Table of Contents

Ever wondered why a business operating legally in one U.S. state might be considered “foreign” just a few miles away, within the same country? The answer lies in the classification of a Limited Liability Company (LLC) at the state level.

When an LLC is initially formed in a particular U.S. state, it is designated as a domestic LLC within that state’s jurisdiction. However, if that same entity expands its business activities into any other U.S. state, it then assumes the legal status of a foreign LLC in that new territory.

This distinction carries significant implications for compliance rules, tax obligations, and filing requirements. In this article, we will explore the key differences between domestic vs. foreign LLC, and what steps you need to take to stay compliant in either case.

What is a domestic LLC vs. a foreign LLC?

Firstly, let’s take a look at the definitions of these entities and what determines their classification.

What is a domestic LLC?

A domestic LLC is a Limited Liability Company that operates in the same state where it was originally formed. If you start your LLC in Texas and your business activities also take place in Texas, your entity is considered a domestic LLC in that state.

So, what is a domestic LLC in practice? It means your company is registered and compliant under that state’s laws and regulations. You follow local filing requirements, pay state-specific taxes, and work with a registered agent in that state.

Most businesses begin as domestic LLCs. If you only plan to operate in your home state, this status keeps things simple and cost-effective. According to the U.S. Small Business Administration, forming an LLC at the state level helps protect owners from personal liability while simplifying operational structure.

In short, when someone asks, what does a domestic LLC mean, the answer lies in the state where the company was first established and continues to do business.

What is a foreign LLC?

A foreign LLC refers to a business that operates in a state other than the one where it was formed. For example, if you register an LLC in Delaware but conduct business in California, your LLC is considered a foreign LLC in California.

The term “foreign” may sound like it refers to international operations, but it does not. It simply means your business is expanding across state lines. Each state requires foreign LLCs to register, usually through a Certificate of Authority or a similar process.

When business owners ask Do I need to register as a foreign LLC, the answer is yes if you have a physical presence, employees, or regular operations in another state. States use this designation to ensure companies comply with local rules and pay appropriate taxes.

In order to grow beyond their original state, businesses must know the difference between a foreign LLC and a domestic LLC. In the absence of a valid registration, you are at risk of fines, penalties, and limited access to local courts. Next, we’ll discuss the differences in more detail.

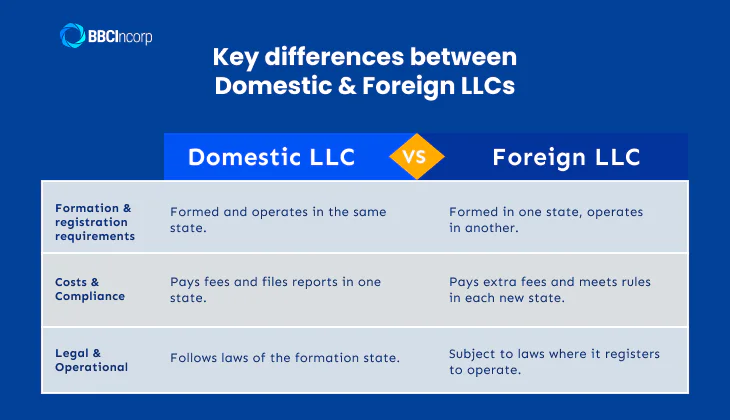

Key differences between domestic and foreign LLCs

While both structures offer liability protection, their practical and legal obligations diverge significantly, impacting everything from compliance and tax filings to ongoing fees and state-specific requirements. As your business expands beyond its initial formation state, recognizing these key differences becomes paramount.

Formation and registration requirements

The primary difference between a domestic and a foreign LLC lies in their formation and registration requirements.

A domestic LLC is an entity registered in the state where it was originally formed.

The state is considered its home state, and it only needs to complete the initial registration process there. For example, an LLC formed in Delaware and operating solely within Delaware is a domestic Delaware LLC.

Conversely, a foreign LLC is an entity that operates in any state other than its formation state.

If a Delaware LLC decides to expand its operations into, say, California, it must register as a foreign entity in California. This process, known as foreign qualification, involves filing specific documents with the California Secretary of State, typically a Certificate of Authority or an Application for Registration of Foreign Limited Liability Company.

A critical requirement for foreign qualification in most states is the appointment of a registered agent within that state. The registered agent serves as the official point of contact for service of process and other legal notifications, so that the foreign LLC receives important communications from the state.

Costs and compliance

The initial formation fees for a domestic LLC are paid only in its home state. Meanwhile, foreign LLC incurs additional state filing fees for each state in which it foreign qualifies.

These fees vary considerably from state to state and can add up quickly as a business expands its footprint. Beyond initial registration, foreign LLCs often face different ongoing compliance obligations.

Many states require foreign qualified LLCs to file annual reports or pay recurring franchise taxes, which can be distinct from the requirements of domestic LLCs in the same state.

For instance, some states impose higher franchise taxes on foreign entities or require more frequent reporting. This translates to increased administrative upkeep for foreign LLCs, requiring careful tracking of deadlines and regulations across multiple jurisdictions.

Legal and operational implications

Being a domestic LLC as opposed to a foreign LLC has impacts on how contracts are enforced and lawsuits are handled. Generally, a domestic LLC is subject to the laws and jurisdiction of its formation state for most legal matters.

However, a foreign LLC operating in another state agrees to be subject to the jurisdiction of that state’s courts for actions arising from its business activities there. If a foreign LLC is sued in the state where it is foreign qualified, the lawsuit will proceed under that state’s laws and within its court system.

Furthermore, some states impose specific restrictions or additional scrutiny on foreign LLCs. These could include limitations on the types of business activities they can engage in or more stringent disclosure requirements.

How to register as a foreign LLC

Expanding into another state means your LLC may need to be registered as a foreign entity. Each state sets its own rules, but most follow a common process, and getting this right will let your business operate legally and avoid penalties. Below, we will outline when registration is required and how to complete it step by step.

When do you need to register as a foreign LLC?

You must register as a foreign LLC when your company carries out business activities in a state outside its formation state. While definitions vary slightly, most states use a similar checklist to determine whether registration is necessary. You likely need to register if your business:

- Has a physical office or storefront

- Employs staff based in the new state

- Holds inventory or leases commercial property

- Enters into ongoing contracts or service agreements

- Uses sales agents or representatives within the state

If you have ever asked do I need to register as a foreign LLC, these criteria provide a clear guide. Even businesses that operate mainly online may still need to register if they have employees or repeated commercial activity across state lines.

Being aware of this requirement helps you stay compliant as your company moves from domestic to foreign LLC status in other states.

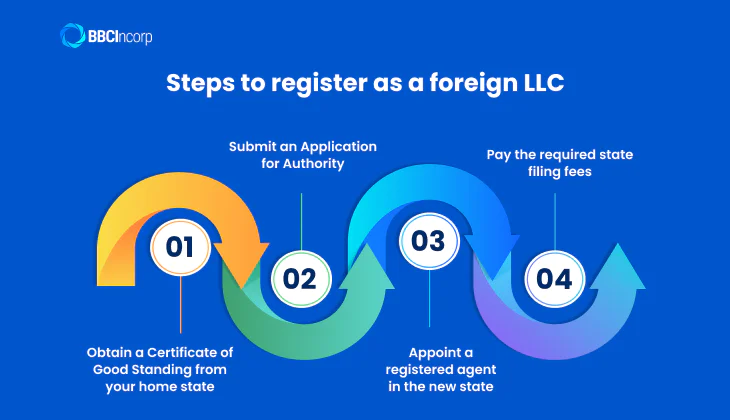

Steps to register as a foreign LLC

Once your business confidently meets the criteria for foreign registration, the exciting next chapter involves navigating the essential filings in your new target state. Each state maintains unique nuances, yet the core process for foreign qualification generally follows a clear, step by step path. This ensures your LLC can legally operate beyond its original borders.

Step 1: Obtain a Certificate of Good Standing from your home state

Consider this your LLC’s official report card. It confirms excellent standing and compliance with all regulations where it was initially formed. This crucial document, typically issued by the Secretary of State, affirms your LLC’s legitimate existence.

Step 2: Submit an Application for Authority

This application, sometimes termed a Certificate of Authority, must be filed directly with the Secretary of State in your expansion state. It formally requests permission for your LLC to conduct business as a foreign entity within that jurisdiction.

Step 3: Appoint a registered agent in the new state

Your registered agent must be an in-state individual or entity with a physical street address. They are authorized to receive all official legal and governmental documents on behalf of your LLC. Appointing an expert as your agent lets you foster prompt and reliable communications, protecting your LLC from potential legal issues.

Step 4: Pay the required state filing fees

These fees are a standard part of the foreign qualification process. As required by the authority, this expense mostly ranges from $100 to $300.

Upon successful approval, your LLC gains the legal right to operate as a foreign entity. By following these steps, you ensure a smooth and compliant expansion. This effectively manages the distinct responsibilities that come with transitioning your LLC from a domestic to a foreign LLC status.

These key steps are vital to harnessing your business’s full potential across multiple states, so make sure to always keep the difference between domestic and foreign LLCs in mind.

Choosing your status: Domestic or Foreign LLC

Deciding between domestic or foreign LLC classification depends on where you form your business and where you plan to operate. Each option carries different compliance obligations and long-term implications.

Forming in your home state: the domestic LLC route

Most businesses start by forming an LLC in their home state. This is often the most straightforward choice, especially if your operations, customers, or employees are located in a single state.

It keeps filing and compliance requirements limited to one jurisdiction and reduces administrative costs. This is often the most cost-effective approach for small businesses without cross-state expansion plans.

Popular formation states: Delaware, Wyoming, and Nevada

However, some entrepreneurs choose to form an LLC in states known for their favorable business environments. Delaware, Wyoming, and Nevada are common choices:

- Delaware is popular for its strong legal system and extensive case law supporting business disputes.

- Wyoming offers minimal fees and does not charge state income tax.

- Nevada is known for business privacy protections.

While these advantages are appealing, forming outside your home state means your LLC will be considered foreign wherever you actually operate. That introduces new registration and reporting requirements. You can read more about the best state to set up an LLC in our other dedicated article as well.

Moreover, if you form your LLC in one of these states but operate elsewhere, your business becomes a foreign LLC in each additional state.

This necessitates registering in every new jurisdiction as a foreign entity and complying with local rules, taxes, and filing requirements. The distinction between foreign and domestic LLC status now affects your workload.

Weighing the benefits and obligations

Choosing a state like Delaware may offer long-term legal or financial advantages (e.g., streamlined formation, strong privacy, and many other advantages of Delaware LLC available), but the added complexity of foreign registration demands careful consideration. You will need to maintain good standing in both the state of formation and each state where you operate.

When weighing domestic vs. foreign LLC status, assess the total cost of formation, ongoing compliance, and legal support over time. A foreign-friendly state might aid fundraising or regulatory flexibility, but only if your business is ready to manage the associated obligations.

Please keep in mind that the choice between domestic or foreign LLC status should align with your operational footprint, not solely the promise of favorable laws elsewhere.

Common misconceptions about domestic and foreign LLCs

Business owners often face confusion when navigating foreign vs. domestic LLC rules. Misunderstandings about terminology, registration, and tax obligations frequently lead to costly errors. This section aims to dispel the most common myths and provide accurate guidance.

“Foreign” means international.

A widespread misconception is that a foreign LLC refers to an international company. In reality, “foreign” simply signifies an LLC formed in one state that operates in another. For instance, if your LLC is formed in Delaware but conducts business in New York, it is a foreign LLC in New York, not a global business entity.

You only need to register once.

Some believe forming an LLC in one state grants the right to operate nationwide. This is incorrect. If your LLC meets a state’s criteria for doing business, such as maintaining a physical location or employing staff, you must register as a foreign LLC in that state. Ignoring this can result in fines or restrictions on your right to sue or enforce contracts.

Delaware formation covers all states.

Although Delaware is a popular formation state, registration there does not eliminate the need for foreign registration elsewhere. A Delaware LLC still needs to file as a foreign LLC in each state where it actively conducts business.

Tax advantages are automatic.

There is no inherent tax benefit to forming a foreign LLC unless you thoroughly plan for the local tax environment. State taxes, filing fees, and franchise taxes vary and must be evaluated individually.

Clarifying these misconceptions is crucial for making informed decisions about your domestic LLC vs. foreign LLC strategy. Understanding what a domestic LLC truly entails and the nuances of foreign qualification are vital for compliant and effective interstate operation.

Start your LLC the smart way with BBCIncorp

Forming a limited liability company is a key step in building a strong business structure. Whether you are launching a local startup or planning multi-state expansion, choosing the right jurisdiction matters.

BBCIncorp provides reliable support for setting up Delaware LLC non resident entities efficiently, starting with one of the most respected options in the United States: Delaware. Known for its flexible corporate laws and established legal system, Delaware remains a popular destination for both startups and international investors.

If you are looking for other international jurisdictions that offer tax advantages, privacy, or extensive market access, consider these options:

- LLC in Cyprus for access to the European Union and a wide network of double tax treaties

- Cayman Islands limited liability company for zero direct taxation and strong legal protections

- Other favorable jurisdictions such as Belize and the British Virgin Islands, with efficient setups and low ongoing compliance.

Understanding the difference between domestic and foreign LLCs is only the beginning. BBCIncorp assists global entrepreneurs in formation, registration, and ongoing annual compliance in any jurisdiction you choose. Visit our service site or get in touch with our team today for more information.

Conclusion

Understanding the domestic vs. foreign LLC distinction is crucial for compliance and growth. A domestic LLC operates solely in its formation state, while a foreign LLC conducts business beyond it. Each structure carries unique registration, compliance, and tax obligations. Failing to register as a foreign LLC where required can lead to penalties or restricted legal rights.

Regardless of your choice, the right setup safeguards your business and ensures smoother operations. Our legal and tax professionals can assist you if your business plans to operate in multiple jurisdictions.

For expert guidance and assistance on growing your business, please reach out to us at service@bbcincorp.com to learn more about how we can help you obtain these vital credentials.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.