Table of Contents

The journey of running your LLC will inevitably involve periods of change. Welcoming new partners, planning for retirement, or adapting to new market opportunities makes the transfer of LLC ownership significant.

This process is about safeguarding the future of your venture and fostering a continuation of operations. There are numerous factors to consider, particularly legal challenges, internal disputes, and the risk of invalidating the ownership change itself.

Today’s article will act as your trusted companion, offering clear, actionable insights on how to transfer LLC ownership with confidence and lay a solid foundation for the next chapter of your LLC’s journey.

Transferring ownership of an LLC

Let’s start by exploring the fundamentals of transferring ownership within an LLC, as well as the common reasons why this becomes necessary.

What does transferring LLC ownership mean?

Over the life of a Limited Liability Company (LLC), your business will likely encounter major transitions, and a key one is the shift in ownership. So, what exactly does transferring LLC ownership mean, and how does it typically occur?

In simple terms, LLC ownership change is the legal process of changing the individuals or entities who are the members of the LLC. This change directly affects who holds the rights to the LLC’s profits, assets, and decision-making power, as well as who bears the responsibilities and potential liabilities.

Reasons to transfer LLC ownership

There are several common situations where you might need to change LLC ownership, as the following suggestions:

- Adding new partners for growth: As your business expands, bringing in new partners with valuable skills, expertise, or capital is vital to fuel further growth and address key concerns like access to funding and attracting qualified employees.

- Member departure:When a member leaves the LLC due to retirement, a career change, or personal reasons, their ownership interest needs to be transferred to the remaining members or a new member.

- Resolving partnership issues: Disagreements between partners can and will, unfortunately, occur. In this case, transferring ownership can be a way to restructure the business and move forward, especially considering that up to 70% of business partnerships reportedly fail due to these issues.

- Strategic business changes: Major strategic moves like merging with another company or acquiring another business.

- Succession planning: For the long-term continuity of the business, owners often plan to transfer their ownership to the next generation or key employees as part of their retirement or exit strategy. This leads to common questions such as “How to transfer an LLC to a family member”, “Can I transfer my LLC to another person?”, and “How to transfer an LLC to another person”.

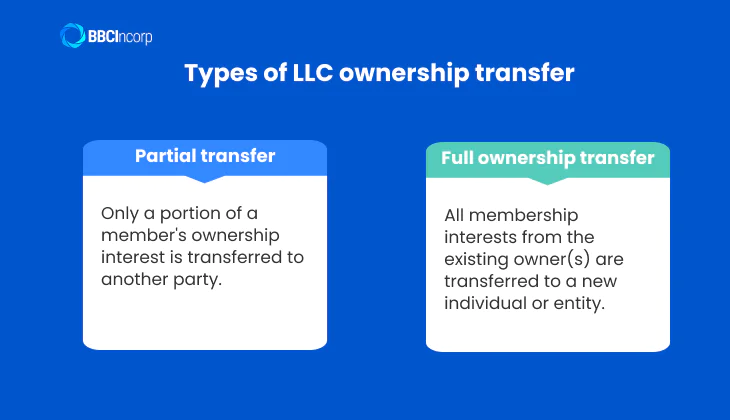

Types of LLC ownership transfer

Deciding whether you need a partial or full transfer is the first key step in planning your LLC ownership transition. Primarily, these choices fall into two categories: partial transfers and full transfers. Let’s delve into the details.

Partial transfer

A partial transfer of LLC ownership occurs when only a portion of a member’s ownership interest is transferred to another party. This might be selling or gifting a percentage of their membership units while retaining some level of ownership and roles in the business.

For instance, an existing member of a multi-member LLC, with 2 members in total, sold 20% of their 50% stake to a new investor, resulting in three members with ownership percentages of 30%, 50%, and 20%.

Partial transfers are common when bringing in new partners with specific expertise or capital without requiring existing members to relinquish their entire stake. The process for a partial transfer typically involves amending the LLC’s operating agreement to reflect the new ownership percentages and possibly updating state records.

Full ownership transfer

In contrast, a full transferring ownership of an LLC is the complete transfer of all membership interests from the existing owner(s) to a new individual or entity. The original owner(s) give up all control and rights to the LLC.

A common scenario for a full transfer is the outright sale of the entire entity to the next LLC owner. This differs from selling the business assets (like equipment, inventory, and intellectual property), where the original LLC might still exist as a shell. With a full ownership transfer, the new owner(s) take over the existing LLC structure, including its liabilities and obligations.

The process for a full transfer is more comprehensive, often requiring a formal transfer agreement, detailed due diligence, and extensive updates to state filings.

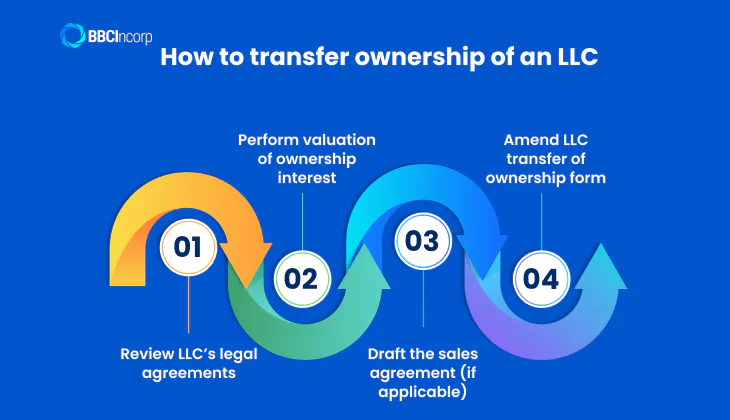

How to transfer ownership of an LLC?

Below are the several phases you must follow to ensure a legally compliant transition.

Step 1: Review LLC’s legal agreements

The foundation of any LLC ownership transfer lies within its governing documents, primarily the operating agreement and potentially a buy-sell agreement.

Operating agreement

An operating agreement is a foundational document that describes how your LLC will be managed and operated. As such, it is considered the blueprint for the entity, regardless of whether it was formed by setting up LLC online or filing physically with the authority. It typically includes provisions addressing the transfer of membership interests.

Reviewing this document is the first critical step. Start by asking: Does it mention specific procedures for transferring ownership? Are there any restrictions on who can become a member or any required approvals from existing members?

Buy-sell agreement

As a separate agreement or a section within the operating agreement, a buy-sell agreement outlines the process for how and when a member can leave the LLC and how their interest will be handled. It tends to include triggers for a transfer (like retirement or death), valuation methods, and who has the first right to purchase the departing member’s interest.

A well-drafted buy-sell agreement can prevent future disputes and provide a clear roadmap for ownership changes. Therefore, businesses must carefully examine the document to understand any pre-defined steps on how to change ownership of an LLC.

Step 2: Perform valuation of ownership interest

Before you can finalize any transfer, it’s crucial to accurately determine the fair value of the ownership interest being moved. Valuation in advance helps both parties understand potential tax implications for gifts, including transfers to family members.

Some of the common methods used to value an LLC ownership stake are:

- Book value: Using your LLC’s balance sheet to calculate the owner’s equity. It’s quicker but might not reflect the true market value or future potential.

- Market value: Estimating what a willing buyer would pay for the interest in the current market. This can be challenging for LLCs that aren’t publicly traded, as it requires research into comparable business sales.

- Discounted Cash Flow (DCF): Projecting the LLC’s expected future cash flows and then discounting them back to their present-day value. This method considers the potential profitability of the business.

- Agreed-upon value: If your LLC has a well-defined buy-sell agreement, it may already specify a particular valuation method or even a pre-determined value for ownership transfers.

If there are significant transfers or if a clear valuation method isn’t in place, utilizing a professional business appraiser is highly recommended for you.

Step 3: Draft the sales agreement (if applicable)

You must include the following key elements in the sales agreement:

- Identification of parties: Identify the seller(s) and buyer(s).

- Description of ownership interest: Specify the exact percentage or units of ownership being transferred.

- Purchase price and payment terms: Detail the agreed-upon price and how and when the payment will be made.

- Closing date: The date when the transfer officially takes effect.

- Representations and warranties: Statements by both parties about the state of the business and their legal standing.

- Indemnification clauses: Provision on who is responsible for potential liabilities or breaches of the agreement.

- Governing law: Specify which state’s laws will govern the interpretation of the agreement.

A lawyer should be engaged during the drafting of the sales agreement so that all parties’ interests are protected legally.

Step 4: Amend LLC transfer of ownership form

Depending on your state, transferring LLC ownership requires filing a specific form with the Secretary of State (or equivalent).

What is the transfer of ownership form?

The LLC transfer of ownership form is a state-required document notifying them of changes in your LLC’s members or managers after a full or partial transfer. The document names vary but often include “Amendment to the Articles of Organization”, “Change of Members/Managers Form”, “Statement of Information Update,” or “Certificate of Amendment.”

How to file the applicable form

- Visit your relevant authority’s website for the LLC amendment or change form.

- Fill out the required details about the ownership transfer.

- Pay the filing fee as listed on the government’s website. In the U.S., most states charge between USD20 and 150 or more.

- File the form online, by mail, or in person, following the government’s instructions.

Not all jurisdictions require a specific form. For example, Delaware and Wyoming only require that changes in membership are reflected in the LLC’s internal records, such as the operating agreement. Please verify the requirements by checking with the relevant authority beforehand.

Additional note: Are “ownership change” and “ownership transfer” the same?

Among the various ways to transfer your LLC ownership, selling the entire business to a new buyer is a particularly common and preferred approach for a complete transition. To help you navigate this process more easily, the following section will detail the process of selling your LLC entity.

How to sell an LLC?

The steps listed in this section directly address this scenario:

Step 1: Obtain member approval

Before selling an LLC, you must get approval from your members, as defined in your operating agreement. This could require a simple majority vote, a higher threshold like a supermajority, or even everyone’s agreement (unanimous consent).

Remember to thoroughly document this vote with meeting minutes and signed resolutions. The document proves the decision to sell will protect owners against legal challenges later on.

Step 2: Update LLC documents and legal filings

Once member approval is secured, you’ll need to update the legal documents and file the necessary paperwork with the state.

- Amend the transfer of ownership form:As discussed in the previous section, if your state requires a specific form to reflect changes in ownership, you’ll need to complete this form to reflect the buyer(s) as the new member(s).

- File with the state:Submit the completed amendment form, along with any required filing fees, to the appropriate state governing body.

- Notarize signatures:Many key documents related to the sale will require notarization. You must have a notary public verify the identities of the individuals signing the documents to add an extra layer of legal validity to the transaction.

- Update IRS responsible party:When LLC ownership changes, you must notify the IRS of the new individual responsible for the business’s taxes. You may also need a new Employer Identification Number (EIN). If you’re wondering “How to find my EIN?”, the IRS issues it upon application (online, by fax, or by mail) and sends a confirmation letter afterward. This notice should be carefully retained for your business records.

Step 3: Address tax and financial implications

Next, you are required to address the transfer ownership of llc tax consequences proactively.

Generally, the sale of your ownership interest is treated as a capital asset sale, meaning any profit (the difference between your basis and the sale price) will be subject to capital gains tax on your individual tax return, with the specific rate depending on your holding period and income bracket.

Furthermore, if the sale results in a change of the LLC’s “responsible party” with the IRS, you’ll likely need to file IRS Form 8822-B to update their records, and similar requirements may exist at the state level. Given the intricacies of tax laws, consulting a qualified tax advisor well before the sale is highly recommended.

Step 4: Transition responsibilities and assets

A smooth transition of responsibilities and assets is essential for the continued success of the business under new ownership. Make sure key connections like customer accounts, contracts, and supplier relationships are smoothly passed on. This might involve formally assigning contracts and introducing the new owner(s) to your existing network.

Then, give the buyer detailed records covering all parts of the business: financials, operations, customer information, and marketing. Offering training can also be a big help.

The new owner(s) should be able to access essential tools like bank accounts, software, websites, etc., and have the former removed as agreed in your sales agreement.

Step 5: Finalize the transaction

To officially conclude the sale, the final step is ensuring all the details of the sales agreement have been met. Take a moment to review and confirm that both you and the buyer have fulfilled all your stated responsibilities and that any conditions for the sale have been satisfied.

Following this, verify that the payment has been fully processed according to the terms you both agreed to. Lastly, notify all the important people, such as your customers, suppliers, and employees, about the change in ownership.

By completing these final actions, you will have successfully finalized the transfer of your LLC’s ownership.

Important considerations for LLC ownership transfer

Although transferring ownership in an LLC can seem easy enough, you would want to keep these points in mind to prevent future penalties and disruptions.

First, the money agreements around the transfer are crucial. What’s the agreed price for the ownership being moved? How will this affect the money situation of both the current owners leaving and any new owners coming in? How do I change ownership of an LLC without affecting my other ventures?

Second, think about the value of the business. How might this change in owners affect what the LLC is worth overall? New skills coming in or experienced people leaving can change how clients see you, how you do in the market, and what your business is ultimately worth.

Third, make sure that all the current owners completely agree on the terms of the transfer. If anyone disagrees or isn’t clear on things, it could lead to legal or business problems later on. Open talking and having the agreement written down is important.

Fourth, don’t forget about the new legal obligations. Are there any specific state or national laws that could affect how you can transfer ownership under the conditions you’re planning? This could be rules for your specific industry or general LLC rules.

Finally, look into any extra taxes you might have to pay. While the person selling might pay tax on any profit, there could also be other taxes for the LLC itself or the remaining/new owners because of how the transfer is set up.

Transfer ownership of LLC with BBCIncorp

Let BBCIncorp expertly manage every step of your LLC ownership transfer, ensuring a smooth and time-efficient process for your company. Our cost-effective Corporate Secretary services include filing for:

- Change of Articles of Association

- Share transfer

- Share issuance and allotment

- New member/officer appointments

- Handling officer resignations/removal

- And many more services you might need

We offer scalable solutions to support both offshore company setup and relocating your LLC from one state to another. Furthermore, our dedicated BBCIncorp expert team is always ready to provide support for any questions you may have.

Get in touch with us now for more information on how we can help!

Conclusion

While a significant step, LLC ownership transfer is a manageable process when approached with comprehensive planning on how to transfer LLC ownership. Every phase of building your business is crucial to success, whether integrating new partners, guiding member transitions, planning for succession, or even selling the LLC for a profitable outcome.

Remember that clear communication among members, a thorough understanding of your state’s requirements, and attention to tax implications are paramount. By carefully following the steps, you will lay the foundation for your LLC’s next chapter.

Whether you need help navigating complex filings or ensuring compliance, the BBCIncorp team is here to assist you. Contact us today at service@bbcincorp.com for timely support and advice.

Frequently Asked Questions

How long does it take to transfer ownership of an LLC?

The duration to complete an LLC ownership transfer can vary. Simpler internal transfers may take a few days to several weeks. However, more complex transactions, such as those involving new members, business valuation, detailed legal agreements, or the sale of the entire LLC, can take several weeks to a few months or longer.

How do I change the percentage of ownership in an LLC?

Changing ownership percentages in an LLC involves these steps:

- Review your operating agreement and follow the specified process.

- Obtain member agreement through written consent from all affected members.

- Amend the operating agreement to reflect the new percentages.

- File with the state if required by your state’s rules.

- Update internal records such as membership certificates to be accurate.

- Consult a tax advisor about potential consequences.

Seeking advice from legal and tax professionals is recommended to ensure you’re complying with all regulations.

How much does it usually cost to transfer ownership of an LLC?

The precise cost of LLC ownership transfer is influenced by a range of variable factors. You should expect:

- State filing fees: Most states charge fees, typically USD20 to over USD150, but you must check your jurisdiction’s laws.

- Legal fees: You’ll pay for an attorney or professional help with documents if applicable.

- Valuation fees: A professional business appraisal will cost money.

- Accounting fees: Consulting a tax advisor will also involve fees.

- Internal costs: Your business will likely incur internal costs, such as staff time.

Here are some rough estimates:

- If you handle most things yourself, the cost will range around a few hundred dollars.

- With professional help, costs could range from hundreds to a few thousand dollars.

What are the benefits of letting BBCIncorp handle your LLC ownership transfer?

Choosing BBCIncorp for your LLC ownership transfer offers several advantages. We manage the entire process, ensuring adherence to all relevant regulations and freeing you from administrative burdens. Our services are cost-effective and scalable, adapting to your specific requirements. Chat with our team today for more information.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.