities”.

Another option is to search for your business activities name in the HSIC Codes Directory for the Hong Kong Standard Industrial Classification Code. Activities are available in Chinese and English, so you don’t have to worry about the language barrier.

Tip 2: Consult with relevant authorities and local experts

To determine the appropriate category for your company, you might want to seek assistance from governmental authorities, such as the Hong Kong Census and Statistics Department, or local business advisors like BBCIncorp.

Not only do these professionals provide valuable guidance and support, but they will also help you decide which industry is most promising for your business. In fact, you can simply contact the Census and Statistics Department for expert advice immediately via:

- Email: gen-enquiry@censtatd.gov.hk

- Office number: 2582 4807

Setting up your Hong Kong business with BBCIncorp

We provide simple and efficient service for Hong Kong company formation. Contact our support team now through the chatbox for more information.

Tip 3: Consider additional regulatory requirements of the industry

Depending on your business activities, certain industries may have distinct requirements or reporting obligations associated with particular HSIC classifications.

Hence, after taking in the advice of other parties, don’t forget to research the legal obligations or industry standards that may impact the selection of your business code. What’s the most beneficial field? Will the licenses be an obstacle? What other authorities must your business report to?

Below are a few popular choices and their legal requirements:

- Financial services (HSIC Code 64): These businesses are subject to regulations imposed by the Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA), including getting an SFC license to operate legally.

- Healthcare services (HSIC Code 86): Healthcare providers in Hong Kong are regulated by the Department of Health and the Medical Council of Hong Kong regarding patient care, medical ethics, data privacy, and so on.

- Specialized construction activities (HSIC Code 43): Construction companies must comply with the obligations of the Buildings Department and the Construction Industry Council. Thus, they must comply with safety standards, building codes, and environmental protection, as well as report workplace accidents and incidents.

- Retail and Wholesale Trade (HSIC Code 47): Retailers and wholesalers are governed by the Customs and Excise Department and the Consumer Council. They must adhere to consumer protection laws, product standards, and fair trading practices, as well as any industry-specific requirements.

Tip 4: Save room for potential growth and diversification

Businesses in Hong Kong are dynamic entities, and as they evolve over time, their operations, products, services, and market focus may shift to meet market demands. Therefore, make sure to select an HSIC code that can accommodate any future expansions.

Once you’ve pinpointed a potential Hong Kong Standard Industrial Classification Code for your business, proceed with the registration process to establish your company.

Let’s consider an example of a Hong Kong business that manufactures organic skincare products:

- Initially, the company may register under the 202301 code (Manufacture of cosmetics, perfume, and toilet preparations).

- However, after a few years, the company may decide to establish its own branded stores or flagship stores in strategic locations for retail.

- As a result, they will have to opt for code 477204 (Retail sale of cosmetics and personal care products) before conducting retail activities.

- With an established reputation and high-quality products, this new expansion is much easier to conduct. Thus, it enables the company to successfully expand into its own retail stores.

In conclusion

To wrap up, the HSIC code system in Hong Kong provides businesses with a structured framework for organizing and understanding their operations within the larger economic context. This system is truly a valuable tool for maintaining a good standing, conducting market analysis, and facilitating business planning.

By carefully selecting the appropriate identity code, businesses can accurately define their industry classification continue to make informed decisions, and adapt to evolving market conditions in the dynamic landscape of Hong Kong’s economy.

For further assistance or inquiries on business operations in Hong Kong, our dedicated team at service@bbcincorp.com is always available. Reach out to us via email or the chatbox today.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.