Table of Contents

If you are operating a business in the U.S., or planning to establish one, the Employer Identification Number (EIN) is a fundamental requirement. This unique nine-digit code integrates into various crucial operations of your entity. Specifically, an EIN is a business tax ID number used to file federal taxes, open business bank accounts, and hire employees legally.

As a business owner, you might at some point wonder, “How to find my EIN number for my business?”. In cases where you need it for strategic purposes, like when you start a new business or simply misplace your EIN, there are certain steps to follow. In this article, we will provide clear instructions on how to navigate the relevant processes.

Do you need an EIN?

When establishing your business in the US, one of the first considerations is whether or not to obtain an Employer Identification Number (EIN). This nine-digit identifier, issued by the Internal Revenue Service (IRS), serves as your business’s Federal Tax ID (or FEIN), much like an individual’s Social Security number. It allows government agencies, financial institutions, and other entities to recognize your company as a distinct legal entity.

Generally, you will need one if your business:

- Operates as a corporation or partnership: For an S corporation, a C corporation, or a partnership, an EIN is a prerequisite for federal tax purposes, even without employees.

- Has employees: You must have an EIN to manage payroll, report employment taxes, and issue W-2 forms for hiring or planning to hire new employees.

- Administers a Keogh plan: When your business establishes a Keogh retirement plan for self-employed individuals and small business owners.

- Files specific Federal Tax Returns: Businesses obligated to file employment, excise, or alcohol, tobacco, and firearms tax returns.

- Withholds taxes for non-resident aliens: If your business pays non-wage income to non-resident aliens subject to U.S. tax withholding.

- Operates trusts: Most trusts, with specific exceptions for particular grantor-owned revocable trusts, IRAs, and those filing Exempt Organization Business Income Tax Returns, need an EIN.

- Is a Real Estate Mortgage Investment Conduit (REMIC): This specific entity dealing with mortgage-backed securities requires an EIN for tax and operational purposes.

- Is a Qualifying Nonprofit Organization: Nonprofit organizations, even without staff, must obtain an EIN to apply for and maintain their tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

Even if your business structure is a sole proprietorship or a single-member LLC lacking employees, obtaining an EIN can still provide significant advantages. For instance, most U.S. banks require an EIN to open a business bank account

Moreover, using an EIN instead of your Social Security number on official documents enhances your personal security by reducing identity theft risk.

How to find an EIN number for a business? (if you already have one)

It’s not uncommon to misplace important business paperwork, and the Employer Identification Number (EIN) is no exception. The original documentation may have been lost due to time or simply a change in the record-keeping system.

Here are four efficient methods if you are looking for “How to find my EIN”.

Reviewing crucial business documents

The most accessible starting point is your existing business paperwork. Your EIN is likely documented on several key items:

- The IRS EIN Confirmation Letter: This official notice, often labeled CP575 or bearing a similar designation, is the primary proof of your EIN assignment.

- Previously filed Business Tax Returns: Your federal business tax returns, such as Form 1120 (for corporations) or Form 1065 (for partnerships), are where to find EIN number.

- Business loan and credit applications: When applying for financing, your EIN is a standard requirement. Hence, it should be noted on these application documents.

- Business bank account statements: Financial institutions use your EIN for account identification, so the number is printed on your regular account statements.

- Legal formation documents: Your Articles of Incorporation or Articles of Organization (for LLCs) filed with the state may also contain your EIN.

Contact the Internal Revenue Service (IRS)

If you cannot find your EIN in your records, the IRS Business & Specialty Tax Line is your best option for direct assistance.

Call 800-829-4933 during business hours (Monday through Friday, 7 a.m. to 7 p.m. local time). Be prepared to verify your identity by providing:

- The legal name of your business as registered with the IRS.

- The business address listed on your tax documents.

- Your business entity type (e.g., sole proprietorship, LLC, corporation, etc.).

- The name and title of an authorized principal (such as an owner or officer).

Inquire with your financial institution

If your business has an active bank account, your financial institution likely has your EIN on file. Banks require an EIN when you open a business account, apply for loans, or set up merchant services. You can contact your bank’s customer service team or your business banking representative.

Try requesting a copy of any documents where your EIN may be recorded, such as your account application or business loan records.

Reach out to your state tax agency

If your business is registered with your state for tax purposes (e.g., sales tax, franchise tax), the state tax authority may also have your EIN in their records. In this case, please contact your state’s Department of Revenue or equivalent agency on how to find your FEIN.

How to find out your Employer Identification Number? (if you don’t have one)

Not every business starts with an Employer Identification Number (EIN).

- A sole proprietorship that initially operated using the owner’s Social Security number might reach a point where they hire staff, thus triggering the EIN requirement.

- Similarly, a single-member LLC that initially didn’t have staff and operated under the owner’s Social Security number might later expand and need this number for payroll or other business purposes.

- Newly established businesses structured as corporations, partnerships, or with employees from the outset will also need to apply for their number.

To find an EIN number for a new entity, you must first formally establish that entity through the relevant state authorities before applying to the IRS. Fortunately, the IRS provides several methods to accommodate constantly changing needs:

How to find my EIN number online?

The IRS provides a convenient online EIN Assistant tool on the website. This is often the quickest way to find an EIN number. To use this method:

- Navigate to the EIN Assistant page on the official IRS website (irs.gov).

- You will be guided through a series of questions about your business. Answer these questions accurately and completely.

- Upon successful completion of the online application, your EIN will be issued immediately online.

- The IRS online EIN application is typically available Monday through Friday, from 7 a.m. to 10 p.m. Eastern Time.

- Be aware that the online application must be completed in one session, as you cannot save your progress and return later.

How can you find your EIN number by mail?

You can also apply for an EIN by completing Form SS-4, Application for Employer Identification Number. First, download Form SS-4 from the IRS website, then carefully complete all sections of the form with accurate information.f

Next, mail the completed Form SS-4 to the appropriate address based on your business’s location:

- Within the United States: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999

- Outside the 50 states or the District of Columbia: Internal Revenue Service, Attn: EIN International Operation, Cincinnati, OH 45999

The processing times for mail-in applications can vary, so make sure to plan accordingly.

How to apply for EIN number via fax?

Another option for obtaining an EIN is by submitting Form SS-4 via fax. Similar to the process above, you will have to complete Form SS-4 as described and fax the documentation to the IRS.

Since the IRS provides specific fax numbers based on your location, please visit the IRS website page titled “Where to file your taxes (for Form SS-4)” to locate the correct fax number.

They generally respond to faxed applications within four business days. However, applications submitted without a return fax number may experience processing delays of up to two weeks.

How to find out the employer identification number by telephone?

This method is specifically for applicants located outside of the United States. If you are an international applicant, you can call the IRS at 267-941-1099 anytime Monday through Friday between 6 a.m. and 11 p.m. Eastern Time to request an EIN.

If you wish to authorize another party to apply for the EIN on your company’s behalf during the call, you should first print Form SS-4, complete and sign the “Third Party Designee” section, and be prepared to work with the IRS representative. In most cases, if all the required information is provided, the IRS will issue the EIN to you during the telephone call.

Important note

Regardless of the application method you select (online, mail, fax, or phone), the IRS restricts applications to one EIN per day per responsible party.

Please choose the method that best suits your needs and ensure all information provided is accurate to avoid processing delays.

How to find the EIN of another business?

There are valid reasons to find the EIN number of a business. You may need it to verify a vendor’s or client’s tax details, complete a Form 1099, or conduct due diligence during a merger or partnership. Therefore, knowing how to find a company’s EIN is a useful skill for business owners, accountants, and legal professionals.

Follow these steps to locate a business’s EIN based on its type and your relationship to it:

For publicly traded companies

You can utilize the U.S. Securities and Exchange Commission’s (SEC) EDGAR database:

- Navigate to the U.S. SEC EDGAR online database

- Enter the company’s name or ticker symbol into the search bar.

- Browse the company’s filings, such as their annual reports (Form 10-K) or quarterly reports (Form 10-Q).

For non-profit organizations

The IRS’s Tax Exempt Organization Search tool is a reliable resource.

- Visit the IRS’s Tax Exempt Organization Search tool (IRS, n.d.).

- Enter the organization’s name, city, state, or EIN (if you have partial information).

- The search results will display the organization’s EIN along with other pertinent details about their tax-exempt status.

For private companies

- First, attempt to contact the company directly by reaching out to their accounting or finance department.

- Politely request their EIN, explaining the legitimate business purpose for your inquiry (e.g., vendor onboarding, contract execution).

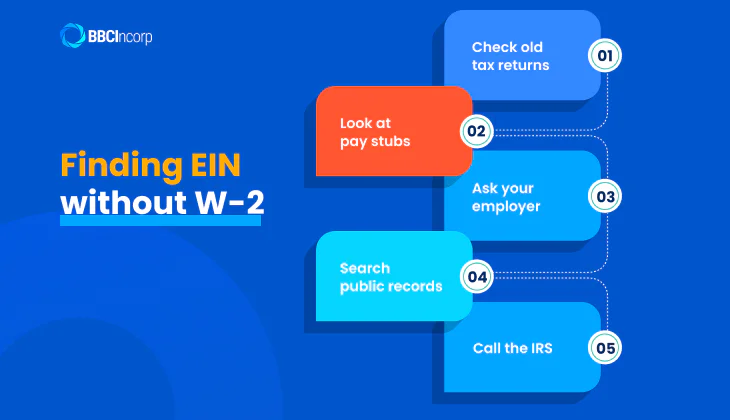

Finding my EIN number without W-2

If your W-2 is missing and you need your Employer Identification Number (EIN), you can try several alternative routes.

Check old tax returns

If you’ve filed taxes before, your prior Form 1040 may list the EIN of your employer, especially if you entered W-2 information in past years.

Look at pay stubs

Similarly, inspect your pay stubs or direct deposit confirmations, as the EIN is often printed near the company’s identification. Look for a 9-digit number formatted like XX-XXXXXXX.

Ask your employer

If these documents are inaccessible, your next step should be to directly contact your employer. Contact your current or former employer and ask for their EIN. The human resources or payroll department can answer upon request.

Search public records

For publicly traded companies and non-profit organizations, the EIN is often a matter of public record.

- Public companies: Use the SEC EDGAR database.

- Nonprofits: Try the IRS Exempt Organizations Search.

- Registered businesses: Examine your state’s Secretary of State website or business registry, or search functions for the EIN.

Call the IRS

If you’re unable to find the EIN through any of these means, call the IRS Business & Specialty Tax Line at 800-829-4933 (M–F, 7 AM–7 PM). Be prepared to verify your identity.

In addition to the W-2, these varied methods are reliable ways of obtaining the EIN when the form is unavailable.

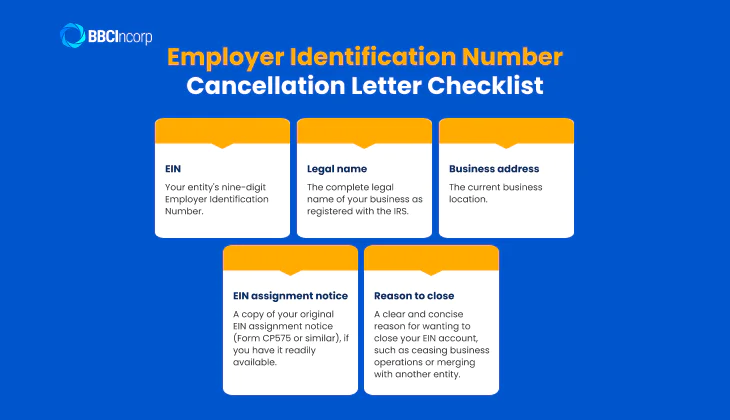

Changing or canceling the EIN of a company

You need to notify the IRS in writing to formally cancel or deactivate your EIN. Your cancellation letter should include the following details:

- Your entity’s nine-digit EIN.

- The complete legal name of your business as registered with the IRS.

- The current business address.

- A copy of your original EIN assignment notice (Form CP575 or similar), if you have it readily available.

- A clear and concise reason for wanting to close your EIN account, such as ceasing business operations or merging with another entity.

This letter should be mailed to the Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999 (IRS, n.d.). Ensure all information is accurate to facilitate the cancellation process.

Although you cannot change your existing EIN, certain fundamental shifts in your business may necessitate applying for a new one. These situations include:

- Change in ownership: If your business undergoes a significant change in ownership, such as through a sale or transfer of the majority of the business, if you inherit or acquire an existing business as a new legal entity, or if the company becomes a subsidiary of a larger corporation, a new EIN might be required.

- Change in business structure: Altering your business structure can also trigger the need for a new EIN. Examples include incorporating a sole proprietorship or partnership, or if a single-member LLC elects to be taxed as an S corporation.

- Bankruptcy: If your business becomes subject to a bankruptcy proceeding under Chapter 7 or Chapter 11 of the Bankruptcy Code, the bankruptcy trustee may be required to obtain a new EIN for the estate to manage the business’s financial affairs.

In these scenarios, you would follow the standard application process outlined earlier in this guide, either online, by mail, or by fax, using Form SS-4. Further, it is mandatory to accurately represent the new ownership or business structure in your application.

Finding your EIN number quickly with BBCIncorp

Establishing a U.S. business as an international entrepreneur can be complex, especially when obtaining an EIN due to IRS requirements and remote access. At BBCIncorp, we specialize in global company formation across key jurisdictions, including:

- Delaware incorporation

- Cyprus company registration

- Panama companies setup

- Incorporation of companies Cayman Islands

- And many more prominent options for offshore company corporations and global companies.

Our experienced team acts as your dedicated partner, handling all necessary paperwork and direct communication with the IRS on your behalf. With over a decade of experience, BBCIncorp has successfully assisted thousands of clients in launching and maintaining compliant international businesses.

Interested in starting your offshore venture? Contact BBCIncorp today at service@bbcincorp.com to explore our comprehensive suite of full-service solutions and how we can support your EIN application! We are committed to offering timely assistance for your business needs.

Conclusion

The Employer Identification Number (EIN) is a foundational element for your U.S. business endeavors. This key identifier enables critical functions from tax compliance to banking and talent acquisition. Thus, losing track of your EIN can create unnecessary problems for your business. “How can I find my EIN number then?” You can find it by reviewing your business records, reaching out to the IRS or your financial institution, or exploring state tax resources. Even identifying another business’s EIN is achievable through accessible resources.

In the case of new ventures or evolving businesses that need a new EIN due to structural changes, you can apply with ease through the IRS. It is advised to be proactive and keep your EIN documents in a credible location at all times.

Frequently Asked Questions

Is an EIN and federal tax ID number different?

No, they are the same. The Employer Identification Number (EIN) is the official name for what is commonly called a federal tax ID number. The IRS issues this number to identify your business for tax purposes.

You will need to use your EIN when:

- Filing federal and state tax returns

- Opening a business bank account

- Applying for business licenses or permits

- Hiring employees

- Completing vendor forms or tax documents like Form 1099

You may also see it referred to as a FEIN (Federal Employer Identification Number)

If you’re starting a business or forming a company in the U.S., you’ll most likely need an EIN, even if you don’t have employees. The IRS will provide this number to your business via application, and it’s free to apply online.

Is it possible to run a business without an EIN?

Yes, if you’re a sole proprietor with no employees and no excise tax obligations, you can operate your business using your Social Security number (SSN) instead of an Employer Identification Number (EIN).

However, you’ll need an EIN if you

- Hire employees

- Form a partnership, corporation, or multi-member LLC

- File certain tax returns (e.g. employment, excise, or alcohol/tobacco/firearms taxes)

- Withhold taxes for non-resident aliens

- Establish a retirement plan like a Keogh

- Apply for business licenses; or

- Open a business bank account

While not always required, having an EIN adds professionalism, improves data privacy, and simplifies tasks like banking and tax filing. In most scenarios, it’s better and often necessary to get your EIN.

How many EINs can I have?

Can you have multiple EIN numbers? Yes, you can have multiple EINs but only one per business entity. If you operate several businesses under different legal structures, such as separate LLCs or corporations. Each entity can and should have its own EIN.

Notably, the IRS limits EIN issuance to one per day per responsible party.

Is an EIN the same as a TIN?

An EIN (Employer Identification Number) is a specific type of TIN (Taxpayer Identification Number). The term TIN is a broad category used by the IRS to identify individuals and entities for tax purposes.

Although an EIN serves this purpose specifically for businesses, corporations, partnerships, and other organizations (like non-profits and trusts), other forms of TINs exist. You can see more on the difference between EIN and TIN of other taxpayers in our dedicated article as well.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.