Table of Contents

Panama stands today as one of Latin America’s most dynamic gateways for global business, thanks to its strategic position linking the Atlantic and Pacific Oceans via the Panama Canal. This pivotal location makes it a vital conduit for global trade, logistics, and transportation, connecting markets across North America, the Caribbean, and South America.

Beyond geography, the country’s modern infrastructure, extensive free trade zones, and investor-friendly tax regime continue to strengthen its appeal to international entrepreneurs and companies looking to establish Panama corporations.

Although Panama’s economic growth moderated to 2.9% in 20241 following the closure of a major copper mine, the outlook for 2025 is significantly brighter. The International Monetary Fund (IMF) projects growth of around 4.5%2, driven by strong performance in services, infrastructure, and trade. The economy remains dominated by the services sector, which accounts for more than 75% of GDP3, with logistics, financial services, tourism, and communications leading the way.

Panama’s business landscape is also becoming more attractive from a regulatory perspective. Its recent removal from the EU’s high-risk list for money laundering marks a crucial step in boosting investor confidence and facilitating smoother cross-border financial operations. These developments, combined with an improving business environment and growing economic resilience, make Panama an ideal jurisdiction for incorporation.

Against this backdrop, understanding the conditions for doing business — from market opportunities to legal requirements — is essential for any entrepreneur planning to form a Panama corporation. This guide explores why Panama remains a top choice for global investors and how to successfully incorporate a company in this thriving business hub.

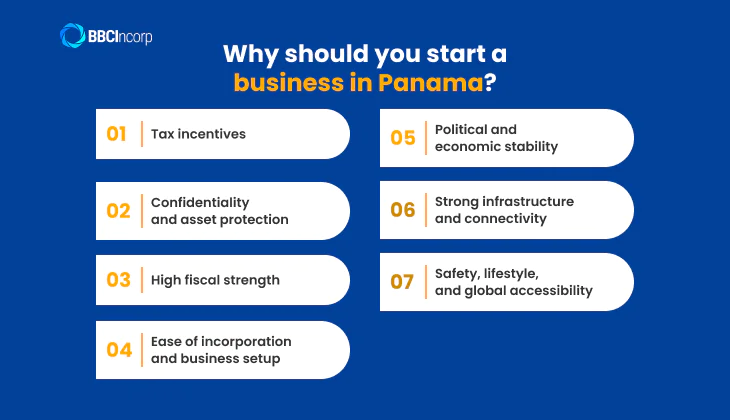

Why should you start a business in Panama?

Starting a business in Panama offers strategic advantages for global investors. A Panama corporation benefits from political stability, tax efficiency, strong infrastructure, and access to international markets, making it an ideal choice for long-term growth.

Tax incentives

Tax efficiency is a must-have hallmark in every offshore jurisdiction, and Panama is no exception. The country adopts a territorial approach to taxation, only domestic-sourced income will be taxed (at a 25% fixed rate post-tax-deduction) regardless of if the entity has Panama residency or not.

Note that a business entity’s domiciliation status is only relevant when evaluating its eligibility for withholding tax (WHT).

Panama companies that operate within any free zone like the Panama Pacific (Pacifico) Special Economic Area (PSEA) or the Colon Free Zone (CFZ) can enjoy various forms of tax benefits. Each zone has its approach to promoting trade which, as a result, employs a different set of tax benefits from each other to achieve it.

Confidentiality and asset protection

There exists a concept called the “corporate veil” which is the protective mechanism that Sociedad can provide for its shareholders. Specifically, shareholders’ personal assets are shielded from litigation and government seizures since the corporation is a separate legal entity with the same capacity to take on duties and rights.

Another non-income generating counterpart to the entity type is a PIF (Private Interest Foundation), an equally popular choice for those looking for enhanced asset protection and estate planning with the added benefit of legal circumvention of their home country’s CFC (Controlled Foreign Corporations) law.

Although it doesn’t directly conduct any business activities, it holds the shares of another currently operating business. It also can partake in any financial activities that would serve to bolster the value of its assets, meaning that it can own bank accounts, securities brokerage accounts, and more.

High fiscal strength

Since Panama has a decentralized banking system, i.e., there’s no central bank, no exchange controls are present which means there’s no cap on monetary remittances abroad, including dividends, interests, branch profits, and royalties.

The balboa is the state’s official currency used for transactions, pegged at 1:1 to the U.S. dollar, further solidifying its fiscal stability from any global financial crises and keeping inflation as low as possible.

Ease of incorporation and business setup

One of Panama’s most attractive features for foreign investors is the simplicity and speed of its company formation process. Incorporation typically takes between two and five business days, and once the company is registered, a business operation permit can be obtained online with minimal fees. For sole proprietors, the cost of a business permit can be as low as 15 dollars.

Municipal taxes are generally low and vary depending on the nature of the business and its location. This accessibility makes Panama a preferred choice for entrepreneurs, small and medium-sized enterprises, and multinational companies seeking to establish a presence in the region.

Political and economic stability

Panama has maintained a stable democratic government since 1989, providing a predictable legal and regulatory environment that supports business growth. The economy has expanded consistently since 2005 and is projected to grow by 4.5 percent in 2025, driven by a strong services sector, expanding infrastructure, and strategic trade routes. Low inflation and sound fiscal policies continue to support Panama’s reputation as one of the most stable economies in Latin America.

Strong infrastructure and connectivity

Panama’s infrastructure is among the most advanced in Central America. The country offers widespread access to high-speed internet, modern telecommunications networks, and an extensive system of highways connecting major cities and neighboring countries.

The Panama Canal remains a cornerstone of global trade, while Tocumen International Airport provides direct flights to more than 100 international destinations, making global connectivity seamless for businesses and investors.

Safety, lifestyle, and global accessibility

Panama is widely regarded as one of the safest countries in the region, supported by political stability, strategic defense agreements with the United States, and a large international expatriate community. The country is also largely free from natural disasters such as hurricanes and tornadoes, making it an attractive and secure location for long-term investment.

English is widely spoken, particularly in business and financial sectors, and the country’s high quality of life, welcoming environment, and excellent infrastructure make it not only a competitive business hub but also an appealing place to live and work.

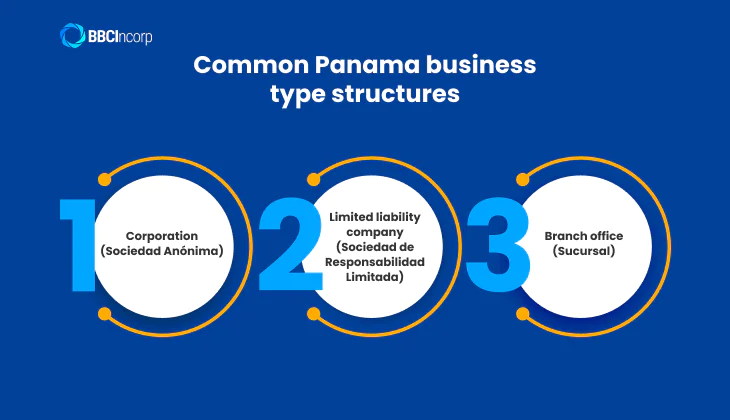

Panama business type structures

Choosing the right business structure is one of the most impactful steps when incorporating in Panama, as it directly influences your company’s legal standing, tax efficiency, governance flexibility, and long-term growth potential.

Below is an overview of the most common company structures available in Panama, along with specialized options designed for asset protection, international trade, and investment.

Common structures

Corporation (S.A.)

The Sociedad Anónima (S.A.), or corporation, is one of the most popular business structures in Panama. Similar to a public limited company, it allows for the issuance of shares and limits shareholders’ liability to the amount of their contributions. This makes it especially suitable for larger businesses seeking to raise capital from investors.

An S.A. requires between three and fifty founders, regardless of nationality, and does not have a legally mandated minimum capital. However, a starting capital of USD 10,000 is often recommended. The incorporation process typically takes two to three weeks and requires the appointment of at least three directors, a resident agent (a Panamanian lawyer), and a registered fiscal address.

Companies must submit annual tax declarations, maintain at least one shareholder, and pay annual fees to the Public Registry. Due to its flexibility, legal protections, and scalability, the S.A. remains the most widely used structure for both local and international business operations in Panama.

Limited liability company (LLC or S.R.L.)

A Sociedad de Responsabilidad Limitada (S.R.L.) is Panama’s equivalent of a limited liability company and is often preferred by smaller businesses and investors seeking personal asset protection. The liability of shareholders is limited to their capital contributions, shielding them from company debts and obligations.

The incorporation process generally takes about two weeks and requires at least two shareholders or associates, one administrator, and the appointment of company officers such as president, secretary, and treasurer. A resident agent and a fiscal address in Panama are also mandatory.

While the S.R.L. cannot issue shares like a corporation, it provides a simpler governance structure and flexible management. This makes it ideal for small to medium-sized enterprises (SMEs) and family-owned businesses.

Branch office

A branch office (Sucursal) allows a foreign company to establish a presence in Panama without creating a separate legal entity. The branch operates as an extension of the parent company, which retains full liability for its operations and obligations.

The registration process usually takes two to four weeks and requires documentation such as the parent company’s articles of incorporation, a certificate of good standing, and a resolution authorizing the branch’s creation. A Panamanian legal representative, a fiscal address, and a taxpayer identification number (RUC) are required.

While there is no minimum capital requirement, the parent company must declare a capital contribution. Branches are subject to corporate income tax and VAT on locally generated income. This structure is best suited for established foreign businesses looking to expand operations without forming a separate subsidiary.

Other structures companies Panama for specific needs

Private interest foundation

A Private Interest Foundation (PIF) is a legal entity primarily used for asset protection, estate planning, and wealth management rather than commercial activities. PIFs do not issue shares, and their assets are legally separated from those of the founders, beneficiaries, and protectors.

The formation process takes about three weeks and requires the designation of a beneficiary and a protectorate, along with a Private Protectorate Document. The foundation must also have a resident agent, a fiscal address, and a defined purpose and duration.

While PIFs are exempt from Panamanian taxes (except for the annual registration fee), they must obtain a commercial license and submit tax declarations if they engage in business activities. This structure is ideal for individuals and families seeking to protect assets, plan inheritances, and manage wealth confidentially.

International business company (IBC)

An International Business Company (IBC) is designed for global trade, asset management, and cross-border investments. IBCs are especially popular among foreign investors due to their tax advantages, confidentiality, and flexibility.

Income generated outside of Panama is exempt from local taxation, provided the company does not conduct business within the country. IBCs require at least one shareholder and three directors, who may be of any nationality, and must appoint a resident agent and maintain a fiscal address in Panama.

There is no minimum capital requirement, but a starting capital of USD 10,000 is recommended. IBCs must also keep corporate records, including a register of shareholders and a minute book. This structure is highly suitable for companies engaged in international commerce, holding activities, or investment management.

Partnerships

Partnerships in Panama can be formed as either general partnerships or limited partnerships. In a general partnership, all partners share management responsibilities and are personally liable for business obligations. In a limited partnership, at least one partner has unlimited liability, while others are liable only up to their investment.

Partnerships are straightforward to establish and offer a more flexible management structure but provide less liability protection compared to corporations or LLCs. They are often chosen by small businesses, professional service firms, and joint ventures.

Sole proprietorships

A sole proprietorship is the simplest and most cost-effective business structure in Panama. It allows an individual to operate under their own name without creating a separate legal entity. While easy to establish and subject to minimal regulatory requirements, the owner bears unlimited personal liability for all business debts and obligations.

This structure is most suitable for small-scale entrepreneurs, freelancers, and consultants who wish to operate quickly with low startup costs.

Given its versatility, legal protection, and growth potential, the Sociedad Anónima (S.A.) is often the preferred choice for foreign investors. To help you take advantage of these benefits, the next section walks you through the key steps to register a Panama corporation.

How to register a Panama corporation?

Corporate details

Subscribers: As mentioned before, at least two individuals of this denomination must be present to initiate the registration process. Additionally, there’s no requirement that states they have to be Panama citizens/ residents. Subscribers are lawfully entitled to own one share of the corporation which will be resigned after registration has been completed via signing a document.

Directors: A minimum of three directors (Treasurer, Secretary, and President), can be natural or corporate, are expected to be in place after the corporation has been formed. Their names and addresses are also required to be filed with the Public Registry. A Nominee Directors Service is also a good option to have if anonymity needs to be maintained. Meetings can be organized to take place anywhere in the world as stated in the Articles of Incorporation.

Shareholder(s): At least one shareholder, either an actual person or business entity, must be present post-incorporation to receive the issuance of one share (US$100).

Share capital: By standard, the usually authorized share capital is US$10,000 divided into 100 common voting shares, i.e., US$100 per voting share. No par value and bearer shares are also allowed with the latter allowed under the condition that it is held in custody by a resident agent or qualifying entities such as a bank, fiduciary, or trust company.

Resident agent/ registered agent: All registered Panama corporations have to enlist resident agents in the form of either a lawyer or a law firm domiciled in the country to partake in legal proceedings.

Purpose of Incorporation: Most would list out the general objectives as to why their corporation is incorporated but further specifications can be made within the corporate bylaws.

Registration procedure

Step 1: Choose a name

You are given the option of submitting up to 3 name choices for your corporation, they all can be in any language as long as they have any of the following required corporate suffixes:

- Incorporation (Inc)

- Corporation (Corp)

- Sociedad Anónima (S.A.)

Prior checking with the Public Registry is advised on the availability of the name before the final decision is made. Reservation of such a name is available for up to 30 calendar days.

Step 2: Produce signed company bylaws

Law 32 of 1927 does not contain any legislative article that stipulates the inclusion of corporate by-laws (estatutos) in the incorporation procedure. By this, it can be inferred that a business entity can exist without the presence of one.

However, it’s still good practice by shareholders to draft one in addition to the Article of Incorporation to chart out deeper structural and operational details for later reference.

The typical information often stated in a corporate bylaw includes, among other things, the following:

- Frequency and nature of shareholder/ board meetings;

- Details of the company (name, address, location, company type);

- Procedure for record-keeping, issuing shares, ways of conducting business, etc;

- Prerequisites and procedures for future amendments to the Articles of Incorporation.

Important Tips

– Avoid repeating the same provisions already made within the Articles of Incorporation. Negligence of this can result in you having to also make amendments to the articles whenever the provisions are changed.

– A corporate bylaw is considered a legal admission in courts of law to substantiate that the governance of an organization was carried out on a fully compliant basis with pre-chartered internal rules and regulations.

– Unless otherwise requested for legal assistance by competent authorities, the bylaws will remain exclusively within the company records.

Step 3: Prepare the information requirements

Here is a quick recap of all the prerequisites you need to have before proceeding with the registration process:

- Three options for your company name;

- Name and information of shareholders.

- Purpose of incorporation/ planned activity.

- Operational period (set deadline or indefinite).

- Share capital.

- A specified number of nominal shares owned by each shareholder.

- Name and address of at least 3 dignitary-nominated directors.

- Name and address of the resident agent.

Step 4: Register with relevant authorities

Once you’ve gathered all the information required to file the articles of incorporation, it’s time to register your corporation with corresponding public authorities.

Firstly, you must notarize your Articles of Incorporation with a Notary Public for the issuance of a public deed which you can then register with the Public Registry. This will set forth the existence of your corporation as a legal entity with a legal capacity equivalent to a natural person.

In this regard, it can enter legal relations, incur responsibilities, and have rights. If your corporation intends to conduct commercial or trading activities upon incorporation, additional fulfilling of formalities to relevant government entities is mandatory.

All corporations incorporated under Panama constitutions have to register before The Directorate General of Revenues (DGI) to obtain a Tax Identification Number, better known as an “RUC”.

Next, you must obtain an Operation Notice (Aviso de Operación) through the Panamá Emprende System under the Ministry of Commerce and Industries (MICI), in accordance with Law 5 of January 11, 2007. Upon receiving the Operation Notice, a unique number is separated from your RUC which will serve to identify in detail each taxpayer that carries out operations within the Republic of Panama.

You will also need to register your corporation on a municipal level. For this, you can register with the Treasury of the corresponding municipality in which your corporation has a headquarter(s) (Article 84 of Law 106 of 1973).

Finally, file the RUC form on DGI’s official online portal and submit it along with the Notice of Operation, followed by a registration with the Social Security Fund (CSS) (Article 87 of Law 51 of 2005)

Step 5: Open a corporate bank account

As controversial as Panama’s banking legislation may seem, it’s also one of its strongest assets to attract foreign businesses as there are almost no reporting requirements (aside from the signed Tax Information Exchange Agreement with the US) or income taxation for offshore Panama corporations.

Furthermore, it’s one of the capitalist countries for corporate banking, housing 41 top-ranking Central American banks. It’s not a dead-set requirement to open a corporate bank account in Panama to conduct business on its soil as it’s still possible to open an offshore bank account in another jurisdiction that aligns better with your business.

To better know which offshore bank is the most suitable for your business, try our banking tool for a linear walkthrough of the selection process.

Other considerations to have during and after registration

High eligibility for friendly nation visa

For ex-pats looking to make a long-term stay in Panama, the nation offers the option of establishing residency through ownership of a lawfully incorporated corporate vehicle under the Friendly Nations program. It also includes providing residency to optional dependents, e.g., spouses, children up to 25 years old, and parents of the applicant.

Applicants will also have to go through a two-year provisional period to prove they have fully complied with statutory requirements to request permanent residency status. Note that the discontinuation/ dissolution of the corporate vehicle used for registration does not affect the applicant’s residency status.

FATCA compliance for U.S Citizens

The IRS is the most resilient and vigorous tax enforcement agency whose notoriety even permeates to some Hollywood flicks like Wolf of Wall Street. They have a reputation for having a non-compromising approach to maintaining tax nexuses with all professionals and corporate entities in the U.S.

All Americans (citizens or legal residents) who participate in any income or non-income-generating business activities are required to file a 5471 form.

This means that a rental property registered under a corporation that passively generates revenue can still be subject to tax filing with the IRS, a less than pleasant endeavor to say the least. For this reason, estate holding is severely restricted for U.S. business owners.

At the other end of compliance are banks whose duties include reporting to the IRS on an annual basis on the opened account information. Another global authority you will have to report to is the Financial Crime Enforcement Network (FinCEN) by filing an FBAR to clarify the amount of money and assets in your foreign accounts.

As you can already deduce, this thick layer of anti-money laundering deterrents makes it impossible to use nominative dignitaries for Americans when incorporating a business in any offshore jurisdiction including Panama.

Economic Substance Requirements

The start of 2019 saw a mass adoption of new economic substance (ES) provisions by key offshore jurisdictions as a response to global legislative encroachment on financial transparency.

It has two prongs of compliance, the business entities incorporated within any ES-enacted jurisdictions and the jurisdictions themselves as governing figures.

Panama is among the latest members in the list of offshore jurisdictions that have adhered to ES requirements, effectively elevating the transparency of its corporate landscape.

The scope of compliance varies across jurisdictions but generally centers around substantiating the core income-generating activities (CIGA) along with an aptitude for business activities such as management, control, operation, etc.

Visit our site for a more detailed guide to Economic Substance requirements and regulations.

BBCIncorp – Your trusted partner for incorporating a Panama company

Embarking on your business journey in Panama can unlock numerous opportunities, but the incorporation process involves a range of legal, administrative, and compliance steps that may seem overwhelming — especially for foreign investors unfamiliar with local regulations. That’s where BBCIncorp becomes an invaluable partner.

With extensive experience assisting entrepreneurs and global businesses, BBCIncorp offers comprehensive, end-to-end support tailored to your specific needs. From choosing the right business structure and preparing incorporation documents to obtaining your Tax Identification Number (RUC), securing your Operation Notice, and ensuring municipal registrations, we guide you through every stage of setting up a Panama corporation with clarity and confidence.

Beyond incorporation, our services extend to essential post-registration support, including bank account opening assistance, accounting and compliance solutions, and ongoing corporate maintenance.

Our team’s deep understanding of Panama’s legal and tax landscape ensures that your company is structured efficiently — helping you maximize tax advantages, protect assets, and operate in full compliance with local laws.

Whether you’re seeking a strategic base for regional expansion, an advantageous tax environment, or a reliable jurisdiction for international operations, BBCIncorp streamlines the process so you can focus on what matters most: growing your business in Panama with a trusted partner by your side.

Conclusion

Even with the explanation, registering a Panama corporation can still be confusing for those unfamiliar with the jurisdiction and its legal infrastructure.

For this reason, we offer our clients professional help in the form of free consultation services and specialized Panama offshore services to further streamline the registration procedure.

Get in touch with our team for further consultation on your business via service@bbcincorp.com or leave a message in our chatbox.

Reference:

(1) https://www.reuters.com/world/americas/panamas-economic-growth-slows-29-2024-after-key-mine-closure-2025-03-19/

(2) https://newsroompanama.com/2025/08/26/the-imf-projects-4-5-growth-for-the-panamanian-economy-in-2025/

(3) https://gedeth.com/blog/2025/04/07/panama-economic-landscape/

Frequently Asked Questions

What are the types of Panama companies?

Panama offers several business structures, including:

- Corporation (S.A.) – Most common for trade and investment.

- Limited Liability Company (S.R.L.) – Popular with small businesses.

- Branch Office – Extension of a foreign company.

- Private Interest Foundation – For asset protection.

- International Business Company (IBC) – For offshore activities.

What are the special economic zones in Panama?

Panama has established several special economic zones to attract foreign investment and promote trade. Key special economic zones include:

- Colon Free Zone (CFZ) – Global trade and re-export hub.

- Panama Pacifico – Focused on logistics, services, and manufacturing.

- Other regional zones – Support agroindustry, logistics, and industrial development.

Are there any disadvantages of doing business in Panama?

While Panama is highly attractive for its tax benefits and strategic location, there are some drawbacks to consider. Bureaucratic procedures can be time-consuming, banking regulations are strict, and legal processes may move slowly.

Additionally, language barriers and reputational issues linked to offshore activity can pose challenges for some businesses.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.