Table of Contents

A Limited Liability Company (LLC) is a flexible business structure that offers liability protection, tax advantages, and simplified management. Many entrepreneurs choose an LLC to separate personal and business assets while benefiting from fewer compliance requirements.

Along with this type of incorporation, the question How long does it take to get an LLC approved? is frequently asked. The timeframe for approval depends on the registration state, filing method, and processing speed. Understanding these timelines is essential for effective business planning, as delays can impact operations, banking setup, and legal agreements.

In this article, we’ll explore the key factors influencing approval times, typical processing timelines by state, and strategies to expedite the process.

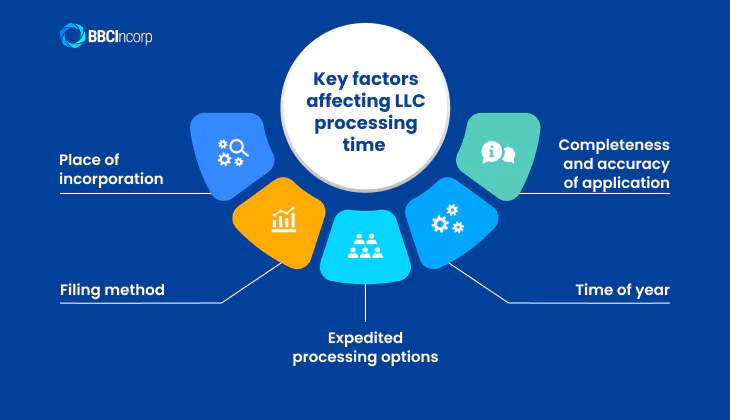

Key factors affecting LLC processing time

The time it takes to get an LLC approved depends on several factors, which can either speed up or delay the process. Understanding these key factors allows you to plan, avoid unnecessary problems, and choose the most efficient filing method.

Place of incorporation

The place of incorporation refers to the country or jurisdiction where a business is legally registered. The processing times for LLC approval vary significantly across jurisdictions.

In the United States, standard LLC processing times can range from 2 to 14 business days, depending on the state and filling method. While Seychelles registration usually takes up to 3 business days.

Filing method

The filing method is the process used to submit business registration documents for approval The two main options are online filing and mail-in filing, each with different processing speeds. Online filing is generally faster, as many jurisdictions process applications within a few days. Choosing the right filing method can significantly impact approval time, making online submission the preferred option for faster business registration.

For Example

In Nevada (U.S.), online LLC filings can be approved within 24 hours, in contrast, mail-in filings take longer around 3-4 weeks plus mail time.

Expedited processing options

Expedited processing options allow businesses to shorten the approval time for their LLC registration by paying an additional fee. Many jurisdictions offer this service, but the availability, cost, and processing speed vary.

Take Delaware (U.S.) as an example: The standard cost to form an Delaware LLC is $110, with a processing time of 10 business days. If expedited service is required, fees increase significantly. One-hour processing costs $1000 two-hour service is $500, and same-day filing ranges from $100 to $200.

Time of year

The time of year can affect how long it takes to get an LLC approved. Processing tends to slow down at the beginning and end of the year due to a surge in applications. The reason is many businesses file before December 31 for tax benefits, while January brings a wave of new registrations for the upcoming fiscal year. Furthermore, some states also have annual report deadlines, adding to delays.

Completeness and accuracy of application

The completeness and accuracy of your LLC application directly impact how long it takes to form an LLC. Errors, missing details, or incorrect information can lead to delays or rejection, requiring resubmission and prolonging how long it takes to set up an LLC.

Common mistakes include incorrect business names, missing signatures, or incomplete forms. So, ensuring all documents are correctly filled out and submitted according to state requirements can help streamline processing. By avoiding errors, you can reduce setbacks and get a clearer estimate of how long it takes to get an LLC approved.

How long does it take to form an LLC by U.S. States?

Processing times for forming an LLC diverse across the United States, with each state and the District of Columbia offering different standard processing durations and expedited options. Below is a comprehensive overview.

| State | Standard Online Filing Time | Expedited Options (if available) |

| Alabama | Immediate | No expedited service is available. |

| Alaska | Immediate | No expedited service is available. |

| Arizona | 14–16 business days | No expedited service is available. |

| Arkansas | 3–7 business days | No expedited service is available. |

| California | 1–2 weeks | $370 for 2-business-day processing. |

| Colorado | Immediate | No expedited service is available. |

| Connecticut | 2–3 business days | No expedited service is available. |

| Delaware | 1–2 weeks | $1,000 for 1-hour service; $500 for 2-hour service; same-day service ranges from $100 to $200. |

| District of Columbia | 5–7 business days | $100 for 1-day service; $50 for 3-day service. |

| Florida | 2–5 business days | $100 for 24-hour processing. |

| Georgia | 7 business days | $100 for 2-day service; $250 for same-day service; $1,000 for 1-hour service. |

| Hawaii | 3–5 business days | $25 for 1–3 day expedited processing. |

| Idaho | Several business days | No expedited service is available. |

| Illinois | Up to 4 weeks | $100 for expedited processing. |

| Indiana | 1–2 business days | No expedited service is available. |

| Iowa | Immediate | No expedited service is available. |

| Kansas | Immediate | No expedited service is available. |

| Kentucky | Immediate | No expedited service is available. |

| Louisiana | 3–5 business days | $30 for 24-hour processing; $50 for 2–4 hour processing. |

| Maine | No online filings | $50 for 24-hour processing; $100 for same-day processing. |

| Maryland | 4–6 weeks | $50 for expedited 7-day processing. |

| Massachusetts | 2–5 business days | $20 expedited fee for online filings. |

| Michigan | 5–10 business days | $100 for same-day processing; $500 for 2-hour processing; $1,000 for 1-hour processing. |

| Minnesota | Under 7 business days | $20 expedited fee for online filings. |

| Mississippi | 1–2 business days | No expedited service is available. |

| Missouri | 1–3 business days | No expedited service is available. |

| Montana | 3–5 business days | $20 for 24-hour service; $100 for 1-hour service. |

| Nebraska | 1–2 business days | No expedited service is available. |

| Nevada | 2 business days | $125 for 24-hour processing; $500 for 2-hour turnaround; $1,000 for 1-hour processing. |

| New Hampshire | 2–3 business days | $25 for 24-hour service; $50 for same-day service. |

| New Jersey | 1 business day | $25 for 8.5 business hour processing. |

| New Mexico | Several business days | No expedited service is available. |

| New York | Around 1 week | $25 for 24-hour processing; $75 for same-day processing; $150 for 2-hour service. |

| North Carolina | 7–10 business days | $100 for 24-hour processing; $200 for same-day processing. |

| North Dakota | Up to 5 business days | $50 for expedited processing. |

| Ohio | 3–7 business days | $100 to $300 per document, depending on urgency. |

| Oklahoma | 1 business day | $25 for same-day document processing. |

| Oregon | A few business days | No expedited service is available. |

| Pennsylvania | Up to 15 business days | $300 to $1,000, depending on urgency. |

| Rhode Island | 5–7 business days | No expedited service is available. |

| South Carolina | Same or next day | $100 for 24-hour service; $200 for same-day service. |

| South Dakota | Immediate | $50 for expedited processing. |

| Tennessee | Several business days | No expedited service is available. |

| Texas | 4–5 business days | $25 per document for expedited processing. |

| Utah | 24 hours | $75 for 1–2 business day processing. |

| Vermont | Less than 1 business day | No expedited service is available. |

| Virginia | Up to 4 weeks | $50 or $100 for next-day service; $200 for same-day service. |

| Washington | 2 business days | $50 per paper filing; $20 for online filings. |

| West Virginia | 5–10 business days | $25 for 24-hour service; $250 for 2-hour service; $500 for 1-hour service. |

| Wisconsin | 10–14 business days | $35 per document for 1–2 day processing. |

| Wyoming | 2–3 business days | No expedited service is available. |

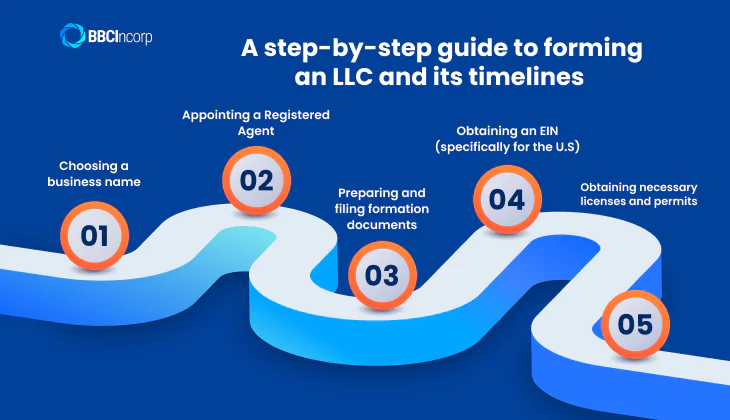

A step-by-step guide to forming an LLC and its timelines

Forming an LLC involves several steps, each with its own procedure time. Understanding each stage of the process helps set realistic expectations and avoid unnecessary delays. This guide provides a step-by-step breakdown of how to form an LLC, including estimated processing times for each step.

Step 1: Choosing a business name

Choosing a business name is the first step in forming an LLC. The name must be unique, comply with state regulations, and typically include “LLC” or a similar designation, for example, Sunrise LLC, or HBO LLC. Moreover, before finalizing a name, check its availability through the state’s business registry to avoid conflicts.

In some cases, you may also need to register a trade name or “Doing Business As” (DBA) if operating under a different name. Processing times for name approval vary by state, usually taking between one to five days, depending on the filing method and state requirements.

Step 2: Appointing a Registered Agent

Appointing a registered agent is a mandatory requirement for forming an LLC. This agent serves as the official recipient of legal and government correspondence, such as lawsuits or compliance notices. The agent must have a physical address in the state where the LLC is registered and be available during business hours.

Business owners can act as their own registered agent, but many options for professional services to ensure reliability and privacy. Appointing a registered agent typically takes 1 day, but careful consideration is advised to ensure compliance and smooth operations.

Step 3: Preparing and filing formation documents

You must prepare and file the necessary formation documents, such as the Articles of Incorporation or Certificate of Formation. These forms typically require details like the LLC’s name, address, registered agent, and the members or managers involved in the business.

Accuracy is essential, as errors or omissions can result in delays or rejection of the application. After that, you file the documents through various methods, including online submission or mail depending on the state. The approval timeline differs significantly by jurisdiction, ranging from one day to several weeks, depending on state regulations and application volume. If available, expedited filing options can reduce processing time.

Step 4: Obtaining an EIN (specifically for the U.S)

An Employer Identification Number (EIN) is a unique nine-digit number issued by the IRS to identify businesses for tax purposes. It is required for LLCs with multiple members, those hiring employees, or those electing corporate taxation. Even single-member LLCs may need an EIN to open a business bank account.

The application process is free and can be completed online through the IRS website, with approval granted immediately. Keeping the EIN confirmation letter safe is essential for future business transactions.

Step 5: Obtaining necessary licenses and permits

Once your LLC is formed, the next step is securing the necessary licenses and permits. Depending on your industry and location, this may include health permits, professional licenses, sales tax permits, or zoning permits. For example, a restaurant may need health department clearance, while an online retailer might need a sales tax permit.

The specific requirements will differ based on both your business type and jurisdiction. The timeline for obtaining these licenses and permits can fluctuate significantly, ranging from a few days to several months, influenced by the complexity and processing time of local authorities.

Expediting your LLC formation with BBCIncorp

Forming an LLC can be a time-consuming and complex process, especially if you are unfamiliar with legal requirements. BBCIncorp simplifies and accelerates this process by offering comprehensive LLC formation services.

Why Choose BBCIncorp for LLC Formation?

- Comprehensive service package: BBCIncorp handles all essential steps, including registered agent services, document filing, EIN application, and compliance guidance, ensuring a smooth formation process.

- Faster processing times: Compared to self-filing, BBCIncorp expedites the LLC formation timeline, helping you establish your business efficiently and avoid unnecessary delays.

- Expert compliance support: The team ensures all filings meet legal requirements, reducing the risk of rejections, penalties, or processing issues.

- Delaware LLC formation: BBCIncorp specializes in setting up LLCs in Delaware, a preferred U.S. business hub, offering seamless registration and ongoing compliance support.

- Offshore LLC formation options: If you seek international business advantages, BBCIncorp assists with company formation with bank account in various jurisdictions, offering tax benefits and asset protection. Available locations include Anguilla, Bahamas, Belize, British Virgin Islands, Cayman Islands, Delaware (US), Panama, St. Kitts & Nevis, St. Vincent & Grenadines, Marshall Islands, Samoa, Cyprus, Mauritius, Seychelles, Ras Al Khaimah (UAE), and the United Kingdom.

- End-to-end guidance: Guiding you through every step, from selecting the optimal business structure to ensuring all required documents are correctly prepared and submitted. With expert assistance, you can navigate legal requirements smoothly and set up your business with confidence.

Conclusion

Understanding how long does it take to get an LLC is important for effective business planning. Processing times vary by state, filing method, and additional requirements such as obtaining an EIN or necessary permits. While some LLCs are approved within a day, others may take weeks. To avoid unnecessary delays, ensure all documents are accurate and consider expedited filing options if available.

For a faster and hassle-free process, using professional services like BBCIncorp can streamline formation and compliance. Proper planning will help you establish your LLC smoothly and begin operations without setbacks.

Frequently Asked Questions

How long does it take to get an LLC approved, and can I begin operating my business before the approval is finalized?

LLC approval times vary by state and filing method. Online filings can take a few days to weeks, while mail submissions may take longer. Some states offer expedited processing for a fee to shorten the wait time. At the same time, you cannot operate your business until approval is granted.

How long does an LLC take to process, and how can I check the status of my application?

To check the status of your LLC application, visit the Secretary of State’s website for the state where your LLC is registered, search for the business entity database, and enter your LLC’s name or registration number.

If an LLC application is rejected, what steps should you take to reapply, and how long does it take to get your LLC approved with a second application?

In case your LLC application is rejected, first review the rejection notice to identify the issue, such as missing information, name conflicts, or incorrect filings. Correct the errors and resubmit the application following the state’s guidelines.

The processing time for a second application depends on the state and filing method. If no major corrections are needed, approval may take the same time as the initial submission, ranging from a few days to several weeks.

Can using an LLC formation service expedite the approval process?

Yes, you can. These services have experience handling state-specific requirements, ensuring that your application is correctly completed and submitted without errors that could cause delays.

Many services also offer expedited filing options, which may reduce processing time depending on the state. However, actual approval times still depend on the state’s processing speed.

What does it take to get an LLC approved by mail, and how long does it typically take?

To get an LLC approved by mail, you must complete the required formation documents, such as the Article of Incorporation, and submit them along with the necessary filing fees to the appropriate state agency. Processing times for mail filings vary by state and usually longer than online filing methods.

The approval time for an LLC application submitted online fluctuates by state. Checking with the relevant state agency can provide the most accurate estimate for processing times in your jurisdiction.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.