Table of Contents

Over the years, offshore companies have been widely recognized for their flexibility, tax efficiency, and ability to support global operations. They offer business owners the freedom to expand internationally while protecting assets and optimizing costs, advantages that make offshore structures a popular choice among global investors.

What is an offshore company, and why do so many entrepreneurs choose this model? This guide will help you understand the fundamentals of offshore formation, its key benefits, and practical steps to set up your own offshore company successfully.

Key Takeaways

- Offshore companies are legal entities formed abroad; they’re lawful when transparent and compliant.

- Key benefits: tax optimization, asset protection, privacy, quick setup, low maintenance.

- Common uses: international trading, holding/IP, some crypto (where allowed).

- Choose reputable jurisdictions with solid banking, treaties, and clear substance rules.

- Notables: Hong Kong, Singapore, BVI, Belize, Cayman, Seychelles.

- Mind strict compliance (FATCA/CRS, KYC/AML, CFC) and risks like double taxation, onboarding, and FX costs.

- Basics to set up: pick an entity, hire a trusted provider, complete KYC, register, open an account.

Part 1: The concept of an offshore company

What is an offshore business?

An offshore company is a business entity incorporated in a jurisdiction different from where its owners reside. Many entrepreneurs and investors choose this structure to benefit from favorable tax regimes, flexible legal systems, and a more stable economic environment abroad. Although the company must comply with the laws of the chosen jurisdiction, its owners can live and manage operations from anywhere in the world.

For instance, if you live in Singapore and establish a company in Belize, that entity would be considered an offshore company. Later, if you open another one in Hong Kong, you would then own two offshore companies registered in separate jurisdictions.

Common misconceptions about offshore companies

People usually clump the term offshore companies together with global crimes such as tax evasion or money laundering. But that is not true. The reason why they have such a negative image of offshore companies is due to their association with tax havens and money laundering activities.

Tax havens are jurisdictions that offer low or no taxes on income, as well as other advantages such as privacy and financial secrecy. This allows wealthy individuals and corporations to avoid paying taxes in their home countries.

As offshore companies are often registered in tax havens, they are seen as a way for people to evade taxes, which is why they have gained a negative reputation.

However, if used, offshore companies can offer a lot of growth opportunities for businesses all around the world. But before getting into the perks of setting up an offshore company, understanding how it works is also a crucial aspect.

How do offshore companies work?

Understanding how offshore companies work is key to seeing why they’re a popular choice for global entrepreneurs. In essence, these companies allow business owners to operate internationally while benefiting from favorable legal and tax conditions.

- Registration and jurisdiction: Offshore companies are incorporated under the laws of a foreign country that offer strategic benefits, such as low or zero corporate taxes and minimal reporting requirements. Common jurisdictions include the Cayman Islands, Belize, and Estonia. Once registered, the company is governed by the legal framework of that jurisdiction but may operate primarily in other countries.

- Operations and activities: An offshore company can perform a wide range of legitimate activities, including managing investments, trading internationally, owning intellectual property, or holding real estate. The flexibility of offshore structures allows owners to centralize operations while minimizing administrative burdens.

- Purpose and benefits: The main reasons for forming an offshore company include tax optimization, asset protection, and enhanced confidentiality. Many business owners also use offshore entities to gain easier access to global financial systems and to structure cross-border transactions efficiently.

- Legal Compliance: While offshore companies offer significant benefits, they must comply with the laws of both the offshore jurisdiction and the owner’s home country. Transparency, accurate reporting, and adherence to anti–money laundering regulations are essential to ensure the company’s legitimacy.

For instance, a business owner in Singapore may establish an offshore company in Estonia to benefit from its digital business infrastructure and favorable tax conditions. This setup enables global expansion without the heavy tax burden typically associated with domestic operations.

Part 2: The benefits of an Offshore in Business

“How can I benefit from an offshore company?” is a common question. Tax optimization lies on top of the list. But offshore companies can offer you more than that. Other typical benefits include better privacy, asset protection, ease of incorporation, and low-cost maintenance.

Tax Optimization

So why do many businesses choose to use offshore companies as a tool for tax optimization?

The goal of tax optimization is to reduce the amount of taxes owed by abiding by the laws and regulations that are in place in a particular state or country. So, to lower their portion of taxation, the taxpayer will utilize and benefit from the tax processes set in place by the State. Both individuals and businesses can utilize tax optimization to lower their tax obligations and fees.

A method or system is said to be optimized when it is improved with the goal of better performance and higher profitability. Tax optimization, as opposed to tax fraud, which is against the law, therefore refers to using the law to lessen the tax burden. Tax evasion, which involves misrepresenting one’s income to the Internal Revenue Service and entails employing illegal methods to avoid paying taxes, must also be separated from tax optimization.

The practice of yacht owners registering their vessels in nations where doing so is affordable and where overseas income is tax-exempt is an example of tax optimization. These methods are legitimate and are employed by individuals to lower their tax obligations.

So to reduce the ridiculous amount of tax rates such as 37.5% in Puerto Rico, 30% in Germany, and 33.33% in France, following the offshore path is the right choice.

You can search on Google and easily find out many places where the income tax is much lower than in your home country. These places can be grouped into 2 main categories: no tax and low tax.

No tax jurisdictions

If you aim for the former group, you should consider everything carefully. Some no-tax jurisdictions are changing their policies fast. They are starting to impose taxes and regulations on certain kinds of income and business activities. And some places have a really bad reputation in the business world. These are the ones you should avoid.

Bad-reputation jurisdictions would cost you a hard time opening a bank account and running your offshore company. In particular, banks in Singapore or Hong Kong are very concerned about opening an account for companies in tax havens. The same goes for customers and clients. They would also be concerned to do business with your company if it is incorporated in such jurisdictions.

The pressure is on choosing the right place. Incorporating in a wrong jurisdiction with unsuitable policies can cost you severe consequences and a waste of resources. That’s why thorough planning and research are a must (or at least the right consultation from real professionals).

Example

Here is an example of offshore planning:

You open a company in the British Virgin Islands (BVI) to provide services overseas. You also establish your company’s management in another country to make it not a BVI resident for tax purposes. These will ensure no corporate tax will be paid in this jurisdiction.

And since BVI has a fair reputation, you can open a corporate bank account in Singapore. This will allow your company to receive money from customers with ease.

If necessary, you then need to establish your tax residency in another country where you can receive your business money without being taxed.

Low tax jurisdictions

On the other hand, there are low-tax countries. They are more stable, well-recognized, and respectful when compared to tax havens (certain tax havens are changing their regulations – we will discuss this matter later in this blog). Companies incorporated in Singapore or Hong Kong can easily open their bank accounts and do business in many other places, as these countries are known to have good reputations and well-structured legal frameworks.

Many low-tax countries adopt a territorial tax system. This means only the income generated from within these countries is subject to tax (while foreign-sourced income is not). Furthermore, these countries usually have a network of international tax treaties, which can bring you tax reductions and even exemptions. These are a big plus besides their minimal tax rates.

So, if you accept paying a small amount of tax in return for respect and stability, low-tax jurisdictions can be the right choice.

Explore the list of top 5 countries with no income tax that you should know.

Better privacy

Generally, it is a must for companies to register and maintain their profiles and data with the Company Registrar. However, you can feel secure as all information of identity would be kept confidential.

Many offshore countries shall not disclose the company’s beneficial owners, directors, and shareholders to the public, except in certain cases like a court order or international arrangements between related overseas jurisdictions.

Asset protection

Many jurisdictions provide an excellent cover for your assets. Besides financial privacy policies, you can benefit from the foreign judgment denial. This means, your assets are shielded against the judgment made by foreign courts. Only the court of the incorporation jurisdiction can place a judgment on the assets.

For instance, if you formed a trust in Belize, the trust’s property would be shielded from any claim according to the law of another jurisdiction. The only judgments that are recognized in Belize are those made by the Belize government. Trust is one of the most ideal vehicles for your asset protection.

If you looking for a business vehicle for asset protection, look no further than offshore trust.

Some other common offshore centers that offer financial privacy are the BVI, Seychelles, Cayman Islands, and Nevis.

Ease of incorporation and maintenance

The offshore incorporation process is rather simple and fast. You can register a company in certain countries just within a few days. The incorporation requirements are normally very minimal.

The best thing is that many service providers out there can help you with registration. All you need to do is find a trustworthy provider, pay for service, and supply the necessary documents. They will go on and register the company on your behalf. You do not need to travel or care about the hassle of paperwork.

As for company maintenance, it varies according to different jurisdictions. However, you can expect the reporting requirements to be very minimal too. Some countries also offer many exemptions for small businesses regarding annual compliance. You can always get help from outsourcing services to relieve the burden of accounting or tax filing requirements.

Legal Protection

Establishing an offshore company separates the business from its owners, as it is incorporated under the laws of a foreign jurisdiction. This separation helps protect company assets from ordinary domestic claims, making it difficult for creditors or litigants in the owner’s home country to enforce local court orders directly.

Most offshore jurisdictions impose strict rules that prevent foreign judgments from accessing company assets unless there is clear evidence of criminal wrongdoing. By operating transparently and complying with local laws, owners can use offshore structures as an effective tool for asset protection and long-term business security.

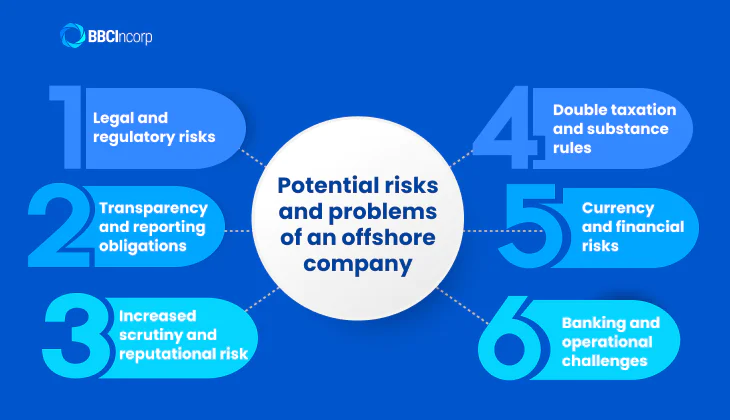

Part 3: Potential risks and problems of an offshore company

Using an offshore company for tax optimization or business exp expansion can bring strategic advantages, but only when you fully understand its challenges and limitations. Below are the key risks and problems associated with offshore structures.

Legal and regulatory risks

While offshore companies are legal when properly registered and compliant, using them to evade taxes, conceal assets, or launder money is strictly illegal and subject to severe penalties. Business owners must ensure that all operations align with both the laws of the offshore jurisdiction and the regulations of their home country.

Many jurisdictions have also adopted economic substance requirements, meaning companies must demonstrate genuine business activity — such as having employees, offices, or operational expenses rather than existing solely on paper. Non-compliance can result in fines, loss of good standing, or even dissolution.

Furthermore, international frameworks like FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard) have made global tax transparency a norm, requiring disclosure of beneficial ownership and financial information across borders.

Transparency and reporting obligations

Offshore entities are no longer as private as they once were. Most countries now require their residents or citizens to declare foreign assets and offshore income to domestic tax authorities. This makes true anonymity nearly impossible.

Additionally, many offshore jurisdictions enforce annual reporting obligations, such as filing financial statements, shareholder details, or director information. Failure to comply may lead to financial penalties, reputational damage, or the revocation of company status.

Increased scrutiny and reputational risk

Global authorities and tax agencies have intensified their scrutiny of offshore structures. Entities incorporated in tax-neutral or low-tax jurisdictions are often subject to enhanced due diligence by regulators, banks, and business partners.

Offshore companies can also face negative public perception. Since scandals like the Panama Papers and Paradise Papers, the term “offshore” is sometimes associated with tax evasion or corruption. Even when used legally, this perception can harm credibility with investors, clients, and regulators.

Double taxation and substance rules

Double taxation arises when income is taxed both in the offshore jurisdiction and the home country. Companies should assess whether Double Taxation Agreements (DTAs) exist between the two jurisdictions and seek professional advice to minimize exposure.

In addition, some countries apply Controlled Foreign Corporation (CFC) rules, which attribute offshore income back to the parent company for taxation. To mitigate such risks, businesses must structure their offshore entities with clear substance and commercial justification.

Currency and financial risks

Since offshore companies often operate in foreign currencies, they are exposed to exchange-rate fluctuations that can affect profit margins. Regular monitoring and hedging strategies are essential to manage these risks effectively.

Currency conversion fees and cross-border transaction costs should also be factored into financial planning, as they can reduce overall profitability.

Banking and operational challenges

Banks now impose strict Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. Without transparent ownership or clear business activities, applications may be rejected or accounts suspended.

Operational costs can also be higher than expected. Legal, accounting, and compliance fees combined with ongoing administrative duties often outweigh the perceived tax savings.

Lastly, selecting the wrong service provider or corporate agent can expose you to fraud, data breaches, or compliance failures. Partnering with a reputable firm with proven offshore expertise is therefore crucial.

Part 4: Types of Offshore Business Models

Now you get the idea of an offshore company meaning and its pros and cons. Let’s go deeper into the common particular use of them.

Trading business

Using offshore companies for trading business purposes is very popular. With the development of technology, now you can set up an online business without any hassle. You can register your offshore company in one country, get supplies from another and sell them to a third nation while managing your company right at your home.

When choosing a jurisdiction for international trading, here is what you should consider:

- The tax policies

- The incorporation process and filing reports

- The requirements for licenses and permits

- The targeted markets and other related issues

- Certain existing international rules and regulations

Hong Kong and Singapore are 2 good examples. They follow a territorial tax system and have a network of international tax treaties. These tax treaties bring you reduced tax rates and even tax exemptions on certain kinds of income when it is transferred from one signing country to another.

Hong Kong is the gateway to a huge potential market in China. Meanwhile, Singapore has one of the best banking systems and financial services in the world. These are the typical characteristics that can greatly benefit your trading business on a global scale.

Read more about the offshore company for international trading and things to consider.

Holding business

Your offshore company can hold several shares in another foreign company and receive dividends as a main source of income. It can also hold other types of assets like patents and trademarks, rent them or sell them overseas to make profits.

For holding businesses, you should consider countries with strong intellectual property (IP) regimes to ensure privacy and protection for your assets. An additional network of international tax treaties is a plus. Don’t forget to look into the international rules and how dividends, royalties, and other related income are taxed in both your place(s) of incorporation.

To get a good idea of how to use and where to form an offshore holding company, simply check out our article.

Cryptocurrency

Cryptocurrency is now more popular than ever. It is being traded in and out due to the potential for huge profits. More and more offshore companies are being used as a vehicle to enhance greater benefits for cryptocurrency transactions.

However, you should beware that setting up a cryptocurrency-related business is not so easy. Many jurisdictions do not allow crypto-related activities. And opening a bank account for a crypto company can be a real pain.

Find out more about the pros and cons of an offshore company for cryptocurrency.

Part 5: Common jurisdictions to set up an offshore company

There is no such thing as one best offshore jurisdiction that all entrepreneurs agree on. Every offshore jurisdiction has its own set of policies and related regulations. Thus, each one brings you different advantages that fit your current needs.

When you choose a jurisdiction for offshore incorporation, you should consider the following matters:

- Main goals when opening an offshore company

- Stability and reputation of the jurisdiction

- Taxation (low tax or no tax, and the availability of other tax benefits)

- Investment opportunities (the markets and government treatments)

- Type of business entity

- Incorporation process (processing time, incorporation requirements, and cost)

- Annual maintenance requirements and fees

- Citizenship (if you plan to live there permanently)

- We have listed out some popular countries where you should take into account for your offshore company incorporation:

Territories in Europe

European territories are known for their strong legal systems, business-friendly environments, and global credibility, making them ideal destinations for offshore company formation.

- United Kingdom: The UK is ranked in the top 10 nations worldwide for ease of doing business by the World Bank. A large network of tax treaties (with 130 countries) is also an advantage of this country.

- The British Virgin Islands: BVI and the Cayman Islands share many common features. But a plus is that the incorporation cost in the BVI tends to be much more affordable than that in the Cayman Islands.

Key advantages of establishing an offshore company in Europe:

- Strategic geographic position, allowing easy management of European and global operations.

- Stable political and economic systems, ensuring long-term business security.

- Extensive double taxation agreements that help reduce international tax liabilities.

- Strong financial and legal frameworks promote transparency and investor confidence.

- Modern banking and digital infrastructure enable smooth international transactions.

Financial Hubs in Asia

Asia hosts some of the world’s most dynamic and trusted financial centers, offering exceptional opportunities for business offshore formation. These jurisdictions combine political stability, modern infrastructure, and strategic access to regional and global market.

- Hong Kong: Startups, SMEs, and foreign investors are big fans of Hong Kong. Two key highlights to urge business people to move to Hong Kong: The two-tier profits tax system, and its strategic location as a gateway to Mainland China.

- Singapore: This is a promising destination for offshore seekers, especially fintech enterprises. Its reputation, supportive trading platforms, and friendly tax regime are persuasive reasons leading Singapore to a top of choice. To explore the full process in detail, you can read more about how to set up an offshore company in Singapore.

Advantages make Asia’s financial hubs ideal for businesses:

- Low and transparent tax regimes, enabling companies to retain more profits from overseas operations and reinvest efficiently.

- Extensive double taxation treaties, helping businesses minimize cross-border tax liabilities and streamline global financial management.

- Fast and efficient incorporation process, allowing companies to set up and begin operations within a few working days.

- Advanced financial and banking infrastructure, supporting multi-currency transactions, digital payments, and secure fund management for international clients.

- Robust investor and intellectual property protection, ensuring business assets and innovations are legally safeguarded.

- Strategic geographic location, providing direct access to key Asian markets such as China, India, and ASEAN countries, while maintaining strong global connectivity.

Islands in the Caribbean and Pacific

The Caribbean and Pacific islands are among the most sought-after offshore jurisdictions, known for their tax efficiency, privacy protection, and investor-friendly frameworks.

- Belize: If you are looking for an offshore jurisdiction with a competitive price, fast incorporation, and ease of banking needs, do not miss out on Belize in your consideration list.

- Cayman Islands: Located in the western Caribbean Sea, this is a very common choice for most foreign investors who are seeking tax-free benefits.

- Seychelles: The country is positioned as a place of favor for manufacturing and trading between Africa, Europe, and Asia. Incorporating a Seychelles IBC is an option to go among many choices of a tax haven.

Each island offers distinct advantages that cater to specific business and asset management goals.

- Zero or low corporate tax regimes enable international companies to optimize profits while maintaining full legal compliance.

- Efficient company formation process, with jurisdictions like Belize allowing incorporation within a few days and minimal documentation.

- Comprehensive asset protection laws, as seen in the Cook Islands, which help shield wealth from litigation or external claims.

- High level of confidentiality, where ownership and financial details remain securely protected under strict privacy statutes.

- Well-regulated financial ecosystems, particularly in the Cayman Islands, which serve as a leading center for hedge funds and global investment vehicles.

- Operational flexibility, with jurisdictions such as Nevis allowing versatile company structures that support both small businesses and large holding firms.

Unlock our full comparison of the 20 best offshore company jurisdictions with the key characteristics of each. Or, you can discover in detail the top 6 best offshore company jurisdictions for foreigners.

Part 6: How to set up an offshore company?

After finalizing the place of incorporation and having your offshore plan ready, the next step is to set up your company. Here is the general incorporation process. Please note that things may get slightly different according to different jurisdictions.

Choose the type of business entity

There are tons of different types of business entities. Each type will bear different key characteristics. When choosing your type of entity, you should consider the following aspects:

- The entity’s legal status

- The liability of the entity

- The tax and other benefits of the entity

Tip

The advice is to go for the type of company that has a separate legal status.

Establishing an offshore company separates the business from its owners, as it is incorporated under the laws of a foreign jurisdiction. This separation allows the company to hold its liabilities, enter into contracts, buy or sell property, take loans, and be sued or sue in its own name, while owners are not personally liable beyond their capital contributions. Such a structure helps protect company assets from ordinary domestic claims, making it difficult for creditors or litigants in the owner’s home country to enforce local court orders directly.

Most offshore jurisdictions impose strict rules that prevent foreign judgments from accessing company assets unless there is clear evidence of criminal wrongdoing. Depending on your business goals, different structures may offer additional benefits, so it is important to understand the types of offshore companies and choose the one that suits your situation.

Get a professional service provider (Recommended)

Setting up an offshore company can be complex, as each jurisdiction has its own incorporation requirements and processes. While it’s possible to register a company on your own, hiring a professional service provider saves significant time and effort. These providers are experienced in handling all paperwork, KYC procedures, and filing applications with local authorities, often offering complete packages that cover post-incorporation support such as bank account setup and tax compliance.

By using a trusted provider, you can complete the entire process online without travel, ensuring your offshore company is established correctly and efficiently. For a reliable and hassle-free solution, consider the offshore company formation services offered by BBCI, where professionals manage everything from registration to ongoing compliance.

Do KYC procedure

Upon successful payment for the service, the provider will ask you to provide certain kinds of information and documents. This is known as the know-your-customer procedure (or KYC). Normally, the required documents include:

- The address proof of the shareholders and key members

- The company name

- The main business activities

- Other supporting documents (if needed)

Once collecting everything needed, the service provider will start to register an offshore company on your behalf. They will proceed to file an application and submit it to the local government for approval.

If you aim to do it by yourself, you will need to file everything and submit it to the local company registrar.

Learn more about the whole process of setting up your offshore company in 4 simple steps.

Part 7: The fast-changing of offshore landscapes

The offshore environment has changed a lot. This is a result of the practices of the EU and the OECD during recent years. To align with the accepted EU standard, there has been a massive transformation concerning taxation and company legislation in some landscapes that we often called “offshore” jurisdictions. What are the remarkable changes?

Removing ring-fencing

This is one of the very first responses that many countries considered when it comes to the adjustments of preferential tax regimes.

Gone are the days when International Business Companies in many traditional financial hubs like Saint Vincent and the Grenadines are ring-fenced. These days you can find that both residents and non-residents get the right to start a business with this type of company, and they can trade with local residents as well.

Economic substance rules

A large number of companies are reaping benefits from a favorable tax regime, but importantly they have no economic substance in the jurisdiction. The debates arose as people need more transparency and clarification on the legality of offshore structures. Many well-known offshore business centers have been increasingly taking step by step to implement the economic substance regime.

Generally, economic substance requirements are applicable for certain businesses such as pure equity holding companies, financial services, banking and insurance businesses, regulated businesses, and so forth. The economic substance rule was enacted in many offshore jurisdictions such as Belize, The Cayman Islands, The BVI, and many others.

Beneficial ownership regulation

Further legislative adjustments to the offshore industry can also be found in the presence of the Beneficial Ownership Act in several countries. Accordingly, in-scope companies in places where this rule came into force must verify the identity information of their beneficial owners to the competent authority via their registered agents.

Learn more about the Beneficial Ownership Rule: An AML Compliance Guide.

Those are some key changes to offshore landscapes you can find recently. For better improvements towards transparency, you, as non-resident entrepreneurs, may expect to witness more revisions and updates in the upcoming time. The advice for you, please spend time examining the system of law in relevance to your offshore company jurisdiction before moving.

Or, again, seek advice from professionals who will let you know what should be done with your offshore planning.

Comprehensive Offshore Company Formation Services at BBCIncorp

Expanding your business internationally can be challenging without the right guidance. BBCIncorp offers professional offshore company formation services that simplify the process while ensuring full compliance with local laws.

- Digital client portal: Track your incorporation progress online anytime, anywhere.

- Dedicated support: Expert guidance from incorporation to post-registration services.

- Streamlined process: Fast-track registration with minimal paperwork and e-signature support.

- Comprehensive packages: All-in-one solutions including KYC, licenses, and banking setup.

- Global coverage: Incorporation services in over 15 countries with local expertise.

Register Your Offshore Company in Just 4 Steps

BBCIncorp simplifies the process into four clear steps to ensure a smooth and successful formation.

- Step 1: Determine the right legal business entity: We get expert guidance to choose between Limited (Ltd), Limited Liability Company (LLC), or International Business Company (IBC).

- Step 2: Choose the company name: Our team ensures your chosen name is unique and compliant with the requirements of your jurisdiction.

- Step 3: Legalize your company registration: BBCIncorp registers necessary business licenses and permits to operate legally in your chosen location.

- Step 4: Open a business account: We set up a traditional bank account or fintech solution to efficiently manage company transactions.

Offshore Company Formation Packages & Pricing at BBCIncorp

BBCIncorp offers transparent, flexible packages tailored to different business needs. Each package includes incorporation, KYC verification, and optional post-registration services such as bank account opening and corporate compliance support.

| Jurisdiction | First Year Fee | Annual Fee |

| Africa | $669 – $1,999 | $649 – $1,849 |

| Americas | $449 – $2699 | $639 – $2,799 |

| Asia | $2,999 | $2,999 |

| Europe | $549 – $1,899 | $499 – $1,399 |

| Oceania | $929 | $899 – $909 |

* Note: Annual fees do not include economic substance filings if applicable.

Understanding what is an offshore company helps entrepreneurs and investors see how it can support international expansion, asset protection, and tax efficiency. Offshore jurisdictions like Belize, the British Virgin Islands, the Cayman Islands, and Seychelles continue to attract businesses seeking flexible and strategic opportunities. Careful planning is essential to select the right location and structure for your company.

To simplify the process and ensure full compliance, partnering with a trusted service provider is highly recommended. BBCIncorp offers professional offshore company formation services, guiding you from incorporation to post-registration support, so you can focus on growing your business globally with confidence.

Drop us a message now to clarify your queries via service@bbcincorp.com!

Frequently Asked Questions

How do onshore and offshore companies differ?

Onshore companies are registered and operate in the same country as their owners, fully subject to local regulations and taxes. Offshore companies, on the other hand, are registered in a foreign jurisdiction, often offering benefits like tax efficiency, asset protection, and easier access to international markets. For a more detailed comparison, see onshore vs. offshore company.

Does an offshore company have to pay taxes?

Tax obligations vary depending on the jurisdiction and the company’s activities. Some offshore locations have low or zero corporate taxes, while others may require reporting and minimal tax contributions. Always check local regulations and consult a professional to ensure compliance.

What reporting requirements must an offshore company comply with?

Offshore companies typically have minimal reporting obligations, but requirements differ by jurisdiction. Common compliance tasks include submitting annual accounts, maintaining proper company records, and fulfilling any specific local regulations. Professional guidance is recommended to avoid penalties.

Can an offshore company open a bank account?

Yes, offshore companies can open corporate bank accounts, but the process usually requires proper documentation such as proof of identity, proof of address, company registration documents, and sometimes a business plan. Banks may also perform due diligence or KYC checks before approval.

How Long Does It Take to Set Up an Offshore Company?

The setup time depends on several factors, including the jurisdiction, the type of company, and the completeness of your documents. Some locations offer fast-track incorporation, while others may take longer due to local regulations. Contact professional incorporation services like BBCIncorp for guidance tailored to your situation.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.