- What is a company secretary?

- What is the importance of a company secretary in Hong Kong?

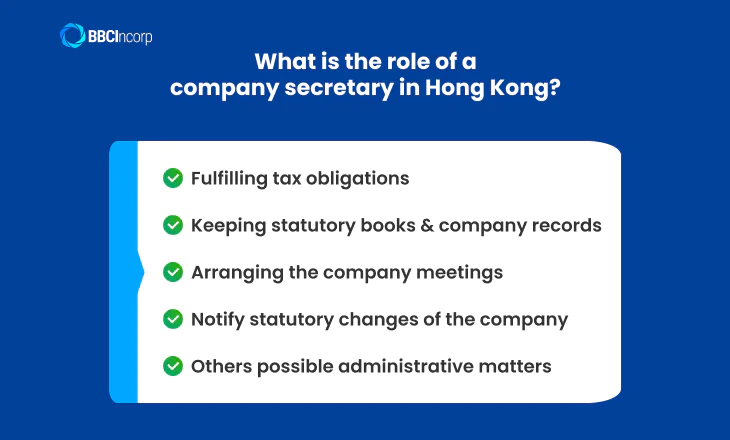

- What is the role of a company secretary in Hong Kong?

- Who can be appointed a company secretary in Hong Kong?

- How to appoint a company secretary in Hong Kong

- What makes a good company secretary?

- Streamline your business compliance with BBCIncorp’s company secretary service

- Conclusion

Hong Kong is one of the world’s most dynamic business hubs, attracting thousands of entrepreneurs and investors each year. In 2024 alone, over 145,000 new companies were incorporated, raising the total number of registered businesses to more than 1.46 million(1), a testament to the city’s strong global appeal.

Before setting up a company, it is vital to understand key legal requirements that ensure compliance and smooth operations. One essential obligation for every Hong Kong-registered company is to appoint a company secretary. But what is a company secretary, and why is this role mandatory? This article will explain all the information, helping business owners to choose a qualified professional.

What is a company secretary?

A company secretary in Hong Kong is the company’s representative whose main responsibility is to ensure that the company and its operation are fully compliant with all statutory laws and regulations following the Hong Kong Companies Ordinance.

In general, the company secretary function is of vital significance to the direction, administration, and corporate governance of a Hong Kong company.

Notably, the term “company secretary” should not be confused with the term “secretary” in general, as an accompanying secretary in Hong Kong has a wider range of responsibilities.

Annual Compliance Requirements

In addition to having a company secretary, there are other annual compliance requirements you need to comply with. These requirements usually include:

- Renewal of company secretary and registered office

- Accounting and auditing

- Renewal of Hong Kong business registration

- Internal records

- Annual general meetings

- Maintenance and update of any changes to the Companies Registry

- Annual return and tax filing

Read more on Hong Kong Companies’ Annual Compliance Requirements for helpful details.

What is the importance of a company secretary in Hong Kong?

There are many reasons why having a company secretary in Hong Kong is essential.

In reality, it is one of the compulsory requirements determined based on the Company Ordinance, therefore if you want to register a Hong Kong company, you are left with no choice but to select a company secretary.

It should be noted that a company can fail to be listed on the Stock Exchange if the company does not appoint a qualified company secretary.

A company secretary in Hong Kong is also a contributing factor to the growth and sustainability of a company.

To be specific, there are two major benefits of having a company secretary:

- Better connection between the company and the Hong Kong government

Not only does an HK company secretary work with directors and shareholders of the company, but he/ she also liaises and interacts with various government and regulatory bodies responsible for regulating the company’s operation and activities.

Some of the statutory bodies that company secretaries must work with include:

(1) Registrar of Companies

(2) Inland Revenue Department

(3) Stock Exchange of Hong Kong

(4) Securities and Futures Commission of Hong Kong

- Strong compliant status with the Hong Kong law

There are certain duties to result in successful business setup and administration in Hong Kong jurisdiction.

Qualified company secretaries will help you to understand and proceed with the right and orderly steps to comply with Hong Kong law, ensuring the company runs smoothly without any conflict with the law.

Free ebook

Everything you need to start business in Hong Kong

Find out in a matter of minutes.

What is the role of a company secretary in Hong Kong?

The duties and responsibilities of a company secretary in the sovereign state are wide in scope, ranging from administrative to managerial functions. Below are some main duties:

Fulfilling tax obligations

Taxation is a major consideration for entrepreneurs choosing Hong Kong as their business base. Although Hong Kong offers one of the world’s most favorable tax systems, companies must still comply with specific regulations. The company secretary plays an essential role in ensuring that all tax obligations are fulfilled accurately and on time.

What do they do?

- Register the company with the Inland Revenue Department (IRD) immediately after incorporation.

- Ensure that all tax returns are completed correctly and submitted within statutory deadlines.

- Seek clarification or additional approval from the IRD when dealing with complex or exceptional tax matters.

- Assist in claiming eligible tax reliefs and deductions to optimize compliance and efficiency.

Keeping statutory books and company records

Hong Kong law requires every company to maintain up-to-date statutory records that are always ready for inspection by government authorities. The company secretary is responsible for maintaining these records and ensuring all information remains current and accurate.

What do they do?

- Maintain and regularly update statutory registers, including details of directors, shareholders, and significant controllers.

- File Annual Returns and other documents with the Companies Registry on time.

- Prepare and distribute company accounts and annual financial statements.

- Ensure compliance with the Companies Ordinance (Cap. 622) and other relevant regulations.

Arranging the company meetings

Organizing company meetings is one of the fundamental duties of a company secretary. They ensure that board meetings and Annual General Meetings (AGMs) are conducted in accordance with the company’s Articles of Association and local laws.

What do they do?

- Schedule and arrange board meetings and AGMs as required.

- Prepare and circulate meeting agendas and necessary documents to directors and shareholders in advance.

- Attend meetings to take accurate minutes and record all resolutions.

- Ensure decisions made during meetings comply with Hong Kong company law and are properly documented

Notify statutory changes of the company

After incorporation, a company may undergo several changes in structure or management. The company secretary must notify the Companies Registry of these updates within the legally required timeframe to keep official records accurate.

What do they do?

- File notifications on changes such as:

- Appointment or removal of directors or shareholders

- Change of company name

- Alteration of share capital

- Relocation of registered office address

- Submit all required forms (e.g., NR1, ND2A) within 15 days of any change.

Others possible administrative matters

Beyond routine compliance, the company secretary also ensures effective communication and strong corporate governance practices within the organization.

What do they do?

- Act as a liaison between the company, shareholders, auditors, regulatory bodies, and if applicable the Hong Kong Stock Exchange (HKEX).

- Advise the board of directors on corporate governance, data protection, and anti–money laundering (AML) obligations.

- Stay informed of new legal and regulatory developments that may affect the company’s operations.

- Support business continuity by implementing proper record-keeping and compliance systems.

Who can be appointed a company secretary in Hong Kong?

According to Section 474 (4) of Cap. 622 Companies Ordinance of Hong Kong, a Hong Kong company secretary must satisfy the conditions below:

- Individual company secretary

-

-

- Must be an ordinary resident of Hong Kong (holding a valid Hong Kong Identity Card and residing locally).

- Should possess adequate knowledge of company law and compliance procedures.

- Cannot act as both the sole director and company secretary of the same private limited company.

- May serve as company secretary for multiple companies, provided they can perform all duties effectively.

-

- Corporate company secretary

-

- Must be a Hong Kong-registered company with a valid Trust or Company Service Provider (TCSP) License, issued under the Anti–Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615).

- Must have a registered business address in Hong Kong, serving as the company’s official contact point for legal and government correspondence.

- Often engaged by businesses that prefer outsourced company secretarial services for cost efficiency and professional expertise.

*Additional notes:

- The sole director of a private company cannot also act as the company secretary.

- Both individual and corporate secretaries must be based in Hong Kong and qualified to handle statutory filings and compliance tasks.

- Many foreign-owned companies choose to outsource this role to professional secretarial firms to ensure accurate, timely compliance with Hong Kong’s corporate laws.

In summary, whether an individual or a corporate entity is appointed, the company secretary must meet Hong Kong’s residency and licensing requirements, ensuring full legal compliance and effective business administration.

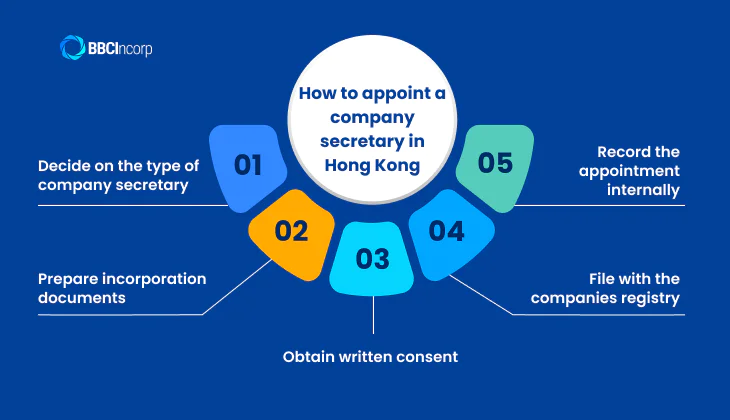

How to appoint a company secretary in Hong Kong

The appointment usually takes place during the incorporation process but must follow several statutory procedures to ensure full compliance.

Step 1: Decide on the type of company secretary

Determine whether your company will appoint an individual or a corporate body as the company secretary.

Step 2: Prepare incorporation documents

Gather the necessary incorporation papers, including:

- Form NNC1 (for companies limited by shares)

- Articles of Association

- Form IRBR1 (for business registration)

Ensure that the company secretary’s details are accurately filled in under the “First Secretary” section of Form NNC1.

Step 3: Obtain written consent

The proposed company secretary must provide a written consent to act in the role. This document should be kept in the company’s internal records for verification purposes.

Step 4: File with the companies registry

Submit all incorporation documents to the Companies Registry. Once approved, the Registry will issue the Certificate of Incorporation, officially confirming the company’s registration and the appointment of its first secretary.

Step 5: Record the appointment internally

After incorporation, record the appointment in the company’s minute book and keep copies of the incorporation forms and written consent for statutory compliance.

What makes a good company secretary?

A good company secretary is a key figure ensuring that a company operates smoothly and in full compliance with Hong Kong laws. Beyond statutory qualifications, their effectiveness depends on professional expertise, ethics, and soft skills that help the company maintain transparency and stability.

Qualifications

To be appointed as a company secretary in Hong Kong, the individual or entity must meet the following requirements:

- Be a Hong Kong resident if an individual.

- Hold a Trust or Company Service Provider (TCSP) license if a corporate entity.

- Possess a solid understanding of Hong Kong’s Companies Ordinance, corporate governance, and local tax regulations.

- Ideally have a background in law, accounting, or business administration to effectively manage compliance and documentation.

Skills

After meeting the legal requirements, an excellent company secretary should demonstrate the following skills:

- Problem-solving ability to handle compliance or operational issues efficiently.

- Strong time management and planning to meet statutory filing deadlines.

- Teamwork skills for effective coordination with directors, auditors, and government authorities.

- Clear and transparent communication to keep all stakeholders informed.

- Attention to detail to maintain accurate records and prevent filing errors.

Together, these qualifications and skills define what makes a company secretary not just competent, but truly valuable to the company’s long-term growth and compliance success.

Streamline your business compliance with BBCIncorp’s company secretary service

Managing corporate compliance in Hong Kong can be time-consuming, especially for foreign entrepreneurs navigating complex local regulations. BBCIncorp simplifies this process with its all-in-one company secretary service Hong Kong, designed to keep your business compliant, organized, and worry-free.

With years of experience supporting international clients, BBCIncorp’s team of experts handles everything from annual filings and record maintenance to corporate governance and regulatory updates. Our goal is to help you stay compliant effortlessly while focusing on business growth.

Here’s what the service includes:

- Annual compliance management: Renew business registration, file annual returns, and prepare meeting documents on time.

- Statutory record-keeping: Maintain your company’s registers, including the Significant Controllers Register (SCR), securely stored online.

- Corporate governance support: Arrange meetings, draft resolutions, and record minutes to ensure transparent operations.

What truly sets BBCIncorp apart is its expertise, flexibility, and customer-first approach. Our professionals stay updated with Hong Kong’s corporate regulations and deliver timely, precise compliance support. Through BBCIncorp’s secure management portal, you can easily access company records, track filing deadlines, and receive automated reminders.

By outsourcing your secretarial duties to BBCIncorp, you’ll save time, minimize compliance risks, and gain peace of mind knowing your company’s obligations are handled by professionals who care about your business success.

Conclusion

Understanding the answer to “what is a company secretary” is essential for any business owner aiming to establish or maintain a company in Hong Kong. The company secretary ensures full compliance with Hong Kong’s corporate laws by managing statutory records, filing annual returns, and advising the board on governance matters.

With experienced specialists and transparent service packages, BBCIncorp helps you stay compliant, allowing you to focus on what truly matters. Get in touch with us through the chatbox or leave a message via service@bbcincorp.com for more advice based on your company’s conditions!

References:

(1): https://www.scmp.com/news/hong-kong/hong-kong-economy/article/3295152/hong-kong-saw-record-company-registrations-2024-authorities

Frequently Asked Questions

Which businesses are obligated to have a company secretary?

All Hong Kong-registered companies—including private, public, and guarantee companies—are legally required to appoint a company secretary. Failure to do so may result in fines of at least HKD 100,000.

Can I change company secretary in Hong Kong?

Yes, you can change your company secretary in Hong Kong at any time by following the proper procedure below:

- Pass a board resolution to officially approve the resignation of the current secretary and appoint a new one.

- File Form ND2A with the Companies Registry within 15 days of the change. This form records both the cessation of the old secretary and the appointment of the new one.

- Update company records, including the register of directors, members, and minute books, to reflect the change.

What is the salary of a company secretary in Hong Kong?

The average company secretary salary in Hong Kong is around HKD 70,000 per month, based on recruitment agency data. Salaries typically range from HKD 40,000 to HKD 100,000, depending on experience, qualifications, and company size. Senior professionals in listed or multinational firms often earn at the higher end of this range.

A company secretary is responsible for internal governance and compliance, handling statutory filings, maintaining company records, and organizing board and shareholder meetings. Meanwhile, a designated representative typically serves an external function, acting as the main contact for regulators or representing the company in legal and administrative matters.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is a company secretary?

- What is the importance of a company secretary in Hong Kong?

- What is the role of a company secretary in Hong Kong?

- Who can be appointed a company secretary in Hong Kong?

- How to appoint a company secretary in Hong Kong

- What makes a good company secretary?

- Streamline your business compliance with BBCIncorp’s company secretary service

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.