Table of Contents

Opening a Cayman Islands bank account is a strategic move for businesses and investors seeking secure, flexible, and globally recognized banking solutions. Renowned for its political stability, sound financial regulations, and world-class offshore services, the Cayman Islands has become one of the leading international banking hubs.

This guide walks you through every step of the process from choosing the right bank and preparing the required documents to meeting compliance standards and managing your funds effectively.

Key Takeaways

- Opening a Cayman Islands bank account offers access to a reputable global banking hub known for financial stability, asset protection, and regulatory transparency.

- Successful account setup requires careful preparation, choosing the right bank, providing verified documentation, and complying with CIMA, FATCA, and CRS standards.

- Applicants should consider key evaluation factors such as the bank’s reputation, service range, fees, and compliance credibility to ensure a long-term, reliable relationship.

- Proper planning and professional guidance not only simplify account opening but also strengthen your offshore banking foundation for future growth.

- BBCIncorp helps streamline the process from document review to communication with banks, saving time and ensuring compliance.

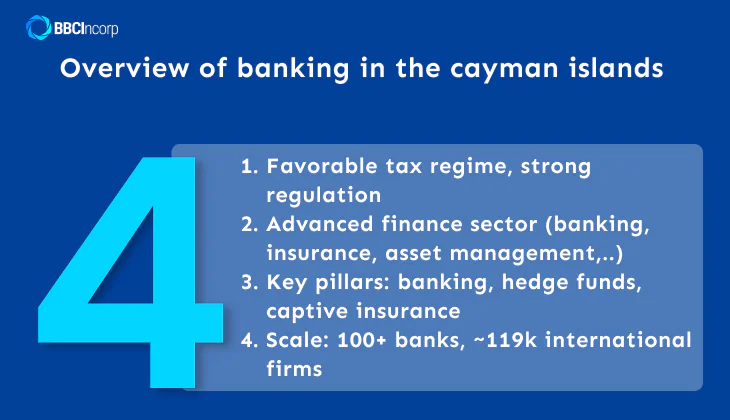

Overview of banking in the cayman islands

Overall, the Cayman Islands has long been known as a premier international financial center and leading jurisdiction for offshore banking, investment funds, and structured finance transactions.

The region has been offering a highly attractive business and investment environment, which has made it a popular choice for many individuals and corporations looking to establish an onshore or offshore presence.

The Cayman Islands are famous for their:

- Favorable tax regime with a solid regulatory framework for investors, entrepreneurs, and high-net-worth individuals

- Highly developed financial services sector, including banking, insurance, asset management, and securities trading

- The largest sectors are banking, hedge fund management, and captive insurance

- Home to more than 100 banks and 119,000 international companies

- And so forth (which we will go into detail in the following sections)

However, international regulations and compliance standards do apply to the Cayman Islands, especially non-citizens, which means businesses and individuals are responsible for complying with them strictly.

Penalties for violations

Corporate entities operating in the Cayman Islands that violate local laws and related regulations may be fined, suspended, or revoked licenses as per the law.

Who should consider opening a Cayman bank account?

Not everyone will find it easy to open a Cayman Islands bank account. The jurisdiction enforces strict due diligence requirements, especially for non-residents with no direct link to the islands. Generally, applicants must prove a legitimate connection either personal, professional, or financial to be considered eligible.

Those who should consider opening a Cayman Islands bank account include:

- Residents and foreign nationals with ties to the Cayman Islands, such as holding a residence permit, owning property, or having family connections.

- Business owners and investors establishing offshore entities or investment funds within the jurisdiction.

- High-net-worth individuals (HNWIs) seeking wealth diversification, privacy, and long-term asset protection in a reputable offshore hub.

- Clients with existing relationships with global banks that also operate in Cayman, such as Butterfield, CIBC, or Scotiabank.

- Trusts, foundations, and investment structures managing significant assets that benefit from Cayman’s robust regulatory framework.

For non-residents without clear local ties, opening an account remains possible but challenging. Banks will likely request additional documentation, proof of income sources, and a detailed explanation of fund purposes. In short, Cayman banking best serves those who already maintain or plan to establish legitimate connections to the territory.

Types of Bank Accounts in the Cayman Islands

Cayman Islands banks provide a wide range of account types designed to meet different personal and corporate needs. Whether you are managing day-to-day transactions or diversifying your assets offshore, understanding each option helps you choose the most suitable structure for your goals.

Common types of Cayman Islands bank accounts include:

- Current accounts (checking): For daily transactions, payments, and international transfers. Ideal for both individuals and businesses needing frequent access to funds.

- Savings accounts: Provide interest on deposits, suitable for those looking to store and grow their capital safely.

- Fixed-term deposit accounts: Offer higher interest rates in exchange for locking funds for a set period, typically from 3 months to several years.

- Multi-currency accounts: Allow account holders to hold, send, and receive multiple currencies within a single account useful for global businesses and investors.

Most banks also offer online and mobile banking services, enabling clients to manage funds remotely and securely. Minimum deposit requirements vary widely by institution, ranging from a few thousand to several hundred thousand USD, depending on the account type and client profile.

Some banks cater exclusively to corporate or high-net-worth clients, while others offer more accessible retail banking solutions. Understanding these distinctions ensures you select an account that aligns with your financial strategy and compliance needs.

Benefits of a Cayman Islands Bank Account

First off, the Cayman Islands is considered one of the most stable and secure offshore financial centers in the world. Its banks are regulated by the Cayman Islands Monetary Authority (CIMA), which has a reputation for being a strong and effective regulator.

Here are various vital benefits to exemplify:

Financial privacy

Account holders in the Cayman Islands are protected by strict bank secrecy laws, which provide an excellent level of privacy and security. Confidentiality can help protect assets by making it more difficult for creditors or other parties to identify and seize them.

Asset protection

The Cayman Islands offers a range of legal facilities that can be used to protect assets, including partnerships, limited liability companies, and foundations. For example, LLCs in the Cayman Islands are not required to disclose the names of their owners, which can provide an additional layer of protection.

Business owners can also choose to set up a trust to protect their assets. Trusts in Cayman can be structured in various ways to protect properties from creditors, lawsuits, and other risks.

The Cayman Islands is also home to many insurance companies. Insurance provides a way to transfer risk to an insurance company in exchange for the payment of premiums. In the event of a loss or damage to assets, insurance can provide financial compensation, which can protect the value of the assets.

Tax advantages

The Cayman Islands has a favorable tax regime, with no corporate tax, capital gains, gift taxes, inheritance taxes, sales taxes, withholding taxes (on dividends, interest, or royalties paid to non-residents), and value-added taxes. It becomes an attractive destination for individuals and businesses seeking to minimize tax liabilities.

Access to a wide range of financial services

The Cayman Islands is a well-established financial center, offering a range of banking, investment management (thanks to the world’s largest hedge funds and private equity firms), fiduciary services, trusts, insurance, real estate, property management, and many more.

Stable political and economic environment

The Cayman Islands is a British Overseas Territory with a stable political and economic environment and a well-developed financial infrastructure. The jurisdiction has a diversified economy, with a strong financial service sector and a growing tourism industry.

Overall, the Cayman Islands’ characteristics as a jurisdiction provide a predictable and reliable framework for international business and investment, so incorporation in the region would be a smart decision regardless of whether your enterprise is domestic or offshore.

Note

Please keep in mind that working with a qualified professional is extremely crucial to ensure that you comply with local laws and regulations and take advantage of the opportunities available in the jurisdiction.

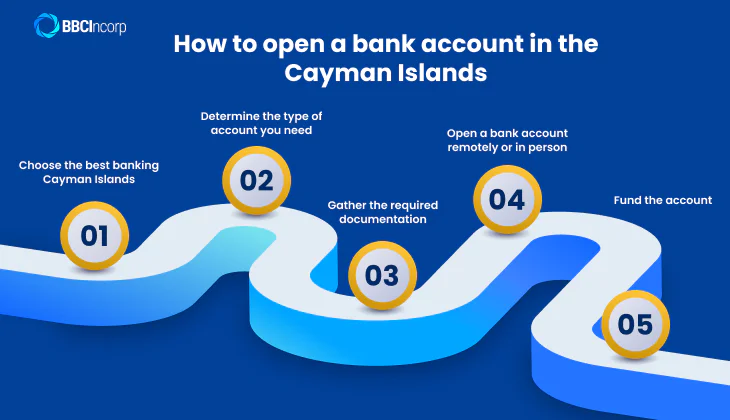

How to open a bank account in the Cayman Islands

The process of opening a Cayman Islands bank account can be more complex than in other jurisdictions, but as long as you adhere well to the necessary procedures, your business will be off to a great start.

Step 1: Choose the best banking Cayman Islands

Research and compare the different Cayman Islands banks to determine which best meets your needs and requirements. To name a few, the top well-established banks operating in the Cayman Islands are:

Butterfield Bank – The reputable and well-established name

Butterfield is among the largest banks in the Cayman Islands, with many branches and ATMs throughout the jurisdiction, along with efficient online and mobile platforms. The bank is known for its customer-centric personalized solutions.

Cayman National Bank – Running the widest ATM network in the region

Cayman National Bank is a leading name with a Category A banking license, offering premier domestic and international financial banking services. If you plan to become a local, their ATM network in the jurisdiction available at all times would be helpful.

PROVEN Bank (Cayman) Ltd – High-quality service for offshore accounts

Formerly known as Fidelity Bank (Cayman) Ltd., PROVEN Bank is a well-regarded offshore bank with competitive interest rates. Despite being newly established, its solid international presence enables the system to serve clients worldwide.

Scotiabank Cayman – The award-winning digital bank brand

The brand is honored as “Global Finance’s World’s Best Digital Banks 2022”, and “Best Bank for 2022 in the Cayman Islands” by Global Finance Magazine (New York). Scotiabank offers foreign currency business accounts, reducing exposure to exchange rate fluctuations.

Tips

Wonder which can be the best bank for your Cayman Islands company? Try our Banking Tool now for a more specific decision.

RBC Royal Bank – Global Reach with Local Expertise

RBC Royal Bank combines international strength with local market understanding. It offers diverse personal and corporate banking services, including credit facilities, savings, and investment solutions. Its multi-currency account options and strong customer support make it ideal for global clients managing assets across multiple jurisdictions. RBC’s reputation for transparency and financial stability adds to its appeal in the Cayman banking sector.

First Caribbean International Bank – A Strong Regional Presence

As part of the CIBC Group, First Caribbean International Bank is a leading institution across the Caribbean. It offers an extensive portfolio of retail, commercial, and private banking services. The bank’s well-integrated regional network allows clients to benefit from consistent service standards and cross-border banking convenience, making it a smart choice for entrepreneurs and expatriates in the Cayman Islands.

Fidelity Bank – Trusted for Savings and Personal Banking

Fidelity Bank focuses on customer-oriented retail banking, offering savings, mortgage, and loan products tailored to both residents and non-residents. It is well-regarded for its transparent policies and approachable service. Fidelity provides online banking capabilities that allow clients to manage their Cayman Islands bank accounts securely and conveniently, making it suitable for those seeking straightforward, reliable solutions.

CIBC FirstCaribbean International Bank – Tailored for Business and Individuals

CIBC FirstCaribbean provides flexible financial solutions for both individuals and businesses operating across the Caribbean. Its services include multi-currency accounts, credit facilities, and investment management options. The bank’s commitment to compliance, digital transformation, and client service excellence has established it as a key player for professionals and corporations expanding into the Cayman Islands.

Alhambra Bank & Trust Ltd – Boutique Private Banking Experience

Alhambra Bank & Trust delivers bespoke private banking, trust, and investment services tailored for high-net-worth clients. Its personalized approach ensures privacy and discretion, while its experienced advisors provide strategic wealth management guidance. With a focus on exclusivity and relationship-based service, Alhambra is ideal for clients seeking a more intimate and confidential Cayman banking experience.

Trident Trust Company (Cayman) Ltd – Expert in Corporate and Fiduciary Services

Trident Trust is an international leader in corporate, fiduciary, and fund administration services. In Cayman, it caters primarily to institutional clients and offshore structures requiring professional compliance and governance support. Its expertise in trust management and regulatory matters makes it a valuable partner for companies establishing a long-term Cayman Islands bank account for operational or investment purposes.

Step 2: Determine the type of account you need

Decide whether you need a personal or business account and choose the type of account, such as a checking, savings, or investment account.

A Cayman bank account managed for you may offer a range of investment products, such as stocks, mutual funds, and bonds, which are commonly associated with higher professional fees. However, they can provide a significantly greater return when administered well.

Step 3: Gather the required documentation

Cayman Islands residents may have fewer documentation requirements for opening a bank account, as the government may already have access to your information. Moreover, you may also qualify for services and products available only to residents.

Non-residents can open accounts if they have ties to the islands (personal, business, or residential connection), even without being present, but you may be subject to greater scrutiny, higher fees, more documentation, and operation tracking.

In general, the common requirements for opening an offshore bank account in the Cayman Islands as a non-resident may include the following:

- Proof of identity: a valid passport or other government-issued photo identification

- Proof of residence: such as a utility bill (less than three months old) or other documents that verify your residential address

- Bank reference: documents from your existing bank or financial institution with your bank history

- Source of funds: You may need to provide information about the fund sources you plan to deposit in the account

- Minimum initial deposit: depending on the bank and the type of account (generally from a few thousand to a hundred thousand dollars for a reputable one)

As a foreigner, there is a high chance you would be required to comply with additional regulations, such as those related to anti-money laundering (AML) and know-your-customer (KYC) standards. Thus, a minimum balance might be required to avoid fees or closure.

What's more

Cayman Island banks will do thorough background checks before allowing you to open an account in compliance with the mandatory due diligence requirements to make sure you are entirely legally qualified.

Step 4: Open a bank account remotely or in person

Some banks in the Cayman Islands allow you to open an account remotely, while others may require you to visit the bank in person. However, most banks in the Cayman Islands do require that you open a bank account in person.

You may need to make travel arrangements to the jurisdiction. Contacting the bank directly to confirm their account opening procedures at the current time would be of great help!

Step 5: Fund the account

Once the account is opened, you will typically need to make an initial deposit to fund the account. Depending on your bank and account type, the initial deposit will vary. After you have completed the required information and funded the account, the bank will complete the account activation process. You will then be able to use the account.

Looking to open

offshore bank accounts?

Here is your cheat sheet to make it easier.

Things to Do After Opening a Bank Account in the Cayman Islands

Opening a Cayman Islands bank account is only the first step toward establishing a secure and efficient financial presence offshore.

Once the account is active, ongoing management and compliance play a critical role in maintaining its legitimacy and operational effectiveness. Account holders should pay close attention to fund transfers, account monitoring, tax reporting, and global compliance requirements to ensure continued alignment with both local and international regulations.

Transferring and Managing Funds

Efficient fund management is essential to maintaining the credibility of your Cayman Islands bank account. Transfers should be conducted through authorized and traceable channels, ensuring transparency in all incoming and outgoing transactions.

Banks in the Cayman Islands generally support multi-currency operations, enabling clients to manage capital across multiple jurisdictions. It is advisable to retain supporting documents for all transfers, as financial institutions periodically verify transaction legitimacy in accordance with AML (Anti-Money Laundering) and KYC (Know Your Customer) standards.

Account Maintenance and Monitoring

Post-opening maintenance is a fundamental aspect of responsible banking in the Cayman Islands. Account holders must comply with the institution’s minimum balance requirements, review account statements regularly, and promptly address any irregularities.

Timely updates regarding changes in ownership, business activity, or contact details must also be provided to the bank to maintain transparency and compliance with regulatory expectations. Failure to do so may result in service restrictions or account suspension.

Tax Responsibilities and Compliance

Although the Cayman Islands applies a tax-neutral framework, account holders remain responsible for fulfilling tax obligations in their country of residence. This includes declaring offshore income, dividends, or interest generated from a Cayman Islands bank account.

Non-disclosure can trigger severe penalties under international tax cooperation laws. Engaging a qualified tax professional is recommended to ensure that all cross-border tax and reporting requirements are met in full.

Global Reporting Requirements

The Cayman Islands complies with international transparency frameworks designed to prevent tax evasion and enhance financial accountability. Banks in the jurisdiction are legally bound to share relevant account information with tax authorities under the following agreements:

- Foreign Account Tax Compliance Act (FATCA)

- Common Reporting Standard (CRS)

- Tax Information Exchange Agreements (TIEAs)

These frameworks require Cayman Islands banks to collect and disclose accurate information about account holders, including identification, residency status, and income derived from their accounts.

Failure to comply with these reporting requirements can result in significant penalties or reputational damage. Therefore, account holders should remain informed of evolving regulations and seek professional tax or legal advice to maintain continuous compliance.

A few setbacks you need to consider

It’s always a good idea to do some research on the potential setbacks of any location before incorporating a company so that you can make an informed decision about what’s best. Ideal as the Cayman Islands seems to be, there are several difficulties to consider:

Limited local market

While the Cayman Islands is a well-established financial center, the local market is limited in scope. This can be particularly true for businesses in certain industries, such as retail, where there is limited demand for certain products or services.

High cost of banking

Many of the banks operating in the region specialize in providing services to high-net-worth individuals, corporations, and other financial institutions, and as a result, they charge higher fees and rates. Banks operating in the region must comply with a range of regulations and requirements, which can be expensive.

Natural disasters

Cayman is prone to natural disasters such as hurricanes and earthquakes. These can cause damage to bank facilities, making it difficult for banks to operate normally. This can lead to disruptions in services and delays in processing transactions.

To mitigate the impact of these setbacks, banks in the Cayman Islands have developed coping solutions such as comprehensive disaster preparedness, business continuity plans, or strategies specializing in niche markets that have a global reach.

The Cayman Islands might not be an ideal destination for everyone. Make sure to carefully weigh the pros and cons with local experts before making any decisions on how to open a Cayman Islands bank account.

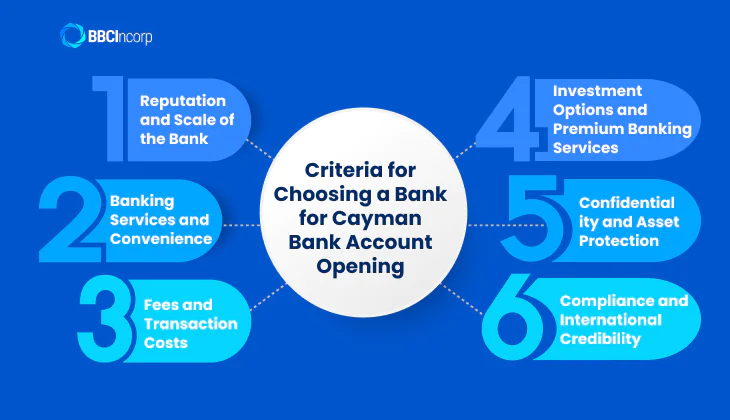

Criteria for Choosing a Bank for Cayman Bank Account Opening

1. Reputation and Scale of the Bank

Choose a bank with a strong international presence or a long-standing history in the Cayman Islands, such as Scotiabank, Butterfield, Cayman National, or Fidelity.

- Ensure that the institution complies with international banking regulations and maintains transparent risk-management practices.

2. Banking Services and Convenience

- Look for banks that provide comprehensive online banking platforms and user-friendly mobile applications.

- Essential services include international wire transfers, multi-currency accounts, and global investment management.

- Many banks in the Cayman Islands offer tailored solutions for individuals, corporations, and international investors.

3. Fees and Transaction Costs

- Compare monthly maintenance fees, international transfer charges, transaction costs, and foreign-exchange rates.

- Check the minimum balance requirements needed to maintain an active account.

- It is advisable to request detailed fee schedules from multiple banks before making a decision.

4. Investment Options and Premium Banking Services

- Some institutions offer tiered account structures with different benefits depending on the deposit level.

- High-net-worth individuals (HNWIs) may find private banking services especially appealing for their personalized management and exclusive privileges.

5. Confidentiality and Asset Protection

- Cayman banks are known for their strict privacy standards and robust cybersecurity systems.

- The Cayman legal framework provides strong asset-protection mechanisms, often through trusts and other legal structures designed to safeguard wealth from external claims.

- While financial privacy is a core value, Cayman banks still comply with AML/KYC rules and cooperate with legitimate tax-information exchange requests to preserve the jurisdiction’s global reputation.

6. Compliance and International Credibility

- Ensure the bank is licensed and regulated by the Cayman Islands Monetary Authority (CIMA).

- Selecting an institution with a proven international reputation will help minimize risks when handling cross-border transactions or expanding your business globally.

Open a Cayman Islands Bank Account Quickly with BBCIncorp

Opening a bank account in the Cayman Islands can be a complex process, requiring detailed documentation and regulatory compliance. BBCIncorp assists clients in simplifying this journey by providing professional guidance, document review, and application support helping you connect with suitable banks efficiently and confidently.

Professional offshore banking support

BBCIncorp acts as a trusted facilitator for clients seeking to open Cayman Islands bank accounts. Our consultants guide you through each stage, from initial eligibility checks to preparing the required documents, ensuring your application is properly structured before submission.

Compliance-focused process

Each case is carefully reviewed to meet the due diligence standards set by the Cayman Islands Monetary Authority (CIMA). BBCIncorp helps clients understand FATCA and CRS reporting obligations and ensures all documentation aligns with international banking expectations.

Transparent and efficient workflow

Through a clear, step-by-step process, BBCIncorp minimizes unnecessary delays and helps clients stay informed throughout the application. Our digital working system allows for remote coordination, reducing paperwork while maintaining accuracy and confidentiality.

Tailored solutions for every client

BBCIncorp understands that every client’s banking objective is unique. Whether you are opening an account for a Cayman company, a holding entity, or personal offshore purposes, our consultants provide solutions aligned with your business needs, risk profile, and compliance requirements.

End-to-end assistance

From document review to communication with the selected bank, BBCIncorp supports clients at every step. Our goal is to simplify your Cayman Islands banking experience, ensuring a smooth, compliant, and time-efficient process.

Client Information Required for Cayman Bank Account Opening

To ensure a smooth and compliant application process, clients should prepare the following documents before starting their Cayman Islands bank account opening procedure. BBCIncorp will assist in reviewing, certifying, and organizing these materials to meet each bank’s due diligence requirements.

- Application forms

- Bank statements

- Bank reference letter

- Certified copies of passports, proofs of residence of all directors/shareholders

- Business plan

- Company business evidence (sales/purchase orders, invoices, etc.)

- Certified copies of your Cayman company incorporation documents

- Government certification of company good standing status

Please note that additional documents may be required depending on the bank’s internal policies, the nature of your business, and the complexity of your application. Requirements can vary across institutions, so clients are encouraged to remain flexible and responsive during the due diligence process.

For detailed guidance on Cayman Islands bank accounts, visit Open Bank Account for Cayman Islands Company.

Conclusion

In terms of banking services, the Cayman Islands is a greatly advantageous jurisdiction whether you are doing business onshore or offshore. Getting a Cayman Islands bank account here is bound to benefit your business in many ways owing to its tax advantages, reputable financial infrastructure, stable political environment, confidentiality, and diversification.

Have a look at our banking support services to discover how we can assist you in opening a bank account in the Cayman Islands.

Frequently Asked Questions

How much does it cost to open a bank account in the Cayman Islands?

To be informed of a more accurate estimate of the cost of setting up a bank account in the Cayman Islands, it’s best to contact the specific banks and inquire about their account opening requirements and associated fees. More conveniently, you can also get in touch with our BBCIncorp’s professional team for reference.

The amount can be in USD, CAD, KYD, and other leading currencies, although banks may require higher minimum account balances for some currencies.

What is the currency used in the Cayman Islands?

The official currency of the Cayman Islands is the Cayman Islands Dollar (KYD), which is exchanged for the US dollar at a fixed rate of KYD 1 = USD 1.20. The Cayman Islands is a dual-currency economy, so both USD and the local KYD currency are widely accepted.

Upon arrival, a maximum of USD 10,000 in cash can be brought into the Cayman Islands without declaration.

Is it possible for non-residents to open a bank account in the Cayman Islands?

Yes, non-residents can open a bank account in the Cayman Islands, although the process can be more complex than for residents. Most banks require proof of connection to the jurisdiction such as owning a local business, holding property, or having professional or family ties.

Additional due diligence, identity verification, and source-of-funds documentation are typically required to comply with Cayman’s anti–money laundering (AML) standards.

Who is eligible to open a Cayman bank account?

Eligibility extends to both individuals and companies with legitimate financial or business purposes. Cayman banks often favor clients with transparent financial backgrounds and clear reasons for maintaining offshore accounts, such as international trade, investment management, or asset diversification.

What is the minimum deposit required to open a Cayman Islands bank account?

The minimum deposit varies by bank and account type. Personal accounts may start from around US$1,000 to US$10,000, while corporate or private banking accounts generally require higher deposits, sometimes up to US$50,000 or more. Certain banks also maintain minimum balance requirements to keep the account active, depending on the client’s profile and risk level.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.