Scale Your BVI Company With Banking Solutions

One of the crucial tasks after forming your BVI company is to open a business bank account. This will help you keep track of your spending and keep your finances in order. A business bank account also lets you optimize taxes, simplify accounting, and establish credibility.

Facts About BVI Banking System

- Financial services in BVI - like banking or insurance - are supervised by the BVI Financial Services Commission

- The introduction of the International Business Company Act, 1984 has made BVI a global leading international financial centre

- Due to strict control over bank licensing, there are only 6 commercial banks and 1 restricted licensed bank in BVI

- FirstCaribbean International Bank is a popular choice for offshore ventures and businesses

Reasons To Open A Business Bank Account In BVI

- No personal visit or signatory travel is required for bank account opening

- Reasonable deposit for offshore bank application

- Fast approval for opening a business bank account

- Easy bank application for trading, consulting, and holding company

- BVI financial institutions are highly credible

Choose A Package For Bank Account Opening In BVI

Start tracking and managing your finances today with our exclusive packages that scale with your business

Order Banking Support Separately

US$499*

* This fee is only for customers who have already used our company formation service

Order Package that Includes Banking Support

US$400*

Save US$99 when ordering Standard or Premium Package

Note: Our banking support fee does not include the fee for bank account application or any other required fee (if any) chargeable by the bank you choose to apply.

What's Included In Our Fee

- Consultancy on bank options that are most suitable for your business

- Consultancy and review of the application process and document preparation

- Support in preparing certified documents when needed such as Certificate of Incumbency and Courier hard copy to the bank

- Appointment arrangements with the bank(s)

- A dedicated support team available for banking-related questions

Why Our Service is Unique

- One-time fee for multiple bank applications with premium package (if you fail to open a bank account in one bank, we continue to assist you in applying for other banks, without extra charge)

- Affordable and efficient pricing plan

- Support for opening a BVI bank account remotely

- A proven record of over 12 years of experience with international banks

- Prompt response and a step-by-step guide to the application

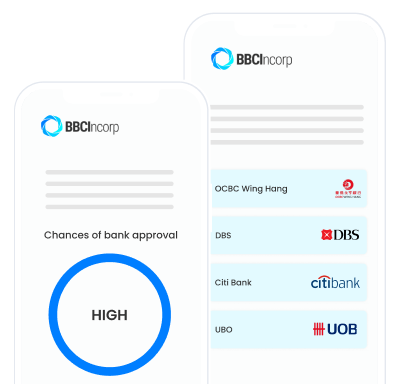

Still unsure and need more banking options for your BVI company?

Find out with our Banking Tool

Required Documents

Application forms

Bank statements

Bank reference letter

Certified copies of passports, address proofs of all directors/shareholders

Business plan

Business trading proofs (sales/purchase orders, invoices…)

Certified copies of your BVI company incorporation documents

And government certification of company good standing status

Additional supportive documents beyond the listed above might be requested to open your BVI company bank account depending on each local regulation, your business fields, and on a case-by-case basis.

Please get in touch with us to know the exact essential documents for your case.

Frequently Asked Questions

What challenges you may face in finding the best banks for BVI company?

Before taking the plunge and opening a bank account for your BVI company, you should be aware of any potential obstacles or challenges that could damage your chances of success.

Here are some of the most common challenges you may face when searching for the best bank for your BVI company:

• Choosing the wrong banks

Some banks do not provide support for BVI companies due to internal policies and procedures, and they won't tell you about this until you've already submitted an application. This can be a huge waste of time and energy, so it's best to research the banks ahead of time and make sure they are best suited to your needs.

• Your business is newly incorporated

Banks usually require proof that your business is authentic and has genuine sources of income. Generally, you must provide an audited financial statement to open a bank account, which can be tricky if your business is just starting out and there's little evidence of its operation.

• Your business is considered high-risk

If your business is involved in certain industries, banks may consider it to be "high risk" and reject your application. This could be for a variety of reasons, ranging from the type of industry to the activities involved. Before you apply for an account, make sure your business does not belong to any of these industries.

What are the best banks for your BVI company?

The best banks to choose will depend on your specific needs, circumstances, and goals. See our recommendation below to make better decisions for your company:

• You need a local bank account in the BVI

If you are planning to transact with local residents and want to minimize your currency conversion fee, a domestic bank is an ideal choice for your financial needs.

In this case, we highly recommend FirstCaribbeasn International Bank, which offers comprehensive banking services and competitive rates.

• You want an account with prestige banks

Having a business account with renowned banks helps boost your reputation and increase credibility. This is highly necessary if your company deals with foreign partners, clients, and investors.

For this purpose, we suggest you go for HSBC or UOB in Singapore as they provide reliable banking solutions and have top-notch security. Just keep in mind that you'll be required to physically visit the branch to open an account.

• You want to open an account remotely

If you're looking for an offshore account that allows you to open and manage your finances without having to travel or personal visit, then we suggest going with offshore banks such as Belize Banks, Caye International Bank Ltd, Heritage Bank, or Mauritius Commercial Bank.

Can I open a UK bank account for my BVI offshore company?

Yes, it is possible to open a UK bank account for your BVI offshore company. However, the process can be quite complicated and require a significant amount of paperwork.

Generally, required documents will include:

- Certified copies of passports of all company members

- Copies of your business certificate of incorporation

- A business plan

- Proof of business activities (e.g., contract, agreements, utility bills, and so on)

- Bank statements and reference letter

Furthermore, you’ll need to travel for a personal meeting, which is quite hard and expensive to do.

It is best to take your time and research the process thoroughly before making any decisions. Additionally, make sure to find a bank that is willing to work with companies from the BVI as some banks may not be so accommodating.