Table of Contents

A brief definition of each business structure

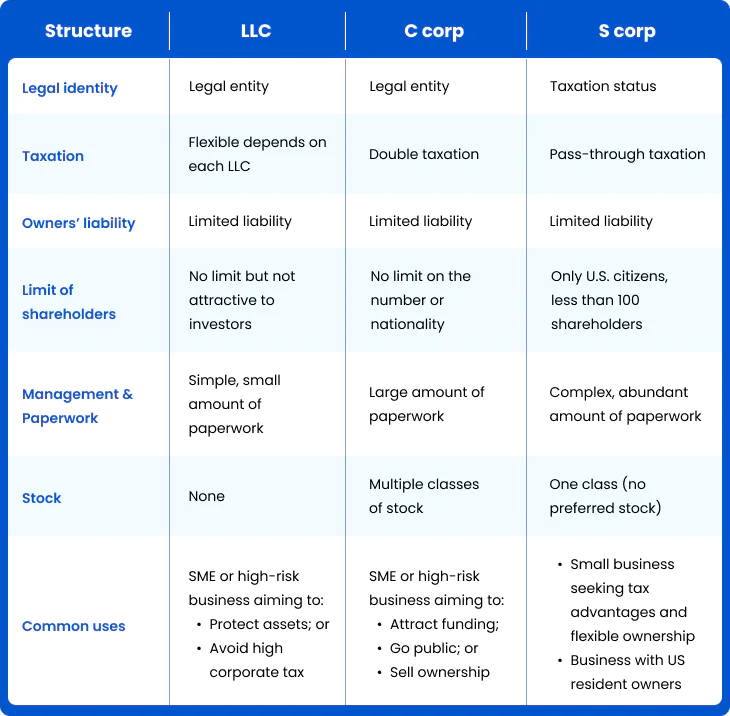

First, let’s take a brief look at each entity classification. An LLC, for instance, is popular with small and medium businesses due to its simplicity, flexibility, and favorable tax advantages.

Regarding corporations, an enterprise is typically incorporated as a C corporation when you plan to attract investment from overseas with no restrictions on the number of owners. S corporations, however, are merely tax statuses that corporations select to benefit from pass-through taxation.

To exemplify, we have specified their features and common models right below.

Taxation

LLC: Flexible taxation

When it comes to tax obligations, LLCs can choose to be taxed differently depending upon the number of members and the particular advantage of the choice to the business in terms of tax obligations, either as a “disregarded entity”, a partnership, or a corporation.

C corporation: Double taxation

The profit of a C corp is taxed twice; once at the company level and once at the shareholder level. To comply with the legal requirements, you first file a federal return (Form 1120) with the IRS to pay corporate income tax. Then the shareholders must pay personal income tax upon receiving dividends or selling stocks.

Fortunately, parts of the taxes can be deducted by distributing additional profits from the corporation as salaries or bonuses at the end of the year or “retaining the earnings”.

S corp: Pass-through taxation

An S corp is a pass-through entity, which means that the company’s income is taxed at the individual level, not on its income. Compared to the tax treatment of C corporations, this is a huge advantage, which is why many entrepreneurs prefer this structure.

Pass-through taxation allows the corporation to distribute higher dividend payouts to shareholders by not requiring federal income tax payment on most earnings, with a few exceptions for built-in gains and passive income.

Management and Regulations

Aside from taxation differences, ownership regulations show a government’s fair treatment, as a more flexible approach is associated with a less trustworthy image. Here are several key points on the systems and their regulations to remember:

LLC

- Flexible management system

You can choose to have your member or manager operate the business. This allows you to choose the best way to manage your company based on the members’ skills, interests, and time commitments.

However, management-wise, investors would be hesitant to put their money into such a non-stable entity.

- High level of privacy

An LLC allows business owners to keep their personal and business affairs separate, which is extremely important if you value privacy. Several states do not require LLCs to list members on formation documents, so you can start without disclosing your identity.

- Minimum formalities and simple processes

LLCs have significantly fewer formalities and paperwork to file than corporations. The members are specifically exempt from strict record-keeping procedures, annual general meetings, or maintaining details of shareholders, directors, officers, and employees.

C corp

- Diversity in ownership structure

Unlike other business entities, C corporations are allowed to have an unlimited number of shareholders including individuals, businesses, and even investors from overseas. Moreover, the shares are easily transferable so shareholders tend to find C corps the most ideal.

- Costly forming process

The launching of a C corporation requires additional burdens regarding the adequate budget and other legal requirements, not to mention ongoing maintenance fees. Before setting up, every C corporation must have a registered agent who is accountable for receiving legal notices on behalf of the business as well.

- Strict regulations and paperwork

Among the many formalities required of C Corporations are complex tax policies, annual shareholder meetings, accounting, and auditing. As part of C Corp’s compliance, large amounts of paperwork must be filed, including articles, annual reports, and other documents.

S corp

- Restricted ownership structure

Forming an S corp is only approved on the occasion that the owners are American citizens, residents, allowable individuals, or legal bodies. Additionally, the owner cannot be an ineligible business (certain financial institutions, insurance companies, etc.).

Tax-pass-through benefits are numerous, which is probably why the IRS imposes strict requirements on S corporations, e.g. existing as domestic organizations.

- Complicated processes & paperwork

If you wish to choose the S corp status, you must first register as a C corporation, and then all shareholders must sign and date Form 2553 to qualify.

Annually, you are required to file a special tax return (Form 1120-S) to report the income, gains, losses, deductions, credits, etc. Your S corp may be subject to different tax rules than other corporations as well.

Similar to other corporations, the corporate formalities of an S corp include holding regular board meetings, keeping minutes, and issuing stock to shareholders.

HELPFUL NOTE FOR STARTERS

A key difference between LLCs and S corporations is that LLCs can have unlimited members, while S corporations can only have at most 100 shareholders. C corps also put no restrictions on memberships, but due to double taxation, costs can be burdensome.

Investment Potential

LLC

The investment potential of an LLC is unfavorable as these entities are often small-scale businesses with little credibility. An LLC does not own or issue stock, as a result, this is never a highly valued option among giant investors.

Another factor is that an LLC’s ownership interest is much more difficult to transfer than shares of a corporation.

C corp

There is no doubt that C corporations are the superior pick when it comes to attracting investors considering the following advantages:

- This arrangement allows you to have as many shareholders as possible, including foreign sources and venture capitalists.

- The management system is strictly consistent and formal, demonstrating an image of reliability and professionalism

- C corps can issue multiple classes of stocks, especially stocks with preferences for dividends and distributions.

S corp

S corporations may be an alternative, but they are not recommended. It may be unpleasant for investors to be taxed on their share of a company’s income even if they do not receive any cash distributions.

For an S corp, there is only one class of stock known as common stock (disregarding voting rights). On a brighter note, for US citizens who qualify to become shareholders, this might come as a more convenient option.

Popular practical application

In what situation should you form an LLC?

Generally, LLCs are well-suited for small, medium-risk, or even higher-risk businesses aiming for a lower tax rate than a corporation, possibly in the fields of consulting, technology, manufacturing, and retail.

Many professional service providers like doctors and lawyers also prefer to form an LLC for its asset protection benefits.

Who should be forming a C corporation

C corporations are less restricted in terms of the owner’s residency, citizenship, and other legal requirements than other business structures. Several other signs that a C corp is beneficial are:

- Aiming for special rights, regarding dividends and voting rights

- Working with international partners or engaging in overseas sales

- Having more than 100 shareholders

- Planning to sell the business or transfer ownership in the future

Who is qualified to form an S corporation

This treatment is only available to domestic owners:

- US citizen/ resident (cannot be a non-resident alien)

- Allowable individual or legal body (individuals, certain trusts, or estates)

Note that ineligible businesses (certain financial institutions, insurance companies, and domestic international sales corporations) are not approved as defined in U.S. Code § 1361.

Other feasible business options

The two alternatives we mention here may help you further if you are still unclear about which organizational framework is best for your business upon reaching this part of the article.

Sole proprietorship

An individual who establishes a sole proprietorship runs his or her own business and is responsible for all decisions concerning it. All profits and losses belong to the sole owner, and he or she has unlimited legal responsibility.

They are often small business owners, freelancers, self-employed individuals, local stores, landscapers, part-timers, etc.

Partnership

The formation of a Limited Partnership (LP) can be an efficient tool for entrepreneurs who plan to invest without managing or who want to operate without making a substantial investment in a business. Despite limited influence over business decisions, limited partners benefit from lower personal liability in the business’s operation outcomes.

Common partnership business examples include law firms, physician groups, real estate investment firms, and accounting groups.

Immediate Sorting Tool

Curious about the most advantageous business structure to start up your company? Try BBCIncorp’s US Business Entity Selection Tool now to find out!

Setting up process

One essential angle to take into consideration when mapping your business’ future paths is the procedure on how to create your entity from scratch.

Starting an LLC

In general, an LLC’s formation consists of five fundamental steps:

Step 1: Choose where to start the LLC

Step 2: Name your company

Step 3: Appoint a registered agent

Step 4: File Articles of Organization

Step 5: Proceed with additional requests after the registration filing

Read about the requirements and happenings of each step.

Forming a C corp

For a C corporation, there are more to keep in mind as the complexity rises significantly in comparison with an LLC. The six necessary steps are:

Step 1: Choose a name for your C corporation

Step 2: Appoint a Registered Agent

Step 3: Draft your articles of incorporation

Step 4: File your articles of incorporation with the state

Step 5: Appoint directors and officers for your C corporation

Step 6: Hold a meeting of the board of directors to establish bylaws for your C corporation

Details on how to conduct the complete incorporation for C corps.

Launching an S corp

Regarding the establishment of an S corporation, you should pay attention to the supplementary works after filing for a typical corporation. Examine the basic steps below:

Step 1: Choose your state of incorporation

Step 2: Choose a unique business name

Step 3: Appoint a registered agent

Step 4: File the Articles of Incorporation/ Organization

Step 5: File Form 2553 to apply for S corp status

Understanding significant demands on forming an S corp in the US is vital to a successful enterprise.

Key takeaways

The following table summarizes the major highlights of the three structures’ business particulars:

Still, looking for more clues on the fitting enterprise settings for your business? Feel free to discuss this matter further with our professional team via service@bbcincorp.com or leave a message directly in the chatbox. We are looking forward to hearing from you!

Frequently Asked Questions

Should you set up an S corp or C corp?

S corps are tax designations that satisfy several conditions (e.g. having under 100 domestic shareholders). If your business is aiming for pass-through taxation, form an S corp. If you are planning to attract various foreign investment sources, decide on the C corp structure instead.

Go through the S corps vs. C corps key differences for better consideration.

How do you convert from a C corporation to an LLC?

There are three options available at the moment for a C corp to LLC conversion: dissolving the corporation and forming a new LLC, merging the corporation with the new LLC, or converting from a C Corporation into an LLC (limited to several states).

Go through more helpful instructions on the conversion.

Things to consider when converting an S corporation to an LLC

Typically, here are the factors entrepreneurs tend to measure before converting their S corp into a new LLC:

- The possible flexibility in management

- The cost of the process, and tax consequences

- Changes in legal and financial obligations

- Additional paperwork, state requirements when coming to filing taxes

- The most suitable approach to convert the business

Should I form an LLC or an S corp as an estate entrepreneur?

When starting your real estate business, regardless of size or scope, how to structure your venture is the first fundamental task you must complete. An LLC or S corp will protect your personal assets from being seized in case of litigation consequences in the long run.

Considering a variety of pros and cons of the two models will benefit your decision greatly.

What is the best state to form an LLC?

Some of the most preferable jurisdictions for you to start running your LLC and the reasons:

- Delaware: easy LLC formation, high privacy protection, low corporate income tax rates of 8.7% with a well-respected legal system

- Wyoming: low annual fees, cheap forming costs, no state corporate income tax, reliable personal asset protection laws

- Florida: strong protection against lawsuits, and many incentives for startup growth including the Qualified Target Industry Tax Refund (QTI).

- Nevada: no corporate or personal income tax, no residency requirement for LLC members or managers, no minimum capital requirement, and great asset protection

Other crucial points to be mindful of before deciding on the fitting state to establish your successful LLC.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.