Table of Contents

Forming a Limited Liability Company (LLC) is a smart move for protecting your personal assets and establishing a legal business structure. However, your official LLC name might not always align with your branding or the specific services you offer.

That’s where an LLC doing business as DBA (Doing Business As) becomes useful. By registering a DBA under your LLC, you can legally operate under a different name while keeping your existing business structure intact. Whether you’re expanding into new markets or rebranding, using an LLC doing business as DBA offers added flexibility and branding opportunities.

In this guide, we’ll explain what a DBA means for your business, walk you through exactly how to add a DBA to an LLC, and highlight key legal considerations to ensure your filing is valid and compliant.

What is a DBA and how does it work under an LLC?

A DBA under LLC allows businesses to operate under a different name without changing the company’s legal structure. This gives LLCs added branding flexibility while keeping their formal identity intact. This section explains what a DBA is and how it functions when used by an LLC.

What is a DBA?

A DBA, or “Doing Business As,” is a trade name that a company registers to conduct business publicly under a different name from its legal one. While the official LLC name is used for contracts, banking, and tax filings, the DBA name appears on websites, advertisements, storefronts, and more.

For Example

An LLC registered as “Clearview Ventures LLC” could register “Morning Roast Café” as its DBA to reflect a specific product or service line. This setup allows businesses to target different audiences without creating new legal entities.

A DBA for an LLC does not create a separate legal identity. It is simply a name the business uses in public. All financial and legal responsibilities remain with the original LLC. This means the LLC is still liable for actions carried out under the DBA, making it a branding tool, not a protective structure.

See More

If you are exploring the difference between LLC and DBA, keep in mind that an LLC (Limited Liability Company) is a separate legal entity that protects the owner’s personal assets and provides a clear management structure

How does a DBA work under an LLC?

To understand how a DBA works under an LLC, consider it a practical solution for businesses wanting to diversify. A single LLC can register multiple DBAs for different product lines or service categories. This enables business owners to expand into new markets while maintaining a single legal entity.

Using a DBA for LLC purposes does not affect ownership, tax filings, or company structure. It simply changes the name seen by customers. Internally, the LLC retains all liability and control. That is why DBAs are often referred to as assumed or fictitious names.

Can you use a DBA with an LLC? Yes. In fact, many entrepreneurs do this to manage several brands under one LLC. Can you have a DBA under an LLC in more than one state? Yes, as long as you register it correctly according to each state’s rules.

In short, a DBA for an LLC offers flexibility without complicating your legal setup. Whether you are launching a new product line or creating a distinct identity for a niche service, registering a DBA under LLC is a cost-effective and efficient approach that supports growth without added complexity.

Why add a DBA to your LLC?

Whether you are expanding into new markets or building a distinct brand identity, add DBA to the company offers practical advantages. Here are key reasons to consider adding a DBA to your LLC.

Benefits of using a DBA under an LLC

There are many strategic benefits to using a DBA for an LLC. One of the most common reasons is the ability to run multiple businesses under one legal structure. For instance, an LLC can manage several different services or product lines using separate DBAs, helping streamline costs and operations. Instead of forming new companies, you simply register a new DBA under your existing LLC.

Another major advantage is improved branding and marketing. A DBA allows you to present a name that resonates more with your customers than the official LLC name. This is particularly helpful when the legal name is generic or does not reflect the nature of your products or services.

Adding a DBA to an LLC also supports business expansion. If you are entering a new industry or launching a new line, a DBA helps you build a brand that fits the new direction. Best of all, you can do this without the time and expense of forming a new legal entity.

When is it necessary to add a DBA?

You may need to add a DBA to your LLC when launching a new product or service that has a different identity from your main business. For example, if your company offers both catering and event rentals, you might use separate DBAs to market each side of the business more effectively.

Another case is when you want to target a new customer segment. If your LLC provides services for both corporate and individual clients, separate DBAs allow you to tailor branding and messaging to each audience.

Opening a new location under a unique name is also a common reason. Many franchises or expanding businesses use location-specific DBAs to build local brand recognition while still operating under the same LLC.

If you have ever asked, “Can I have a DBA under my LLC?” the answer is yes. An LLC doing business as DBA provides flexibility and helps position your business for long-term growth.

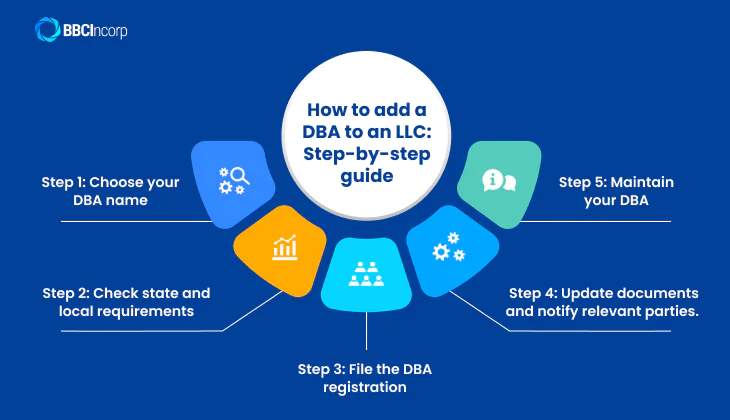

How to add a DBA to an LLC: Step-by-step guide

Adding a DBA to your LLC is a straightforward process, yet it requires careful planning and attention to detail. Whether you’re expanding your brand or operating multiple lines under one entity, here’s how to add a DBA to my LLC effectively.

Step 1: Choose your DBA name

Selecting a suitable DBA name is the foundation of the process. It should be unique, legally acceptable, and aligned with your branding goals. Avoid potential trademark conflicts by conducting thorough trademark searches via the United States Patent and Trademark Office and reviewing state federal trademark databases.

Most Secretaries of State and county clerk websites offer business name databases where you can check for name availability. This ensures the DBA name is not identical or confusingly similar to an existing business. A clean name search reduces the risk of rejection or legal challenge.

Choosing a strong DBA helps your brand stand out while also ensuring compliance. A thoughtful name can prevent future headaches and protect your brand identity.

Step 2: Check state and local requirements

DBA regulations vary significantly across states and local jurisdictions. Some states require DBA registration at the state level, while others may require filings at the county level. Additionally, zoning laws and licensing regulations in your city or county may affect your chosen DBA, particularly if it implies a specific business activity.

For example, a childcare business DBA may require zoning clearance, and a food-based DBA may require local health permits. It is essential to check municipal requirements such as those from city planning or licensing departments.

Furthermore, some states require a publication notice after DBA filing. These can range from one to several weeks in a local newspaper. States including California, Illinois, Florida, and New York have such mandates. Failure to comply can result in revocation or fines. Knowing state-by-state rules ensures your DBA is legally solid.

Step 3: File the DBA registration

Once your research is done, it’s time to officially register the DBA. Filing can be accomplished through the Secretary of State office or a county clerk, depending on your jurisdiction. Many states offer online filing, though some still require paper submission.

You’ll need to complete forms asking for detailed information such as:

- The legal name of your LLC and its address

- Proposed DBA name

- Contact information and registered agent details

- Signature of responsible LLC member

Fees generally range from $10 to $100, depending on the location. After filing, some states require a publication notice: for instance, California mandates four weeks of legal notices in a county newspaper within 30 days after filing. New York also has strict publication rules for business name announcements.

Once the filing is accepted, you’ll often receive a certificate or confirmation. Retain this document for your records and future renewals.

Step 4: Update business documents and notify relevant parties

After the DBA has been approved, update your business documents:

- Bank accounts: Provide your bank with the new DBA certificate so you can issue checks and receive payments under the new name.

- Contracts and invoices: Amend templates to include “LLC, doing business as DBA.”

- Signage and marketing: Update your website, social profiles, business cards, and signage to reflect the DBA.

You may also need to inform the IRS or state tax authorities if your DBA affects tax reporting. Generally, for single-member LLCs using the same EIN, there’s no EIN change, but you should inform your bank and any relevant license issuers.

It’s a good habit to send notifications to vendors, clients, and other stakeholders explaining the DBA name usage to avoid confusion.

Step 5: Maintain your DBA

Maintaining your DBA involves staying on top of renewals and compliance. Most registrations last 3 to 5 years and require renewal fees. Some states send reminders; others expect proactive management.

Be aware of any zoning changes, or updates to licensing rules if your DBA serves a specific business function. If there are any changes in ownership or LLC structure, you may need to file amendments or new DBA registrations.

Lastly, continue to monitor trademarks to ensure your DBA name remains distinctive and legally defensible.

By following these steps—including name choice, jurisdictional research, proper filing, updates to business documents, and ongoing maintenance—you ensure that your DBA under LLC is legally sound and effective for brand growth. Let me know if you’d like state-specific guidance or sample forms.

Costs, timelines, and legal considerations

Filing a DBA under your LLC involves financial planning, attention to timing, and legal compliance. In this section, we will cover typical expenses, how long the process takes, and key responsibilities associated with maintaining a DBA for your business.

How much does it cost to add a DBA to an LLC?

When researching how to get a DBA for my LLC, business owners should understand the expected costs:

- State filing fees: Most states charge between $10 and $100 to register a DBA, with the average around $30 to $50. Some offer expedited processing for an additional fee.

- Publication costs: Certain states, such as California and New York, require legal notices to be published in newspapers. These costs can range from $40 to over $100, depending on location and newspaper rates.

- Local fees: If your state requires county-level filing, counties may impose their own charges.

- Professional services: Using a legal service or third-party filing provider may add $50 to $300, depending on the complexity of the filing.

In total, registering a DBA typically costs between $40 and $150, though this can vary by state and service provider. Understanding how to get DBA for LLC in your jurisdiction helps you budget effectively and avoid unexpected fees.

Timeline to register a DBA

The registration process does not take long, but timing depends on how and where you file:

- Name selection and research: 1 to 2 days

- Filing application: Online forms can be completed quickly, while mailing paperwork may take longer

- Processing time: Most states process online submissions within 3 to 10 business days. Paper filings may take several weeks.

- Publication requirement: If applicable, this can extend the process by 4 to 6 weeks

- Final confirmation: DBA certificates are usually issued within 1 to 4 weeks of approval

Altogether, setting up a DBA under an LLC may take anywhere from one week to eight weeks depending on state requirements and any publication steps involved.

Legal implications and compliance

While learning how to add a business to an existing LLC through a DBA, it’s essential to understand the legal boundaries. A DBA does not create a separate legal identity or offer liability protection. All obligations remain with the parent LLC.

To remain compliant:

- Maintain all annual reports and fees required for the LLC

- Renew your DBA regularly based on state-specific rules, usually every 1 to 5 years

- Make sure all public documents and contracts clearly reflect the structure (e.g., “ABC Enterprises LLC doing business as Bright Cleaners”)

- Avoid presenting your DBA as a separate company, which could confuse customers or invalidate contracts

Also, registering a DBA does not protect your business name under trademark law. If brand protection is a priority, consider filing a federal or state trademark.

Failing to renew or misusing the DBA could lead to fines, cancellation of the name, or legal disputes, so regular reviews of your filings and documentation are recommended.

How DBA filing varies across states

DBA filing requirements can differ significantly depending on where your LLC is registered. Understanding these variations helps ensure your business stays compliant with local regulations and avoids unnecessary delays or penalties.

Some states, such as Alabama, Alaska, Arizona, Delaware, Florida, Hawaii, Kansas, Maryland, Mississippi, Nebraska, Ohio, Wisconsin, and Wyoming, do not process DBA registrations at the state level. Instead, you may need to register at the county or city level, depending on local rules.

Other states, like California and New York, have more layered processes. For instance, California requires DBA filing with the county clerk and publication of a legal notice in a local newspaper once a week for four weeks, within 30 days of registration. New York requires publication for six consecutive weeks and submission of proof to the county clerk.

In Florida, filing a fictitious name also includes a mandatory publication step, and the DBA must be renewed every five years. You’ll need to provide your registration name, business address, owner information, EIN (if applicable), and a publication certificate.

Texas requires a separate DBA certificate for each county where the name is used. Arizona waives the publication requirement only if the business is located in a county that maintains an online public record.

Always consult your state’s Secretary of State or county clerk for the most accurate and up-to-date requirements before proceeding.

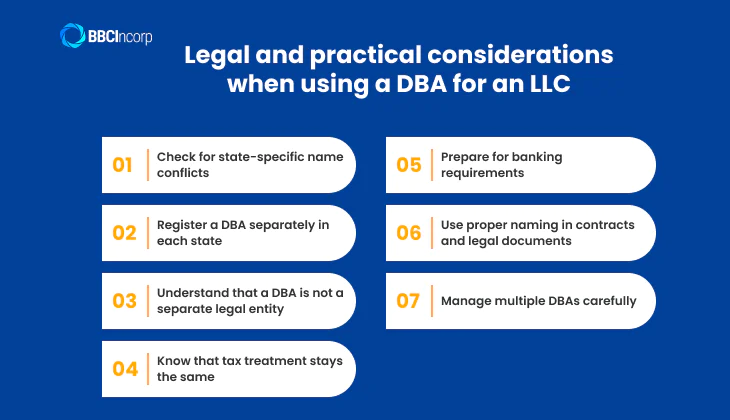

Legal and practical considerations when using a DBA for an LLC

When an LLC operates under a DBA—especially across multiple states—there are important legal and operational points to consider. These elements help you remain compliant and make informed decisions.

Check for state-specific name conflicts

Before you expand into a new state, conduct a thorough business name search. If your LLC’s legal name closely resembles a company already registered in that state, you may be required to register a DBA to operate legally. Failing to do so can result in fines, denial of contracts or permits, or even forced dissolution of DBA operations.

Register a DBA separately in each state

Doing business in multiple states requires separate DBA registrations where you intend to use a different name. Even if your LLC is already foreign-qualified, each state typically mandates a specific filing for a DBA (sometimes called a fictitious or assumed name). California and Texas may need county-level filings, while New York also requires proof of publication after registration.

Understand that a DBA is not a separate legal entity

A DBA for an LLC is simply a trade name, not a separate legal structure. It does not alter liability protection. All debts, obligations, and legal exposure still reside with the LLC. This means you must conduct proper bookkeeping and internal records to ensure all DBAs are tied to the LLC for tax and liability purposes.

Know that tax treatment stays the same

A DBA does not affect how your LLC is taxed. The IRS continues to treat your LLC as the taxable entity, regardless of the name under which you operate. Whether your LLC is taxed as a disregarded entity, partnership, S corporation, or C corporation, the DBA has no impact on federal tax filings or state tax obligations.

Prepare for banking requirements

To open a bank account using your DBA, you typically need to present a certified DBA certificate along with your LLC formation documents and EIN. Major banks like Bank of America require these documents before opening a separate checking account under the DBA name . Maintaining distinct bank accounts helps separate financial reporting and builds credibility under the DBA.

Use proper naming in contracts and legal documents

All contracts, invoices, and legal documents should display both your LLC’s full legal name and the DBA. For example: “Ironclad Properties LLC doing business as Ironclad Rentals.” This avoids confusion and ensures enforceability by clearly identifying the obligated entity.

Manage multiple DBAs carefully

An LLC can register multiple DBAs, but each one must be filed separately and adhere to separate registration and renewal rules. There is no federal limit on the number of DBAs a single LLC may have, though some states impose local filing or publication fees for each name. All DBAs share the same internal records, bank accounts, and liability umbrella of the LLC.

By navigating name conflicts, fulfilling registration per state, handling tax and banking correctly, and keeping accurate documentation, you can leverage DBAs effectively while maintaining legal clarity and business flexibility. If you’re unsure how to proceed or want to avoid compliance risks, it’s worth considering professional support for registering your DBA.

Why choose BBCIncorp to help you add a DBA to your LLC?

At BBCIncorp, we understand that adding a DBA to your LLC involves more than just filling out a form. Our team is here to simplify the process and ensure your business remains compliant across every state where you operate.

End-to-end support for DBA setup

We provide clear, step-by-step assistance for registering or change DBA to LLC. From checking name availability to filing with the correct state or county agency, we take care of the details so you can stay focused on growing your business.

Nationwide compliance coverage

Our registered agent services are available in all 50 U.S. states. We help you:

- Track and meet state-specific DBA renewal deadlines

- Maintain good standing across jurisdictions

- Stay updated with timely compliance reminders

U.S. and offshore expertise

Whether you’re operating in Delaware, Wyoming, or expanding into international markets like the Cayman Islands or British Virgin Islands, our experience ensures your structure aligns with regulatory requirements across borders.

EIN, banking, and document support

We assist with obtaining your EIN opening business bank accounts under your DBA, and organizing your documents through our centralized client dashboard. This makes it easier to manage your DBA registrations in one secure place.

Advisory for long-term growth

Beyond filing, we offer guidance for:

- Managing multiple DBAs

- Business restructuring

- Multi-state expansion and cross-border strategies

If you’re wondering how to add a DBA to your LLC or how to set up a DBA under an LLC correctly, BBCIncorp is ready to help—backed by global experience, dedicated support, and digital tools built for modern entrepreneurs.

Conclusion

Adding a DBA to an LLC is a practical way to grow your brand presence without forming a new legal entity. Whether you’re exploring new markets, launching a product line, or refining your brand identity, a DBA offers the flexibility to operate under a different name while keeping your LLC’s structure intact.

The steps for how to add a DBA to an LLC vary by state, and requirements can be complex. Still, with proper filing, a DBA strengthens your marketing efforts and ensures compliance. So, can an LLC have a DBA? Yes—and many businesses use them successfully across multiple locations or industries.

If you’re ready to move forward but want expert support, BBCIncorp can guide you through the entire process, from filing to renewal. Contact our team today to simplify your DBA registration and ensure your LLC stays fully compliant.

Frequently Asked Questions

Can I have more than one DBA under my LLC?

Yes. In most states, you can add a DBA to an existing LLC without limit. You can register as many DBAs as you want, provided each name is available and properly filed.

Each DBA requires a separate application in the state or county jurisdiction. Having multiple trade names under one LLC lets you target different markets or launch varied brands while keeping your legal and tax structure simple.

Is a DBA the same as a trademark?

No. Although both involve business names, they serve different purposes. A DBA is a state-level registration allowing you to operate under a different name. A trademark grants exclusive rights to your brand at the federal level. So while you may create a DBA for your LLC, you’ll need to file with the USPTO if you want broader legal protection for your brand.

Can I change my LLC name instead of filing a DBA?

Yes—but it involves more effort. You can file articles of amendment to officially change your LLC’s legal name through your Secretary of State. For temporary or market-specific branding, adding a DBA to an existing LLC is simpler, faster, and less expensive than a full legal name change.

Can I use a DBA in multiple states?

Yes, but you must register it in each state where you do business under that name. If your LLC expands to another state and wants to use the same trade name, you’ll need to file a new DBA registration there, respecting local naming rules and possible publication requirements.

Do I need an EIN for my DBA?

Generally, no. You use your LLC’s EIN for tax reporting and banking, even if you’re operating under a DBA. Unless you hire employees or change the tax structure of your LLC, you won’t need a separate EIN. However, you should inform the IRS of your new trade name to keep records accurate.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.