Table of Contents

Overview of an offshore brokerage account

An offshore brokerage account is a financial account held by an individual or entity in a foreign country, typically one with favorable financial and regulatory conditions. These accounts are used primarily for investing in various financial instruments such as stocks, bonds, mutual funds, and other securities.

Typically, you initiate the process of opening a brokerage account with a brokerage firm. Once you’ve funded this account, whether through cash or credit sources, you gain the ability to engage in trading and exchange various types of investment securities at your discretion.

Purposes of offshore brokerage account

Offshore brokerage accounts serve various purposes, with some common intentions being:

- Investing, holding, and trading stocks, bonds, forex, securities, or other financial instruments;

- Engaging in a diversity of flexible transactions with different accounts;

- Enjoying tax advantages resulting from the offshore status;

In essence, an offshore brokerage account gives you the ability to manage your investments internationally, potentially benefiting from favorable tax conditions and a wide range of investment options.

Offshore vs Domestic brokerage account

Offshore brokerage accounts are distinct from domestic brokerage accounts, which are held within the investor’s home country.

If you’re wondering about the distinctions between offshore and domestic brokerage accounts, we’ll break down the key differences for you:

Offshore brokerage account

- Requires a high minimum deposit

- Offers flexibility in choosing financial instruments and provides extensive investment options

- Permits the use of multiple foreign currencies

- May come with advantageous tax treatment and operates under a more open regulatory framework

- Carries a higher level of risk

Domestic brokerage account

- Has a low minimum deposit requirement

- Provides access to a limited range of financial instruments and investment choices

- May not allow the use of multiple foreign currencies in some cases and typically doesn’t offer tax benefits

- Operates under a stricter regulatory framework

- Tends to have lower associated risks

Offshore brokerage account: Benefits and Drawbacks

There are both pros and cons to opening an offshore brokerage account:

Benefits

- Global flexibility: With an offshore brokerage account, you can invest and earn returns from anywhere in the world at your convenience. Unlike domestic accounts, offshore accounts offer a wide range of investment options, including stocks, bonds, futures, forex, exchange-traded funds, mutual funds, and more.

- Tax advantages: Offshore brokerage accounts can provide significant tax benefits and incentives for businesses, especially in terms of capital gains tax exemptions. This can result in substantial tax savings for investors.

- Asset protection: In some domestic jurisdictions, regulatory instability can pose a risk to your financial assets. By holding your assets in stable offshore jurisdictions like Hong Kong or Singapore, you can enjoy enhanced security and protection for your investments.

- Enhanced privacy: Offshore laws often establish strict corporate and banking confidentiality frameworks to safeguard the privacy of account holders. This ensures that your financial information remains confidential. Additionally, offshore accounts offer access to international markets, enabling diversification of investment opportunities without income-related restrictions.

To get a good understanding of offshore bank accounts, simply check out our article on the 8 benefits of offshore bank accounts that you must read.

Drawbacks

- Opening costs: The initial cost of opening an offshore brokerage account can be higher compared to domestic accounts. The specific fees vary depending on the chosen jurisdiction and broker.

- Initial deposit requirements: Different brokers have varying requirements for the initial deposit. Some online brokers may allow you to start an investment account with no initial deposit or at a minimal cost, while others may demand minimum investments ranging from $100,000 to $1 million.

- Financial risks: Utilizing a margin account, as explained in section 5.2, can introduce potential risks to your offshore brokerage account. Furthermore, improper use of offshore brokerage accounts can unexpectedly lead to financial crises.

- Legality concerns: Offshore investments have a history, both positive and negative. Questions about the legality, morality, and safety of such accounts have piqued the interest of the business world. Due to instances of tax evasion through offshore channels, many countries, particularly in the United States and Europe, have tightened their tax laws.

If you’re considering opening an offshore investment account through a reputable brokerage and you’re in full compliance with the law, you can have confidence in your decision. However, it’s essential to note that navigating tax laws may require some extra attention.

In practice, it’s crucial to select a well-respected offshore jurisdiction to manage your assets. Make sure you’re fully compliant and well-prepared, including conducting thorough due diligence. With these precautions in place, you can confidently proceed and make the most of the investment opportunities offered by offshore brokerage accounts.

Interested in opening an offshore brokerage account?

Feel free to chat with our support team for practical guidance. Our banking service is tailored to meet your specific needs, ensuring a swift path to achieving your financial goals.

Types of offshore brokerage accounts

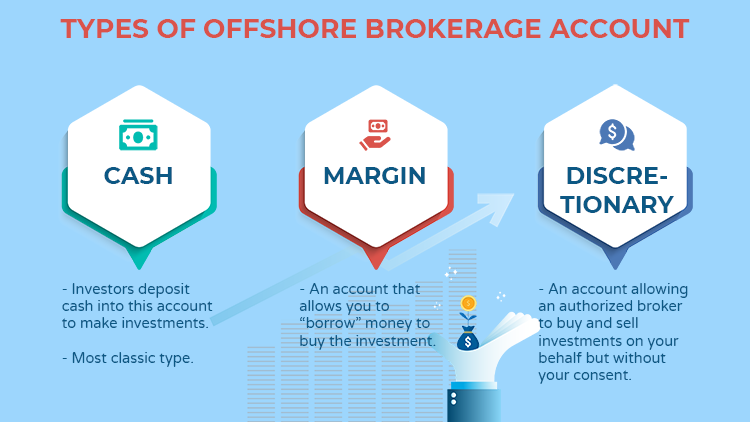

Overall, there are three types of brokerage accounts that you should know. They are:

- Cash account

- Margin account

- Discretionary account

In what follows, we will learn the key features of each type!

Cash account

To begin with, a cash brokerage account means you deposit cash into the account to make investments as well as enter transactions.

For example, if you want to buy a stock at the price of $3,000, you must have that full amount in your cash account to make the investment purchase.

Furthermore, in some cases, you also need to prepare the commissions to order the trade in advance.

In general, the cash account is the most classic type of brokerage account. Most brokers will automatically set out and register this type of brokerage account for you.

Whether you wish to upgrade your account to another type or not will be left to the brokers’ discretion.

Margin account

While a cash account only accepts cash and the brokerage firm will not lend you any money, a margin account is another approach.

With a margin account, the brokerage firm will allow you to “borrow” money to buy the investment you want.

For instance, if you open a margin account and want to buy the stock at the price of $3,000, you can place in your account the cash amount of $2,000 and borrow from the brokerage firm the remaining $1,000 to buy.

Although you can borrow the amount with low-interest rate loans and flexibly manage the trade settlement for your investment, there will be higher risks of losing money.

Consequently, the broker who lends you money will hold the right to sell your investments to cover the deficits without any acceptance from you, especially in the case that your own investment fails or decreases in value.

Discretionary account

Basically, a discretionary account is an account allowing an authorized broker to buy and sell investments on your behalf but without your consent.

It appears to be common that discretionary account is suitable for those with a large investment portfolio, but not self-directed investors.

We’ve summarized the key highlights of the above-mentioned brokerage accounts:

Cash account

- Must have full cash amount in the account

- Good for beginning investors

- Low-level risks

Margin account

- Just need a part of the cash amount in the account, the other can be “borrowed” from the broker

- Suitable for those seeking flexible trade settlements

Discretionary account

- The authorized broker will hold full right to decide the investment purchase of the account

- Fit for those with a large investment portfolio and who need to hire an advisor for management

Countries for offshore brokerage account

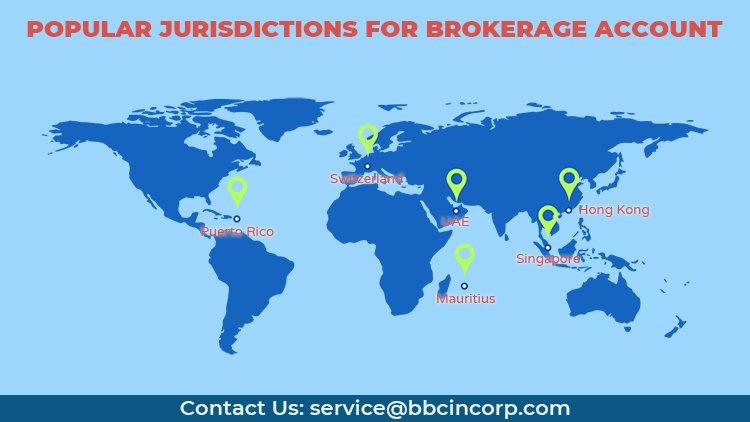

Several countries and jurisdictions are popular choices for opening offshore brokerage accounts due to their favorable financial regulations, tax benefits, and investor-friendly environments.

Some of the commonly considered countries for offshore brokerage accounts include Switzerland, UAE, Mauritius, Singapore, and Hong Kong.

Switzerland: Known for its strong banking and financial services sector, Switzerland offers stability, privacy, and a well-developed infrastructure for offshore banking and investing. It has a long history of financial expertise.

Singapore: The country is a global financial hub known for its political stability, strong regulatory framework, and well-developed financial services industry. It is a popular choice for offshore investments in Asia.

Hong Kong: With its strategic location and robust financial sector, Hong Kong is another popular choice for offshore brokerage accounts in Asia. It offers access to Asian markets and a competitive business environment.

United Arab Emirates (UAE): The UAE, particularly Dubai and Abu Dhabi, has emerged as a significant financial center in the Middle East. It offers favorable tax policies and a growing financial services industry.

Mauritius: The country is often chosen for offshore investments due to its tax treaties, which can help reduce withholding taxes on dividends and interest. It also provides political stability and a favorable regulatory environment.

Investors often use both offshore bank accounts and offshore brokerage accounts together to achieve diverse financial and investment goals.

For more information on this topic, you can explore a list of the top 9 countries with best offshore bank account.

The bottom line

In a nutshell, opening an offshore brokerage account has both benefits and drawbacks. So if you are looking for offshore investment via a brokerage account, you’ll need meticulous planning and financial preparation.

Additionally, to make the most of its benefits regarding the legality, tax implication, better asset protection, or international investment opportunities, you should choose a reputed offshore jurisdiction and brokerage firm to work with.

Please note that the information presented in this blog is for general use. If you as an investor are seriously putting opening an offshore brokerage account into consideration, please engage professional experts for practical advice on your circumstances.

Feel free to get in touch with us via service@bbcincorp.com if you have questions concerning offshore brokerage accounts!

Frequently Asked Questions

What is offshore trading?

Offshore trading refers to the practice of buying and selling financial instruments, such as stocks, bonds, currencies, commodities, and other securities, through brokerage accounts located in foreign countries or offshore financial centers.

It is a strategy employed by individuals and entities to take advantage of certain benefits and opportunities offered by offshore financial jurisdictions.

Is offshore brokerage account necessary for offshore trading?

An offshore brokerage account is not strictly necessary for offshore trading, but it is a common and convenient way to facilitate offshore trading activities. Offshore brokerage accounts are specifically designed to provide access to international financial markets and offer certain advantages, such as tax benefits and asset protection, which can be appealing to offshore traders.

What is an offshore brokerage firm?

Offshore brokerage firms are financial institutions or companies that provide brokerage services to clients who wish to invest in international financial markets and assets, often in offshore or foreign jurisdictions. These firms specialize in facilitating offshore trading and investment activities, offering a range of services to help clients access global markets while taking advantage of various benefits offered by offshore financial centers.

Can I use an offshore brokerage account for offshore stock trading?

Yes, you can use an offshore brokerage account for offshore stock trading. These accounts are purpose-built to make it easy for you to trade in global financial markets, which includes purchasing and selling stocks that are listed on foreign stock exchanges.

With offshore brokerage accounts, you gain access to a broad spectrum of international stock markets. This means you have the opportunity to invest in stocks from a variety of countries and regions worldwide.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.