Table of Contents

When starting a business, one of the first decisions entrepreneurs face is selecting the right structure. For many small company owners and startup founders, this choice often comes down to sole proprietorship or LLC (Limited Liability Company). Both structures offer unique advantages and challenges, so understanding these is crucial to determining the best fit for your goals.

This article takes a deep look at the differences between sole proprietorship vs. LLC, breaking down their benefits, drawbacks, and key features to help entrepreneurs make informed decisions.

Sole proprietorship vs. LLC: Understanding the basics

Choosing between a sole proprietor and an LLC is a critical decision for any small company owner. Each structure has its own advantages and disadvantages, and understanding the pros and cons of an LLC vs. a sole proprietorship can help you decide which is best for your situation.

What is a Sole proprietorship?

A sole proprietor is the simplest and most common structure. It’s a setup where an individual owns and operates a venture, with no legal distinction between them and their work.

Examples include freelance graphic designers, independent consultants, and small online sellers.

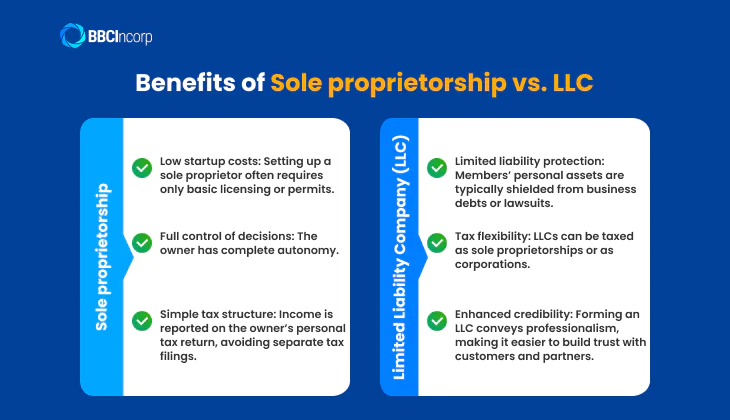

Advantages of sole proprietorship

- Low startup costs: Setting up a sole proprietor is straightforward and inexpensive, often requiring only basic licensing or permits.

- Full control of decisions: The owner has complete autonomy with no need for formal decision-making processes.

- Simple tax structure: Income is reported on the owner’s personal tax return, avoiding separate tax filings.

Disadvantages of sole proprietorship

- Unlimited personal liability: There’s no separation between the owner and the venture, meaning personal assets are at risk if debts or legal issues arise.

- Difficulty raising capital: Sole proprietors often struggle to attract investors who prefer more formalized setups.

- No legal distinction: The setup ceases to exist if the owner retires, passes away, or decides to close it.

What is an LLC?

A Limited Liability Company (LLC) is a more formal structure offering personal liability protection to its owners while maintaining flexibility. The business is considered legally separate from its owners, often referred to as “members.”

Advantages of an LLC

- Limited liability protection: Members’ personal assets, such as homes or savings, are typically shielded from business debts or lawsuits.

- Tax flexibility: LLCs can be taxed as sole proprietorships (pass-through taxation) or as corporations, depending on what’s beneficial.

- Enhanced credibility: Forming an LLC conveys professionalism, making it easier to build trust with customers and partners.

Disadvantages of an LLC

- Higher costs: The initial setup fees and annual maintenance costs (e.g., filing fees) are higher than a sole proprietorship.

- Compliance requirements: LLCs must follow administrative guidelines, including annual reports and ongoing filings.

Tips Understanding the

Choosing the right business structure is a critical decision that can impact your liability, taxation, and growth potential. To make an informed choice, it’s highly recommended to weigh the benefits of sole proprietorship vs. LLC carefully.

LLC vs. Sole proprietorship: Compare and contrast

Struggling to decide between two structures? Let’s break down the key difference between sole proprietor and LLC to help you make an informed decision.

Similarities between sole proprietorships and LLCs

- Ease of formation: Both are relatively simple to start. A sole proprietorship requires minimal formal registration, while an LLC involves straightforward paperwork and nominal fees.

- Pass-through taxation: Both structures allow income to flow directly to the owner’s personal tax return, avoiding the double taxation that corporations often face.

- Single-owner friendly: Both sole proprietorships and LLCs can be operated by a single individual. Sole proprietorships are inherently single-owner structures, while LLCs offer the flexibility to operate as a single member LLC vs multi member LLC, depending on the number of owners involved.

- Operational flexibility: Neither structure mandates formalities like shareholder meetings, allowing for more streamlined day-to-day management.

- Financial recordkeeping: Both structures require maintaining accurate financial records for tax reporting.

What is the difference between a Sole proprietorship and an LLC?

By understanding the key differences between an LLC and a sole proprietorship, you can choose the structure that best fits your business goals and minimizes potential risks

Legal protections

- LLC personal liability protection: An LLC is recognized as a distinct legal entity, separate from its owners, with its own assets and financial obligations. This separation generally shields the personal assets of LLC members from debts and legal claims. As a company grows, so does its exposure to potential risks, whether through hiring employees, operating a physical location, or conducting daily operations. An LLC provides a valuable layer of protection, offering peace of mind as your company expands.

- Sole proprietor personal liability protection: A sole proprietorship offers no liability protection, as the owner and the enterprise are legally regarded as one entity. While this structure allows the owner to retain all profits, it also makes them personally responsible for any debts, legal claims, or liabilities, including those arising from employee actions. If the company cannot meet its financial obligations, the owner’s personal assets may be at risk to cover the shortfall.

Tax implications

LLC taxation: An LLC benefits from pass-through taxation, meaning profits are taxed only once at the individual level. As an owner, you’re responsible for the tax obligations, which are reported on your personal income tax return. In multi-member LLCs, each member’s share of the profits is taxed based on their individual earnings.

To report taxes, you’ll need to submit Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), along with your personal 1040 form, detailing your financial performance. LLCs offer flexibility in taxation, allowing them to be treated as sole proprietorships, partnerships, or corporations.

Sole proprietor taxation: Like LLCs, sole proprietorships also utilize pass-through taxation, with income or losses reported on your personal tax return. However, unlike LLCs, sole proprietors cannot elect to be taxed as a corporation.

You’re only taxed on the profit you generate, not the total revenue. Sole proprietors generally must pay self-employment taxes, often requiring quarterly payments. Because of these additional taxes, it’s important for sole proprietors to take advantage of all available deductions.

Administrative requirements

LLC requirements: LLCs come with additional formalities to ensure proper operation and compliance with state laws. These include filing Articles of Organization with your state, paying ongoing maintenance fees such as annual franchise taxes, and adhering to annual reporting requirements. Some states may also require an operating agreement and regular updates to registered agent information. These steps help establish credibility and protect the LLC’s legal standing.

Sole proprietor requirements: Operating as a sole proprietor is much simpler, with fewer administrative tasks to manage. Typically, it only involves registering your business name (if different from your own) and obtaining the necessary local or state licenses or permits. Reporting requirements are minimal, and there are no annual fees or complex filings, making it an attractive option for those seeking simplicity.

Scaling and investment potential

LLC potential: LLCs are highly adaptable for scaling, providing a formal structure that adds credibility. This can make it easier to onboard new members, attract investors, or secure funding. LLCs also offer limited liability protection, which gives potential investors confidence in the business’s legal safeguards and financial structure. These features make LLCs a preferred choice for businesses planning significant growth or expansion.

Sole proprietorships potential: Sole proprietorships often face challenges when scaling or attracting investors. Because they lack a formal business structure and limited liability protection, investors may perceive them as higher-risk ventures. Additionally, sole proprietorships typically rely on the owner’s personal resources and credit, which can limit growth opportunities and make securing funding more difficult.

| Feature | Sole proprietor | LLC |

|---|---|---|

| Legal protection | No legal protection; owner is personally liable for business debts and obligations. | Provides limited liability protection; owners are not personally liable for business debts. |

| Tax implication | Income is taxed as personal income of the owner (pass-through taxation). | Pass-through taxation is common, but LLCs may opt to be taxed as a corporation. |

| Administrative requirements | Minimal requirements; straightforward setup and operation. | Requires more formalities like registration, filing annual reports, and maintaining proper records. |

| Scaling and investment potential | Limited scaling potential; challenging to attract investors due to lack of formal structure. | Greater scalability and more attractive to investors due to legal protections and flexible structure. |

Should I form an LLC or Sole proprietorship?

Should I form an LLC or sole proprietorship? The choice isn’t always clear-cut. This section simplifies the decision by outlining when each option is most suitable, giving you the clarity you need to choose the best path for your business success.

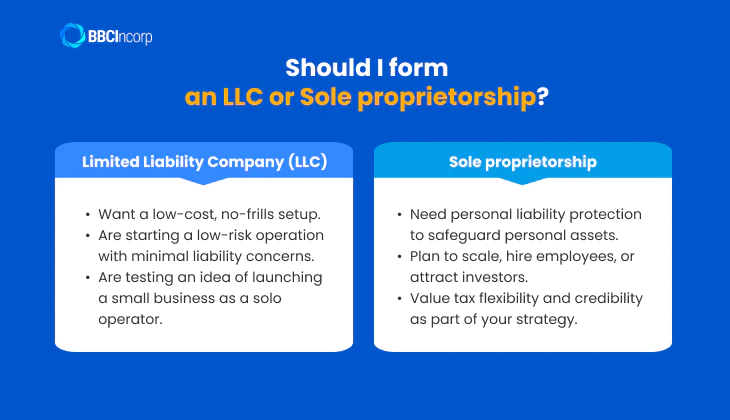

When to form a sole proprietorship?

A sole proprietorship might be the right fit if you:

- Want a low-cost, no-frills setup. Sole proprietors are the simplest and cheapest type of structure to start, with minimal paperwork and no need to register with the state in most cases.

- Are starting a low-risk operation with minimal liability concerns. If your activities have little chance of lawsuits or financial risks, a sole proprietorship keeps things straightforward.

- Are testing an idea of launching a small business as a solo operator. It’s ideal for freelancers, consultants, or sole traders who are starting small and want to keep things flexible and uncomplicated.

When to choose an LLC

An LLC (Limited Liability Company) could be the ideal choice if you:

- Need personal liability protection to safeguard personal assets. An LLC creates a legal separation between you and your company, protecting you in case of lawsuits, debts, or unexpected losses.

- Plan to scale, hire employees, or attract investors. If you have long-term growth in mind, an LLC offers a structure that supports expansion and builds credibility with potential partners and stakeholders.

- Value tax flexibility and credibility as part of your strategy. LLCs allow you to choose how your operations are taxed, either as a sole proprietorship, partnership, or corporation, allowing you greater control over your finances. When comparing the advantages and disadvantages of a corporation, LLCs stand out for their simpler structure and fewer formalities, while still presenting a professional image to customers and clients.

Both options come with unique benefits and challenges, so whether you’re asking yourself “Do I need an LLC or sole proprietorship?” or deciding on a structure for your plan, it’s crucial to evaluate your goals, risk tolerance, and long-term vision before making a decision.

Common myths and misconceptions between LLC and Sole proprietorship

Sole proprietorship and LLC are the same

Many new owners often wonder, “Is sole proprietorship the same as LLC?”. The answer is no—sole proprietorships and LLCs are very different in terms of structure and liability.

A sole proprietorship is owned and operated by one individual, with no distinction between the owner and the entity. This means the owner is personally responsible for all debts and obligations.

An LLC, or Limited Liability Company, on the other hand, is a separate legal entity. It provides the owner(s) with limited liability, meaning their personal assets are protected from liabilities. The key difference lies in the level of personal asset protection and how it is taxed and operated.

Sole proprietorships are always risky

While sole proprietorships do come with higher personal liability risks, they aren’t “always risky” by default. Risks largely depend on the nature of the business, how it is managed, and whether adequate insurance coverage is in place.

While sole proprietorships don’t provide liability protection, they can still be a practical, cost-effective choice for low-risk ventures or side hustles. That said, the lack of liability protection does mean the owner’s personal assets are at stake if debts or legal issues arise, so owners should carefully consider the type of operations they plan and take steps to mitigate risk.

LLCs are only for large businesses

LLCs are not limited to large operations. They are actually a popular choice for startups, small-scale projects, and even freelancers. Many entrepreneurs prefer LLCs because they combine the simplicity of sole proprietorships with liability protection similar to corporations.

LLCs also offer flexibility in management and taxation, making them suitable for businesses of all sizes. Whether you’re running a home-based setup or something on a larger scale, an LLC can be a practical option depending on your goals and growth plans.

Launch your business with confidence with BBCIncorp

Setting up a company can be overwhelming, but you don’t have to do it alone. At BBCIncorp, we simplify the process with our all-in-one solutions, helping you set up and manage your company seamlessly.

From choosing between a sole proprietorship vs. LLC in Delaware to staying compliant with corporate secretarial services or simplifying your accounting and tax filings, we’re here to support you every step of the way.

- Hassle-free company formation in Delaware with complete guidance

- Reliable corporate secretary services to keep your business compliant

- Expert accounting and tax filing support to manage your finances

Beyond Delaware, BBCIncorp also specializes in offshore business setup, offering a wide range of services tailored to your needs. Let us help you turn your business vision into reality with confidence and ease.

Conclusion

Ultimately, the choice between a sole proprietorship and LLC comes down to your individual business goals, liability tolerance, and long-term growth plans. Both structures have their merits, but the right one for you will depend on your unique needs. Take the time to evaluate what fits your vision and helps set the foundation for your entrepreneurial success.

Frequently Asked Questions

LLC or sole proprietorship: Which offers greater tax advantages?

LLCs and sole proprietorships each have their own tax benefits, but many agree that an LLC provides more flexibility and opportunities during tax time. Separating your personal and work finances through an LLC can also simplify and clarify the tax filing process.

If you operate as a sole proprietor, it’s important to diligently track additional deductions, like health insurance premiums. Additionally, maintaining separate accounts for your work and personal expenses is a smart move to prepare for any future audits.

Can you switch from sole proprietor to LLC (or conversely)?

Yes, you can change a sole proprietorship to LLC or vice versa. For those operating as sole proprietorships, transitioning to an LLC is a straightforward process. It involves completing the required paperwork and registering with your state, much like creating a new business from scratch.

On the other hand, changing an LLC into a sole proprietorship is more complex. You must first secure written consent from all LLC members. After that, you’ll need to formally dissolve the LLC with the state where it was originally registered. Lastly, you must address any pending debts and update all relevant licenses to align with the newly established sole proprietorship.

How much does it cost to form an LLC?

The cost to establish an LLC differs by state, generally ranging from $50 to $500, with this amount payable directly to the state. Besides the official fees, you might consider hiring a lawyer or utilizing a legal service to assist with the registration process and drafting your operating agreement, and the expenses for these services can vary significantly.

How much does it cost to form a sole proprietorship?

A major advantage of opting for a sole proprietorship as your business structure is that there are no formation costs. Since state registration isn’t required, starting a sole proprietorship doesn’t incur any formal setup fees.

However, it’s important to remember that self-employment taxes will apply, adding an additional 15.2% for Social Security and Medicare contributions.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.