Table of Contents

Starting a business involves several key steps, with incorporation being one of the most significant milestones for entrepreneurs looking to establish a formal corporate entity. One critical piece of this process is understanding “What are Articles of Incorporation?” and the pivotal role they play in forming a corporation.

Filing this document with the appropriate state authority not only establishes your business as a legal entity but also sets the foundation for its long-term operation and credibility. This guide will walk you through everything you need to know about Articles of Incorporation, including their meaning, benefits, filing process, and next steps to ensure compliance.

What are Articles of Incorporation?

The Articles of Incorporation, also known as a Certificate of Incorporation in some states, is a formal legal document required to create a corporation, outlining the essential details required to legally establish the business.

To provide the articles of incorporation definition, these documents include critical information such as the corporation’s name, purpose, registered agent, and the number of shares authorized.

It acts as the foundation for the corporation’s legal existence, providing essential details about the business structure and operations.

Articles of Incorporation meaning

At its core, the Articles of Incorporation serve as the “birth certificate” of a corporation. When filed with the state, this document officially creates the corporation, granting it legal recognition. Each state has its own requirements, but the Articles typically include information such as the corporation’s name, purpose, and registered agent details.

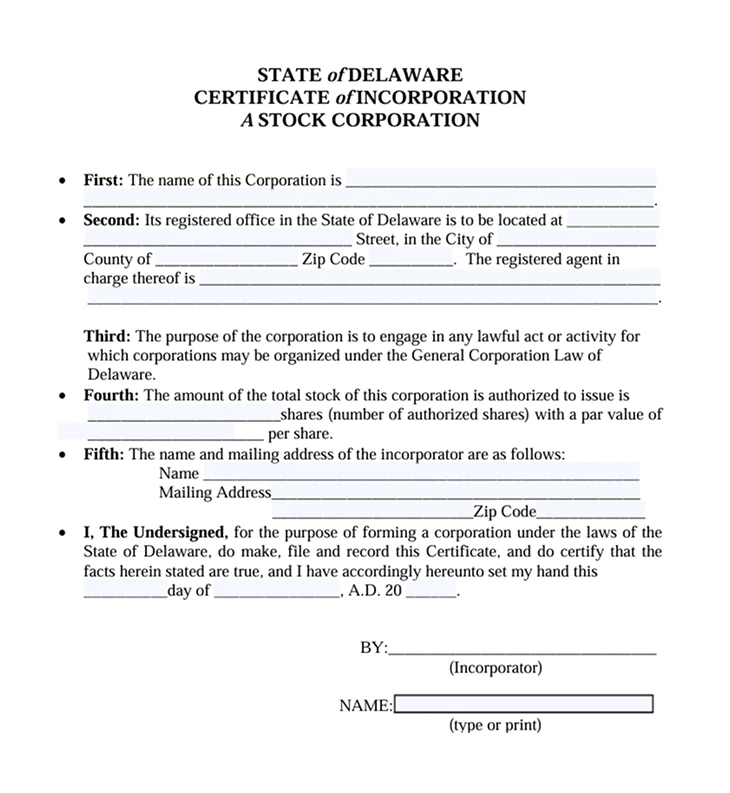

Example of Articles of Incorporation

Below is an example of Articles of Incorporation (also referred to as a Certificate of Incorporation in Delaware), which answers the question “what do articles of incorporation look like” and is a document required by the state to establish a corporation.

This document is divided into six key sections:

- Name: Specifies the official name of the corporation.

- Registered office and Registered agent: Lists the address of the corporation’s registered office and the registered agent authorized to receive legal documents.

- Purpose: Defines the purpose or objectives of the corporation.

- Stock information: Details the authorized amount of stock the corporation can issue.

- Incorporator information: Includes the name and mailing address of the individual responsible for filing the document.

- Signature: The undersigned section, where the incorporator formally signs the document.

Each section serves a critical role in legally defining the corporation’s existence and structure.

Benefits of filing Articles of Incorporation

Filing Articles of Incorporation opens the door to several key benefits for your business:

Personal asset protection

One of the top reasons business owners incorporate is to protect their personal assets. Filing Articles of Incorporation establishes a clear boundary between your personal and business liabilities.

If your corporation faces debts or legal issues, your personal property, like your home or savings, typically remains safe. This protection is invaluable, particularly in industries prone to risks or lawsuits.

Exclusive rights to business name

When you incorporate, your business name is registered with the state, ensuring that no other corporation in the same state can use the exact same name. This provides a level of exclusivity and protects your brand identity within that jurisdiction.

However, it’s important to note that this protection is typically limited to the state where you incorporate. If you want broader protection, such as nationwide exclusivity, you may need to register your business name as a trademark with the U.S. Patent and Trademark Office (USPTO).

Potential tax advantages

Although corporations are taxed differently from sole proprietorships or partnerships, they can benefit from specific tax advantages. Depending on the structure (such as C corporation or S corporation), you might reduce overall tax liability, retain earnings within the business, or deduct costs like employee benefits.

Enhanced business credibility

An incorporated business carries more weight in the eyes of customers, vendors, and investors. The “Inc.” or “Corp.” at the end of your company name signals stability, professionalism, and long-term commitment. This can help attract clients and strengthen your reputation in your industry.

Additionally, many companies and government entities prefer to work with incorporated businesses, opening doors to bigger contracts or partnerships.

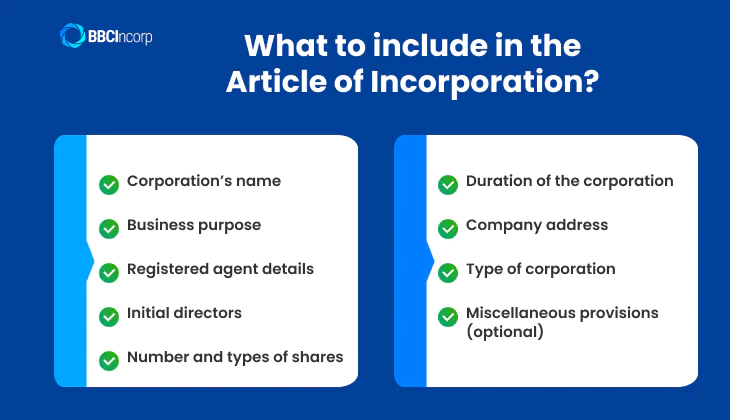

What to include in the Article of Incorporation?

When preparing your Articles of Incorporation, here’s the critical information you’ll need to include:

- Corporation’s name: The official legal name of your business.

- Business purpose: Either a general purpose or a specific one tailored to your operations.

- Registered agent details: Name and address of the individual or entity authorized to receive legal documents on behalf of your corporation.

- Initial directors: Names and addresses of the individuals who will oversee the corporation.

- Number and types of shares: The number of shares the corporation is authorized to issue and any details about their classes.

- Duration of the corporation: Whether the corporation is perpetual or exists for a specific term.

- Company address: The principal office address of the corporation.

- Type of corporation: For instance, C Corporation or S Corporation.

- Miscellaneous provisions (optional): Any additional details relevant to your corporate operations, such as shareholder rights or voting procedures.

How Article of Incorporation differs from other documents

While Articles of Incorporation lay the groundwork for a corporation’s legal status, it’s important to note what articles of incorporation do not include.

By understanding the role and limitations of the Articles of Incorporation, you can better navigate the various documents needed to successfully set up and maintain your business.

Corporate Bylaws

Purposes

Articles of Incorporation legally establish the corporation, while corporate bylaws dictate how the corporation will operate internally.

Key differences

Unlike Articles of Incorporation, Bylaws are not filed with the state. They are used internally to maintain organizational structure and ensure smooth governance. Without Bylaws, a corporation may struggle with operational efficiency, especially as it grows.

Operating Agreement

Purposes

Operating agreements are for LLCs, whereas Articles of Incorporation are for corporations. While Articles of Incorporation focus on registering the business with the state, an Operating Agreement outlines the internal workings of the LLC. It defines member roles, profit distribution, and decision-making processes.

Key differences

Articles of Incorporation grant legal status; operating agreements set ownership and operational rules.

Certificate of Good Standing

Purposes

A Certificate of Good Standing shows that a business has met all state-required obligations, such as filing annual reports or paying franchise taxes. Unlike Articles of Incorporation, it doesn’t establish the business but acts as proof that the business is properly maintained and in compliance with state laws.

Key differences

Articles establish a corporation, while a Certificate is often required when expanding into new states, applying for loans, or securing major contracts. Without it, some states or institutions may view the business as inactive or in bad standing.

Business license

Purpose

While Articles of Incorporation create the legal framework for a corporation, a business license is what allows it to legally operate in a specific area or industry. Issued by local, state, or federal governments, the business license ensures you’re meeting industry-specific regulations.

Key difference

Articles are typically filed once during formation, licenses often require periodic renewal and are specific to the business’s location and function.

Tax identification documents

Purpose

A Tax Identification Number (TIN) serves as a unique identifier for tax purposes. It’s needed to:

- File taxes.

- Open bank accounts.

- Hire employees.

Key difference

Unlike Articles of Incorporation, which define a business as a legal entity, a TIN is strictly tied to the financial operations and tax obligations of your business.

In summary, articles of corporations focus solely on establishing the business’s legal identity. They are not designed to address ongoing compliance, operational strategies, or tax obligations. Instead, their primary purpose is to fulfill state requirements for officially registering a corporation, ensuring it can legally operate.

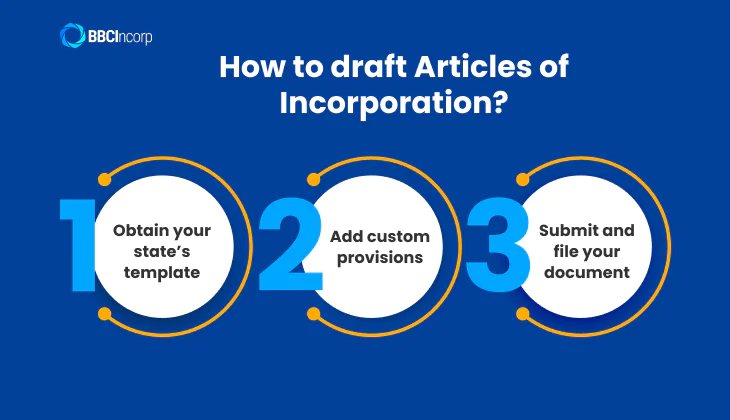

How to draft Articles of Incorporation?

Once you understand “what is an article of incorporation“, you can begin drafting one for your business. Using a state-provided template can simplify the process and ensure everything is completed smoothly.

Step 1: Obtain your state’s template

Most states provide a standardized Articles of Incorporation template on their Secretary of State website.

To find the template:

- Visit your state’s Secretary of State or business registration website.

- Search for “Articles of Incorporation” forms.

- Download the correct template for your corporation type (e.g., professional corporation, nonprofit, etc.).

The template will typically include fields or sections for basic details like your corporation’s name, address, and the name of your registered agent.

Step 2: Add custom provisions

Custom provisions are optional, but they can provide clarity and protect your business interests down the line. Some custom provisions you might consider adding include:

- Voting rights: Specify the voting rights of shareholders, especially if your corporation will issue multiple classes of stock.

- Indemnification clause: Protect directors and officers from personal liability for corporate actions.

- Duration clause: State how long you want the corporation to exist, whether indefinitely or for a specific period.

- Restrictions (if any): Include clauses that limit certain activities, such as restrictions on transferring shares.

Step 3: Submit and file your document

Once your template is complete and customized, it’s time to file it. Most states allow you to file Articles of Incorporation online, by mail, or in person.

- Pay the filing fee: Filing fees vary by state but typically range from $50 to $300.

- Retain a copy: Keep a copy of the finalized document for your records, as you’ll need it for tasks like opening a business bank account or securing an Employer Identification Number (EIN).

When and where to file Articles of Incorporation?

Understanding when and where to file, who is responsible for handling the process, and how much it costs can make the process seem less intimidating.

When to file

The Articles of Incorporation are filed during the initial phase of setting up a corporation, right after choosing a business name, confirming its availability, and selecting a registered agent to represent your company.

It’s crucial to file as soon as you’re ready. Waiting too long to file could delay critical next steps, like opening a corporate bank account or obtaining an Employer Identification Number (EIN) from the IRS.

Where to file

Articles of Incorporation are filed with the Secretary of State (or its equivalent) in the state where you plan to operate your corporation.

Each state has its own office for business filings, which can typically be found on the state government’s website. Many states also offer online filing services, making it faster and more convenient to complete the process.

Who prepare and file the Articles of Incorporation

The person responsible for preparing and filing Articles of Incorporation is known as the “incorporator.” This can be a business owner, a company representative, or anyone designated to handle the paperwork.

For added convenience and accuracy, you can enlist the help of a business attorney or an online incorporation service. Trusted providers like BBCIncorp specialize in navigating state-specific requirements and ensuring error-free filings, whether you’re incorporating in Delaware or exploring offshore jurisdictions.

Filing fees

The cost to file Articles of Incorporation varies widely by state, typically ranging from $50 to $300. Additional costs may apply if you use an attorney or an online service to prepare and file the documents.

Some states also charge a franchise tax or require an annual report after the initial filing, so it’s wise to budget for ongoing compliance costs.

What happens after filing Articles of Incorporation?

Filing Articles of Incorporation is a major milestone in forming your corporation, but it’s just the beginning of your business’s legal and operational setup.

After your documents are submitted, there are several essential steps to complete before your corporation is fully operational and in compliance with state requirements.

- Create bylaws: Bylaws help ensure your corporation runs smoothly and stays compliant with state laws. They’re also often required by banks or investors during due diligence.

- Hold initial shareholder and director meetings: Once you’ve drafted your corporate bylaws, it’s time to organize a meeting to adopt corporate bylaws, appoint officers, and make initial decisions.

- Obtain an EIN (Employer Identification Number): You can apply for an EIN online through the IRS website. Approval is usually immediate, so you can start using your EIN right away for tax and banking purposes.

- Secure business licenses or permits: Check if your business requires additional licenses to operate legally. and apply as soon as possible to avoid penalties or delays.

- Maintain compliance: Meet ongoing state requirements like annual filings or franchise taxes.

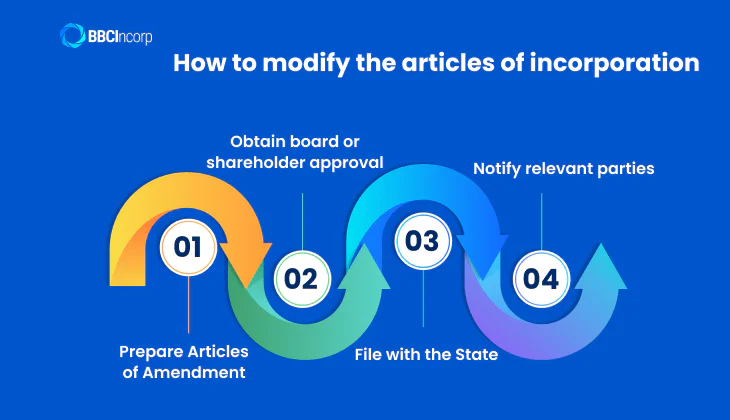

How to modify the articles of incorporation

As your business grows and evolves, you may need to update your Articles of Incorporation to reflect these changes. Common reasons for amendments include:

- Changing the business name

- Updating the registered agent or address

- Modifying the stock structure

- Revising the business purpose

- Adding or removing provisions

Below, we’ll walk you through the steps involved to amend your Articles of Incorporation.

Step 1: Prepare Articles of Amendment

Most states provide a form called “Articles of Amendment,” which serves as the official document for updating your original Articles of Incorporation.

When filling out this form, you’ll typically need to include:

- Corporation name: The current legal name of your corporation as it appears in the Articles.

- Amendment details: Clearly explain the changes you’re making (e.g., “Changing the corporation name from ABC Corp. to XYZ Inc.”).

Step 2: Obtain board or shareholder approval

Certain amendments, such as changes to the business name or stock structure, may require formal approval. This usually involves a vote by the board of directors or shareholders.

Be sure to document the decision in the meeting minutes, including the date of approval and any relevant details.

Step 3: File with the State

Once your Articles of Amendment are prepared and approved, file them with your state’s Secretary of State (or the equivalent office).

Processing times can differ depending on the state’s workload and whether any corrections are needed. It may take anywhere from a few days to several weeks for your amendment to be officially approved.

Step 4: Notify relevant parties

After your amendments are approved, update all relevant records and parties, including government agencies, banks, investors, and vendors.

For instance, if you changed your business name, you might need to update your EIN with the IRS or revise your business license.

Get your Articles of Incorporation with BBCIncorp

Simplify the incorporation process with BBCIncorp, an industry expert in company formation. Here’s how we can help:

- Delaware company formation: Let us handle the entire process for you. From start to finish, we’ll secure your Certificate of Incorporation quickly and without the stress.

- Offshore company formation: Explore the benefits of incorporating in offshore jurisdictions. With flexible requirements and no need to file Articles of Incorporation. Cayman Islands company registration and Cyprus company registration offer excellent opportunities for entrepreneurs.

Count on BBCIncorp for a seamless, hassle-free company formation experience.

Conclusion

Drafting and filing Articles of Incorporation is a vital step toward establishing a legally recognized corporation. These documents don’t just safeguard your personal assets; they help your business stand out with unique benefits like name exclusivity and enhanced credibility.

If you’re still wondering, “What are Articles of Incorporation and why do I need them?”, remember that this foundational legal document can propel your business toward growth and success. When you’re ready to take the leap, consult resources like BBCIncorp to streamline the process, saving time and effort.

Frequently Asked Questions

Is it possible for a single individual to file Articles of Incorporation?

Yes, a business can be incorporated by just one person. This individual will handle all responsibilities for the company and will also act as the sole shareholder. Additionally, they can be listed as the only member on the Articles of Incorporation.

Where should the forms be filed, and what are the associated filing fees?

Articles of Incorporation are filed with the Secretary of State where your business is based. Fees vary by state, ranging from $50 to $500 or more.

Where can I access the required forms?

Most states provide downloadable forms for Articles of Incorporation on their Secretary of State website, along with detailed filing instructions.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.