Table of Contents

The operational flexibility and liability protection afforded by an LLC are significant advantages for business owners. However, the process of owner compensation is often more complex than in traditional employment structures. Unlike salaried or wage-based roles, LLC owners must determine the timing and method of income distribution, subject to regulations that vary based on the entity’s classification.

Given that accurate management of owner compensation directly impacts tax obligations, the integrity of legal protections, and the overall financial stability of the company, this guide offers the detailed breakdown you need on “how to pay myself from my LLC”. Let’s delve in with BBCIncorp.

What is an LLC and how does it affect payment?

A limited liability company (LLC) is a flexible business structure that combines the liability protection of a corporation with the simplicity of a sole proprietorship or partnership.

Owners, called members, can choose how the LLC is taxed: either as a disregarded entity, a partnership, or an electing corporation. This tax flexibility plays a direct role in how you draw income from the business.

The way you structure your LLC, whether it is a single-member or multi-member entity, affects not only how to pay yourself as a business owner but also your legal responsibilities and personal liability.

For example, a single-member LLC is typically taxed as a sole proprietorship, meaning you take draws from profits rather than a formal salary. In contrast, LLCs taxed as corporations may pay owners through wages or dividends, subject to different reporting and tax rules.

Maintaining compliance and protecting your finances requires an understanding of the relationship between your business structure and income distribution, so make sure to consider every possible aspect of your decision.

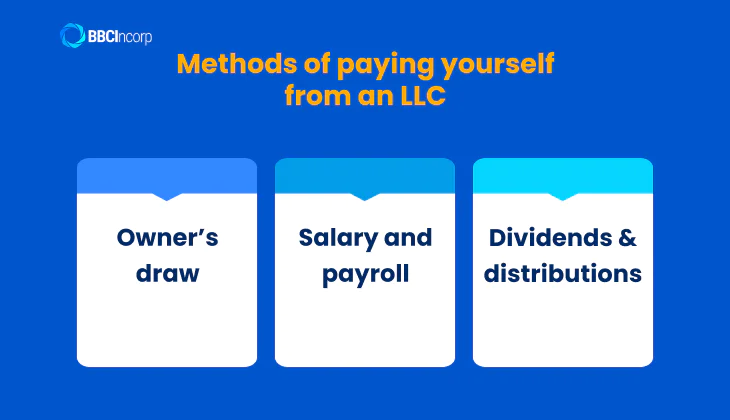

Methods of paying yourself from an LLC

When it comes to paying yourself as an LLC, the right method depends on how your business is structured and taxed. Whether you operate as a single-member or a multi-member LLC, or elect to be taxed as a corporation, each of the types of LLCs offers their own options and tax outcomes.

Owner’s draw

For LLCs operating as sole proprietorships or partnerships, the prevalent method of owner compensation is an owner’s draw. This entails transferring funds from the business account to the owner’s personal account through mechanisms such as checks or electronic transfers.

While owner’s draws are not subject to immediate payroll tax withholding, it is the owner’s responsibility to accurately report these withdrawals on their personal tax return and remit self-employment taxes.

This approach offers flexibility and potentially lower administrative costs. However, bookkeeping practices are essential to maintain accurate cash flow management and ensure proper tax reporting. Understanding your specific role within the titles for LLC owners will further clarify associated tax obligations as well.

Salary and payroll

If your LLC has elected to be taxed as an S corporation or C corporation, paying yourself a salary is both common and mandatory. You must run formal payroll, issue yourself a W-2, and withhold appropriate federal and state taxes.

The key benefit here is that your salary is a deductible business expense, which can reduce taxable income. It also allows you to access benefits like retirement contributions or health insurance through the company. Wondering, can the owner of an LLC pay himself through payroll? Yes, but only if your LLC has elected corporate taxation.

Dividends and distributions

In the case of LLCs taxed as corporations, owners can also receive money in the form of dividends or profit distributions. These are not subject to payroll tax. As a result, they can lead to tax advantages when structured correctly. However, dividends are not deductible for the business and may be subject to double taxation under a C-corp model.

This combination of salary and distributions is often seen as the best way to pay yourself as an LLC owner, balancing tax savings with compliance. If you’re asking how to pay yourself with LLC while minimizing taxes, this approach is worth exploring with a tax professional.

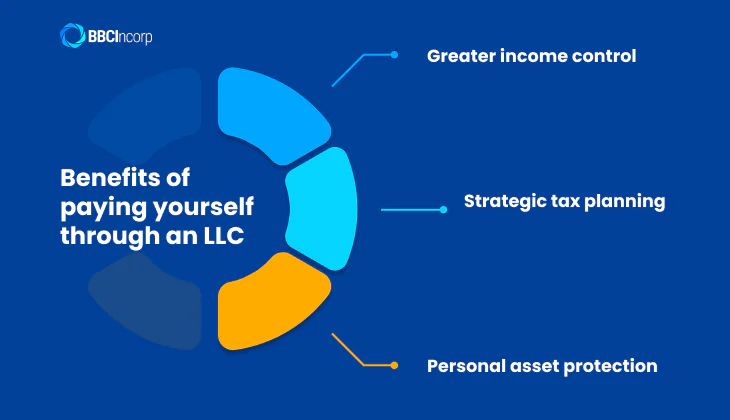

Benefits of paying yourself through an LLC

Operating as a Limited Liability Company provides key advantages in managing your earnings and safeguarding your personal assets.

Greater income control

You can enjoy the flexibility to decide when and how much you pay yourself, unlike the fixed schedules of traditional employment. This allows for better management of personal cash flow and capitalizing on profitable periods.

Strategic tax planning

LLCs are avenues for smart tax management and reducing your overall tax burden. For higher-earning LLCs, electing S corporation tax status is truly advantageous.

By paying yourself a reasonable salary (subject to payroll taxes) and taking the remaining profits as dividends (not subject to self-employment tax), you will be able to achieve major tax savings.

Personal asset protection

The core of an LLC is the separation of your personal and business liabilities. This legal distinction generally protects your personal assets, such as your home and savings, from business debts and lawsuits, providing financial security as you manage your income.

Notably, leveraging these advantages through informed decisions about how you pay yourself is essential for maximizing the financial success and security of your LLC.

Knowing how to pay yourself from your LLC involves more than just transferring funds. To stay compliant and avoid unexpected tax bills, it’s essential to understand how your LLC is taxed and how that affects your payment method. Whether you take an owner’s draw or run payroll, each choice carries different reporting requirements and tax obligations.

Tax implications when paying yourself from your LLC

To stay compliant and avoid unexpected tax bills, it’s essential to go through how your LLC is taxed and how that affects your payment method.

Understanding tax classifications and filing

By default, a single-member LLC is treated as a disregarded entity, meaning the IRS taxes it like a sole proprietorship. Business income flows directly to the owner’s personal tax return via Schedule C. A multi-member LLC, on the other hand, is taxed as a partnership, requiring a separate informational return (Form 1065) and issuing Schedule K-1 to each member to report their share of the income.

Choosing corporate tax treatment (S corp or C corp) changes the game. The LLC becomes a separate tax entity, and you must follow corporate tax rules, including payroll and formal reporting. Knowing your tax classification is the first step toward understanding whether and how you should pay yourself from your LLC.

Payroll taxes for salaries

If your LLC is taxed as an S corporation or C corporation, and you take a salary, LLC payroll rules apply. You’ll need to withhold Social Security, Medicare, and other payroll taxes, as well as issue a W-2 at year-end. The business also pays a portion of these taxes as an employer.

In contrast, taking an owner’s draw, common in sole proprietorships and partnerships, does not involve payroll tax withholding. However, you’ll still pay self-employment taxes, which include both the employer and employee share of Social Security and Medicare. Understanding the difference between LLC and payroll taxes helps you plan compensation more efficiently.

Quarterly estimated taxes

Regardless of structure, LLC owners who receive income outside of payroll must often make quarterly estimated tax payments to avoid penalties. This applies to owners who rely on draws rather than wages.

Make sure to estimate your total annual income and divide your tax liability into four quarterly payments. The IRS provides Form 1040-ES to help with calculations.

Being proactive about estimated taxes ensures you meet federal requirements and avoid underpayment issues. If you’re still wondering, “Should I pay myself from my LLC?, consult an advisor from BBCIncorp to get advice on your payment strategy.

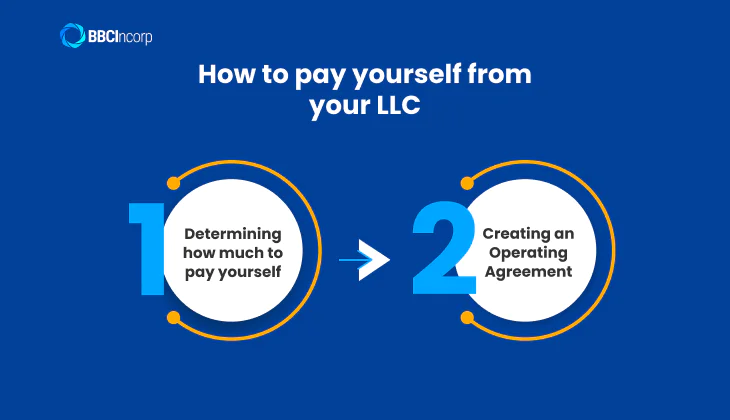

How to pay myself from my LLC?

Strategically determining how you compensate yourself from your LLC is a pivotal decision. And a well-defined plan will foster consistent progress while providing a predictable and reliable income amount. Here’s how to pay yourself in an LLC.

Step 1: Determining how much to pay yourself

The first step is deciding on “how much should I pay myself from my LLC?”. Start by reviewing your business’s net income, current cash reserves, and upcoming expenses. A smart approach is to pay yourself an amount that covers your personal needs without undermining the company’s operations.

Look at both your fixed personal expenses and your business’s cash flow patterns. Avoid taking large draws or salaries during slow periods and adjust your compensation as your profits grow.

When thinking about the best way to pay yourself from your LLC, remember that consistency is important. Setting a regular schedule for draws or salary payments can help with budgeting for both your personal and business expenses.

Step 2: Creating an Operating Agreement

Next, establish clear payment guidelines through your LLC’s Operating Agreement. This document sets out how and when owners can take money from the company, offering structure and transparency.

For single-member LLCs, it can outline the process for making draws or adjusting payment amounts if business income fluctuates. For multi-member LLCs, you must include rules for multiple owner compensation, such as guaranteed payments or proportional distributions.

An Operating Agreement also strengthens the legal separation between you and your business. Courts look favorably on companies that operate under documented procedures, reducing risks if legal issues arise.

Taking the time to document how compensation works can also make future transitions, such as bringing on new partners or investors, much smoother. By staying disciplined about how you pay yourself, you not only support your lifestyle but also reinforce the financial stability and credibility of your business.

Best practices for paying yourself from your LLC

Paying yourself from your LLC sounds simple, but small mistakes can cause major tax problems, cash flow issues, and even put your liability protection at risk.

First, always file the correct tax forms for your LLC type. Single-member LLCs typically report income on Schedule C, while multi-member LLCs must file Form 1065 and issue K-1s to members. If you elect S corporation status, filing Form 1120-S is necessary. Using the wrong form can delay filings, trigger IRS penalties, and complicate future tax planning.

Second, calculate your taxes carefully. Whether you are taking an owner’s draw or paying yourself a salary, you need to set aside enough for self-employment taxes or withhold payroll taxes properly. Many owners underestimate their tax burden, leading to harmful, unexpected bills at payment times.

Third, plan for quarterly estimated taxes. If you draw income but do not withhold taxes through payroll, you must submit estimated tax payments four times a year. Missing these payments can result in penalties and interest charges.

Another critical mistake is mixing business and personal finances. Always maintain separate business bank accounts and never pay personal expenses directly from business funds. Keeping finances separate strengthens your liability shield and simplifies bookkeeping.

Finally, pay yourself sustainably. Do not drain business cash reserves to cover personal expenses. Set a regular, affordable payment schedule that balances your needs and your company’s financial health.

Mastering these details makes paying yourself LLC simple and answers key questions like should I pay myself a salary from my LLC, or do I have to pay myself from my LLC with confidence and security.

Unlock hassle-free LLC setup with BBCIncorp

Establishing your Limited Liability Company correctly from the outset is crucial for simplifying how you pay yourself later. Whether you’re forming a local or offshore entity, BBCIncorp streamlines the setup process, ensuring a solid foundation for compliant and efficient owner compensation through:

- Choosing the right structure: We guide you in selecting the optimal LLC structure (e.g., single-member, multi-member, potential for S corp election) that aligns with your income goals and tax strategy.

- Clear financial foundations: We assist with setting up essential financial infrastructure, including bank account opening, which is vital for managing owner draws or salary payments.

- Compliance from the start: Our post-formation support ensures your business remains compliant with all regulations, which is essential for accurately reporting and managing your owner compensation.

- Expert guidance: We can connect you with professionals for advice on tax implications and the best methods for paying yourself based on your specific LLC structure.

Let BBCIncorp handle the complexities of LLC formation in Delaware, Singapore, Hong Kong, or other vibrant jurisdictions for your business. Visit our site today to learn more.

To wrap up

Paying yourself correctly from your LLC is vital for maintaining compliance, optimizing taxes, and ensuring your business’s financial health. Whether you choose the owner’s draws or a salary, understanding the implications of how to pay myself from my LLC is crucial. This guide has provided a foundation for making informed decisions.

For personalized guidance and support in setting up your LLC and managing your owner compensation, consider reaching out to BBCIncorp. We can help you navigate the complexities and establish a solid financial framework for your business.

Don’t hesitate to reach out to our team at service@bbcincorp.com for prompt assistance in setting up your global company.

Frequently Asked Questions

Can I pay myself from my LLC?

Yes, you can pay yourself from your LLC, but the method depends on how your LLC is taxed. For single-member LLCs, payments typically come as owner’s draws, reported on your personal tax return with self-employment tax.

Multi-member LLCs distribute profits among members based on ownership share, with each reporting income via Schedule K-1. If your LLC elects to be taxed as an S corp or C corp, you must pay yourself a reasonable salary through payroll, withholding income, and employment taxes.

How do I pay myself in a single-member LLC?

In a single-member LLC, the most common way to pay yourself is through an owner’s draw. You simply transfer money from your business account to your personal account by check, bank transfer, or payment app.

There’s no need to run payroll or withhold taxes, but you are personally responsible for reporting the income on Schedule C of your tax return and paying self-employment taxes.

To stay compliant, keep detailed records of each draw, maintain separate business and personal accounts, and set aside money for quarterly tax payments. This method is flexible and suits most solo entrepreneurs.

How much should I pay myself from my LLC?

Deciding how much to pay yourself from your LLC requires careful consideration. First, calculate your essential personal living expenses. Next, analyze your business’s financial health, ensuring sufficient funds for operations, taxes, debt, and future growth. Researching industry salary benchmarks for similar roles can also provide guidance.

Instead of focusing solely on a salary figure, develop a comprehensive financial plan that prioritizes covering business costs, saving for taxes, and reinvesting for the future while meeting your personal income needs. The ideal amount balances your personal requirements with your LLC’s sustainability and growth potential.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.