Table of Contents

Making the switch from a sole proprietorship to a Limited Liability Company (LLC) is a pivotal step in the lifecycle of any business. For sole proprietors considering this transition, it’s a strategic choice that signals growth, organization, and preparation for the future. By forming an LLC, you can protect your personal assets, gain tax advantages, and enhance your business’s credibility.

But understanding how to change from sole proprietor to LLC can feel overwhelming without the right guidance. If you’re ready to explore what it takes to move from sole proprietor to LLC, this guide provides everything you need to know, step by step.

Reasons to convert sole proprietorship to LLC

Switching from a sole proprietorship to an LLC offers several significant advantages. Many small business owners choose to make this move for good reason:

Limited liability protection

Unlike a sole proprietorship, an LLC creates a legal separation between your personal and business assets. This means your personal savings, home, or other assets are typically protected if your business faces lawsuits or accumulated debts. This shield is especially crucial as your business grows and incurs more risks.

Tax flexibility

LLCs offer significant tax flexibility, which can be especially appealing for small business owners. By default, LLCs are subject to “pass-through” taxation, meaning the business itself does not pay taxes. Instead, profits and losses are passed through to the owners’ personal tax returns, avoiding double taxation seen in traditional corporations.

Single-member LLCs are taxed as sole proprietorships, while multi-member LLCs are taxed as partnerships. Additionally, LLCs can opt to be taxed as an S-Corporation or C-Corporation, depending on which offers the best advantages for your business’s financial situation.

Enhanced credibility

Operating under an LLC structure can elevate your business’s image. Clients, investors, and vendors may view an LLC as more structured and trustworthy than a sole proprietorship. This edge could help you establish partnerships or further your industry presence.

Growth potential

An LLC structure makes it easier to add new members and investors or adjust ownership percentages compared to a sole proprietorship. This flexibility is essential for businesses preparing for expansion.

Potential drawbacks of converting to an LLC

- Cost: Establishing an LLC comes with state formation fees and ongoing compliance expenses, which can add up over time.

- Complexity: Managing an LLC typically requires more paperwork and administrative effort compared to the simplicity of a sole proprietorship.

- Tax implications: Depending on your income, operating as an LLC may push you into a higher tax bracket, potentially resulting in greater tax liability than being taxed as a corporation.

These factors should be carefully considered when comparing a sole proprietorship vs. LLC to determine which structure aligns best with your business goals.

| Feature | Sole proprietorship | LLC |

|---|---|---|

| Liability | Personal liability for business debts | Limited liability protection |

| Setup | Simple and inexpensive | More complex and costly |

| Taxes | Pass-through taxation | Pass-through, or elect corporate tax |

| Paperwork | Minimal | More extensive |

| Management | Direct control by owner | Flexible, member-managed or manager-managed |

| Continuity | Ends with owner’s death/exit | Can continue despite member changes |

| Credibility | May be perceived as less credible | Generally more credible |

Tips

Business owners often face significant challenges when transitioning to an LLC, largely due to a lack of clarity about “What is an LLC“. It is highly recommended that owners develop a clear understanding of this business structure to navigate the process smoothly.

Key considerations before changing from sole proprietor to LLC

If you’ve been asking yourself, “Should I turn my sole proprietorship into an LLC?” The answer might be yes, but it’s a decision that requires careful planning to ensure a smooth transition. Consider the following factors before starting the process:

Debt and liability transfers

The transition to an LLC does not automatically absolve the pre-existing debts and liabilities of your sole proprietorship. Failure to meticulously address and transfer these obligations can expose you to significant financial and legal jeopardy. You must ensure that all creditors, contracts, and outstanding liabilities are formally addressed before the transition. This includes direct engagement with vendors, clients, and any involved parties to secure the necessary agreements and releases.

Intellectual property

Ensure trademarks, copyrights, and other intellectual property are formally transferred to your new LLC to protect them legally. This process ensures that your IP is protected under the structure of the new business entity, safeguarding it from potential disputes or unauthorized use. Consult a legal professional to handle transfers and update registrations properly.

Legal requirements

It’s essential to stay compliant with your state’s legal requirements. This involves updating all necessary business licenses and permits, as well as notifying relevant agencies, tax authorities, or other regulatory bodies about any changes to your business.

Tax implication

Switching to an LLC will likely impact how you handle taxes, as it changes the rules for filing and taxation. Make sure you familiarize yourself with the new rules for LLC taxation, including self-employment taxes and possible deductions, and consult a tax professional to ensure you’re meeting all obligations and maximizing your benefits.

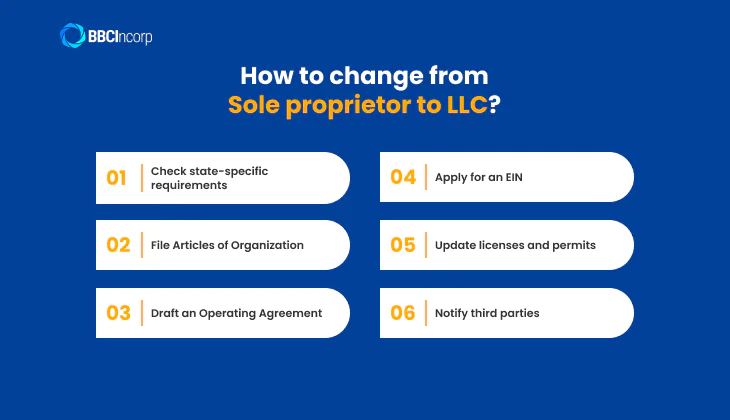

How to change from sole proprietor to LLC?

Converting from a sole proprietor to an LLC can be a smart move for added legal protection and business growth. By following the steps below, you can successfully navigate how to transfer sole proprietorship to LLC, giving your business enhanced legal protections and credibility.

Step 1: Check state-specific requirements

Start by thoroughly researching your state’s specific rules and regulations for forming an LLC. Each state has unique requirements you’ll need to follow, including filing fees, paperwork, naming conventions, and business name availability. Some states may also have additional steps, such as publishing a notice in a local newspaper or obtaining specific licenses depending on your industry.

Carefully following all state guidelines ensures a smooth and efficient transition from sole proprietorship to LLC, helping you avoid unnecessary delays or legal issues.

Step 2: File Articles of Organization

The next step to convert from sole proprietor to LLC is filing the Articles of Organization (sometimes called a Certificate of Formation) with your state’s Secretary of State office. This document legally establishes your LLC and usually requires:

- Your LLC’s name. Ensure the name includes a designation like “LLC” or “Limited Liability Company.” Conduct a business name search to confirm its uniqueness and compliance with state regulations.

- The name and address of your registered agent

- Business purpose information

- Management structure (member-managed or manager-managed)

This is a crucial part of the process, as it officially transitions your business to an LLC in your state’s legal system.

Step 3: Draft an Operating Agreement

While not required in all states, LLC Operating Agreement is highly recommended, especially if your LLC has multiple members. This document outlines ownership percentages, management roles, profit-sharing protocols, and decision-making processes.

Some banks or financial institutions may require an Operating Agreement to open a business account, so drafting one is highly beneficial. While not a public filing, this document adds a layer of organization and legal protection to your LLC.

Step 4: Apply for an EIN

When switching from sole proprietor to LLC, you’ll need to obtain a new EIN from the IRS, even if you already have one for your sole proprietorship. This is essential for filing taxes, opening business bank accounts, and hiring employees under your new LLC structure.

The application process is straightforward, quick, and entirely free on the IRS website. You can apply online, by mail, or by fax, but applying online is the fastest option, and you’ll receive your EIN immediately after completing the process.

If you’ve previously applied for an EIN but misplaced it and are now wondering, How to find my EIN?, start by checking the confirmation letter sent by the IRS when your EIN was issued. You can also review past tax returns, bank statements, or official business documents where the number may be listed.

Step 5: Update licenses and permits

When you convert to an LLC, you’ll need to update any existing business licenses or permits to reflect your new LLC structure. These updates ensure that your business operates legally under the correct entity name.

Be sure to check with your state or local government offices to confirm the requirements and deadlines for updating these documents, as rules vary by location and industry. Staying compliant is crucial to avoiding fines or disruptions to your business operations.

Step 6: Notify third parties

Once you convert into an LLC, it’s important to notify banks, vendors, clients, and other stakeholders about the change. This ensures everyone you do business with is informed and that all records and agreements reflect your LLC structure.

Additionally, inform your customers and clients if the change will affect their billing information, payments, or legal documentation. Taking the time to update all third-party records will help maintain trust and ensure a smooth transition for your business operations.

How much does it cost to change a sole proprietorship to a LLC?

The cost to transfer sole proprietorship to LLC can vary widely depending on your state and specific circumstances. Below is a detailed breakdown of the expenses you may encounter during this process:

Filing costs

State filing fees are one of the primary costs associated with forming an LLC. These fees typically range from $50 to $500, depending on your state. Some states also charge annual fees, franchise taxes, or require reports to keep your LLC compliant. Be sure to check your state’s requirements to avoid any surprise costs later.

Legal or advisory fees

You can handle the transition on your own, but many business owners hire an attorney or professional service for help. The cost of legal or advisory fees depends on how complex your business is and how much support you need, typically ranging from $500 to $5,000.

These professionals make sure all paperwork is accurate, deadlines are met, and your LLC complies with state laws. While optional, their help can save you time and prevent costly mistakes down the road.

Additional costs

When transitioning to an LLC, you might encounter extra expenses. For instance, you may need to update business licenses, permits, or registrations to match your new business structure. If you own trademarks, trade names, or other intellectual property, you might need to re-register them under your LLC, which can come with additional fees. Some states, like New York, also require you to pay publication fees to announce your LLC formation in a local newspaper.

Start your LLC in Delaware today with BBCIncorp

If you’re wondering how to change from sole proprietor to LLC, the process typically involves filing formation documents with the state and updating your business registrations. Thinking about where to form your new LLC? Delaware is a top choice, known for its business-friendly policies and benefits for entrepreneurs..

Why start your LLC in Delaware?

Delaware stands out as a business hub for LLCs due to:

- A favorable tax system that saves you money

- Flexible operating agreements tailored to your needs

- Strong privacy protections for business owners

Why choose BBCIncorp?

At BBCIncorp, we make forming your Delaware LLC simple, efficient, and stress-free. Our services are designed to set you up for success from the very beginning.

What you’ll get with us:

- All-in-one services: From drafting and filing documents to obtaining your EIN and providing registered agent services, we handle it all.

- Transparent pricing: No hidden fees or surprises.

- Expert support: Our team is with you every step of the way to ensure your LLC is set up for success from day one.

Start your Delaware LLC with confidence. Partner with BBCIncorp today and let us simplify your journey to success!

Frequently Asked Questions

When should I switch from sole proprietor to LLC?

Expansion and hiring: If your business growth requires hiring staff, switching to an LLC is a smart move. While you can hire as a sole proprietor, it brings significant liability risks. Employee-related incidents, like workplace injuries or mistakes, could lead to lawsuits, leaving your personal assets at risk since sole proprietorships don’t separate personal and business finances. An LLC creates a separate legal entity, offering protection for your personal and business assets, though it’s not foolproof.

Enhanced asset protection: Sole proprietorships are easy and affordable to set up, ideal for low-risk or small ventures. However, they offer weak financial protection. As your business grows and risk increases, this lack of separation between personal and business finances puts your personal assets at risk (e.g., savings or your home). Forming an LLC provides better security, enabling you to grow with less fear of financial loss.

Securing capital: Sole proprietorships often struggle to secure funding, as lenders view them as high-risk. Switching to an LLC improves your chances of getting loans. However, if you’re seeking venture capital or angel investments, an LLC may not be enough, and a corporate structure could be more suitable.

Do I need a lawyer to switch sole proprietor to LLC?

While you can switch from a sole proprietorship to an LLC without a lawyer, it’s generally recommended to seek a professional corporate service provider. Here’s why:

- Complexity: The process involves forming a new LLC and transferring assets, which can be confusing.

- Legal guidance: A professional corporate service can help you propose a name for your LLC and ensure all legal requirements are met.

Can I use my personal bank account for my LLC?

While it’s possible to use your personal bank account for your LLC, doing so carries significant risks. Opening a dedicated business account offers crucial advantages:

- It simplifies tax preparation and provides a clear view of your company’s financial health by separating personal and business transactions.

- It reinforces the legal separation between you and your LLC, strengthening the protection of your personal assets in the event of lawsuits or financial troubles.

- It enhances your LLC’s credibility and professionalism in the eyes of clients and vendors.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.