Table of Contents

In today’s fast-paced business environment, many industries have arisen, offering a wealth of new opportunities for companies to explore. As markets evolve and consumer demands shift, businesses often seek ways to diversify their offerings or enter new sectors. However, expanding into unfamiliar areas can pose risks to a company’s core operations.

To mitigate these risks and maintain focus on their primary business, many organizations choose to establish subsidiary companies. It allows a business to explore new markets or launch different products without disrupting its main operations.

So, what is a subsidiary company, and why is it so crucial in today’s corporate world? Read on to learn how this strategic model helps businesses grow, manage risk, and unlock new potential.

What is a subsidiary company?

Define subsidiary company

A subsidiary company is a business that is controlled by another company, called the parent company. The parent company typically owns more than 50% of the subsidiary’s shares, giving it the power to make major decisions. However, control can also be achieved by influencing the subsidiary’s management or board of directors.

How a subsidiary company works

A subsidiary company is a separate legal business that is owned and controlled by a parent company. This means the parent company has strong control over what the subsidiary does, such as by choosing its board members or guiding major business decisions.

Despite this control, the subsidiary remains a distinct legal entity, with its own management, financial records, and tax obligations. Subsidiaries often operate independently to adapt to local markets or specific industries. For example, a parent company may create a subsidiary to enter a new market while isolating risks and maintaining focus on its core operations.

Subsidiary examples

Alphabet Inc., informally referred to as Google owns several other major companies. Each subsidiary operates in different sectors, contributing to Alphabet’s growth and expanding its business opportunities.

Here’s an updated list of subsidiaries under Alphabet:

- YouTube: Purchased by Google in 2006, it operates independently but benefits from Google’s advertising and search infrastructure.

- Waze: Acquired in 2013, this popular navigation app continues to operate as a separate entity under Alphabet.

- DoubleClick: Integrated by Google in 2008, this advertising technology company helps drive ad revenue and digital marketing services.

- Nest: Acquired in 2014, the company operates in the smart home technology space, producing products like thermostats and security cameras.

- Looker: Joined Alphabet in 2019, Looker is a data analytics platform that is integrated with Google Cloud.

- Fitbit: Acquired in 2021, Fitbit, a leader in wearable fitness technology, has been integrated into Google’s health and wellness initiatives.

- Mandiant: Added in 2022, it is a cybersecurity company that enhances Google Cloud’s security offerings.

Characteristics of subsidiaries

A subsidiary company is defined as a business that is controlled by a parent company, typically through the ownership of a majority of its shares. It has the main features as follows:

- Ownership stake: Subsidiaries can be fully owned, with 100% of shares and complete control held by the parent company. In other cases, they are partially owned, where a majority stake is held but control and financial duties are shared with other investors.

- Governance and influence: The parent company typically influences the subsidiary’s governance by appointing board members or key executives, though the subsidiary maintains operational independence.

- Legal independence: A subsidiary is a separate legal entity, meaning it holds its own legal and financial responsibilities, distinct from its owning company. However, it still operates under the direction and oversight of the parent organization

Types of subsidiary companies

Wholly owned subsidiaries

A wholly owned subsidiary definition is a business entity where the parent company owns 100% of the subsidiary’s shares, granting it complete control over the subsidiary’s operations and decisions. This structure allows the owning company to fully integrate the subsidiary’s activities into its overall business strategy without needing approval from external shareholders or partners.

Parent companies often opt for wholly owned subsidiaries in situations where they seek complete control over the subsidiary’s resources, intellectual property, or market presence. An example of a wholly owned subsidiary is Meta’s acquisition of Instagram, giving it direct oversight of its operations, growth, and strategic direction.

Partially owned subsidiaries

A partially owned subsidiary is a business where the parent company owns more than 50% but less than 100% of the shares, giving it a controlling interest without complete control. While the parent company can influence the subsidiary’s decisions, other shareholders also have a stake and may participate in major decisions.

This shared ownership structure allows for collaboration and financial responsibility between the parent and other investors. Take ESPN as an example, it is an American international basic cable sports channel with 80% ownership and operational control held by The Walt Disney Company, while Hearst Communications owns the remaining 20%.

Co-subsidiary relationship

A co-subsidiary relationship occurs when two or more companies are subsidiaries of the same parent company. In this structure, the holding owns a majority of shares in each subsidiary, giving it control over their operations.

The parent may leverage synergies between the co-subsidiaries, such as shared resources or services, to enhance efficiency. Financially, it consolidates the financial statements of all its subsidiaries, including the co-subsidiaries, to present an overall picture of the group’s performance.

For example, Sony Corporation owns a range of subsidiaries, including Sony Interactive Entertainment (which operates PlayStation), Sony Pictures, and Sony Music. While each of these subsidiaries functions separately, they are all part of the larger Sony umbrella, benefiting from shared resources and strategy.

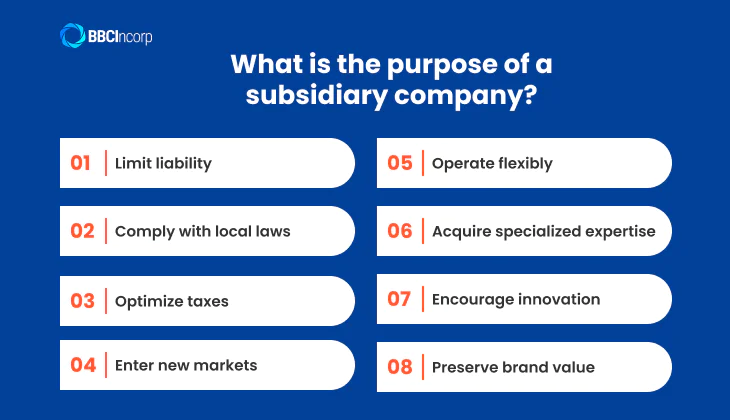

What is the purpose of a subsidiary company?

A subsidiary company is a strategic tool used by parent companies to expand operations, manage risks, and streamline governance. As separate legal entities, subsidiaries offer flexibility and protection while supporting business growth. Here are the main purposes of forming a subsidiary:

- Limit liability: Shields the owning company from financial or legal issues faced by the subsidiary.

- Comply with local laws: Enables easier adaptation to regulations in different countries or regions.

- Optimize taxes: Takes advantage of favorable tax environments where the subsidiary is based.

- Enter new markets: Reduces risk when expanding internationally or into unfamiliar sectors.

- Operate flexibly: Allows independent management and brand positioning under the same corporate group.

- Acquire specialized expertise: Facilitates entry into niche areas through the acquisition or formation of expert subsidiaries.

- Encourage innovation: Enables testing of new products or technologies without exposing the entire company.

- Preserve brand value: Keeps brands distinct, making management and potential sales more straightforward.

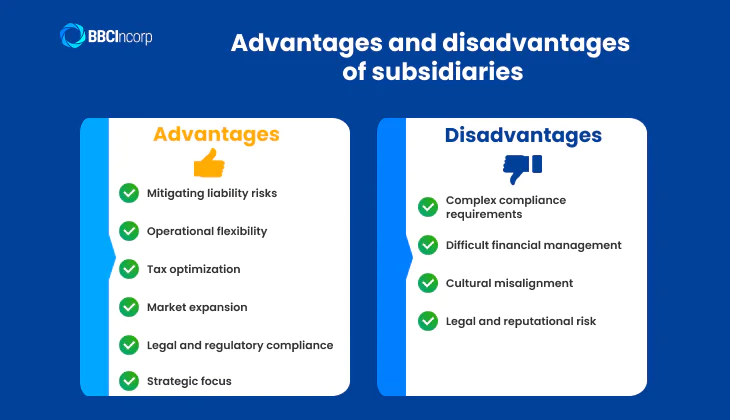

Advantages and disadvantages of subsidiaries

Advantages of having a subsidiary

Establishing a subsidiary can bring several strategic benefits to a parent company, especially when managing diverse operations across different markets or industries. Below are some of the key advantages:

- Mitigating liability risks: Since a subsidiary is a separate legal entity, financial losses, lawsuits, or regulatory issues within the subsidiary do not directly impact the parent company.

- Operational flexibility: Subsidiaries allow parent companies to test new markets, products, or services without risking the reputation or stability of the core business.

- Tax optimization: By establishing subsidiaries in regions with favorable tax policies, companies can reduce their overall tax burden and reinvest savings into growth or innovation.

- Market expansion: Subsidiaries can operate under different brands or strategies, enabling the parent company to enter new or niche markets more effectively.

- Legal and regulatory compliance: Subsidiaries can align more easily with local laws and regulations, particularly in international markets, ensuring smoother operations.

- Strategic focus: Each subsidiary can focus on a specific line of business or expertise, helping the parent company diversify and manage operations more efficiently.

Disadvantages of subsidiaries

While a subsidiary of a company offers various strategic advantages, it also comes with notable challenges that businesses must carefully manage as follows:

- Complex compliance requirements: Managing subsidiaries across different regions or countries often means navigating diverse legal systems, tax codes, and regulatory environments. For instance, U.S.-based subsidiaries must comply with both federal and state regulations, while international ones may require detailed reporting like IRS Form 5472.

- Difficult financial management: Consolidating financial statements across multiple entities can become complicated, especially when each subsidiary operates under different accounting standards or tax laws.

- Cultural misalignment: When a subsidiary is located in a different region from the parent company, differences in corporate culture can emerge. These differences may lead to communication challenges, slower decision-making, and conflicts in management approaches.

- Legal and reputational risk: Although a subsidiary is a separate legal entity, the parent company can still be affected legally and reputationally if the subsidiary violates laws or faces management issues. For example, if a subsidiary violates tax regulations or causes harm to customers, the parent company could be held responsible or suffer reputational damage.

How to establish a subsidiary company

Steps to establish a subsidiary

Establishing a subsidiary company involves a series of structured steps to ensure legal compliance, operational readiness, and alignment with the holding company’s strategy. Below are the key actions that explain how to form a subsidiary:

Step 1: Obtain approval from the parent company

The initial step is to secure authorization from the parent company’s board of directors. This often involves a formal vote or meeting where stakeholders discuss the goals and risks associated with forming the subsidiary.

Step 2: Choose an appropriate business structure

Selecting the correct legal structure is critical. This decision affects tax obligations, liability, and governance. Common choices include a limited liability company (LLC) or a corporation. If you are unfamiliar with the nuances of each structure or their implications, expert legal or tax consultation is recommended at this stage.

Step 3: Register legal documents

To operate legally, the subsidiary must file foundational documents such as the Articles of Incorporation with the relevant government authority. This formalizes the subsidiary as a separate legal entity.

Step 4: Allocate capital and resources

The parent company must fund the subsidiary by transferring necessary assets, such as cash, equipment, or intellectual property. A clear and well-organized process ensures operational readiness and minimizes delays.

Step 5: Governance and compliance requirements

Finally, the parent company appoints a board of directors or management team to lead the subsidiary. This team is responsible for developing business plans, setting key performance indicators (KPIs), and recruiting talent to support growth.

Legal and financial considerations

Exploring how to form a subsidiary involves careful attention to both regulatory and financial matters. A well-structured approach ensures compliance and long-term stability.

Legal requirements

A subsidiary operates as a separate legal entity, so establishing a strong foundation is essential to draft governance documents such as operating agreements or bylaws. These define internal rules, management responsibilities, voting rights, and how conflicts will be resolved, contributing to legal clarity and operational efficiency.

Moreover, choosing a suitable jurisdiction is also critical. Different regions offer varying degrees of regulatory complexity, legal protection, and business incentives. Aligning location with strategic goals helps streamline operations and manage risk.

Financial planning

From the outset, capital allocation must be clearly defined. Funding can be sourced directly from the parent company, loans, or outside investors. For international subsidiaries, tax obligations become more nuanced. While domestic entities are subject to federal and state tax laws, global subsidiaries must also navigate foreign tax systems, transfer pricing rules, and treaty benefits.

In addition, accurate financial reporting is vital to maintain transparency, especially when consolidating subsidiary performance into group-level statements. Businesses should consider engaging legal and tax professionals to help remain compliant, as well as optimize resources throughout the process.

Subsidiary companies vs. other business structures

Difference between subsidiaries and branches

When expanding internationally, businesses often choose between establishing a subsidiary or a branch. Both structures have their own set of legal, financial, and operational differences, which can significantly affect the business’s risk exposure and financial flexibility as follows:

| Aspect | Subsidiary | Branch |

| Legal status | A subsidiary is a separate legal entity, distinct from the parent company. This limits the parent company’s liability. | A branch is an extension of the parent company, meaning it shares the same legal identity. |

| Liability | Limited liability; the parent company is generally not liable for the subsidiary’s debts and obligations. | Unlimited liability; the parent company is directly responsible for the branch’s liabilities. |

| Taxation | Usually taxed as an independent entity in the host country, which may allow for tax advantages. | Taxed both in the host country and the parent company’s country, potentially leading to double taxation. |

| Control and Autonomy | Greater financial autonomy, with the ability to make independent decisions, raise capital, and adapt to local markets. | Typically controlled by the parent company, which may restrict financial flexibility and decision-making. |

| Market adaptation | Can tailor their brand and products to local markets, enhancing their presence and competitiveness. | Maintains the parent company’s brand and operations, ensuring consistency but offering less room for local adaptation. |

In summary, the choice between a subsidiary and a branch largely depends on the company’s goals, risk appetite, and the level of control desired. A subsidiary provides more legal protection and financial flexibility, while a branch offers easier integration with centralized control and lower initial setup costs.

Subsidiaries vs. affiliate companies

Subsidiaries and affiliate companies are both types of business entities linked to a parent company, often used to support market expansion and diversify operations. However, they differ significantly in ownership percentage and the level of control, as shown in the table below:

| Aspects | Subsidiaries | Affiliates |

| Ownership | The parent company owns at least 50% of the shares, possibly 100% (wholly owned). | The parent company owns 20% to 50% of the shares. |

| Control | Have been significantly controlled over operations and decisions. | Limited control; more independent in decision-making. |

| Tax structure | The parent company can file consolidated tax returns. | Affiliate files separate tax returns, and tax benefits depend on ownership. |

| Financial Independence | Be integrated into the parent company’s reports. | Independent and has its own reporting. |

| Management | Be involved in the hiring, training, and management of operations. | Operates independently with no parent involvement in team structure. |

| Loans | Requires the parent company’s approval. | Independently, without needing the parent company’s approval. |

To wrap up, choosing between the two structures depends on how much control and financial connection the parent company wants. Subsidiaries allow for tighter management and shared financial reporting, while affiliates offer more freedom and flexibility in operations..

Key aspects of investment in the subsidiary company

Before investing in a subsidiary, make sure you understand the key factors outlined below to make informed decisions.

Ownership structure

A subsidiary operates as a separate legal entity, but the parent company holds a majority of its shares, which grants it control over key decisions. This setup allows the parent company to benefit from the subsidiary’s activities while maintaining limited liability.

Types of investments

- Wholly owned subsidiary: The parent company owns 100% of the subsidiary’s shares, granting full control over operations.

- Partially owned Subsidiary: The parent holds a majority stake, but the subsidiary may have other minority investors.

- Co-subsidiary: Multiple parent companies jointly own the subsidiary, sharing control and responsibilities.

So, if you have an investment in a subsidiary company plan, you may receive benefits like access to new markets and potential tax advantages. However, it also involves complexities such as financial consolidation, compliance with different regulations, and effective risk management. The parent company’s involvement in the subsidiary’s daily operations and monitoring of financial performance is essential for ensuring the success of the investment.

Start your subsidiary for global expansion with BBCIncorp

BBCIncorp is a trusted partner for businesses looking to establish subsidiaries in strategic global markets. Our company formation services make the process of international expansion straightforward, ensuring that you can focus on growing your business while we handle the complexities of subsidiary setup.

We provide tailored support to help you enter new markets and expand your operations. Our services include:

- Jurisdiction selection: We help you choose the best location for your subsidiary based on market opportunities, tax benefits, and regulatory environment.

- Legal documentation and compliance: Our team handles all the necessary paperwork, ensuring full compliance with local laws and regulations.

- Tax planning and risk management: We assist in structuring your subsidiary for optimal tax efficiency and minimizing potential risks.

- Ongoing support: From registration to post-incorporation services, we ensure your subsidiary runs smoothly and remains compliant with local requirements.

- Market expertise: With our extensive knowledge of global markets, we provide insights into the most promising regions for your business to expand.

We offer various industries, including e-commerce, technology, healthcare, finance, and retail, ensuring that your subsidiary is well-positioned in its respective market. By partnering with BBCIncorp, your business can take advantage of new opportunities, access local expertise, and streamline the process of setting up a subsidiary.

To find out if establishing a subsidiary is the right move for your global expansion strategy, explore our article on foreign subsidiary for global expansion.

Conclusion

In this article, we’ve explored the concept of a subsidiary company, its structure, types of investments, and the critical considerations for businesses. A subsidiary provides various benefits, including enhanced control, financial consolidation, and access to new markets. However, it also introduces challenges such as increased regulatory requirements and management complexity.

Understanding what is a subsidiary company and its structure is crucial for businesses considering global expansion. If you’re contemplating the creation of a subsidiary, it’s essential to assess whether this business model is the best option for your company’s expansion strategy. At BBCIncorp, we offer expert guidance in setting up subsidiaries to ensure you make informed decisions and capitalize on the benefits of this business structure.

Frequently Asked Questions

Can a subsidiary operate independently?

Yes, a subsidiary can operate independently, but the level of independence depends on the parent company and subsidiary relationship.

Is it necessary for a parent company to own 100% of a subsidiary’s shares?

No, it is not necessary for a parent company to own 100% of a subsidiary’s shares. Typically, a parent company must own more than 50% of a subsidiary’s shares to have control over its operations and decisions.

Does a subsidiary need to have its own CEO?

Yes, a subsidiary typically needs to have its own CEO or managing director. This is because a subsidiary is a separate legal entity, responsible for its own operations, compliance, and local decision-making.

Having a dedicated CEO ensures the subsidiary can operate effectively and meet its legal obligations independently from the parent company.

What’s the difference between a subsidiary and an associate company?

The key difference between a subsidiary and an associate company lies in the level of ownership and control held by the parent company:

- Subsidiary: The parent company owns more than 50% of the subsidiary’s voting shares, giving it controlling interest. This allows the parent to make key decisions and consolidate the subsidiary’s financial statements into its own.

- Associate company: The parent owns a significant but non-controlling stake, usually between 20% and 50%. It influences decisions like participating in board meetings, but does not control the company’s operations. Financials are usually accounted for using the equity method, not full consolidation.

Are subsidiaries structured as LLCs or corporations?

Subsidiaries can be structured as either LLCs or corporations. The parent company decides which structure is best for the subsidiary, considering factors like liability protection, taxation, and operational needs.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.