Table of Contents

If you’re considering establishing an offshore company, Cyprus is a prime choice due to its appealing tax regime and strategic location at the crossroads of Europe, Asia, and Africa. One option that stands out for businesses is the Cyprus Limited Company structure, offering numerous advantages and opportunities.

In this guide, we provide valuable insights and step-by-step instructions for setting up a Limited Company. Through this article, our aim is to provide you with the necessary information to navigate the company formation process effectively

Let’s explore the advantages of a Limited Company in Cyprus and get your business ready for incorporation.

Overview of a Cyprus Limited company

Before getting into the details of setting up a limited company in Cyprus, why don’t we take a look at what makes Cyprus so attractive to business owners globally?

Typical uses of a Cyprus Limited company

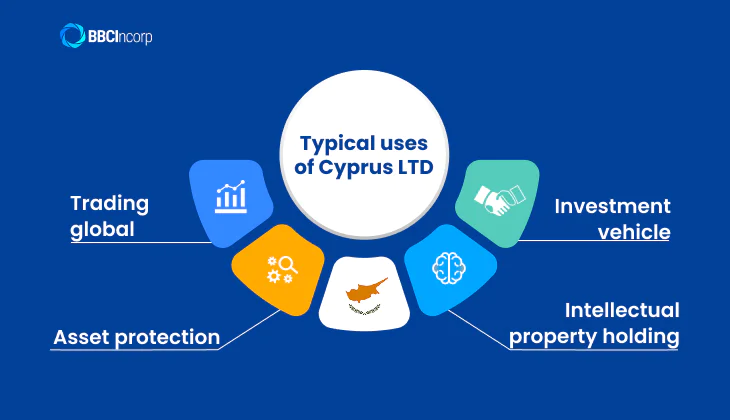

A Cyprus limited company (Cyprus LLC) is a popular choice for many business owners and investors due to its numerous benefits, such as favorable tax rates, a strategic location, and a stable political and economic environment. Here are some of the typical uses of a limited company in Cyprus:

Trading global

A Cyprus limited company is normally used for trading such as import/export, manufacturing, and distribution. The country is a member state of the European Union, which provides trading companies with access to prosperous and global markets.

Asset protection

A Cyprus limited company can be used as an instrument for asset protection, offering a high level of confidentiality and privacy, which can be important for businesses and individuals looking to protect their assets.

Furthermore, Cyprus has an extensive network of double tax treaties with other countries, which provide additional protection for foreign investors and their assets.

Investment vehicle

A Cyprus LLC can be used as an investment vehicle for individuals or groups looking to invest in various assets, such as real estate, stocks, and bonds. The company structure can provide benefits such as limited liability, tax efficiency, and easy transferability of ownership.

Intellectual property holding

A Cyprus limited company can be used as an intellectual property holding company to manage and protect patents, trademarks, and copyrights.

Cyprus has a well-established legal framework for IP protection and is a signatory to various international treaties and agreements related to IP, such as the World Intellectual Property Organization (WIPO) and the European Patent Convention. This provides businesses with a high level of protection for their IP assets.

Cyprus Ltd or Cyprus LLC?

Across jurisdictions, the term LLC (Limited Liability Company) can refer to different structures. In some countries, it denotes a flexible entity type with pass-through taxation, distinct from a corporation.

In Cyprus, the equivalent form is the Private Limited Company (Ltd), governed by the Companies Law, Cap. 113. Liability is limited to the shareholders’ subscribed capital, and the entity is taxed as a corporation at a flat 12.5% rate.

Effectively, the Cyprus Ltd serves as the local counterpart of an LLC, aligned with EU legal standards while providing limited liability protection and corporate-level taxation.

Types of limited companies in Cyprus

In Cyprus, there are several main types of limited companies that businesses can choose to establish, including

Private limited liability company by shares (LTD)

This is the most common type of company in Cyprus. It is a private entity that can have up to 50 shareholders, and the liability of the shareholders is limited to the amount of their share capital. Private limited companies are required to have a minimum share capital of €1,000, and they are not allowed to offer their shares to the public.

Public limited liability company by shares (PLC)

A public limited company is a company whose shares are listed on a stock exchange and can be offered to the public. It can have an unlimited number of shareholders, and the liability of the shareholders is limited to the amount of their share capital. Public limited companies are required to have a minimum share capital of €25,000, and they are subject to more extensive reporting and regulatory requirements than private limited companies.

In addition to these two main types of limited companies, there are also other structures such as:

- Limited liability company by guarantee without share capital

- Limited liability company by guarantee with a share capital

- Variable capital investment company

It is important to consult with legal and financial professionals to determine the most appropriate legal structure for your particular circumstances.

Pros and cons of incorporating a limited company in Cyprus

Are you considering incorporating a LLC in Cyprus? Before you make a decision, it’s essential to weigh the potential benefits and drawbacks. Let’s delve into the advantages and disadvantages of setting up a company in Cyprus to uncover more insights.

Advantages of a limited company in Cyprus

There are several advantages to forming a limited company in Cyprus, which include:

- Limited liability protection: The shareholders’ liability is limited to the amount of share capital, meaning personal assets are protected in case the company faces financial difficulty or gets sued.

- Tax benefits: Cyprus has a favorable tax regime for companies, with a corporate tax rate of 12.5%, which is one of the lowest in the European Union. Non-resident companies may also benefit from a 0% corporate tax on foreign-sourced income. Cyprus’s extensive double taxation treaty network further minimizes global tax exposure. Cyprus also has a network of double taxation treaties with many other countries, which can help to reduce the overall tax burden for businesses.

- Easy to set up: The process of setting up a limited company in Cyprus is relatively straightforward and can be completed quickly, usually within a few days. Requirements are governed by the Cyprus Companies Law, which is modelled after the UK framework, ensuring both familiarity and credibility for international investors. The cost of incorporation and maintenance is also relatively low compared to other European countries.

- Flexible corporate structure: A limited company in Cyprus can have one shareholder, and the shareholder can also be the sole director of the company. This means it is easy for small businesses or entrepreneurs to set up and manage their companies.

- Access to the European market: Cyprus is a member of the European Union, meaning businesses registered in Cyprus have access to the European market and can benefit from the EU’s regulations and policies.

- Intellectual property protection: Cyprus has strong laws protecting trademarks, patents, and copyrights. This can benefit businesses that rely on their intellectual property to generate revenue.

Cyprus also provides nominee service for confidentiality, modern redomiciliation laws that allow foreign companies to migrate domicile, and incorporation opportunities open to any nationality. Its strategic Mediterranean location, English-speaking workforce, and reputation as a hub for trading and holding companies add to its appeal.

Potential limits of a limited company in Cyprus

While there are many advantages to forming a Limited Company in Cyprus, there are also some limitations that businesses should be aware of. These include:

- Reporting requirements: Limited companies in Cyprus are required to maintain proper accounting records and submit annual financial statements to the Cyprus Registrar of Companies. Failure to comply with these reporting requirements can result in fines and penalties.

- Lack of anonymity: While Cyprus has strong data protection laws, businesses should be aware that their financial statements and other corporate documents are publicly available through the Cyprus Registrar of Companies. This lack of privacy could be a concern for businesses that value confidentiality.

- Language barrier: Although the most widely used language is English, some of the documents used for registration are still written in Greek. This can be quite a challenge for businesses that do not prepare beforehand to overcome this cultural barrier.

Procedure for setting up a Cyprus Limited company

While it is possible to incorporate a public limited company (PLC) in Cyprus, the most common and popular structure for businesses is a private limited company (LTD).

An LTD is the most practical legal structure in Cyprus, as it offers a high level of formation success and flexibility, while also providing limited liability protection to its shareholders.

In the following section, let’s explore the full process of Cyprus LLC registration.

Initial requirements

Before a limited company in Cyprus can be incorporated, certain preliminary conditions must be satisfied in line with the Companies Law, Cap. 113. These include securing approval for the company name, preparing the constitutional documents, and filing statutory forms with the Registrar of Companies.

In addition, businesses must complete mandatory tax registration and, where necessary, engage licensed professionals to ensure compliance with local legal and administrative standards.

| Requirement | Details |

|---|---|

| Company name approval | The proposed name must be submitted to and approved by the Cyprus Registrar of Companies to ensure it is unique and not misleading. |

| Memorandum and Articles of Association | These legal documents outline the company’s objectives, structure, and internal governance. They must be prepared in Greek and signed by a licensed Cyprus lawyer. |

| Form HE1 (Statutory Declaration) | A sworn declaration signed before court by the entrusted lawyer, confirming compliance with the Companies Law. |

| Other incorporation forms (HE2 & HE3) | Form HE2 provides details of the registered office address, while Form HE3 outlines directors, secretary, and shareholders. |

| Tax registration | Companies must register with the Cyprus Tax Department to obtain a Tax Identification Number (TIN) and, where applicable, register for VAT. |

| Professional support | Collaboration with licensed accountants and corporate service providers is recommended to ensure compliance with statutory and tax obligations. |

The incorporation of a Cyprus limited company is not just about filing basic forms, it involves a structured set of legal and administrative steps. From securing the company name and preparing the memorandum and articles of association, to filing statutory declarations (HE1, HE2, HE3) and completing tax registrations, each requirement plays a crucial role in establishing a compliant corporate entity.

Ensuring these documents are properly prepared and submitted with the support of qualified professionals provides a solid foundation for smooth business operations in Cyprus.

Steps to incorporate an LTD in Cyprus

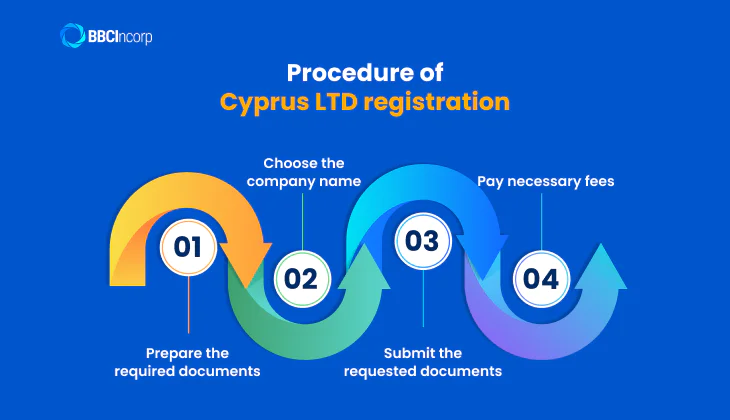

The path to establishing an LTD in Cyprus involves a series of clear and well-defined stages. Although the process requires attention to documentation and regulatory filings, it is designed to be efficient and can usually be finalized within a short timeframe. Below are the four essential steps every applicant must follow.

The incorporation can be broken down into four main stages, including:

Step 1: Preparing the required documents

The first step is to gather and prepare all mandatory documentation. This includes the company’s Memorandum and Articles of Association, which define its purpose and internal rules, as well as statutory forms such as HE1 (statutory declaration), HE2 (registered office), and HE3 (directors, secretary, and shareholders). These documents must be drafted and signed by a licensed Cyprus lawyer to ensure legal validity.

Step 2: Choosing the business name for your company

An application for name approval must be submitted to the Registrar of Companies. The chosen name should be unique, not misleading, and should comply with national naming guidelines. Words implying regulated activities (such as “bank” or “insurance”) may require prior approval from the relevant authority.

Step 3: Submission of all the requested documents

Once the name is approved and the documents are prepared, they are filed electronically with the Registrar of Companies through the e-filing system. The submission includes the Memorandum and Articles of Association, statutory forms, and details of shareholders, directors, and the company secretary.

Step 4: Pay all the necessary fees

At the time of filing, incorporation fees must be paid. The standard government fee is €165, or €235 in the case of a company without share capital. An additional €100 may be paid to expedite the process, reducing approval time.

Incorporating a Cyprus LTD involves careful preparation of legal documents, securing name approval, submitting statutory forms to the Registrar, and paying the required government fees.

When properly managed, the process is both straightforward and efficient, often completed within just a few working days. Partnering with experienced professionals ensures accuracy at each step and minimizes the risk of rejection or delays.

The details for each step can be found in this article about company register Cyprus.

Each stage of the process involves careful attention to detail, and even a minor mistake can result in significant delays or legal issues. As such, you should prepare all documentation in advance and seek legal guidance throughout the process to increase the success rate in registration.

Cyprus Corporate Taxation Structure

Cyprus distinguishes companies as either resident or non-resident for tax purposes. A company is considered tax resident if its management and control are exercised in Cyprus, and only such companies are taxed on their worldwide income. Non-resident entities are subject to tax only on income derived from within Cyprus.

Following EU accession in 2003, Cyprus aligned with international financial standards, phasing out the traditional “offshore IBC” model. In practice, the Private Non-Resident Limited Liability Company (LLC) now provides many of the same advantages once enjoyed by international business companies.

A Non-Resident Private LLC enjoys significant tax benefits, such as: no tax on foreign-sourced profits, no tax on dividends, no withholding tax on dividends, interest, or royalties paid abroad, no capital gains tax (except for immovable property in Cyprus), and no wealth or inheritance tax.

For tax-resident companies, the corporate tax rate is 12.5%, one of the lowest in the European Union. Dividend income from qualifying foreign investments may also be exempt, while capital gains tax is generally limited to real estate transactions in Cyprus. Additionally, Cyprus maintains over 60 double tax treaties, reducing the risk of double taxation and facilitating cross-border trade.

In summary, Cyprus provides a dual tax framework that allows both resident and non-resident LLCs to benefit from favorable rules, making it a highly attractive jurisdiction for international businesses and holding structures.

Post-incorporation compliance for Cyprus LTD

After incorporating a Cyprus Private Limited Company (LTD), there are several post-incorporation compliance requirements that the company must meet. These include:

- Accounting records

Ensure you maintain proper accounting records, including records of all transactions, receipts, and payments of your company, which must be kept in Greek or English for at least six years.

- Financial statements

The company must prepare annual financial statements, including a balance sheet, income statement, and cash flow statement. These statements should be prepared in accordance with International Financial Reporting Standards (IFRS) and audited by an independent auditor.

- Annual general meeting

You will be required to hold an annual general meeting (AGM) within 18 months of incorporation and once every calendar year. This is where you meet with the company’s shareholders and make decisions on important matters such as the approval of financial statements, the appointment of auditors, and directors’ elections.

- Tax returns

It is required that your company file annual tax returns with the Cyprus Tax Authority annually, notifying details of the company’s income, expenses, and tax payable.

- Shareholders’ register

Your company has the responsibility to maintain a register of its shareholders at its registered office, which includes details such as the shareholders’ names, addresses, and shareholdings.

- Register all necessary documents

You must also register for tax, VAT, social insurance, and all trade mark to stay in compliance with Cyprus regulations.

- Changes in company details

If your company makes any adjustments such as changing the registered office, removing directors, or onboarding more shareholders, you’re required to inform the Cyprus Registrar of Companies of these changes.

Depending on your company type, the compliance may differ. But these post-incorporation compliances are crucial for the smooth functioning and legal operation of a Cyprus LTD.

Key Corporate Features

Cyprus has built a reputation as a strategic hub for international business, thanks to its investor-friendly legal system, favorable tax regime, and efficient incorporation procedures. Understanding the main features helps entrepreneurs and investors evaluate whether this structure aligns with their business goals.

| Aspect | Requirement / Feature |

|---|---|

| Legal Framework | Governed by the Cyprus Companies Law, Cap. 113, modeled on the UK Companies Act |

| Shareholders | Minimum of one shareholder (individual or corporate); 100% foreign ownership permitted |

| Directors | At least one director; no nationality restrictions, though appointing a local director helps establish tax residency |

| Company Secretary | Mandatory appointment to ensure statutory compliance and record-keeping |

| Registered Office | A local registered office in Cyprus is required for official correspondence |

| Share Capital | No statutory minimum for private companies; commonly issued share capital starts from €1,000 |

| Confidentiality | Beneficial ownership information must be filed with the Registrar, with limited public disclosure |

| Language & Documents | Memorandum and Articles of Association submitted in Greek, with certified translations available |

One-Stop Solution for Cyprus Company Incorporation

Setting up and running a company in Cyprus requires careful attention to compliance, tax obligations, and corporate governance. For many entrepreneurs, the first challenge lies in navigating the procedures of Cyprus company registration, which demand both precision and familiarity with local regulations. Partnering with BBCIncorp ensures you have a trusted advisor by your side, helping you navigate every stage of the business lifecycle with efficiency and confidence.

Our services are designed with flexibility in mind, offering multiple packages to meet the diverse needs of entrepreneurs, SMEs, and global corporations:

- Company formation: Hassle-free incorporation with tailored guidance from start to finish.

- Corporate secretarial services: Professional support to maintain statutory records and filings seamlessly.

- Nominee director and shareholder services: Ensuring confidentiality and meeting local residency requirements with ease.

- Banking support: Smooth facilitation of corporate bank account opening through trusted local and international partners.

- Accounting and auditing: Reliable bookkeeping and audit services to keep your company compliant and investor-ready.

- Tax filing and advisory: Strategic tax management, from annual filings to cross-border tax planning.

By choosing BBCIncorp, you secure more than an incorporation provider, you gain a partner committed to delivering efficiency, transparency, and peace of mind. With a proven track record across multiple jurisdictions, BBCIncorp combines global expertise with local precision, empowering your business to grow with confidence.

Conclusion

In conclusion, setting up a Cyprus limited company can reveal many potentials for your business but for this to work out, finding help from your local legal authorities or professional is highly recommended.

If the information above still has not stratified your needs, feel free to contact us for more information via service@bbcincorp.com or view our Cyprus incorporation package to accelerate your incorporation process quickly.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.