Table of Contents

A Limited Liability Company (LLC) is a popular business structure that offers entrepreneurs a combination of legal protection and operational flexibility. It shields personal assets from business liabilities while allowing for simplified management and pass-through taxation. This makes it an attractive option for small business owners, freelancers, and startups seeking both credibility and ease of operation.

Starting an LLC may sound complex, but the process is more straightforward than many new entrepreneurs anticipate. With the right guidance, creating an LLC can be completed in just a few days. In this topic, we’ll provide a clear overview of how to start an LLC, helping you begin your business journey with confidence and clarity.

Key features of an LLC

An LLC structure is well-suited for a wide range of business types, from solo entrepreneurs to multi-member ventures. Below are the main characteristics that make the LLC an attractive option for many business owners:

- Limited liability protection: Members of an LLC are typically not personally responsible for business debts or legal liabilities. This means that their personal assets such as homes, cars, and personal savings are usually protected if the business is sued or incurs debt.

- Tax flexibility: By default, LLCs are taxed as pass-through entities, where profits and losses flow through to the members’ personal tax returns. However, they may choose to be taxed as an S Corporation or C Corporation if that provides better financial advantages.

- Ease of formation and management: Compared to corporations, LLCs are simpler to establish and maintain. There are fewer administrative requirements, making it easier for small businesses and startups to focus on growth rather than compliance.

- Flexible management structure: The company structure may be member-managed, where all members take part in daily operations, or manager-managed, where one or more designated individuals handle business decisions. This allows owners to choose a model that fits their preferred level of involvement.

- Versatile business applications: LLCs can accommodate many different business setups, including single-member LLCs, multi-member partnerships, professional LLCs for licensed practitioners, or non-profit LLCs.

- Reduced compliance burden: LLCs generally face fewer legal and reporting requirements than corporations. This includes less frequent filing obligations and simplified recordkeeping, making them more efficient to operate.

How to create an LLC?

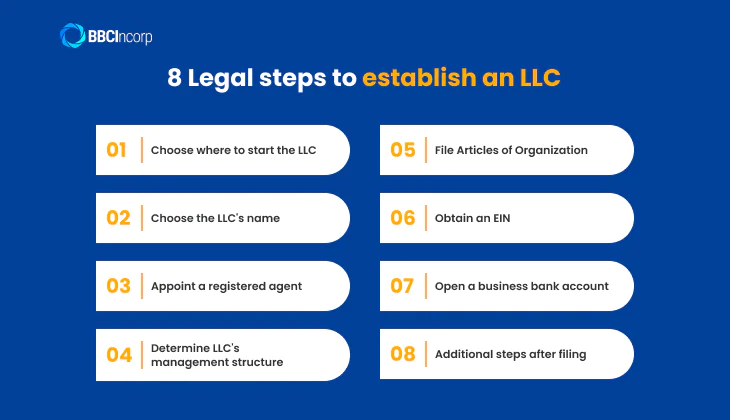

LLCs offer personal asset protection, tax advantages, and operational flexibility, making them a smart choice for many entrepreneurs. Best of all, the starting process is faster and simpler than you might expect. How to start an LLC? Follow the 8 essential legal steps to open an LLC smoothly and fully comply below.

Caption: The 8 essential steps to getting an LLC for your business development.

Step 1: Choose where to start the LLC

The first step to creating an LLC is selecting the right jurisdiction. For most small businesses, registering in the state where operations take place is the most efficient approach, as it avoids extra costs and paperwork associated with foreign registration.

Alternatively, if your business has an international purpose or tax optimization, jurisdictions such as BVI, Panama, or St. Vincent, Cayman Limited Company may offer appealing advantages. These include relaxed regulations, asset protection, and favorable tax treatment. So, you should compare carefully established costs, reporting obligations, and legal protections to determine the best fit for your goals.

Step 2: Choose your LLC’s name

Selecting a name for your LLC requires attention to both branding and legal guidelines. To guarantee your chosen name is compliant and available, keep in mind the following:

- Check name availability: Use your state’s business filing portal to search and ensure the name isn’t already in use or too similar to an existing one.

- Include required terms: Most states require that your business name ends with “Limited Liability Company,” “LLC,” or “L.L.C.”. This helps the public recognize your business as a limited liability entity.

- Avoid restricted terms: Words like “bank,” “law,” “university,” or “government” often require special licenses or approval from regulating agencies. For instance, using “bank” in New York demands approval from the Department of Financial Services.

- Comply with character rules: Some states disallow special characters like “@” or “%” in LLC names. Check your specific state’s naming rules to avoid rejections.

Note

In some cases, such as rebranding, expanding, you can change your LLC’s name later. Check out our guide: Can I change the name of my LLC?

Step 3: Appoint a registered agent

A registered agent is a person or service responsible for receiving legal and government documents on behalf of your LLC. Most states require you to appoint one when creating your company. Here are the key requirements that a registered agent must meet:

- Must be at least 18 years old

- Have a physical address in the state registered (P.O. boxes are not acceptable).

- Available during normal business hours.

Note

The registered agent fees vary depending on your location where the business is registered, the specific services offered, as well as the agent’s experience and reputation.

Step 4: Determine LLC’s management structure

Management structure directly affects how your business will operate on a daily basis. It not only defines decision-making roles but also shapes your company’s workflow and efficiency. You typically have two options:

- Member-managed LLC: In this structure, all members or owners are directly involved in the company’s daily operations. It is most suitable for small businesses where each member wants to actively participate in management.

- Manager-managed LLC: Members appoint one or more managers to run the business. These managers can be members or hired professionals. This structure is better for larger businesses or when some owners prefer not to be involved in daily decision-making.

Step 5: File Articles of Organization

Filing the Articles of Organization is a mandatory step when incorporating an LLC. It must be submitted to the relevant state agency, often the Secretary of State, along with a filing fee that generally ranges from $50 to $200 depending on the jurisdiction. Additionally, some states offer expedited processing for an additional fee.

The Articles of Organization typically include:

- The full legal name of the LLC (must follow state naming rules)

- The primary business address of the LLC

- The name and physical address of the registered agent

- The management structure

- The purpose of the LLC (can be general or specific)

- The expected duration of the LLC, if not perpetual

- The signature and contact details of the organizers

Step 6: Obtain an EIN (Employer Identification Number)

An EIN is a nine-digit number issued by the IRS to identify your LLC for federal tax purposes. It is a required part of the LLC formation step if your business has more than one member, hires employees, or has certain federal tax returns. You can apply for an EIN free of charge through the IRS website.

For single-member LLCs with no employees and not taxed as corporations may use the owner’s Social Security number instead. However, obtaining an EIN is still highly recommended because it allows you to open a business bank account, apply for licenses, and protect your personal information.

Note

If you’ve already registered but misplaced your EIN, there are several ways to find an EIN number for a business, such as checking past tax filings, contacting your bank, or reaching out to the IRS directly.

Step 7: Open a business bank account

Opening the LLC bank account is a crucial step in protecting your LLC’s legal status and managing its finances professionally. It helps separate personal and business funds, reducing the risk of personal liability. To open an account, most banks typically require the following:

- A copy of your Articles of Organization

- Your Employer Identification Number

- LLC operating agreement (in some cases)

- Valid identification of the LLC owner(s)

- Business address and contact details

Step 8: Additional steps after filing

Final steps to set up an LLC, you should also obtain any necessary business licenses or permits, depending on your industry and location, including:

- General business licenses

- Seller’s permits for collecting sales tax

- Industry-specific licenses (e.g., health, liquor, or construction)

- Local operating permits

What to do after forming your LLC

After completing your LLC establishment steps, take the following actions to ensure your business operates legally and effectively:

- Maintain compliance by filing annual reports, paying franchise taxes, and meeting your state’s requirements.

- Understand tax implications and choose the most suitable tax classification for your LLC (such as sole proprietorship, partnership, S corp, or C corp). Consulting a tax advisor is recommended.

- Obtain any additional business licenses or permits required for your industry or location.

- Consider expansion by registering as a foreign LLC if your business operates in another state. Learn more in our guide on moving an LLC from one state to another.

Why you may fail to set up an LLC

Although the steps to start an LLC are generally straightforward, certain mistakes can delay or prevent successful registration. Recognizing common issues in the process of how to start an LLC can help ensure a smoother registration experience.

- Choosing an unavailable business name: If your LLC name is already in use or too similar to another in the same state, your application may be denied. For more clarity on naming rules, refer to our guide: Can two LLCs have the same name in different states?

- Incomplete or incorrect paperwork: Failing to complete forms accurately or omitting required information, such as the registered agent’s details, can result in rejection.

- Not meeting state-specific requirements: Each state sets unique rules for LLC setup. Some may require an operating agreement, public notices, or specific document formats. Ignoring these can prevent successful filing.

- Payment errors: Using the wrong payment method, submitting incorrect fees, or failing to pay altogether can cause your application to be rejected.

Best way to start an LLC

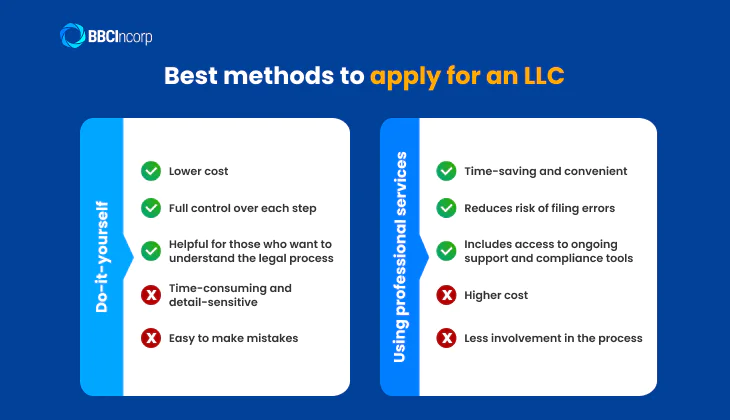

Setting up an LLC, there are two common options: handle the process yourself (DIY) or hire a professional service. Each method has its own advantages and disadvantages depending on your needs, experience, and available time.

DIY method

This approach means you complete all the required steps on your own, including preparing and filing the Articles of Organization, appointing a registered agent, and ensuring compliance with state-specific rules. This is best for entrepreneurs with legal or business experience, or those on a tight budget who are confident in their ability to create their own LLC correctly.

Pros:

- Lower cost compared to hiring a service

- Full control over every step

- Helpful for those who want to understand the legal process

Cons:

- Time-consuming and detail-sensitive

- Easy to make mistakes if you’re unfamiliar with state requirements

- May require significant research to ensure compliance

The DIY method is budget-friendly but requires time and attention to detail. If you’re considering this route, be sure to understand all related start-up company fees and costs to avoid unexpected expenses.

Using a professional service

This method involves hiring a service provider to handle the paperwork, filings, and even compliance reminders for you. These services often offer tiered packages, including expedited filings, EIN acquisition, and operating agreement templates.

For first-time business owners, busy professionals, or anyone who prefers a hands-off approach when choosing to register as an LLC without worrying about the details.

Pros:

- Time-saving and convenient

- Reduces the risk of filing errors

- Includes access to ongoing support and compliance tools

Cons:

- Higher cost than the DIY method

- Less direct involvement in the process

In summary, the best way to set up an LLC depends on your priorities. If you want to save time and minimize risks, hiring a professional may be ideal. When you prefer control and cost-efficiency, the DIY route can be equally effective with careful planning.

How to make an LLC online with BBCIncorp

BBCIncorp is a trusted provider of global business formation services, helping entrepreneurs and business owners open LLCs online with ease and confidence. Whether you’re starting a company in the United States or exploring offshore jurisdictions, BBCIncorp offers efficient and legally compliant solutions tailored to your needs.

With 12 years of experience, BBCIncorp has supported thousands of clients with full transparency and reliability in two main options:

- LLC formation in the U.S. (Delaware): Delaware is one of the most popular states for LLCs opening due to its flexible laws, strong legal protection, and business-friendly environment. BBCIncorp handles the entire process, including name checks, Articles of Organization, and EIN application. You can manage everything remotely and create your LLC company online without visiting in person.

- LLC creation in offshore countries: For international entrepreneurs seeking privacy, tax efficiency, and asset protection, BBCIncorp offers LLC services in key offshore jurisdictions such as Belize, St. Vincent, and St. Kitts. These locations are ideal for businesses with global operations, online services, or investment holdings. BBCIncorp ensures compliance with local regulations while helping you maintain the privacy and flexibility of your offshore company formation.

Why Choose BBCIncorp?

- Streamlined digital onboarding: A secure and intuitive online process allows you to open your LLC efficiently, with minimal administrative burden.

- Comprehensive jurisdiction coverage: We specialize in LLC formation across the U.S., including Delaware, and key offshore areas such as Belize, St. Vincent, and St. Kitts.

- Efficient service with competitive pricing: Benefit from fast turnaround times and transparent pricing structures designed to support businesses of all sizes.

- End-to-end business support: Beyond formation, we offer continued assistance with tax compliance, regulatory filings, and banking setup to ensure long-term operational success.

If you’re looking for the most efficient way to open an LLC company online, BBCIncorp stands out as a reliable and professional partner. Our platform is designed to simplify every step of online LLC establishment, giving you the freedom to focus on growing your business while we handle the paperwork.

Conclusion

Starting an LLC can be a smart and flexible way to protect your personal assets while building your business. This article has outlined the essential steps on how to start an LLC, from selecting a unique name, filing formation documents, obtaining an EIN, and opening a bank account. We hope this information helps you move forward with confidence in starting your LLC and building a solid foundation for your business success.

For added convenience and legal accuracy, you may consider choosing trusted providers like BBCIncorp to simplify the process and handle formalities. Contact for more information!

Frequently Asked Questions

Why do I need an LLC?

- Tax flexibility: With an LLC, you can choose to be taxed as a sole proprietorship, a partnership, or a corporation.

- Tax optimization: Your company will avoid double taxation by pass-through taxation of an LLC. You just need to file individual income tax returns on the business profits.

- Flexibility of structure and management: An LLC can be either an individual or a business entity. In addition, there are no limits on the number of members.

- Limited liability: LLC is a separate legal entity from the owners. You, your business partners, and investors are not liable for the company’s debts and obligations. This makes business agreements more straightforward to enter.

- High degree of personal asset protection: If your business has any relation to fraud or legal non-compliances, your personal asset will be likely to be safe from the claimants.

Do I need an LLC to start an online business?

Most of you start an online business as a sole proprietor that contains high risks. When you get sued by your customers, there is a high chance that you will lose your personal assets by failing the lawsuit.

An LLC for your online business is necessary to protect you and your assets from business liabilities.

Does a small business need an LLC?

Any size of business needs a legal entity. An LLC fits from small, medium to bigger businesses. Owners of small businesses usually prefer the entity thanks to simple formation, separate legal personality and optimal taxation for small businesses.

What is the best way to start an LLC online?

You can start an LLC online by yourself via the Secretary of State’s website. You can manage the whole process. However, lack of experience and expertise will cost you more than expected. There is a high possibility of failure.

Another way of starting the company online is to have a trusted third party to perform the incorporation services for you. In this way, you will have your company with ease and just need to focus on building the foundation for your business growth.

Can I convert an LLC to a corporation?

Yes. You can convert an LLC into other types of business entities.

What are disadvantages of an LLC?

When an LLC member dies or leaves the position, the interest transfer without business continuation agreement will be extremely difficult. Most states will require you to dissolve the LLC and start a new one.

Moreover, an LLC is not appropriate for publicly traded companies.

Additionally, some business sectors can’t be registered under an LLC such as banks and insurance.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.