Table of Contents

Managing taxes as a business owner can feel overwhelming, especially with terms like TIN and EIN commonly mentioned. At first glance, these terms might seem to be the same, but they have distinct meanings.

A TIN (Taxpayer Identification Number) is a broad term used by the IRS to identify individuals and entities for tax purposes. On the other hand, an EIN (Employer Identification Number) is a specific type of TIN assigned to businesses for tax reporting.

Understanding the difference between EIN and TIN is crucial for your business’s compliance with tax laws. In this blog, we’ll clarify what is a TIN vs. EIN, the distinctions between TIN vs EIN and explain why it’s important to know when and why to use each. This will help you navigate tax season with greater confidence and accuracy.

What is a TIN (Taxpayer Identification Number)?

A Taxpayer Identification Number (TIN) is an essential tool for identifying taxpayers to the Internal Revenue Service (IRS) in the United States and other tax authorities globally.

Although the specifics of what constitutes a TIN can vary depending on the jurisdiction, the underlying purpose remains the same: to track tax obligations and facilitate the proper filing of tax returns.

In this section, we will break down the concept of a TIN in both the U.S. and internationally.

In the U.S

In the U.S., the term “TIN” is a broad classification that encompasses several types of numbers used by the IRS. These numbers are necessary for filing tax returns, reporting income, and fulfilling tax obligations. The main types of TINs in the U.S. include:

- Social Security Number (SSN): Assigned to U.S. citizens and permanent residents, the SSN is used to track earnings and calculate social security benefits. It is primarily used for individuals.

- Employer Identification Number (EIN): This is issued to businesses, corporations, partnerships, and other entities for tax reporting purposes. It is used by organizations to file tax returns, pay employees, and report income.

- Individual Taxpayer Identification Number (ITIN): This number is issued to foreign nationals and non-residents who are not eligible for a Social Security Number but need to comply with U.S. tax laws. It is commonly used by individuals who receive income from U.S. sources but are not U.S. citizens or residents.

Each of these numbers is used in different situations, but all fall under the category of TIN. The specific type of TIN you need depends on whether you are an individual or a business entity.

Outside of the U.S.

Beyond the U.S., the concept of a TIN is not universal but is widely used. Different countries assign a unique identifier for tax purposes, although the specific terminology may differ.

For example, in Belize, the TIN is issued by the Belize Tax Service and serves to identify taxpayers for the purposes of tax compliance. Similarly, in the United Kingdom, the equivalent of a TIN is known as a National Insurance Number (NIN), used primarily for individuals.

While many countries issue TINs or equivalents, the format and naming conventions may vary. However, their primary role is the same: ensuring accurate tax filings and tracking tax obligations.

Who requires a TIN?

In the U.S., the IRS requires a TIN for both individuals and entities involved in activities subject to U.S. taxation. Specific groups that need a TIN include:

- Individuals: U.S. citizens, permanent residents, and foreign nationals with U.S. tax obligations (e.g., income sourced in the U.S.) must obtain a TIN.

- Businesses and Entities: Corporations (C-corporations, S-corporations), limited liability companies (LLCs), partnerships, nonprofit organizations, estates, and trusts all require a TIN. This also includes any entity that employs others or must file information returns with the IRS.

Similarly, in other countries, individuals and entities with tax obligations within their borders will need a TIN or its equivalent. This includes foreign nationals earning income from a local source, as well as companies and organizations that need to file tax returns.

When to use a TIN?

You will need to use a TIN in a variety of situations. In the U.S., it is required when filing your personal or business taxes. For example:

- Personal taxes: Individuals use their SSN when filing their annual tax returns.

- Business operations: Sole proprietors or single-member LLC owners without employees still need a TIN (usually their SSN or EIN) to report business income.

- Non-resident aliens: Those not eligible for an SSN but still required to file taxes in the U.S. will need an ITIN.

Outside the U.S., a similar process applies. For example, in many European countries, individuals must provide a TIN when filing their annual income tax returns.

What is an EIN (Employer Identification Number)?

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses and other entities in the United States for tax purposes.

This number is essential for identifying business entities in the U.S. tax system and is sometimes referred to as a Federal Tax Identification Number (FEIN) or Federal Employer Identification Number (FTIN).

The EIN serves as a vital tool for businesses to file tax returns, pay employees, and meet other federal requirements. It acts much like a Social Security Number (SSN) for individuals but is specifically used to identify businesses and organizations.

An EIN is required for various entities, including employers, corporations, non-profits, sole proprietors with employees, partnerships, trusts, estates, governmental agencies, and any business entity with employees or filing certain tax returns.

When to use an EIN?

There are several specific situations where businesses are required to use an EIN:

- Hiring Employees: If your business has employees, you need an EIN to report payroll taxes and file employment tax returns.

- Operating as a Corporation or Partnership: If your business is structured as a corporation or partnership, you must use an EIN when filing business taxes.

- Filing Employment and Excise Tax Returns: Businesses must use an EIN to file returns related to employment taxes or excise taxes, such as for alcohol or firearms.

- Opening a Business Bank Account: Banks typically require an EIN to open a business checking or savings account.

- Applying for Business Loans or Credit: Lenders use an EIN to assess a business’s creditworthiness and provide loans.

- Establishing Business Credit: An EIN is necessary to establish credit for your business, which is essential for growth and expansion.

- Merchant Accounts: To accept credit card payments, businesses must provide their EIN when applying for a merchant account.

The EIN is crucial for complying with IRS requirements and ensuring your business can legally operate and manage its finances.

Do all businesses need an EIN?

Not all businesses need an EIN. For sole proprietorships and LLCs without employees, the owner’s Social Security Number (SSN) can be used for tax purposes. This is particularly true if the LLC does not hire employees or file certain types of tax returns.

While an LLC is a separate legal entity in the eyes of the law, it is not considered a separate tax entity unless it has employees or meets other IRS criteria. In these cases, the LLC owner may use their SSN rather than an EIN.

That said, some business owners wonder, how many EIN numbers can I have? The answer depends on the number of business entities you operate. You can only have one EIN per business entity, but if you own multiple businesses or form additional entities (like another LLC or corporation), each one will require its own EIN.

Understanding whether your business needs an EIN depends on your business structure and activities. If you’re unsure, it’s always a good idea to consult a tax professional or the IRS guidelines.

Find an EIN Number

If you’re asking how to find my EIN, there are several easy and reliable methods to locate it.

Start by checking your business tax documents. Your EIN is listed on IRS Form SS-4 (the application form), prior tax returns, and Schedule C of your personal 1040 if you’re a sole proprietor. It’s usually found in the top section of these forms, near your business name.

You can also call the IRS Business & Specialty Tax Line at 1-800-829-4933. Representatives are available from 7 a.m. to 7 p.m. local time, and will verify your identity before reissuing the EIN.

For online options, visit the IRS website to view previous notices or forms containing your EIN. Third-party services may also help, but choose reputable providers to avoid errors.

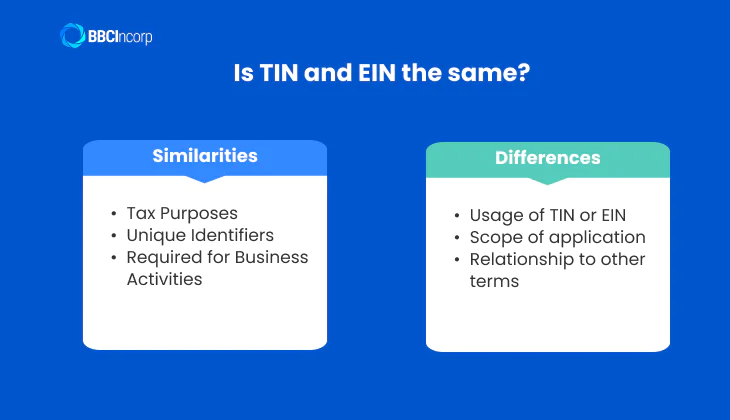

Is TIN and EIN the same?

While the terms TIN and EIN are sometimes used interchangeably, they are not the same. Both serve tax-related purposes, but their scope and application differ significantly. If you’re wondering is EIN the same as TIN or is TIN the same as EIN, the short answer is no—they are related but not identical.

Similarities between EIN vs Tax ID

- Tax Purposes: Both TIN and EIN are used to track tax obligations. They ensure that individuals and businesses comply with the IRS and other tax authorities. Many people ask, is EIN same as Tax ID? The answer is yes—EIN is a type of Tax Identification Number.

- Unique Identifiers: Each EIN or TIN is unique to the individual or business it is assigned to, ensuring accurate reporting and filing.

- Required for Business Activities: Whether you’re comparing TIN number vs EIN or Taxpayer Number vs EIN, both are essential for conducting business activities, such as filing taxes, reporting income, or applying for business credit.

Differences between TIN vs EIN

Usage of TIN or EIN

The term EIN is primarily used in the United States and specifically applies to business entities. It is necessary for corporations, LLCs, partnerships, and other organizations.

TIN is a broader, more general term used internationally. It includes the SSN, ITIN, ATIN, and EIN itself. This means your EIN is a type of TIN, but not all TINs are EINs.

Scope of application

- TIN is required for both individuals and entities. For instance, U.S. citizens, permanent residents, and businesses all have TINs, which could be an SSN, ITIN, or EIN.

- EIN is only required for business entities that need to file tax returns or have employees.

Relationship to other terms

- TIN serves as an umbrella term, covering several types of tax identifiers like SSN (Social Security Number), ITIN (Individual Taxpayer Identification Number), ATIN (Adoption Taxpayer Identification Number), and more.

- EIN, however, is a distinct identifier, exclusive to businesses, and does not include other tax identification numbers.

While TIN vs EIN are both tax-related numbers, they serve different purposes, with TIN being more general and EIN specifically for businesses.

How to apply for an EIN in the U.S.?

Requirements

To apply for an EIN in the United States, you will need the following information:

- Legal business name and physical address

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) of the responsible party

- Type of business entity and a brief description of its purpose

Application Methods

- Online Application: Visit the official IRS website (IRS.gov) and navigate to the “Apply for an Employer Identification Number (EIN) Online” page. Follow the step-by-step prompts to complete Form SS-4 electronically. If the information is validated, the EIN will be issued immediately upon completion.

- Application by Fax: Download and complete Form SS-4 from the IRS website. Fax the completed form to the IRS at the appropriate fax number. If the application is accepted, the EIN will typically be faxed back within four business days.

- Application by Mail: Download and fill out Form SS-4 from the IRS website. Mail the completed form to the appropriate IRS address based on your business’s location. EINs requested by mail are typically issued within four to five weeks.

How to apply for a TIN?

Requirements

Requirements for obtaining a Taxpayer Identification Number (TIN) vary depending on the country and the type of TIN being requested. However, generally required documentation includes:

- Valid government-issued identification (e.g., passport)

- Country of citizenship

- Supporting documentation justifying your need for a TIN (e.g., income tax return)

- Completed application form

Application process

While the process for obtaining a TIN or its international equivalent varies by jurisdiction, the general steps include:

- Determine the appropriate type of TIN based on your situation

- Identify the relevant tax authority or government agency

- Gather the necessary documentation

- Complete and submit the application form

- Await processing and issuance of your TIN

Always consult the official tax authority in the applicable country for the most accurate and up-to-date guidance.

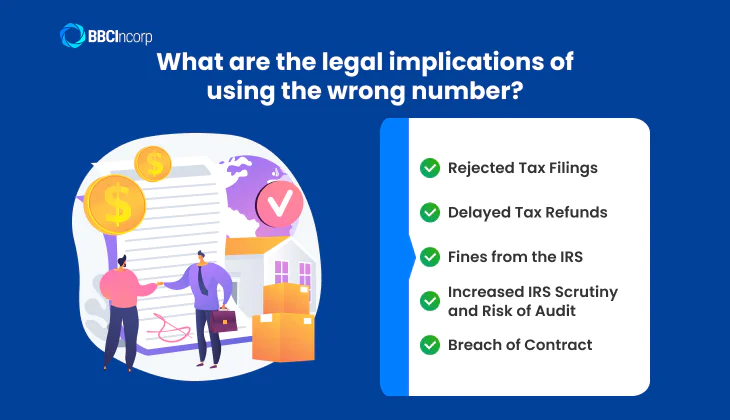

What are the legal implications of using the wrong number?

Using the wrong number, such as an incorrect EIN, SSN, or ITIN, when filing taxes or other business documents can lead to significant legal and financial consequences:

- Rejected Tax Filings: If the wrong number is used, the IRS may reject your tax return or business documents. This can delay processing and impact timely tax filings.

- Delayed Tax Refunds: Incorrect information may delay tax refunds, causing financial strain on businesses or individuals expecting reimbursement.

- Fines from the IRS: Using the wrong identification number can lead to penalties from the IRS for non-compliance. These fines can accumulate quickly, adding a financial burden.

- Increased IRS Scrutiny and Risk of Audit: Errors in identifying your business or tax status can trigger increased scrutiny, heightening the likelihood of an audit. This can lead to additional documentation requests and stress for business owners.

- Breach of Contract: In certain situations, using the wrong number may be considered a breach of contract, especially in transactions that require precise tax reporting, leading to potential legal disputes.

Obtain your EIN or TIN with BBCIncorp

Securing the correct tax identification number is a critical step in maintaining compliance and operating your business legally. Whether you need an EIN in the U.S. or a TIN in Belize, BBCIncorp provides efficient, expert support to simplify the process.

EIN application in Delaware (US)

If you are forming a U.S. company in Delaware, obtaining an Employer Identification Number (EIN) is a necessary step for tax filings, opening a bank account, and hiring employees.

BBCIncorp provides a comprehensive EIN application service in Delaware, designed for both U.S. residents and foreign entrepreneurs. Their expertise ensures that your EIN is processed efficiently, minimizing delays and common errors.

TIN registration in Belize

For businesses incorporated in Belize, BBCIncorp provides Taxpayer Identification Number (TIN) registration as part of its company formation package or as a separate service.

A Belize TIN is mandatory for banking, reporting, and meeting tax obligations under local law. BBCIncorp ensures smooth registration with Belizean authorities.

Offshore company formation

In addition to EIN and TIN services, BBCIncorp assists clients with offshore company formation and bank account setup across multiple jurisdictions. Our full-suite services help entrepreneurs establish legal entities abroad with tax efficiency and operational flexibility.

With BBCIncorp, securing your EIN or TIN is fast, accurate, and hassle-free. Let our experts handle the complexities so you can focus on growing your business globally.

Conclusion

In summary, while TIN vs EIN are both vital tax identifiers, they serve distinct purposes. A TIN is a broad term used globally for any tax identification number, applicable to both individuals and entities. In contrast, an EIN is specifically used in the United States for business entities, such as corporations and LLCs.

If you’re unsure about which number your business needs, BBCIncorp can help streamline the process. Whether you need an EIN for your U.S.-based business or a TIN for international operations, our expert team can assist you in navigating the complexities of Tax Identification Number vs EIN registration.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.