Table of Contents

Overview of LLCs and LLPs in the US

What is an LLC?

A Limited Liability Company (LLC) is a widely-used corporate structure that combines the simplicity, flexibility, and tax advantages of partnerships with the liability protection of corporations.

LLC structures are widely used by famous companies such as Anheuser-Busch LLC, Blockbuster LLC, and Westinghouse Electric Company LLC

This structure has several advantages, including distinct liability, liability protection for members (owners), and impressive tax flexibility.

In accordance with your LLC’s election and the total member number, the IRS will either treat the entity as a corporation, partnership, or as a “disregarded entity”).

What is an LLP?

A Limited Liability Partnership (LLP) is a partnership in which the partners have limited liability for the business’s debts and obligations.

The structure is generally formed between groups of people or businesses sharing a common professional background or mutual. There must be at least two partners for an LLP, and a partnership agreement is used to detail the specifics of the business.

For instance, Kirkland & Ellis LLP, Latham & Watkins LLP, and Baker McKenzie (mostly law firms, accounting firms, and doctor’s offices) are LLPs.

The formation of an LLP is restricted to professionals in some states, such as California, where only lawyers, accountants, and architects are permitted.

One key advantage of an LLP is that its legal structure protects the partners’ personal assets from being seized if another partner is convicted of malpractice.

What is the difference between an LLC and an LLP?

Although both legal business entities offer limited liability protection, you should keep in mind a few standout key differences.

Management structure

An LLC’s owners are considered members, whose membership admissions are recorded and maintained by the LLC or as otherwise provided in the operating agreement.

This entity can either be managed by members or managers, providing a lot of flexibility in how you structure your business.

Meanwhile, the owners of an LLP are known as “partners,” who are in charge of running and managing the company. Similar to a general partnership, a partnership agreement specifies the LLP’s operating structure and profit-sharing policies.

Tax benefit

LLCs are unique since they can choose to be taxed as a disregarded entity, a partnership, or a corporation depending on the number of members.

Although LLCs are not subject to federal income taxes if they do not elect to be taxed as a C corporation, a few states impose annual taxes on them, such as California, Alaska, and Massachusetts.

In addition, when an LLC elects to be taxed as a disregarded entity or partnership, its members are considered self-employed and must pay self-employment taxes.

In contrast, LLPs are taxed as pass-through entities, meaning profits are reported on the partners’ individual income tax returns, and any taxes owed are paid separately.

The partners can avoid double taxation (being taxed twice, once as a business and once as an individual) and deduct losses from/ against taxable income. In comparison to corporations, the filing process is much simpler and requires less paperwork.

Limited liability protection

In general, an LLC shields you from personal liability for any debts or lawsuits brought against the company. Even if the LLC cannot compensate individuals the company has directly harmed, the member’s personal property is still protected from asset forfeiture.

Similar to LLCs, LLPs provide limited liability protection for the partners, but each partner is individually responsible for their own errors and negligence. In the event of a professional malpractice lawsuit against a partner, the other partners cannot be held liable for the debt.

Potential application and limitation

Considering setting up an LLC if you:

- Own a small or medium-sized business (sole proprietorship or partnership)

- Wish to protect your valuable personal assets

- Want to pay less tax than a corporation

An LLC membership interest can be transferred to a new owner without excessive paperwork if the state laws and operating agreement allow it. As a result, it’s preferable to an LLP for buying, selling, and transferring ownership.

You might also want to note that some states prohibit certain types of professionals from forming LLCs. Accordingly, LLCs are not allowed to execute several professional services, including legal, banking, insurance, or trust company business.

An LLP would be the competent choice for owners who are:

- Physicians

- Engineers

- Accountants

- Surveyors

- Architects

- Consultants

- Attorneys

- And so forth.

LLPs are not available nationwide since the model is restricted to certain professions and industries. Nevertheless, this remains a good choice for licensed professionals planning to open their own offices or businesses.

Picking your structure

Take a moment to evaluate the compatibility with each structure through our specialized US Business Entity Selection Tool!

Key takeaways

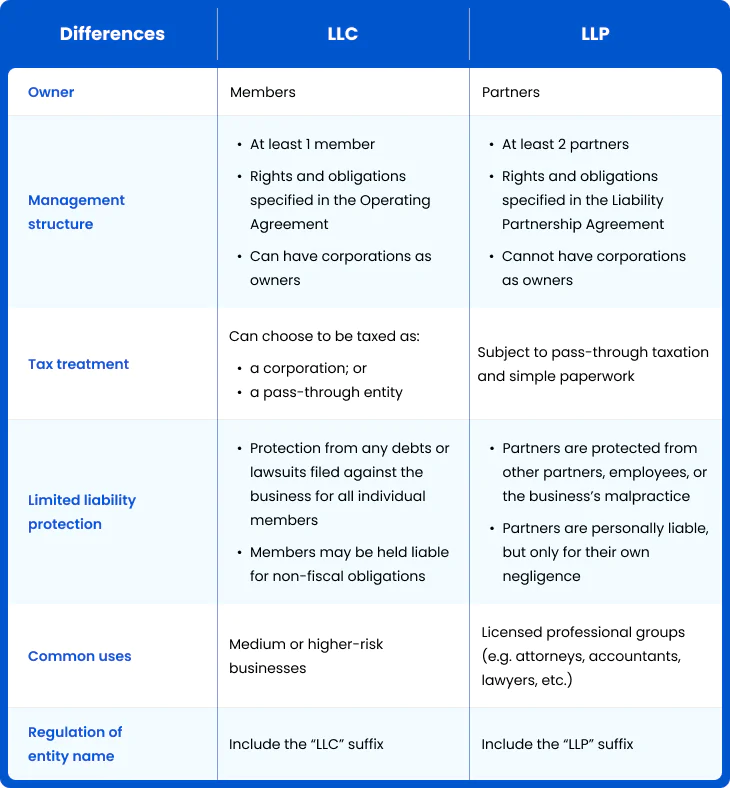

Here is a table summarizing the main distinguishing features of an LLP vs. an LLC.

Your business’s scale and goals will determine which of the two models will be most beneficial for you. In case there are more options than expected to select from before opening the enterprise, take your time evaluating all potential possibilities.

Don’t hesitate to reach out for more information via service@bbcincorp.com or simply start chatting with BBCIncorp at the chatbox below. We look forward to hearing from you!

Frequently Asked Questions

What kinds of professions should form an LLP?

This type of business structure is popular among licensed professionals who want to open a private practice (e.g. attorneys), entrepreneurs examining their ideas before launching the official project, or businesses with multiple owners.

Do take into consideration the state you’re working in and strictly follow their requirements on the matter.

Should a big business owner form an LLC?

A business of any size can be an LLC, further adding to its flexibility. An LLC is a popular and flexible business legal structure, especially for small companies and startups. Most states do not restrict LLC ownership, and there is generally no maximum number of members. You can now start an LLC remotely, saving huge costs and time.

What are the best U.S. states to form an LLC or LLP in 2022

At present, forming an LLC or LLP in Delaware, Wyoming, and Nevada would certainly be a great choice for your business. These states offer favorable tax treatment, including low corporate income tax, the chance to exempt personal income tax, low crime rates, and a professional working environment.

What are the advantages and disadvantages of an LLC?

To name a few, some main advantages and disadvantages of an LLC are as below.

Pros:

- Only one member is required for the formation.

- Personal asset protection from the company’s debts

- Privacy for owners’ personal information.

- Flexible tax treatment

- Easy start-up & maintenance

Cons:

- May require ongoing costs and lots of paperwork.

- Additional tax burden depending on the LLC’s classification

- Some states prohibit certain professions from opening an LLC

- Risk of dispute and conflicts

Advantages and disadvantages of an LLP

What you gain from running an LLP:

- A partner is protected from other partners’ negligence.

- Flexibility in the business management structure.

- Relatively easy to set up

- Pass-through taxation

- Additional financial or intellectual support from partners

Difficulties you will face with an LLP:

- LLPs do not exist in every state.

- Financial situations may be disclosed to the public

- LLPs typically only allow certain professions

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.