Table of Contents

Recognizing and properly accounting for deferred revenue is essential for maintaining financial accuracy and ensuring regulatory compliance. This accounting concept plays a vital role in revenue recognition, especially for businesses that receive payments in advance for products or services yet to be delivered. Misunderstanding deferred revenue can lead to misstated financial statements, tax complications, and operational risks.

But what is deferred revenue in accounting? In this article, we’ll explain deferred revenue’s meaning, how it is treated in financial records, and when it should be recognized as earned income. We’ll also provide real-world examples to illustrate how businesses across industries handle deferred revenue effectively.

Whether you’re managing subscriptions, service contracts, or retainers, understanding deferred revenue will empower you to make better financial decisions and stay compliant with accounting standards.

Understanding deferred revenue

What is deferred revenue?

Deferred revenue or unearned revenue is a liability that arises when a company receives payments for goods or services before fulfilling its obligations. Since the company has yet to deliver what was promised, it cannot recognize these payments as revenue immediately. Instead, they are recorded as a liability on the balance sheet until the goods are delivered or the service is performed.

Common examples of deferred revenue include:

- Subscription-based services: Streaming platforms like Netflix or SaaS providers like Microsoft 365 receive payments in advance for monthly or annual subscriptions, recognizing revenue gradually as the service is provided.

- Prepaid service contracts: Gyms, consulting firms, and insurance providers often collect payments upfront, distributing revenue recognition over the contract period.

- Advance product sales: Event ticket sales, magazine subscriptions, and software licenses generate deferred revenue because customers pay before receiving the full benefit.

Meaning of deferred revenue

To explain deferred revenue, it is crucial to understand its role in accrual accounting. Unlike cash accounting, where revenue is recorded when cash is received, accrual accounting mandates recognizing income when it is earned. This ensures financial statements accurately reflect a company’s obligations and prevents premature revenue recognition, which could mislead investors and regulators.

Proper deferred revenue management is critical for financial health. Companies must systematically shift amounts from liabilities to revenue accounts as obligations are fulfilled, ensuring compliance with standards like GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards). Failure to do so can distort revenue figures, leading to inaccurate financial reporting and potential legal consequences.

Understanding the definition and meaning of deferred revenue helps businesses maintain transparency, optimize cash flow forecasting, and build trust with stakeholders.

Distinguish deferred revenue from other terms

When managing business finances, understanding different revenue concepts is crucial. Among these, deferred revenue, accrued revenue, and unearned revenue are often confused. Let’s break them down clearly.

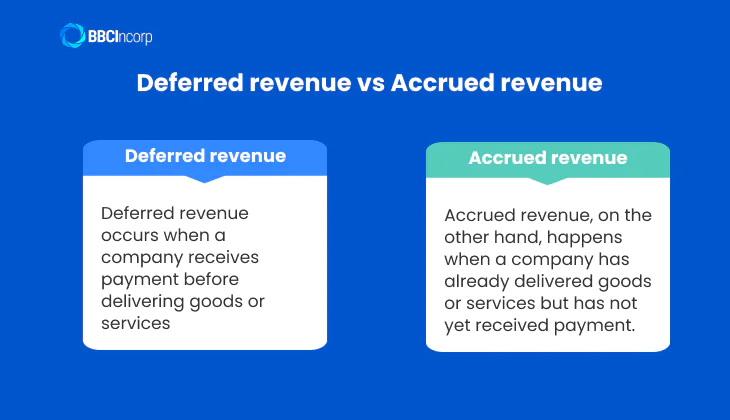

Deferred revenue vs accrued revenue

The key difference between accrued revenue vs deferred revenue lies in the timing of cash flow and revenue recognition:

- Deferred revenue occurs when a company receives payment before delivering goods or services. Since the company still owes the customer, this is recorded as a liability on the balance sheet.

- Accrued revenue, on the other hand, happens when a company has already delivered goods or services but has not yet received payment. This is recorded as an asset because the company is expecting future cash inflows.

Example

- A software company offering annual subscriptions collects payment upfront. This amount is deferred revenue until the service is provided over time.

- A consulting firm completing a project in December but invoicing the client in January records the December revenue as accrued revenue, even though the payment arrives later.

Deferred revenue vs unearned revenue vs deferred income

Many businesses use deferred revenue and unearned revenue interchangeably because both refer to advance payments received before fulfilling obligations. These payments are classified as liabilities since the company must still provide goods or services.

Similarly, deferred income is another term often used in place of deferred revenue. The difference is mainly in terminology—deferred income emphasizes that the payment is not yet recognized as revenue.

Understanding “what is deferred income” and how it differs from accrued revenue ensures accurate financial reporting, helping businesses comply with accounting standards and maintain clear financial records.

Deferred revenue on the balance sheet

The deferred revenue definition refers to an important accounting concept, representing funds received in advance and recorded as a liability on the balance sheet. Even though a company has received payment, it has not yet earned the revenue because it still owes the customer a product or service. Until the company fulfills this obligation, the payment remains classified as deferred revenue.

Is deferred revenue asset or liability?

So, is deferred revenue an asset? While the term “revenue” might suggest it belongs in the income statement, deferred revenue is a liability, not an asset. The reason is simple: the company has an outstanding obligation to deliver goods or services in the future.

According to Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), revenue should only be recognized when it is earned, not when cash is received. Deferred revenue remains a liability for two main reasons:

- Outstanding Obligation: Since the company has already received payment but has yet to provide the promised goods or services, it still owes something to the customer.

- Risk of Refund: If the company fails to fulfill its commitment, it may need to return the money. This potential refund risk further supports its classification as a liability.

Is deferred revenue a current liability?

Deferred revenue is generally classified as a current liability when the company expects to deliver the goods or services within one year. This applies to cases such as:

- Subscriptions (e.g., a prepaid magazine or software subscription)

- Prepaid service contracts (e.g., advance payments for consulting or maintenance services)

- Event tickets (e.g., airline tickets or concert passes sold before the event)

However, if the obligation extends beyond one year, such as multi-year service contracts, a portion of the deferred revenue is recorded under long-term liabilities on the balance sheet.

As the company gradually fulfills its obligations, deferred revenue is reduced. The corresponding amount is then recognized as earned revenue on the income statement. This ensures that financial reports accurately reflect the company’s performance, aligning revenue recognition deferred revenue with the actual delivery of goods or services.

How deferred revenue impacts financial statements

Deferred revenue plays a crucial role in financial reporting, influencing the balance sheet, income statement, and cash flow statement while also affecting key financial metrics and business valuation. Below is a detailed analysis of its impact.

Deferred revenue impact balance sheet

Deferred revenue appears as a liability on the balance sheet because the company has received payment but has not yet delivered the promised goods or services. If the obligation is expected to be fulfilled within one year, it is classified as a current liability; otherwise, it falls under long-term liabilities.

This accounting treatment ensures financial statements accurately reflect the company’s outstanding obligations and prevents premature revenue recognition.

Deferred revenue impact income statement

Deferred revenue does not immediately appear as revenue on the income statement. Instead, it is recognized gradually as the company fulfills its contractual obligations. This method follows accrual accounting principles, ensuring that revenue is recorded in the correct reporting period, preventing artificial inflation of profits in the period when cash is received.

By aligning revenue recognition with service delivery, companies provide a clearer picture of actual business performance.

Deferred revenue impact cash flow statement

Since deferred revenue represents payments received in advance, it contributes to cash inflows under operating activities. However, these funds are not yet subject to taxation until they transition into earned revenue, giving businesses additional flexibility in financial planning.

While deferred revenue strengthens liquidity in the short term, companies must ensure they have sufficient resources to meet future obligations, preventing potential cash flow imbalances.

Other impacts on financial implications

- Liquidity & Financial Ratios: Deferred revenue impacts liquidity ratios such as the current ratio, as it increases liabilities. While a high deferred revenue balance signals strong customer commitments, it also highlights future obligations that must be met.

- Business Valuation: Investors and analysts closely examine deferred revenue levels. A high deferred revenue balance suggests predictable future earnings, enhancing the company’s valuation. However, it also indicates a workload of unfulfilled obligations, influencing investment and acquisition decisions.

By understanding the financial impact of deferred revenue, businesses can enhance transparency, financial planning, and investor confidence, ensuring sustainable growth and stability.

Best practices to manage deferred revenue effectively

Businesses can optimize revenue recognition and maintain financial transparency by following these best practices:

- Automate revenue tracking

Leveraging accounting software to automate deferred revenue recognition minimizes errors and enhances efficiency. Automation ensures revenue is recognized systematically based on service delivery or contract terms, improving compliance with standards like GAAP and IFRS. It also allows finance teams to focus on analysis rather than manual adjustments.

- Reconcile deferred revenue regularly

Periodic reconciliation ensures deferred revenue liabilities align with actual service obligations. Regular reviews—typically monthly or quarterly—help identify discrepancies, prevent premature revenue recognition, and maintain the integrity of financial statements. This practice is essential for audit readiness and regulatory compliance.

- Monitor cash flow and plan strategically

Since deferred revenue provides upfront cash inflows, businesses must manage liquidity carefully to fulfill obligations. Developing accurate cash flow forecasts helps ensure sufficient funds for future expenses, mitigating financial risks, and enabling informed strategic decisions, particularly in subscription-based industries.

- Maintain compliance with accounting standards

Adhering to revenue recognition standards ensures transparency and builds investor confidence. Companies should document policies, disclose deferred revenue details in financial statements, and stay updated on evolving regulations to avoid compliance risks.

By implementing these best practices, businesses can strengthen financial management, enhance reporting accuracy, and optimize long-term revenue planning.

If you’re looking for professional support beyond revenue recognition, our expert services in Accounting, Corporate Secretary, and Business Compliance are here to help. Contact us today to explore how we can support your business growth.

How to record deferred revenue?

In accrual-based accounting, deferred revenue is a critical concept that ensures companies recognize income at the correct time. It refers to payments received from customers for goods or services that have not yet been delivered. Until the company fulfills its obligation, these advance payments are recorded as a liability on the balance sheet.

So, how do you record deferred revenue accurately? Below is a detailed guide that explains how to record deferred revenue in two essential steps.

Step 1: Initial recording (when cash is received)

When a customer pre-pays for goods or services, the company must record the cash inflow, but not recognize it as revenue yet. The appropriate journal entry is:

- Debit (increase) Cash account: This reflects the actual receipt of money.

- Credit (increase) Deferred Revenue account: This records a liability, indicating the obligation to deliver goods or perform services.

Example

If ABC Company receives $1,200 for a 12-month service subscription, the journal entry is:

- Debit Cash $1,200

- Credit Deferred Revenue $1,200

This deferred revenue will appear on the balance sheet under current or non-current liabilities, depending on the expected delivery timeframe.

Revenue recognition deferred revenue

According to revenue recognition principles, revenue must be recognized when earned, not when cash is received. This is the foundation of accounting for deferred revenue. Companies recognize deferred revenue as earned revenue only when they fulfill their contractual obligations, such as delivering goods or completing services.

This distinction ensures that income is matched with the period in which it is earned, providing a more accurate picture of the company’s financial health.

Step 2: Subsequent recording (as revenue is earned)

As the company delivers its product or service over time, a portion of the deferred revenue must be converted into recognized income. This involves:

- Debiting (decreasing) the Deferred Revenue account

- Crediting (increasing) the Revenue account

Example

After one month, ABC Company earns $100 of the $1,200 subscription:

- Debit Deferred Revenue $100

- Credit Revenue $100

This adjusting entry reflects that part of the service has been delivered and the corresponding portion of the liability is now earned revenue.

Properly handling deferred revenue recognition ensures compliance with accrual accounting standards and provides stakeholders with transparent financial reporting. The key is to recognize “what type of account is deferred revenue” only when earned, and to update journal entries regularly as goods or services are delivered.

Whether it’s a 12-month subscription, a design service, or a prepaid candy box, accurate tracking and timely adjustments are essential for effective accounting for deferred revenue.

Conclusion

In summary, deferred revenue represents income received in advance for goods or services yet to be delivered and must be accurately recorded as a liability until earned. Understanding how to properly recognize and adjust deferred revenue ensures compliance with accounting standards and reflects your company’s true financial position.

Whether managing subscriptions, service contracts, or prepayments, proper handling of deferred revenue is essential for transparency and long-term growth. If you need expert guidance or support in managing your financial records, don’t hesitate to reach out to our team at service@bbcincorp.com. We’re here to help your business stay on track!

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.