Table of Contents

Unearned revenue represents payments received by a business for goods or services not yet delivered. Though the cash is in hand, the earning process is incomplete.

For both businesses and investors, understanding unearned revenues is crucial. These amounts directly impact financial statements, affecting how profitability and financial health are assessed.

In accounting and finance, unearned revenues are typically classified as liabilities until the related services are performed or products delivered. Misinterpreting this can lead to poor decision-making.

Let’s explore what unearned revenue really means, why it appears on the balance sheet, and how it shapes financial analysis.

What is unearned revenue?

Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services yet to be delivered. This prepayment represents a liability on the company’s balance sheet because it signifies an obligation to fulfill future performance.

The concept of unearned revenue is rooted in accrual accounting, which recognizes revenues and expenses when they are incurred, not necessarily when cash is exchanged.

Receiving payment before earning it creates an obligation to fulfill in the future, thus requiring the company to report it on the balance sheet as a liability.

Unearned Revenue Examples:

- Subscription Services: Streaming platforms like Netflix charge customers at the beginning of the billing cycle. The collected fees are initially recorded as unearned revenue and recognized as earned progressively over the service period.

- Software Licenses: Companies such as Microsoft sell annual software licenses, receiving full payment upfront. This payment is documented as unearned revenue and is gradually recognized as revenue over the license term.

- Insurance Premiums: Insurance firms collect premiums before providing coverage. These premiums are considered unearned revenue until the coverage period elapses, at which point they are recognized as earned revenue.

Understanding unearned revenue is crucial for accurate financial reporting and maintaining transparency with stakeholders. Properly accounting for these liabilities ensures that a company’s financial statements reflect its true financial position and obligations.

Is unearned revenue the same as deferred revenue?

In accounting, the terms deferred revenue vs unearned revenue are frequently used interchangeably. Both represent liabilities on a company’s balance sheet, reflecting payments received in advance for goods or services not yet delivered.

Despite their similarity, there can be slight differences in usage. “Unearned revenue” is more commonly used in everyday business contexts, especially in service-based industries. In contrast, “deferred revenue” tends to appear more in formal financial statements and regulatory filings.

For practical purposes, when asking is unearned revenue the same as deferred revenue, the answer is generally yes. Both terms describe the same fundamental concept—income received but not yet earned.

Distinguishing between these terms is essential for accurate financial reporting and compliance with standards such as GAAP, particularly in scenarios involving long-term contracts, subscriptions, or prepaid services.

How is unearned revenue classified?

Unearned revenue represents advance payments received by a company for goods or services yet to be delivered. Since the business has not fulfilled its obligation, this type of revenue must be carefully classified in financial records. It’s important to understand what type of account is unearned revenue, especially when preparing financial statements.

Is unearned revenue a liability?

Unearned revenue is classified as a liability because it reflects an obligation to the customer. The business is holding funds for a service or product that has not yet been provided. This creates a legal responsibility, not an earned income.

For example, if a business receives $1,000 in advance for a one-year maintenance contract, it cannot record this as revenue immediately. It must recognize only the portion earned each month as the service is delivered.

Under the accounting equation, liabilities represent claims against the company’s assets. Unearned revenue fits this category because it involves future performance tied to the cash received. Therefore, when a company records unearned revenue, it increases its liabilities on the balance sheet.

When considering what is unearned revenue classified as, it is important to evaluate the timing of service delivery. If the company expects to deliver the product or service within one year, the liability is classified as current. If the obligation extends beyond 12 months, it is recorded as a long-term liability.

So, if you ask, “Is unearned revenue a current liability?” the answer depends entirely on the service period. Timing determines its classification in the financial statements.

Is unearned revenue an asset?

Despite being recorded when cash is received, unearned revenue is not an asset. This is because the company has yet to deliver value in return for the payment, meaning the funds are not yet owned in a true economic sense.

Assets provide future benefits and are fully controlled by the business. Unearned revenue, on the other hand, signifies a future duty. For instance, when a consulting firm receives prepayment for a project, that money remains a liability until the work is completed.

Since unearned revenue is a liability, not an asset, its classification ensures that financial reporting accurately reflects a company’s outstanding obligations.

Reporting and recording unearned revenue

Proper reporting and recording of unearned revenue ensures accuracy in financial statements and compliance with accounting standards. This section outlines how it is classified, where it appears on financial reports, and how it is treated in journal entries.

Where does unearned revenue go?

Unearned revenue is reported on the balance sheet, not the income statement. It is classified as a liability because the company has an obligation to deliver goods or services in the future.

It is typically recorded under current liabilities if the delivery is expected within one year. If the commitment extends beyond that, it may be recorded as a long-term liability.

A common example includes subscription-based businesses. For instance, if a customer prepays $600 for a 12-month subscription, the company lists this amount as unearned revenue on the balance sheet and recognizes $50 as revenue each month.

This classification supports proper financial reporting and ensures compliance with revenue recognition principles. Investors and regulators use this information to assess a company’s future obligations.

Does unearned revenue go on the income statement?

Unearned revenue does not appear on the income statement when payment is received. Since the service or product has not yet been delivered, the revenue is not considered “earned.”

Only after the company fulfills its obligations will the revenue be recognized on the income statement. This avoids overstatement of income and ensures accurate timing of revenue recognition.

By aligning revenue recognition with delivery, financial statements reflect true company performance. This practice is in accordance with U.S. GAAP and IFRS standards.

Is unearned revenue a debit or credit?

In accounting, unearned revenue is a credit entry. When the company receives advance payment, it debits cash and credits unearned revenue.

For example, if a business receives $1,000 upfront for future services, it records:

- Debit: Cash $1,000

- Credit: Unearned Revenue $1,000

As the business provides the service, it makes an adjusting entry:

- Debit: Unearned Revenue

- Credit: Revenue

Knowing whether unearned revenue is a debit or credit ensures transactions are recorded correctly and that liabilities reflect the company’s pending obligations.

Proper treatment of unearned revenue on the balance sheet not only supports clear reporting but also answers the broader question: what is unearned revenue classified as in modern accounting practice?

How to record unearned revenue?

Explain the accounting process for recording unearned revenue in journal entries.

- Unearned revenue starts as a liability because you owe goods or services.

- It converts to earned revenue over time when obligations are fulfilled.

- This ensures accurate financial reporting in line with accounting principles.

Step 1: Record the initial receipt of payment

When a customer pays in advance for a product or service, the business must record this transaction as unearned revenue, reflecting its obligation to fulfill the order. This is documented as a liability on the balance sheet.

Journal entry:

- Debit: Cash (to reflect the inflow of funds)

- Credit: Unearned Revenue (a liability account)

For instance, if a gym receives $600 for a six-month membership, it will initially record the full amount as unearned revenue. This shows that services have yet to be provided.

This step is especially relevant when dealing with unearned service revenue, such as subscriptions, retainers, or prepaid consulting fees.

Step 2: Recognize revenue as it is earned

As time passes and the business delivers on its promise, a portion of the unearned revenue must be reclassified as earned revenue. This process should align with the company’s revenue recognition schedule.

Journal entry:

- Debit: Unearned Revenue (to reduce the liability)

- Credit: Revenue (to record income in the income statement)

Continuing with the gym example, $100 of revenue would be recognized monthly for six months. This approach ensures income is reported when it is truly earned.

Accurately handling unearned revenue accounting maintains transparency and helps prevent the overstatement of profits. It also adheres to the matching principle, aligning revenue with the period in which services are provided.

Correctly accounting for unearned service revenue is essential in industries that rely on advance billing and long-term contracts. It safeguards the integrity of financial statements and builds trust with stakeholders.

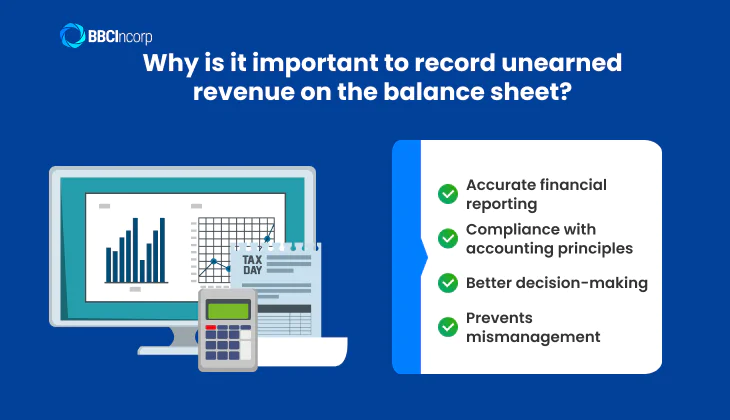

Why is it important to record unearned revenue on the balance sheet?

Accurate financial reporting

Recording unearned revenue ensures that income is not overstated. Recognizing revenue only when earned presents a truthful view of a company’s financial position, which is crucial for internal analysis and external reporting.

Compliance with accounting principles

Accrual accounting standards under GAAP require that revenue be recognized when it is earned, not when cash is received. Properly classifying unearned revenue helps maintain compliance and avoid regulatory scrutiny, especially during audits.

Better decision-making

Accurate revenue recognition improves the reliability of financial statements. This clarity allows business owners, investors, and managers to make well-informed operational and strategic decisions.

Prevents mismanagement

Failure to record unearned revenue correctly can lead to cash flow misjudgments and budgeting errors. It can also affect tax liabilities, potentially resulting in penalties or inaccurate filings.

BBCIncorp provides support for offshore accounting and tax filing

BBCIncorp provides tailored support for offshore accounting, auditing and tax filing. We assist in preparing and maintaining accurate records in accordance with international and U.S. standards.

Our qualified local accountants also deliver detailed management reports to strengthen your financial decision-making process and ensure ongoing compliance.

Conclusion

Unearned revenue represents payments received before a company fulfills its obligations. It is not recognized as income until goods or services are delivered, which is why unearned revenue is a liability on the balance sheet.

Properly recording and classifying this amount ensures compliance with U.S. accounting standards and supports accurate financial reporting.

Businesses should consistently track and update unearned revenue to avoid misstatements and maintain transparency. For companies operating globally, compliance is even more critical.

BBCIncorp offers professional support in managing international accounting, helping your business stay compliant and make better financial decisions.

Frequently Asked Questions

What is unearned revenue in accounting?

Unearned revenue refers to payments a business receives before delivering goods or services. In accounting, this is not recognized as revenue until the performance obligation is fulfilled.

For example, if a software company collects a one-year subscription fee upfront, it records the payment as a liability and gradually recognizes the revenue over the year. This approach complies with the accrual basis of accounting and ensures accurate financial reporting under U.S. GAAP.

Does unearned revenue go on the balance sheet?

Yes, unearned revenue is recorded on the balance sheet as a liability. In U.S. GAAP, it reflects the company’s duty to deliver value to the customer. As the service or product is provided, the liability decreases and revenue is recognized accordingly.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.