Read about an accounting service provider to find the right partner for financial reporting, tax planning, and regulatory support.

For startups entering the Trust and Company Services sector in Hong Kong, securing a Trust & Company Service Provider (TCSP) license is mandatory for legal operation. Moreover, it’s important to keep in mind that the process can be complex due to the requirements in place.

To assist you in this critical endeavor, this article is created to provide a detailed roadmap on the regulatory framework and the steps for obtaining the TCSP license. Read more now!

What is a Hong Kong TCSP license?

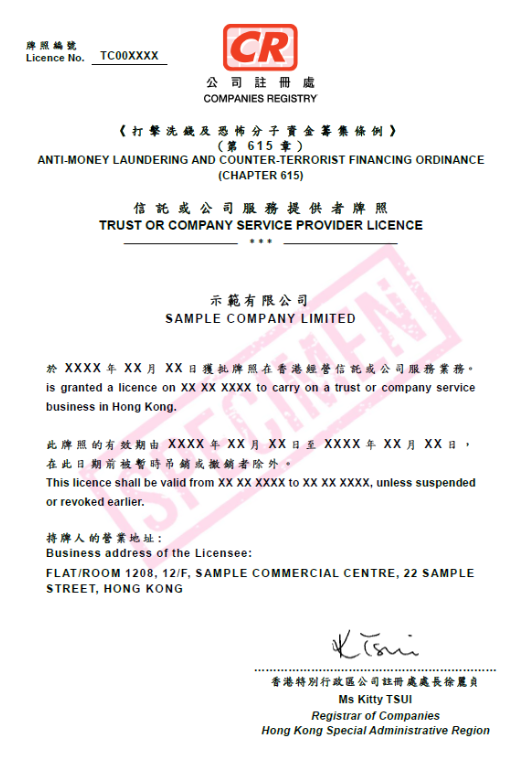

A Hong Kong Trust Company Service Provider (TCSP) license is a legal authorization granted by the Companies Registry. This license permits the holder to provide trust and corporate services within the jurisdiction, such as company formation, provision of registered office facilities, and other related activities.

Holding a TCSP license is a regulatory requirement under the Anti‐Money Laundering and Counter‐Terrorist Financing Ordinance (AMLO), stipulated by the Hong Kong government since 1 March 2018. Simply put, companies operating in this sector must own this license to conduct business legally in Hong Kong.

Sample of a Hong Kong TCSP License (source: Hong Kong Companies Registry)

Beyond serving as a formal requirement, acquiring a TCSP license indicates that the business has met strict regulatory standards set by the authorities. These standards typically include criteria such as financial stability, business integrity, legal competence, and a commitment to upholding anti-money laundering (AML) and counter-terrorist financing (CTF) obligations.

Since the TCSP license is generally valid for only three years from the date of issuance, your company will have to renew the document at least 60 days before continuing to operate legally in Hong Kong.

Which companies must obtain a TCSP license in Hong Kong?

Specifically in the landscape of Hong Kong, the TCSP license applies to a broad range of companies involved in trust and company service activities within the jurisdiction.

Examples of applicable businesses

Here are some common types of companies that fall within the scope of the TCSP licensing requirement in Hong Kong:

- Trustee services such as Hong Kong trust companies: These organizations provide trust and fiduciary services for individuals, families, and enterprises such as estate planning, asset protection, and trust management.

- Nominee shareholder services which involve appointing a representative to hold shares on behalf of the owner, providing confidentiality and privacy for the beneficial owner.

- Provision of directors for companies that offer nominee director services to act on behalf of the beneficial owner, or to fulfill specific roles within the company

Simply put, the scope extends to any entity (e.g. corporations, partnerships, individuals) that:

- Directly or indirectly provides services as a TCSP

- Advertise or publicize their business activities or receive referrals from other companies;

- Intend to generate profit from their activities; and

- Conduct their activities with reasonable or recognizable continuity.

This means both local and overseas enterprises operating in Hong Kong and within the industry fall under the purview of TCSP licensing regulations.

Exemptions to the TCSP license regulation

Exceptions to relevant enterprises obtaining a TCSP license in Hong Kong are typically rare and narrowly defined. However, certain entities or individuals may be exempt from licensing obligations under specific circumstances.

- Governmental bodies: Authorized offices recognized by the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO)

- Authorized institutions: Banks, restricted license banks, or deposit-taking companies duly authorized by the Hong Kong Monetary Authority (HKMA) within the meaning of section 2(1) of the Banking Ordinance, Cap. 155

- Licensed corporations: Entities licensed by the Securities and Futures Commission (SFC) to conduct regulated activities, including Hong Kong TCSPs that provide services ancillary to their principal business

- Accounting and legal professionals: Certified Public Accountants (CPAs), CPA firms, corporate practices recognized by the Accounting and Financial Reporting Council Ordinance, and legal practitioners like solicitors

- Persons prescribed by regulation: Individuals within a class prescribed by the Secretary for Financial Services and the Treasury through specific regulations.

Please note that whether you’re exempted or not, engaging with legal professionals is crucial to staying compliant with the ever-changing landscape.

Penalty for TCSPs with no license

Engaging in trust or company service business activities in Hong Kong without a license is a serious offense under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance.

If an individual or entity is found conducting such activities without the required TCSP license, they can face severe penalties upon conviction. These penalties include:

- Fines: Offenders will be fined up to HK$100,000 per offense

- Imprisonment: In addition to fines, individuals may also be sentenced to imprisonment for a period of 6 months.

The punishments for offenders have emphasized the importance of obtaining the appropriate TCSP license before conducting service activities. In Hong Kong’s highly regulated financial environment, compliance is not only vital but also essential for maintaining business integrity and reputation.

Application process for a TCSP license for your Hong Kong business

Below is a general overview of the Trust Company Service Provider license acquisition process in Hong Kong.

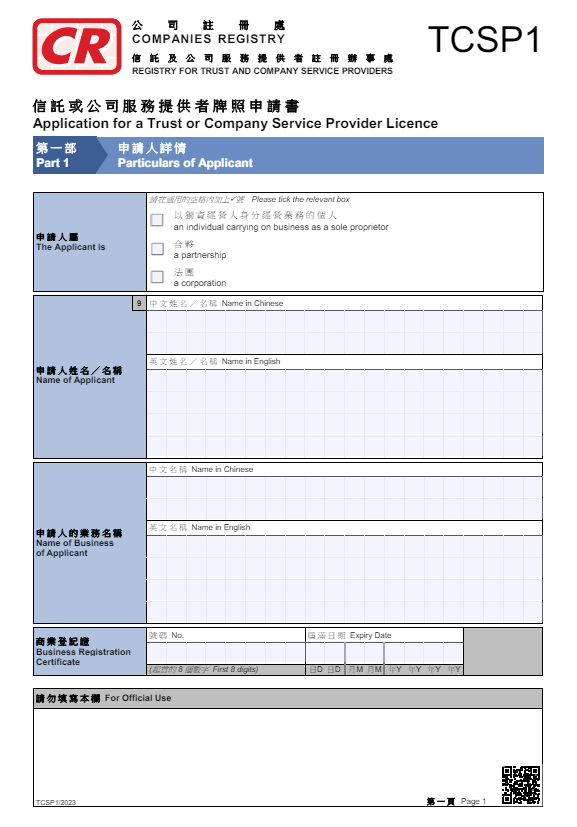

Step 1: Fill in the application form set

First, there are several essential application forms for you to complete. The initial set, which requires a fee of HK$3,440, includes:

- Application for a Trust or Company Service Provider Licence (Form TCSP1)

- Supplementary Information Sheet for Form TCSP1 (Form TCSP1-SIS) on the nature of the intended business

- Supplementary Information Sheet 2A for Form TCSP1 (Form TCSP1-SIS2A) on the number of employees and the target customer segment

Sample of Form TCSP1 (source: Hong Kong Companies Registry)

Step 2: Prepare Fit and Proper Criteria Statement

Besides the forms, applicants must submit a Fit and Proper Criteria Statement for each relevant person or firm. The fit and proper criteria are fundamental requirements used to assess the suitability, integrity, competence, and financial soundness of individuals and entities seeking TCSP licenses.

Statements are divided into two categories based on entity type:

- Form TCSP4 for individuals (e.g. applicants, partners, directors, ultimate owners)

- Form TCSP5 for corporations

Each form will cost an additional fee of HK$975. Please note that this type of statement is not required if the entity is exempt from getting a TCSP license.

Step 3: Prepare other essential required documents

After the form sets are ready, it’s time to prepare other documentation for the licensing process. These documents generally encompass:

- A certified copy of the Business Registration Certificate

- Information on the corporation group’s structure and percentage of shareholdings of each group member

- Details of key personnel involved in the management and operation of the business, compliance officers, and money laundering reporting officers

- Persons exempted from submitting Form TCSP4/TCSP5 (if any) with supporting documents

- A copy of the authorization letter from the board of directors allowing the director to make an application

To ensure you have everything ready for submission, it’s important to consult with a professional firm in Hong Kong for tailored advice on your specific situation.

Step 4: Submit the TCSP application to the CR

It’s time to submit the application to the Registrar of Companies, including the form sets, the Fit and Proper Criteria Statement, and the supporting documents.

You can also choose to send the file in either softcopy or hardcopy:

Online submission

- Simply go to the Companies Registry website and register for an account

- Use the Apply for a Trust or Company Service Provider Licence function within the Online Services

- Upload your completed application forms and all supporting documents

- Pay the application fee using available online payment methods

To assist you with the process, here is a demo video from the CR for reference.

In-person or by post

For delivering the completed application forms in hard copy, you can submit them along with the fees to The Registry for Trust and Company Service Providers.

Their address is at Unit 1208, 12th Floor, One Kowloon, 1 Wang Yuen Street, Kowloon Bay, Kowloon, Hong Kong. Moreover, they receive hardcopy documents only between 8:30 and 5:30 on weekdays.

After submission, the Registrar of Companies will review your application. This process may include a detailed evaluation of your documentation and interviews with key personnel, so be ready if some relevant questions arise.

Step 5: Receive your TCSP license

Following successful application, your TCSP license will be delivered to your address. Particularly, an electronic version is granted within 2.5 months.

You’ll receive an email notification to download your document from the Registry for Trust and Company Service Providers website.

With your license in hand, your company is now empowered to offer a wide range of trust and company-related services with confidence and legality throughout Hong Kong!

To wrap up

In summary, obtaining a Trust or Company Service Provider (TCSP) license is imperative for individuals or organizations providing trust and company services in Hong Kong. With our guidance in this article, you now have a clear roadmap to navigate the application process effectively.

Essentially, if you are planning to launch your business in Hong Kong or have any inquiries about conducting operations here, please contact our team for timely support. Our services cover the full spectrum of Hong Kong incorporation, post-corporate formation, and annual legal compliance.

Simply send an email to service@bbcincorp.com or type in the chatbox to get in touch now!

Frequently Asked Questions

What is a Hong Kong TCSP License?

A Hong Kong TCSP (Trust Company Service Provider) license is an official permit issued by the Company Registry to legitimate businesses offering trust or company-related services.

Any individual or entity intending to engage in trust or company service business must apply for a TCSP license unless they qualify for one of the exceptions.

What is Form TCSP1, 2, 3, 4, and 5?

Forms TCSP1, TCSP2, TCSP3, TCSP4, and TCSP5 are part of the application process for obtaining a Trust or Company Service Provider (TCSP) license in Hong Kong.

Form TCSP1: The main application form for a TCSP license. It gathers general information about the applicant and their intended business activities.

Form TCSP2: This form is used to notify the Registrar of Companies of any changes to the information provided in Form TCSP1 after submission.

Form TCSP3: This form is used to apply for Approval to Become an ultimate owner, partner, or director of a Trust or Company Service Provider Licensee.

Form TCSP4: For individuals (such as applicants, partners, directors, or ultimate owners) to provide a statement regarding their fit and proper criteria to carry on or be associated with a trust or company service business.

Form TCSP5: For corporations (such as partners or ultimate owners) to provide a statement regarding their fit and proper criteria to carry on or be associated with a trust or company service business.

Who is exempted from the Hong Kong TCSP license requirements?

Several categories of entities are exempted from holding TCSP licenses:

- The government authorities

- Authorized institutions, such as banks or deposit-taking companies.

- Licensed corporations conducting trust or company service business ancillary to their principal business.

- Accounting professionals.

- Legal professionals.

- Persons prescribed by regulation by the Secretary for Financial Services and the Treasury.

What if the Registrar decides not to grant you a license?

Should the Registrar refuse to grant your business a license, you will also receive a written explanation for the decision.

In such cases, the applicant can seek a review of the decision by applying to the Anti-Money Laundering and Counter-Terrorist Financing Review Tribunal. This request must be made within 21 days from the date the notice informing the applicant of the decision is sent.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.