Table of Contents

Globally recognized for its blend of corporate liability protection and partnership-like flexibility and tax advantages, the limited liability company (LLC) is a popular business structure for aspiring entrepreneurs worldwide. However, “LLC” is an umbrella term for diverse entity types, each tailored to particular ownership arrangements, governance styles, and business aims.

Choosing the right types of LLC is a critical decision influencing liability, tax responsibilities, and growth potential. Thus, business owners must grasp these distinctions to ensure their options align with long-term vision, objectives, and operational demands. Let’s explore the core differences, benefits, and drawbacks among these LLC variations.

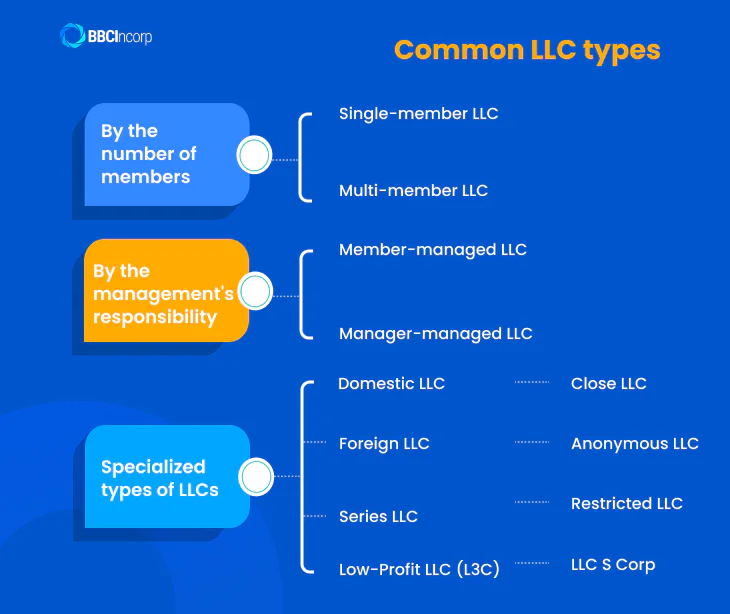

Common LLC types

When considering the setup for your business, understanding the different types of LLCs is essential. In this section, we will explore common types of limited liability companies based on the number of members and management structure. Let’s begin.

By the number of members

Single-member LLC

A single-member LLC is owned by just one person, with the owner being the sole member of the company. By default, this type of LLC is taxed as a sole proprietorship, meaning the owner reports income and expenses on their personal tax return.

Advantages of a single-member LLC

- Simple setup: A single-member LLC is relatively easy and inexpensive to set up, with fewer regulatory requirements compared to corporations.

- Flexibility: The owner has full control over the business decisions and can make changes without consensus from other members.

- Liability protection: Like all LLCs, a single-member LLC offers protection against personal liability for business debts and lawsuits.

Disadvantages of a single-member LLC

- Personal liability risks in certain states: In some states, courts may treat a single-member LLC as an extension of the owner. For example, California courts can pierce the “corporate veil”, exposing owners to personal liability if they do not maintain proper separation between personal and business affairs.

Taxation

While a single-member LLC is taxed as a sole proprietorship by default, it can elect to be taxed as an S-corp or C-corp if it meets the requirements. In this way, self-employment taxes can be reduced, and tax planning can be improved greatly.

Suitable for

Single-member LLCs are ideal for freelancers, consultants, or anyone running a solo business.

Multi-member LLC

Among the types of LLC structures, a multi-member LLC is owned by two or more members who share in the management and decision-making of the business. By default, a multi-member LLC is taxed as a partnership. Consequently, the business itself does not pay taxes, but every member reports their share of income and losses on their personal tax returns.

Advantages of a multi-member LLC

- Shared responsibility: Members can share responsibilities for management and decision-making, making it easier to handle complex business tasks.

- Strengthened liability protection: Like a single-member LLC, multi-member LLCs provide liability protection, keeping personal assets safe from business debts.

Disadvantages of a multi-member LLC

- Increased paperwork: A multi-member LLC requires more formalities, including a written operating agreement that outlines the roles, responsibilities, and profit distribution.

- Conflicts between members: Disagreements between members might arise over business decisions, which may impact the company’s operations and growth.

Taxation

A multi-member LLC is taxed as a partnership by default, but it can elect to be taxed as a corporation, which provides broader taxation options depending on your goals.

Suitable for

Multi-member LLCs are well-suited for family-owned businesses, startups with co-founders, or any business where shared responsibility is important.

Note

A detailed explanation of the difference between single member vs multi member LLCs can be found in our relevant article. Don’t hesitate to pay a visit for more information on the types of LLC ownership.

By the management’s responsibility

There are two different types of LLCs based on this criterion:

Member-managed LLC

In a member-managed LLC, all members are actively involved in the daily operations and management of the business. Each member has an equal say in how the company is run, unless the operating agreement specifies otherwise.

Advantages of a member-managed LLC

- Direct control: All members are directly involved in decision-making, which can foster a collaborative environment and quick decision-making.

- Cost efficiency: With no external manager, members save on management fees if they can take care of the operations themselves.

Disadvantages of a member-managed LLC

- Time-consuming: Managing all aspects of the business will be time-consuming for members who may already have other responsibilities. Inexperienced officers will also struggle with out-of-scope but necessary tasks.

- More conflicts and disagreements: With multiple members making decisions, conflicts will surely arise, especially if members from different jurisdictions or cultures have different business visions.

Suitable for

This entity is ideal for small, closely run businesses where members wish to be involved in the day-to-day operations, such as family-run businesses or partnerships.

Manager-managed LLC

For a manager-managed LLC, members elect one or more managers to handle the daily operations of the business. Managers and other members who focus on higher-level decisions and long-term strategy are now the two types of LLC members. This allows passive investors to be involved without being active in day-to-day management.

Advantages of a manager-managed LLC

- Separation of duties: Members can focus on the broader business strategy. The managers will handle operational tasks on their behalf.

- Ideal for passive investors: The venture is beneficial for investors who want to contribute capital but do not wish to be involved in the business’s daily management.

Disadvantages of a manager-managed LLC

- Less control for members: Members shall have less direct involvement in daily decisions, which could lead to dissatisfaction if they do not trust the managers enough.

- Complexity: A manager-managed company requires a clear distinction between members and managers, leading to additional paperwork and administrative efforts.

Suitable for

This option is perfect for investor-owned businesses, where investors want to have limited involvement in the operational side of the business. It is also ideal for businesses looking to attract outside capital without giving investors direct control.

Specialized types of LLCs

Beyond the basic structures, below are key LLC categories worth exploring further.

Domestic LLC

A domestic LLC is formed and operates within the same state. For example, an LLC registered and doing business in Texas is a domestic LLC in Texas.

Best suited for: Businesses operating primarily in one state with no cross-border transactions.

Advantages:

- Simplified compliance: Only requires following the rules of the state it was formed.

- Easier and quicker to manage: Less paperwork and filing requirements.

Disadvantages:

- Limited reach: Will likely require foreign registration if expanding operations outside the home state.

- May not benefit from favorable laws in other jurisdictions.

Foreign LLC

A foreign LLC is an entity that was formed in one state but conducts business in another. For instance, a Nevada-formed LLC doing business in California is considered a foreign LLC in California.

Best suited for: Businesses operating in multiple states.

Advantages:

- Expands business footprint without creating a new entity.

- Facilitates operational flexibility across state lines.

Disadvantages:

- Must register as a foreign entity in every state it operates.

- Subject to additional fees, taxes, and compliance requirements across multiple jurisdictions.

Series LLC

A series LLC is a structure where a “parent” LLC has multiple “series” or sub-entities, each with its own assets, operations, and liabilities. This model was first introduced in Delaware and is now recognized in several other states, including Illinois and Texas.

Best suited for: Real estate investors, franchise operators, or entrepreneurs managing distinct ventures under one umbrella.

Advantages:

- Segregates liability: One series’ debts or liabilities don’t affect others.

- Reduces administrative costs: Single filing for multiple businesses.

Disadvantages:

- Not recognized in all states, which may complicate expansion.

Accounting and legal compliance can be complex.

Low-Profit LLC (L3C)

An L3C blends a business structure with a charitable mission. It prioritizes social impact over profit while still operating as a for-profit entity.

Best suited for: Social entrepreneurs, mission-driven organizations.

Advantages:

- Attracts impact investors and program-related investments (PRIs) from foundations.

- Maintains operational flexibility of an LLC.

Disadvantages:

- Not recognized in every state.

- Tax treatment is similar to a regular LLC, with no special tax benefits.

Close LLC

A close LLC (or closely held LLC) is designed for small businesses with a limited number of owners who wish to manage the business directly.

Best suited for: Family-owned businesses, partnerships with long-term trust.

Advantages:

- Fewer formal requirements (e.g., no board of directors).

- Greater flexibility in ownership transfer restrictions.

Disadvantages:

- Typically limited to 30 – 50 members.

- Not suitable for businesses seeking venture capital or large-scale expansion.

Anonymous LLC

An anonymous LLC allows owners to keep their identity off the public record. This is permitted in states like New Mexico, Delaware, and Wyoming.

Best suited for: Owners concerned about privacy, asset protection, or potential harassment.

Advantages:

- Enhanced privacy and anonymity.

- Reduces risks of unwanted solicitation or legal exposure.

Disadvantages:

- Owner identity can still be revealed in lawsuits or subpoenas.

- Not allowed in every state, so formation choices are limited.

Restricted LLC

A restricted LLC is a unique structure available only in Nevada. It is designed for estate planning, allowing long-term control over distributions and limiting asset access for a set number of years.

Best suited for: Family estate and succession planning.

Advantages:

- Facilitates long-term wealth transfer.

- Advantageous tax advantages for high-net-worth families.

Disadvantages:

- Limited to Nevada, not suitable for general business use.

- Requires careful planning to comply with state rules.

LLC S Corp

An LLC S Corp is not a different legal entity but an LLC that elects to be taxed as an S Corporation under IRS rules. This structure allows the business to reduce self-employment taxes while maintaining the legal protections of an LLC.

Best suited for: Profitable small businesses looking to minimize tax burden.

Advantages:

- Reduction in self-employment taxes by splitting income between salary and distributions.

- Retains LLC’s limited liability and flexible structure.

Disadvantages:

- Eligibility rules: Must be a domestic LLC with 100 or fewer shareholders, all of whom must be U.S. persons.

- More IRS scrutiny and stricter filing deadlines.

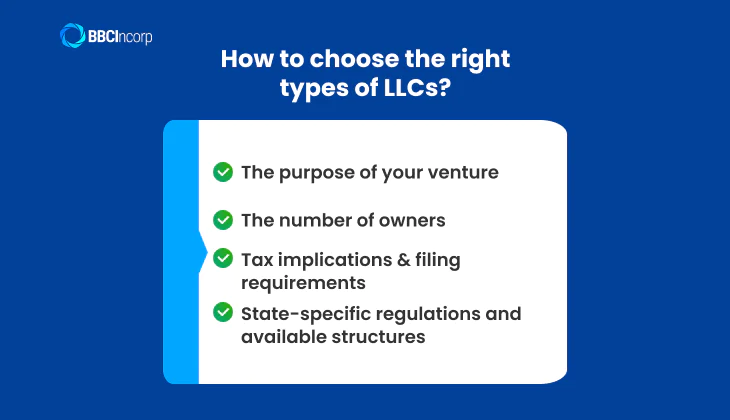

How to choose the right types of LLCs?

Selecting the appropriate LLC structure demands careful consideration of your business’s core attributes. The purpose of your venture, profit-driven or with philanthropic aims, is fundamental. To exemplify, for both profit and social impact, an L3C is recommended. On the other hand, traditional LLCs suit profit-focused businesses better

The number of owners significantly influences the choice. A solo entrepreneur typically opts for a single-member LLC for its simplicity. Businesses with multiple owners form multi-member LLCs, usually taxed as partnerships.

Tax implications and filing requirements differ based on the LLC type and elected tax status. While pass-through taxation is common, LLCs can elect to be taxed as S corporations or C corporations as well.

Crucially, state-specific regulations and available structures vary. Not all states recognize every LLC type. Series LLCs and PLLCs have limited state availability, so make sure to research your state’s specific rules in advance.

Given these complexities, consulting professional service providers is strongly advised. This is where BBCIncorp comes in to offer expert assistance in navigating these factors and selecting the optimal LLC for your global venture.

Launch your LLC quickly and stress-free with BBCIncorp

Setting up a limited liability company doesn’t have to be complicated. Whether you’re forming a local or offshore entity, BBCIncorp simplifies the process from start to finish. We help entrepreneurs worldwide determine what type of LLC is my business, navigate registration requirements, and launch with confidence.

Our team provides fast, end-to-end support for LLC formation across major jurisdictions, including offshore company formation in Delaware, Hong Kong, Singapore, and beyond. We also assist with essential services like bank account opening, so you can start operating immediately.

But our work doesn’t stop at incorporation. BBCIncorp delivers full post-formation support to keep your business compliant and running smoothly:

- Ongoing compliance management

- Annual reporting and filing

- Accounting and auditing

- Company secretary and other services tailored to your needs

Alternatively, we also assist with incorporation in business-friendly, low-tax jurisdictions, such as:

- Cayman Islands LLC establishment

- Company formation in Belize, the Bahamas, British Virgin Islands, the UAE, and many more options.

Whether you’re a solo consultant or managing a cross-border enterprise, our experts help you make the right decision among the types of LLC businesses. Contact the BBCIncorp team for more details.

To wrap up

LLCs are one of the most preferred and commonly formed entities around the world. Thus, different types of LLC structures are available to suit diverse business needs, from sole proprietorships to multi-owner enterprises and specialized professions. Nevertheless, your choice should reflect your operational goals, liability considerations, and tax planning. Given the intricacies involved, expert guidance can prove invaluable in navigating this critical decision.

Build a solid foundation for your LLC business rather than leaving it up to chance. Get in touch with us today at service@bbcincorp.com for prompt support in setting up your global company.

Frequently Asked Questions

What are the 3 types of LLCs?

It’s more accurate to think of LLC types based on different criteria. Here are three key distinctions:

Management:

- Member-managed LLC: Owners directly run the business.

- Manager-managed LLC: Appointed managers handle operations.

Membership:

- Single-member LLC: One owner.

- Multi-member LLC: Two or more owners.

Jurisdiction & purpose:

- Domestic LLC: Operates in its formation state.

- Foreign LLC: Registered to do business in another state.

- Professional LLC (PLLC): For licensed professionals (in some states only).

- Series LLC (SLLC): Parent LLC with sub-LLCs (in some states only).

- Low-Profit LLC (L3C): For social enterprises.

An LLC can fit into multiple categories depending on its structure and operations, so it’s the most common choice for incorporation globally.

What type of LLC is best for my business?

To determine the best LLC type for your business, consider these key factors:

Ownership: A single-member LLC suits solo entrepreneurs for simplicity and direct tax reporting. Multi-member LLCs are for two or more owners, typically taxed as partnerships.

Management: In a member-managed LLC, owners handle operations. A manager-managed LLC is preferable when owners aren’t directly involved in daily tasks.

Business type: Professionals in several fields (e.g., law, science, etc.) may need to form a Professional LLC (PLLC) in specific states. Businesses with diverse assets might consider a Series LLC (SLLC) (where available).

Location: Your primary operating location dictates your domestic LLC, while expansion into other states requires registering as a foreign LLC.

Please contact our team for timely support and a more specific recommendation.

Can I change my LLC type later?

Yes, you can, in most cases, change your LLC type later, but the process varies.

- Changing the number of members (single to multi or vice versa) usually requires updating your operating agreement and potentially informing the IRS.

- Switching management structure (member-managed to manager-managed) typically involves amending your operating agreement and possibly state filings.

- Changing to specialized LLCs like PLLCs or Series LLCs might necessitate dissolving your current LLC and forming a new one.

- Modifying your tax classification (electing S-Corp or C-Corp status) involves filing forms with the IRS, with limitations on frequency.

- Transferring an LLC to another state is contingent upon understanding the specific legal requirements dictated by each jurisdiction.

Crucially, state regulations differ, so consult your Secretary of State. You must always seek legal and tax advice before making changes.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.