Table of Contents

Starting and running an LLC is an exciting milestone for any entrepreneur. But while managing your LLC’s finances, you might wonder, how to file taxes for LLC with no income?

Even if your LLC didn’t generate revenue, tax compliance is still essential to maintain its legal standing and avoid penalties. This guide will answer common questions like “does my LLC need to file taxes if there is no income?” while offering a step-by-step breakdown of the filing process.

Do you need to file taxes for an LLC with no income?

The short answer is yes. Filing taxes for an LLC with no income is required in many cases, even if your business was inactive or didn’t generate revenue during the tax year.

Why? Because LLCs, like all legal entities, are subject to specific federal and state obligations based on their tax classification. Whether your LLC is taxed as a sole proprietorship, partnership, S corporation, or C corporation, there are forms to file to report your status, even if income is zero.

Failure to file taxes for your LLC can lead to:

- Penalties for late filing or non-filing.

- Loss of your LLC’s good standing with the state.

- Potential closure of your business.

To avoid these consequences, it’s crucial to understand your filing responsibilities. Depending on how your LLC is classified for tax purposes, the requirements will vary. Let’s break it down step by step.

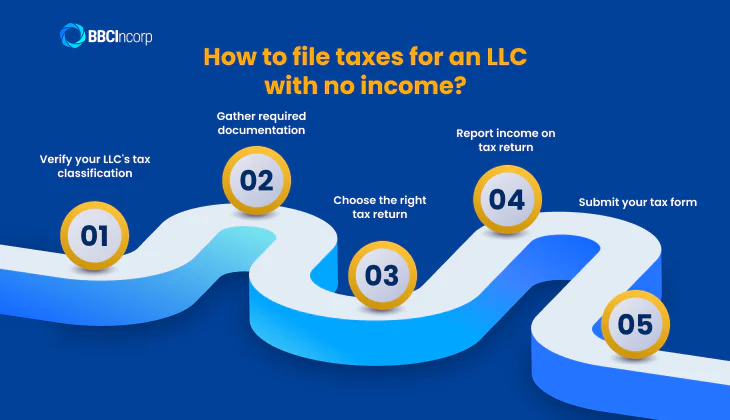

How to file taxes for an LLC with no income?

How do you file taxes with no income? Filing taxes for an LLC with no income involves several steps to ensure accuracy and compliance with IRS guidelines. Follow this simple process for smooth filing:

Step 1: Verify your LLC’s tax classification

The IRS does not recognize LLCs as a tax entity by default but allows them to be taxed in one of the following ways:

- Single-member LLC (default classification): Treated as a sole proprietorship.

- Multi-member LLC (default classification): Treated as a partnership.

- Election to be taxed as a C Corporation or S Corporation.

Your LLC’s tax classification determines which forms you need to file. Check with your formation documents or consult the IRS if you’re unsure about your LLC’s classification.

Step 2: Gather required documentation

Even with no income, complete and accurate documentation is essential. Here’s what you’ll need:

- Employer Identification Number (EIN): Your LLC’s EIN is a unique identifier required for most tax filings. If you don’t have it or misplaced it, see guidance on how to find EIN numbers or how to apply for a new one.

- Financial records: Keep a record of expenses, if applicable, even with $0 income. Organized records make it easier to monitor your LLC’s financial and tax compliance.

Step 3: Choose the right tax return

If your LLC has no income, you’ll still need to file the LLC with no income tax return based on its classification:

- Single-member LLCs: File Form 1040 along with Schedule C to report $0 income.

- Multi-member LLCs: File Form 1065 (U.S. Partnership Return of Income). Do I need to file 1065 if there is no activity? Yes, even inactive multi-member LLCs are required to file Form 1065 to inform the IRS of the partnership’s status.

- C Corporations: Use Form 1120 to report financial details for the calendar year.

- S Corporations: File Form 1120-S, even if there was zero income.

Step 4: Report income on tax return

Regardless of the form you’re using, it’s important to report that your total income is $0 if you had no earnings for the year. This step ensures that your tax records are up to date and helps avoid complications down the line.

Be thorough and accurate when documenting this information, as any discrepancies could raise unnecessary audits or flags from the IRS. Double-check your entries and keep any supporting documents handy in case they are needed for verification.

Step 5: Submit your tax form

So, when does an LLC file taxes? Here’s a quick guide to IRS deadlines based on your LLC type:

- Single-member LLCs: Typically due during individual tax deadlines (April 15).

- Multi-member LLCs: Form 1065 is due March 15.

- Corporations (C and S): Both Forms 1120 and 1120-S are due by March 15.

Filing on time is critical to avoid penalties. Remember, even if your LLC has no income, filing still reflects your business’s legal compliance.

Can an LLC have expenses but no income?

Yes, an LLC can have expenses without generating any revenue. In fact, it’s quite common for new businesses to incur costs before they start earning, such as expenses for setting up the LLC, researching the market, purchasing supplies, or exploring new opportunities. These initial investments are often necessary to lay the foundation for future success.

Filing taxes for LLC no Income but expenses

If your LLC had expenses during the year, it’s important to report them on your tax return, even if your income was zero.

The IRS allows deductions for ordinary and necessary business expenses, which can reduce your taxable income in future years when your business becomes profitable. Some examples of deductible expenses include:

- Operating costs: Expenses like software subscriptions, business tools, or third-party services used to keep your business running.

- Office rent and utilities: Costs for your workspace, whether it’s a home office or a rented commercial space.

- Marketing or advertising costs: Investments in promoting your business, such as website creation, social media ads, or branding materials.

By properly documenting and claiming these expenses, you may be able to carry forward the losses and deduct them in years when your LLC starts generating income, reducing your overall tax liability over time.

What happens if you start an LLC and do nothing

Some people may be wondering: “What happened if I started an LLC and never did anything with it“? In this case, your LLC still exists legally, even if it’s inactive. Here’s what you need to know:

Reporting for an Inactive LLC

The IRS and your state still expect filings, even if the LLC isn’t conducting business. Whether it’s a federal tax return, annual report, or franchise tax, filing is necessary to maintain your LLC’s standing.

How long can an LLC be inactive?

While an LLC can remain inactive indefinitely, certain filing obligations must still be fulfilled annually, depending on your jurisdiction. Failure to comply could result in fines or administrative dissolution by the state.

Not sure how to handle an inactive LLC? BBCIncorp makes it easy with expert LLC formation services and ongoing support. Whether you’re setting up a Cayman Islands limited liability company, a Cyprus LLC, or exploring other options in Seychelles, St. Vincent, or Panama, our team is here to guide you every step of the way.

Conclusion

Understanding how to file taxes for LLC with no income might seem unnecessary, but it’s a vital part of keeping your business compliant and in good standing. Whether it’s file taxes 0 income or understanding expense deductions, staying proactive is essential.

If you’re a new LLC owner or not sure where to begin, take it step by step and consult BBCIncorp for guidance. Ensuring proper tax compliance now can save you significant headaches later.

Frequently Asked Questions

How much should an LLC save for taxes?

The amount an LLC should reserve for taxes depends on factors like its tax classification, income, expenses, and state tax obligations. A common guideline is to set aside 25% to 30% of your business earnings for taxes.

What happens if I miss the tax deadline?

Missing the tax filing deadline can result in penalties, interest charges, and a potential loss of any refunds you’re entitled to. To reduce penalties and interest, file your taxes as soon as possible. If you know you’ll need additional time, consider requesting an extension ahead of the deadline.

What are the consequences of not filing taxes for an LLC?

Failing to file taxes for your LLC will lead to penalties and fees from the IRS. This can include a failure-to-file penalty of up to 5% of the unpaid taxes per month, capped at 25%. Additionally, interest will accumulate on any outstanding tax amounts.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.