- What is an exempt private company limited by shares?

- Benefits of an Exempt private company in Singapore

- Key requirements for Singapore exempt private company

- Exempt private company registration process in Singapore

- Things to do after incorporating a Singapore exempt private company

- Exempt private company vs. Private company

Exempt private companies are one of the pull factors that draw entrepreneurs to Singapore. At first glance, it offers tax incentives and strategic advantages that are only meant for businesses at their embryonic stages, making Singapore an incubator for start-ups and SMEs.

This article is our attempt to present a comprehensive overview of the exempt private company in Singapore. We hope this will help you make a better choice for your company.

What is an exempt private company limited by shares?

An exempt private company (EPC) in Singapore is a private limited company that is owned by a maximum of 20 shareholders, all of whom must be individuals. EPC is one of the most favored types of businesses in Singapore as it provides a wide range of benefits and tax incentives.

As its name may suggest, an EPC can be entitled to some exemptions from certain tax liabilities and audit requirements. Furthermore, like a private limited company, an EPC also brings you similar benefits such as separate legal status and members’ limited liabilities by shares.

When referring to the exempt private company limited by shares meaning, it denotes a form of private limited company in Singapore that is entitled to specific exemptions under the law.

Generally speaking, an exempt private company in Singapore is divided into 2 types, depending on the ability to pay debts. Pursuant to ACRA, the filing requirements of each type are subject to significantly diverse:

- An insolvent EPC (unable to pay debts) is obliged to file either a full set of financial statements in XBRL format or salient data of financial statements in XBRL format, accompanied by a PDF copy of your financial statements.

- A solvent EPC (able to pay debts) enjoys the exemption from filing financial statements. That being said, it is well-advised for you to fulfill the requirement for filing as it is with an insolvent EPC.

Benefits of an Exempt private company in Singapore

To build Singapore’s image as the best place for startups and alleviate the compliance burden for small companies, the government announced the ratification of the amendment in 2003 to the Company Act, marking the dawn of EPC.

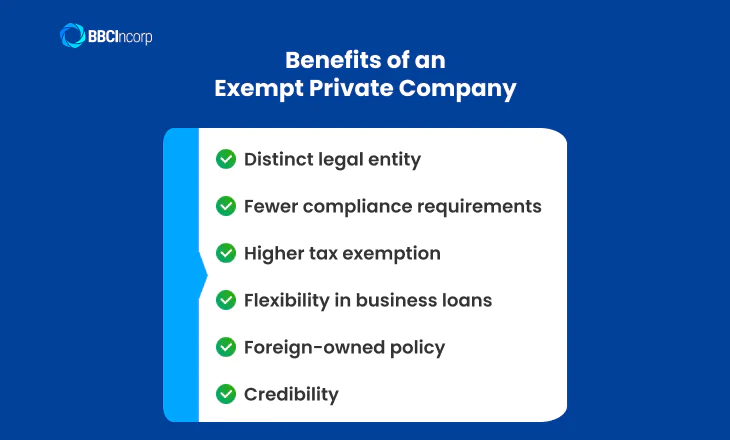

Here are some of the advantages of EPC that you can make use of to drive more profits:

- Distinct legal entity

- Fewer compliance requirements

- Higher tax exemption

- Flexibility in business loans

- Foreign-owned policy

- Credibility

Distinct legal entity

Like a private company limited by shares, an EPC is considered a legal entity separate from its owners/shareholders. This means that an Exempt private company limited by shares in Singapore is liable for its debts and losses. Its shareholders’ liabilities would not go beyond the share capital they own.

Moreover, your EPC in Singapore can ensure continuity with easy transfer of ownership by transferring shares.

Fewer compliance requirements

An EPC can enjoy an exemption from filing annual accounts as long as it is solvent at the time of registering.

An EPC can also be exempted from conducting an annual audit if it meets at least 2 out of the 3 following criteria for the first or second financial year after incorporation:

- Its total annual turnover is equal to or less than $10m

- Total assets are equal to or less than $10m

- Its total employees are equal to or less than 50

All directors and the company secretary have to sign a solvency declaration, the prescribed form of which is available online, and then submit it to the Registrar of Companies in Singapore (ACRA).

However, you are still duty-bound to properly update accounting records and prepare financial statements as per the Companies Act and the Singapore Financial Reporting Standards (FRS).

In any other case in which your company falls short of the aforementioned criteria, the obligation to submit audited accounts and to file annual financial statements applies as per usual.

Higher tax exemption

An exempt private company in Singapore is likely to be qualified for the Tax Exemption Scheme for Startups, which can lead to a significant tax cut for your company.

Under the scheme, your newly-formed EPC is entitled to an exemption based on the Singapore corporate tax rate for the first SG$200,000 of its taxable income every year for the first three consecutive years from the Year of Assessment (YA) 2020 onwards. To be more specific:

- 75% of the first SG$100,000 of chargeable income will be exempted from Singapore income tax.

- Additionally, 50% of the next SG$100,000 will also be exempted from being taxed.

In sum, you can get a maximum exempted amount of SG$125,000 for each year of the first 3 years of incorporation.

Side note, this scheme does not apply to every company. Companies that specialize in investing, such as investment holding ones, or in property development as it is with real estate companies are unable to apply for this tax exemption.

Flexibility in business loans

Other types of business entities, in most cases, are subject to tough restrictions upon making business loans to other related entities and their directors.

In particular, a private company is prohibited from lending or providing guarantees or security to loans of other companies, in which its director has interests or ownership of 20% or more. A private company is also not allowed to extend loans to any of its directors.

In contrast, an EPC enjoys much more independence and flexibility in how they act on its capital as it is exempted from this regulation. As EPCs are not curbed by this restriction, you are allowed to grant loans to other companies to leverage your assets into profit.

Foreign-owned policy

As per the Companies Act, a foreigner is allowed to act as the sole shareholder that owns all the shares of an EPC, which suggests that an EPC is eligible for 100% foreign ownership.

Credibility

Following the same pattern as other incorporated entities, EPCs manifest signs of burgeoning capabilities and financial integrity, which helps you shape the perception that investors and the public have of your business.

Key requirements for Singapore exempt private company

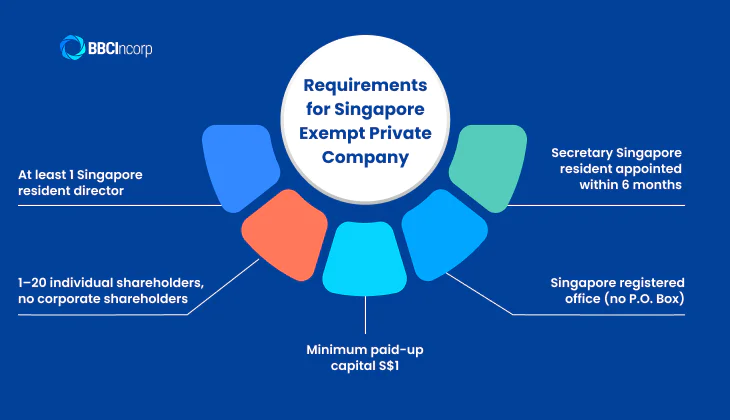

Firstly, you need to know the general requirements to set up an EPC in Singapore, it is quite alike to those of a limited company:

- Director(s)

Every exempt private company (EPC) in Singapore must appoint at least one director who assumes managerial responsibilities and fiduciary duties for the company. This director is required to be ordinarily resident in Singapore, meaning a Singapore citizen, permanent resident, or an individual holding a valid Employment Pass or EntrePass.

Additional directors may be of any nationality, as long as they satisfy the eligibility criteria under Singapore’s company law.

- Shareholder(s)

The number of shareholders must not fall below the minimum required of 1 and is capped at a maximum of 20. A corporate body is barred from holding any bit of shares in an EPC. Pursuant to the Company Act, a shareholder could act as a director, simultaneously.

- Initial paid-up capital

You are obliged to pay a minimum share capital of S$1 to get the green light for your incorporation.

- Company address

It’s a must to have a registered office address in Singapore, a P.O. Box is not accepted.

- Company secretary

You are given a period of 6 months from the date of incorporation to fill the position of the company secretary, who, among others, also holds the key to the registration of the EPC.

This individual must be ordinarily resident in Singapore, well-qualified, and have relevant expertise in administration to ensure consistency in the company’s compliance with regulatory requirements.

Exempt private company registration process in Singapore

The process is similar to setting up a company in Singapore.

You first need to register a business name. As EPC is classified as a private limited, it needs to have a unique name, which must be tailed along by “Private Limited”, “Pte. Ltd” – the abbreviation for private limited, or “EPC” for Exempt private company.

Then you should declare the incorporation by filing a memorandum and articles of association and submit them to the Registrar of Companies for review and approval.

Whether or not the incorporation is approved will be informed via the email address that you have specified.

If it works out, you will be given:

(1) A Unique Entity Number acting as your EPC’s identity number; and

(2) A Certificate of Incorporating as proof of its incorporation.

Thereafter, you should delegate the secretary to issue share certificates to the shareholders reaffirming the number of shares they hold. The secretary will also take charge of circulating the First Board of Directors Resolution and preparing the Bank Account Opening Resolution when needed to apply for a bank account.

Things to do after incorporating a Singapore exempt private company

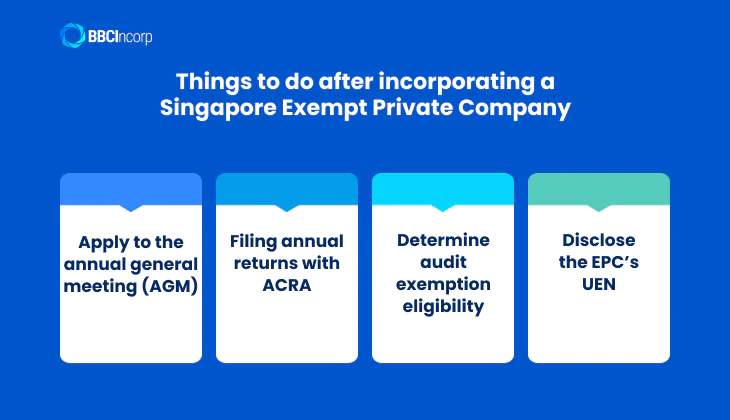

Once an exempt private company (EPC) has been successfully incorporated in Singapore, business owners must comply with several statutory obligations to ensure proper governance and regulatory compliance.

These requirements are set out under the Companies Act and are designed to promote transparency, accountability, and efficient business conduct. Below are the key post-incorporation obligations that every EPC should be aware of.

Apply to the annual general meeting (AGM)

An Annual General Meeting (AGM) is a statutory requirement under the Companies Act unless an exemption applies. For most Exempt Private Companies (EPCs), the first AGM must be held within 6 months after the end of the financial year end (FYE).

The purpose of the AGM is to provide transparency to shareholders by presenting the company’s financial statements, which typically include:

- The Profit and Loss account;

- Balance Sheet;

- Statement of changes in equity;

- Cash flow statement;

- Notes to the financial statements.

In practice, companies are not required to gather shareholders for this meeting physically. The AGM can be conducted through written resolutions or electronic document circulation, provided that all shareholders have the opportunity to review and consent.

During an AGM in Singapore, shareholders may also approve audited or unaudited financial statements, declare dividends, re-appoint directors and officers, and authorise directors’ remuneration.

Filing annual returns

Once incorporated, companies in Singapore are subject to ongoing compliance obligations, one of the most important being the filing of annual returns.

This process ensures that the Accounting and Corporate Regulatory Authority (ACRA) maintains an accurate and transparent record of the company’s particulars, including details of directors and shareholders, registered address, and financial statements.

Under Section 197 of the Companies Act(1), companies must file their annual returns electronically through ACRA’s BizFile+ portal within the prescribed deadlines:

- Non-listed companies: within 7 months after the Financial Year End (FYE).

- Listed companies: within 5 months after the FYE.

It is important to note that even EPCs that qualify for audit exemptions remain obligated to submit their annual returns. Failure to do so may result in late lodgment penalties and, in more serious cases, enforcement action against directors. Ensuring timely and accurate filing is therefore a key responsibility in maintaining compliance.

Audit exemptions

Singapore’s corporate framework provides certain audit exemptions to reduce the regulatory burden on smaller companies, including Exempt Private Companies (EPCs). These exemptions allow qualifying companies to avoid the cost and administrative effort of statutory audits while still maintaining proper financial reporting practices.

Under the Companies Act, an EPC may be exempted from audit requirements if it qualifies as a “small company.” To meet this definition, the company must satisfy at least two of the following three criteria for the immediate past two consecutive financial years:

- Total annual revenue of not more than SG$10 million;

- Total assets of not more than SG$10 million;

- No more than 50 employees.

Despite being exempted from audits, EPCs are still required to prepare accurate financial statements in compliance with the Singapore Financial Reporting Standards (SFRS).

These records may be requested by the Accounting and Corporate Regulatory Authority (ACRA) or the Inland Revenue Authority of Singapore (IRAS) when necessary. Non-compliance with record-keeping obligations can result in penalties and undermine corporate transparency.

Disclosure of EPC’s UEN

Every company incorporated in Singapore is issued a Unique Entity Number (UEN) by the Accounting and Corporate Regulatory Authority (ACRA), and an exempt private company is no exception.

The UEN serves as the official identification number of the company in its dealings with government agencies, banks, and business partners, helping to streamline regulatory and administrative processes.

Under Singapore law, the UEN must be clearly displayed on all official company documents and communications, including invoices, contracts, correspondence, websites, and letterheads. Proper disclosure ensures transparency, allows stakeholders to verify the company’s legal standing, and reduces the risk of fraud.

Failure to comply with these requirements may result in penalties and negatively affect the company’s compliance status. EPCs should therefore ensure that their UEN is consistently presented on all official documents and digital platforms from the time of incorporation.

Free ebook

Key matters for doing business in Singapore

Get all the details for doing business in Singapore with our guide

Exempt private company vs. Private company

When incorporating a business, entrepreneurs in Singapore often encounter two common structures: the exempt private company (EPC) and the Private Limited Company in Singapore (Pte. Ltd.).

These two company types are often compared because they differ in shareholder restrictions, compliance obligations, and audit requirements. Having a clear understanding of these differences helps business owners make informed decisions when choosing the appropriate structure.

The comparison below summarises the main distinctions between EPC and Ptd. Lte.:

| Criteria | Exempt private company | Private Limited Company |

| Shareholders | Maximum of 20 shareholders, all must be individuals. | Maximum of 50 shareholders, may include corporate entities. |

| Ownership structure | Restricted to natural persons only. | Allows both individuals and corporate shareholders. |

| Audit requirement | Eligible for audit exemption if qualifying as a small company. | Generally subject to audit, unless qualifying as a small company. |

| Annual filing | Must file annual returns with ACRA, may follow simplified rules. | Must file annual returns with ACRA, often with stricter requirements. |

| Transfer of shares | Transferable but may be limited by the company’s constitution. | Transferable, subject to provisions in the company’s constitution. |

| Regulatory burden | Typically lighter due to exemptions available. | Typically heavier due to broader obligations. |

Should you have any questions regarding the exempt private company in Singapore, feel free to talk to our consultants by leaving a chat message or sending us an email via service@bbcincorp.com.

References:

(1): https://sso.agc.gov.sg/Act/CoA1967?ProvIds=pr197-,pr201-

Frequently Asked Questions

What are the common challenges of Exempt Private Companies?

Like many business structures, Exempt private companies (EPCs) in Singapore face specific challenges that influence their performance and long-term development:

- Limited access to funding: Difficulty in securing financing can restrict opportunities for expansion.

- Maintaining accurate financial records: Limited resources make it challenging to keep accounts up to date, but utilising accounting software can streamline bookkeeping processes, improve accuracy, and reduce administrative workload.

- High operational costs: Rising overheads often place a financial burden on smaller companies.

- Strong market competition: Competing in saturated industries can make it challenging to sustain profitability.

Are Exempt Private Companies required to be audited?

The obligation to undergo an audit does not apply automatically to every EPC in Singapore. Instead, it depends on whether the company qualifies as a “small company” under the Companies Act. To be regarded as a small company, it must meet at least two of the following three criteria for the two most recent consecutive financial years:

- Annual revenue does not exceed SG$10 million;

- Total assets do not exceed SG$10 million;

- The company has no more than 50 employees.

Companies that satisfy these thresholds may be exempted from statutory audit requirements. Those that do not qualify, however, must appoint auditors and ensure that their financial statements are properly reviewed and filed.

Are Exempt Private Companies permitted to offer loans to their directors or connected companies?

Under Singapore company law, Exempt Private Companies are permitted, in certain circumstances, to extend loans to their directors or to entities connected with them. Any loan arrangement must be properly disclosed to shareholders or the board, structured on fair and reasonable terms, and must not expose the company to undue financial risk.

In many cases, prior approval at a general meeting is also required before the loan can proceed.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is an exempt private company limited by shares?

- Benefits of an Exempt private company in Singapore

- Key requirements for Singapore exempt private company

- Exempt private company registration process in Singapore

- Things to do after incorporating a Singapore exempt private company

- Exempt private company vs. Private company

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.