Table of Contents

What is a trust and offshore trust?

What is a trust?

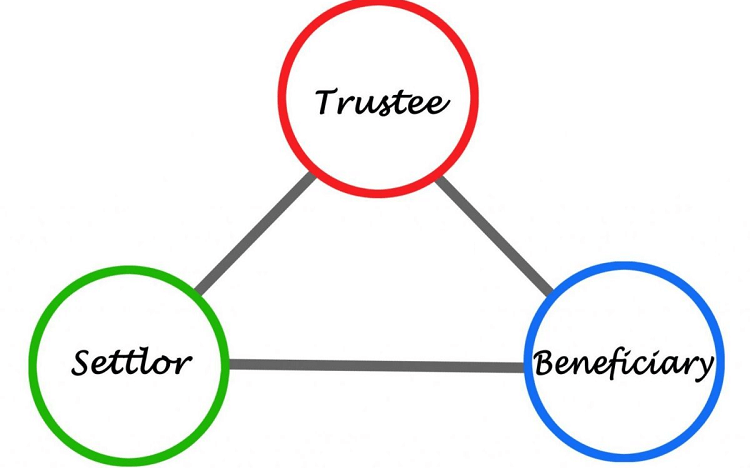

A trust is a legal arrangement when a person transfers his/her property to another person or legal entity for the benefit of the third party. It is a common concept to indicate a three-way fiduciary relationship among Settlor, Trustee, and Beneficiary.

“Deed of Trust”, also known as a Declaration of Trust, is a written legal document that outlines specifics of how assets would be used and distributed upon the agreement of the first two parties (the settlor and the trustee) of the trust.

The trust is commonly used for the purpose of ensuring all assets of the trust will be protected and managed properly under the legal obligation and in line with the desires of the Trust Settlor.

What is an offshore trust?

Offshore trust for asset protection is more widely used than a domestic trust for the same purpose. The term “offshore” simply indicates its difference from the trust. An offshore trust is a trust created in another jurisdiction that is different from where its settlor is residing. It is, therefore, set up and regulated in accordance with the laws and regulations of that particular offshore jurisdiction.

Offshore trust vs. Onshore trust

An offshore trust bears a striking similarity in respect of its nature as well as its effects on its onshore counterpart. Both have the same components within their structures, of which functions, responsibilities, and types of trusts also remain the same.

- Settlor creates the trust and transfers assets of the trust

- Trustee receives trust assets from the settlor and manages them for the benefit of the third party

- Beneficiary benefits from trust assets

- Other components (“Protector” for example) (optional)

Details of each component will be further discussed later.

Notwithstanding, there are some differences between offshore and onshore trusts.

In most cases, foreign asset protection trust, especially when it is set up in tax havens, is not imposed on income tax or capital gains deriving from the trust’s property of assets. By contrast, an onshore trust is tightly attached to its local tax compliance, court rulings and does not enjoy favorable tax advantages like in foreign trusts.

Offshore trusts are more likely to offer stronger protection for the trust assets and higher level of confidentiality in comparison with the onshore ones.

Offshore trust structure: Settlor, Trustee, Protector & Beneficiary

Unlike the conventional three-way fiduciary relationship – like the way that people often thought when it comes to the nature of an offshore trust structure, the emergence of the fourth component in recent years have helped many offshore trusts to run more effectively. That is Trust Protector (note that it is not a mandatory requirement for all offshore trusts to appoint their protector).

For this reason, we will outline four components in a popular offshore trust structure: Settlor, Trustee, Beneficiary and Protector (optional).

Settlors

- The person or entity that creates and owns the assets of the offshore trust

- Settlors are also known as grantors, trustors, trust-makers, donors, depending on different legal systems and their convention uses

- Main responsibilities:

- Make the decision to form the offshore trust

- Give clear instructions on the property to transfer; identities of all beneficiaries; rights and duties of the trustees, etc

- A settlor can act as a beneficiary (third party) and a co-trustee of the offshore trust

Trustees

- The person or entity that holds the assets for the benefits of the beneficiaries

- Typically, a trustee is a financial institution or a licensed trust company

- Main responsibilities:

- Hold legal title to the offshore trust assets

- Superintend the administration of the trust under legal obligations

- Act with due diligence, observe good faith of the offshore trust & look after the trust in any case against debtors

- Exercise powers solely for the benefits of the beneficiaries. The trustee’s power is limited to distribute assets only to the intended beneficiary, but NOT to use the trust assets for his/her own ends

Beneficiaries

- The third party who benefits from the trust

- Such benefits and profits from the offshore trust assets are held and administrated by the trustees

- Main responsibilities:

- Terms and conditions for the distribution of trust assets to each beneficiary must be specified clearly in the Deed of Trust

- Beneficiaries can freely use the asset/property given from a trust, such as sell or assign them to other people

Protectors

- The person who oversees the operation of the offshore trust

- Main responsibilities:

- Supervise the trustees

- Ensure that the offshore trust assets are managed properly

- Under some specific circumstances, the protector can replace the trustee

- Functioned as an advisor of the settlor

Offshore trust: Pros & Cons

Offshore trust is considered one of the best options for those seeking wealth management. Below are several key advantages that an offshore trust can bring back to you:

- Asset protection: This is a key benefit and a top priority for why people prefer setting up offshore trusts. Many experts believe that offshore trust can act as one of the strongest asset protection vehicles in the world as it offers more additional layers of protection that are not present in many home countries

- Tax benefit: Most offshore trusts can be found in tax havens, allowing you to enjoy great benefits from their favorable tax treatments. When placed in tax-free jurisdictions, offshore trusts will not be subject to incur local taxation such as income tax or capital gains generated from the trust property.

- Confidentiality: Placing your asset under an offshore trust, especially in a well-reputed jurisdiction with favorable trust laws typically assures stronger privacy regarding the details of the trust compared to domestic trust. Particularly, the Deed of Trust remains undisclosed to the public, guaranteeing the confidentiality for you trust particulars.

- Security: The fact that your assets are no longer kept under the local court system and government seizure will somehow bring you peace of mind, especially in the event of your home jurisdiction often falling into economic turmoil or crisis. Diversifying your property in another different location also helps you to minimize risks of mutable governance rules, such as tax reforms or banking regulations.

Also making wealthy individuals and corporations in favor of offshore trusts is by dint of its flexibility. Almost types of asset – businesses, cash, real estate, securities, gold to name a few, can be transferred to offshore trust assets.

It is a highlighted feature that the settlors of the offshore trust can include themselves as a beneficiary. The list of potential trust benefit-receivers is not limited to the settlor’s family relations. However, the distribution to each beneficiary must be stated clearly in the Deed of Trust as the aforementioned parts. Offshore trust can also be a good vehicle for estate planning.

On the other hand, offshore trusts have some disadvantages, chief of which is certain costs involved when you transfer your assets to offshore trusts. It appears to be common that the costs tend to be much higher than those for onshore trusts.

It can also be a matter of headache (in terms of tax rate) if you as a beneficiary of the offshore trust, wish to “repatriate” the asset– means bring back the money to your country of residence.

Best offshore trust jurisdictions

As the aforementioned, offshore trusts are often set up in low-tax or zero-tax jurisdictions. The more reputed the chosen jurisdiction is, the more secure your assets are and the more benefits your offshore trust can enjoy. Below are some examples of the best offshore trust jurisdictions where you are highly recommended for setting up your trusts:

- St. Kitts & Nevis

- St. Vincent & Grenadines

- Belize

- Seychelles

- British Virgin Island

- Cayman Islands

- New Zealand

- Switzerland

- Liechtenstein

Want to learn more about trust formation in Nevis or Saint Vincent? BBCIncorp can give you practical advice on required documents and a fuss-free service for your ideal offshore trust. Send us an email!

How to choose the right offshore trust jurisdiction

In order to determine which jurisdiction is the most suitable one for your offshore trust, you should consider some key factors or parameters:

- Trust Laws: Take a careful look into trust legislation of your considered jurisdiction for offshore trust. Trust legislation that is modern, friendly, and coherent will better respond to your business needs. It is common that most trust laws are originated from English Common Law, thus it is easy to understand why legal systems closely linked with English trust laws are widely-chosen by most trust seekers.

- The existing tax regulations: Favorable tax treatments from offshore trust jurisdictions are pull factors to foreign businesses. You should find out whether your company is subject to offshore company tax such as income tax, inheritance tax, estate tax or income tax or not.

- Political and economic stability: A economically and politically stable jurisdiction enables stronger security and assurance for your asset protection in an offshore trust.

- Confidentiality: Ensuring superb confidentiality is one of the important considerations when choosing the right offshore trust jurisdictions. Confidentiality offers an additional layer of protection for your assets, of which trust details are kept out of sight and reach from the public.

- Exchange controls: Ease of moving your funds in and out of the foreign country without much hassles caused by authority’s restrictions offers flexibility for your business, so it should also be considered when choosing your offshore trust jurisdiction.

Have you determined your offshore asset protection trust?

An offshore trust is regarded as one of the best asset management vehicles by virtue of its range of benefits including asset protection, confidentiality, security, tax relief. These outstanding benefits of an offshore trust make it distinct and more preferred than what its onshore counterpart offers. Having said that, notwithstanding, there are still several drawbacks concerning the cost of using offshore trusts.

The positives of having an offshore trust are obviously outweighing its negatives, but it is very important for you to choose the right offshore jurisdiction for setting up this structure. Please keep in mind to put your choice under careful scrutiny by looking into some key factors as we mentioned above to reach the best-suited option.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.