- Why opening a business in Singapore is a smart move

- Can a Foreigner start a business in Singapore?

- How to start a business in Singapore

- Step 1: Initial planning before starting a business in Singapore

- Step 2: Choose the right business structure

- Step 3: Choose the name of your company

- Step 4: Choose a registered business address

- Step 5: Register your company with ACRA

- Step 6: Obtain your Certificate of Incorporation and Business Profile

- Step 7: Open a Corporate Bank Account in Singapore

- Essential requirements after setting up a business in Singapore

- Leveraging BBCIncorp’s Expertise for Business Setup

- Conclusion

Singapore shines as a vibrant global business hub to international entrepreneurs, especially foreigners exploring how to start a business in Singapore as an exceptional launchpad in Asia. With BBCIncorp’s streamlined digital-first approach, entrepreneurs can complete company registration and receive a digital incorporation certificate within a single day.

The city-state has a flat corporate tax rate of 17%, complemented by highly competitive tax reliefs. Additionally, Singapore has networked double-taxation agreements with over 80 countries, ensuring efficient tax structuring and minimal fiscal friction for businesses operating across borders.

This article leverages BBCIncorp’s expertise to deliver clear, data-supported guidance so international SME owners expanding into Asia, or startup founders using Singapore as a regional springboard, can navigate the company setup journey with confidence and ease.

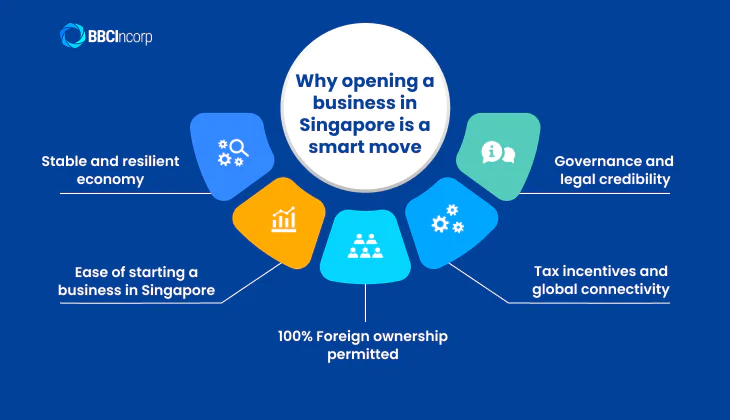

Why opening a business in Singapore is a smart move

Positioned at the crossroads of global trade, Singapore has become a magnet for companies aiming to scale internationally.

Stable and resilient economy

Singapore’s economy continues to demonstrate strength and adaptability. In the second quarter of 2025, GDP grew by a robust 4.3% year-on-year, outperforming expectations despite global headwinds. The first quarter also recorded solid growth of 3.8%, reinforcing resilience amidst economic uncertainty.

This stability makes Singapore a dependable haven for starting a business in singapore as a foreigner, underpinned by prudent fiscal and monetary policies.

Ease of starting a business in Singapore

According to the latest Ease of Doing Business rankings(1) conducted by The World Bank, Singapore secured second place in the list of countries that are the easiest to do business. Registering a company in Singapore is both fast and efficient. In addition, Forbes and similar platforms consistently rank Singapore at the top globally for ease of doing business.

In particular, entities can be formed online via ACRA’s BizFile+ system, often within 24 hours.

100% Foreign ownership permitted

Can a foreigner start a business in Singapore with complete control? The answer is yes, as full foreign ownership is permitted in most sectors. Overseas entrepreneurs can gain full operational control, with only one local resident director required

Tax incentives and global connectivity

Singapore offers an attractive tax regime: a flat corporate tax rate of 17%, with startup exemptions available, such as up to 75% off the first SG$100,000 of chargeable income in initial years, and a wide network of double taxation agreements facilitating tax-efficient cross-border operations. The nation’s logistics infrastructure is world-class.

In 2024, the Port of Singapore handled over 40 million TEUs, setting a new throughput record. Container volumes continued to rise into 2025, with 14.18 million TEUs processed in just the first four months: a 6.1% increase year-on-year.

Governance and legal credibility

Renowned for its rule of law, transparent regulation, and strong intellectual property protection, Singapore remains one of the most trusted business environments globally. Pro-business policies, political stability, and efficient judicial systems create a climate that fosters investor confidence and long-term growth.

Can a Foreigner start a business in Singapore?

Establishing a business in Singapore as a foreigner is exceptionally smooth compared to many other countries. With minimal restrictions and clear legal pathways, Singapore lets entrepreneurs tap into its dynamic economic ecosystem seamlessly.

Legal Eligibility for Foreigners

Foreign individuals can indeed fully own a Singapore-registered company. 100% foreign ownership is permitted, and there is no requirement to have a local partner or shareholder.

However, to comply with regulations, a local resident director must be appointed. This individual may be a Singapore citizen, permanent resident, or an Employment Pass or EntrePass holder.

In addition, company registration in Singapore for foreigners is completed online via ACRA’s BizFile+ portal, and incorporation typically takes just one to two days when all documents are in order

For foreigners who wish to reside in Singapore to actively manage their operations, you are required to apply for an appropriate work visa. The EntrePass targets foreign entrepreneurs with innovative business ideas or venture-backed startups, enabling them to establish and operate a business in Singapore.

Alternatively, established professionals may use the Employment Pass, provided they meet salary and qualification thresholds. The EntrePass also provides flexibility in structuring business entities and sponsoring dependents.

Benefits for Foreign Entrepreneurs

Foreign entrepreneurs in Singapore benefit from an expansive network of double taxation agreements that facilitate efficient cross-border operations and tax planning

Government grants and startup incentives are readily available to support early-stage growth, especially for innovative ventures.

Moreover, hiring international talent is made easier through Singapore’s flexible immigration options and highly professional local workforce.

Singapore’s transparent regulations and legal structure foster investor confidence and reduce compliance risks.

The well-developed ecosystem includes streamlined incorporation processes, reputable banking services, and standard corporate governance measures, all overseen by ACRA and the Ministry of Manpower.

How to start a business in Singapore

In this section, our guide below will walk you through how to start a business in Singapore as a foreigner, and additional steps for ongoing compliance.

Step 1: Initial planning before starting a business in Singapore

Thoughtful planning sets a concrete foundation for setting up a company in Singapore for foreigner entrepreneurs. Begin by researching market demand and refining your business idea.

Ask what unique value your product or services have, who your potential customers are, and what their needs may be. Analyze competitors and local trends to validate your concept and align with consumer insight.

Next, define your business model, scale, and capital requirements. Whether you intend to bootstrap or secure funding, distinguishing between initial one-time costs and ongoing operating expenses is vital.

Singapore’s cost-efficient incorporation starts from just SG$115, which means you can feasibly start a business in Singapore with no capital, relying instead on lean budgets, contingency planning, or creative early-stage funding models.

Finally, identify the licences and permits your business may require. Use the Online Business Licensing Service (OBLS) for a one-stop portal that matches your business activity with relevant regulatory approvals.

Step 2: Choose the right business structure

Selecting the right business structure in Singapore is an important decision that will impact your tax obligations, liability, and growth potential. The country allows various types of business in Singapore entities, each with distinct features:

- Sole proprietorship: Owned and managed by a single individual, this is the simplest structure, but there is no separation between personal and business liabilities.

- Limited liability company (LLC): A separate legal entity with limited liability for shareholders, making it one of the most popular choices among entrepreneurs.

- General partnership: Owned by two or more individuals who share responsibilities, profits, and liabilities.

- Limited partnership (LP): Consists of at least one general partner with unlimited liability and one limited partner whose liability is restricted to their investment.

- Limited liability partnership (LLP): Offers flexibility in management while limiting partners’ liability for debts and actions of other partners.

If you are uncertain which structure to select, a private limited company (Pte Ltd) is generally recommended for foreign entrepreneurs:

- Can have up to 50 shareholders

- Operates as a separate legal entity

- Limits shareholder liability to their shareholding

- Can apply for a 75% tax exemption on the first SG%100,000 of chargeable income and other government incentives (IRAS)

- Distributes dividends tax-free to shareholders

A well-chosen structure will provide stronger protection, better credibility, and greater access to Singapore’s business advantages.

Step 3: Choose the name of your company

The next step in starting a business in Singapore for foreigners is to pick a business name:

- Make sure you prepare a unique, not identical, or too similar name to any existing registered name

- Avoid words or phrases that are offensive or inappropriate

- Do not use terms that suggest an affiliation with government bodies or agencies

- Check that the name does not infringe on existing trademarks in Singapore

Once your proposed name meets these requirements, you can proceed with the reservation process through ACRA’s BizFile+ portal.

Step 4: Choose a registered business address

Next, you must choose a company address.

Every Singapore company must have a local registered address where official correspondence and legal documents are sent. The address must be a physical location in Singapore and cannot be a P.O. Box, although home addresses may be allowed under the Home Office Scheme, with approval from the Housing and Development Board or Urban Redevelopment Authority.

According to the Singapore Accounting and Corporate Regulatory Authority (ACRA), the registered office must be accessible to the public for at least three hours on business days. Hence, many entrepreneurs use professional corporate service providers to secure a suitable address quickly.

Step 5: Register your company with ACRA

As a foreigner set up company in Singapore, you will need to engage a professional incorporation service that is licensed to file with ACRA. Foreigners cannot register a business directly and must appoint a Registered Filing Agent to submit incorporation documents via BizFile+.

Then, your company must meet several key requirements to complete its incorporation:

- Local director: At least one director must reside in Singapore and be a citizen, permanent resident, or Employment Pass or EntrePass holder.

- Local registered address: A physical office address within Singapore is mandatory for official correspondence.

- Company secretary: Within six months of incorporation, a Singapore resident must be appointed as the company secretary.

- Auditor: Unless your company qualifies for an audit exemption, you must appoint an auditor within three months of incorporation to authenticate financial reporting.

Once these essentials are in place, your incorporation application proceeds through ACRA’s BizFile+ portal, and approval typically occurs within one to two business days.

Tip

Before you begin the application, we recommend reviewing our dedicated resource: What Is BizFile Singapore? A Guide to ACRA’s Online Portal.

This guide will help you familiarize yourself with the interface and the Singpass requirements, ensuring a smooth navigation experience during the registration process.

Step 6: Obtain your Certificate of Incorporation and Business Profile

Once the Accounting and Corporate Regulatory Authority (ACRA) approves your application, your company is officially incorporated. You will receive a Certificate of Incorporation via email, which serves as legal proof of your business registration in Singapore.

Along with the certificate, ACRA will issue a Business Profile. This electronic record contains key information about your company, including its registered address, business activities, shareholder details, and the names of directors and the company secretary. Many banks, government agencies, and potential partners require it for verification purposes.

Both documents are accessible through the BizFile+ portal, where you can download and print them when needed.

Step 7: Open a Corporate Bank Account in Singapore

A corporate bank account is essential for running your business in Singapore. It allows you to transact with customers, suppliers, and government agencies while keeping company funds separate from personal assets, safeguarding your financial position.

While the general company registration in Singapore for foreigners process is similar across banks, each institution sets its eligibility requirements. In most cases, you will need your company’s incorporation documents, identification of directors and signatories, and proof of address. In some cases, banks require an in-person interview.

If approved, your account can be opened within a few weeks. Once both your company and bank account are ready, you can now begin operations in Singapore.

Foreign entrepreneurs often find it challenging to apply without professional assistance. In this regard, it’s much better to hire a reputable banking support service provider like BBCIncorp.

We will suggest the best bank in Singapore for foreigners to help you make an easy choice.

Steps to start a Singapore company for foreigners

- Step 1: Initial planning before starting a business in Singapore

- Step 2: Choose the right business structure

- Step 3: Choose the name of your company

- Step 4: Choose a registered business address

- Step 5: Register your company with ACRA

- Step 6: Obtain your Certificate of Incorporation and Business Profile

- Step 7: Open a Corporate Bank Account in Singapore

Essential requirements after setting up a business in Singapore

Even after incorporation, you must follow several critical steps so that your company remains compliant, efficient, and ready to scale in Singapore’s business-friendly environment.

Appoint key personnel

Singapore law requires careful compliance from the outset, and here are the key officers you must appoint:

- Company Secretary: Required within six months of incorporation to manage compliance filings and maintain official registers.

- Auditor: Appoint within three months if your company does not qualify for audit exemption, to facilitate the timely preparation of financial statements.

- Nominee Director Services: Foreign entrepreneurs must appoint at least one local resident director. Nominee services can fulfill the requirements as a compliant but non-operational role.

ACRA systems enforce these milestones rigidly, and timely appointments help foster credibility and good standing. Missing these deadlines is bound to lead to compliance complications or even penalties down the road.

Secure funding for your business

Singapore’s startup ecosystem supports enterprises through grants, co-investment, and equity funding. The Startup SG portfolio includes programmes such as Startup SG Founder, Startup SG Tech, and Startup SG Equity, alongside national schemes targeting productivity, R&D, and market expansion.

These provide capital at key growth stages, from concept validation to scaling operations. Additionally, non-dilutive venture debt financing is available, capping at SG$8 million, to extend your potential without giving up equity.

Investors and financial institutions often view your company’s paid up capital as a primary indicator of financial health and shareholder commitment.

Before approving a loan or investment, they will assess this figure to gauge how much ‘skin in the game’ the owners actually have. A robust capital structure signals stability, which can significantly improve your chances of securing external financing.

Handle hiring and register with CPF

Once hiring begins, employers must register with the Central Provident Fund (CPF) Board and contribute monthly for Singaporean or permanent resident employees earning above S$50. Mandatory contributions include both employer and employee shares and must be paid by the 14th of the following month to avoid fines or penalties.

Proper CPF management and timely payments are essential for demonstrating respect for employee welfare and reinforcing your reputation as a responsible employer.

File Corporate Income Tax properly

All Singapore companies must file corporate income tax annually with the Inland Revenue Authority of Singapore (IRAS). This process has two stages: submitting the Estimated Chargeable Income (ECI) within three months after the financial year-end, and filing the final tax return via Form C-S, C-S (Lite), or Form C, depending on company size and activity.

The flat corporate tax rate is 17%, with possible partial or start-up exemptions for eligible businesses. It’s important to note that timely and accurate filing is essential to avoid penalties or interest charges.

Set up accounting and bookkeeping

Accurate financial tracking is foundational to business success. Implementing cloud-based accounting systems like Xero or QuickBooks ensures reliable bookkeeping, real-time insights, and easier compliance with the Singapore Financial Reporting Standards (SFRS).

Engaging a professional accountant will help your team keep accurate records and prepare your company for financial reporting, tax planning, and audits. Furthermore, you should conduct monthly or quarterly financial reviews to track cash flow and assess profitability internally.

Register for GST (If applicable)

Goods and Services Tax (GST) registration is compulsory if your taxable annual revenue exceeds SG$1 million. Businesses below this threshold can still register voluntarily, which may be beneficial if you deal with GST-registered clients or wish to claim input tax on business purchases.

Once registered, you must:

- Charge GST (currently 9% in 2025) on taxable supplies.

- File quarterly GST returns through myTax Portal.

- Keep detailed records for at least five years.

- Issue GST-compliant invoices.

Failure to register on time or comply with filing and invoicing rules can lead to significant penalties and interest charges.

Maintain ongoing compliance after setting up a business in Singapore

All companies in Singapore, including small private companies, must meet post-incorporation obligations unless exempt. Key requirements include holding Annual General Meetings (AGMs) unless qualified for exemption and filing Annual Returns with ACRA within seven months after the financial year end.

Companies classified as “small” (meeting thresholds for revenue, assets, and workforce) may enjoy audit exemption, but must still:

- Keep accurate statutory registers and accounting records.

- Comply with IRAS and ACRA filing deadlines.

- Maintain up-to-date corporate documents.

Additionally, Singapore offers a foreign income tax exemption if foreign-sourced income is received in Singapore and meets conditions such as being taxed in the foreign jurisdiction and having a headline tax rate of at least 15%.

You can learn more information about Singapore’s income tax for foreigners.

Leveraging BBCIncorp’s Expertise for Business Setup

BBCIncorp has been a trusted partner for global entrepreneurs since 2019, helping thousands of clients successfully establish businesses in Singapore. With our deep understanding of local regulations and a secure online platform, we make the process smooth and fully compliant for both Singapore residents and foreigners.

Why choose BBCIncorp

Starting a business in Singapore is easier when you have the right partner by your side. At BBCIncorp, we provide professional corporate services:

- Singapore company formation service packages, with business bank account included

- Established partnerships with leading banks, financial institutions, and trusted expert partners to meet every business need

- Transparent fees with no hidden charges

- A secure online dashboard that allows you to access and manage your company documents anytime, anywhere

- Dedicated customer support to answer your questions and guide you through every step

Our key services encompass:

- Company incorporation: Registering your company with the Accounting and Corporate Regulatory Authority (ACRA)

- Opening a bank account: Expert guidance on choosing a bank, online banking provider, or electronic money institution, and completing your application

- Visa and work pass assistance: Help with EntrePass, Employment Pass, and other visa applications to enable you and your team to work legally in Singapore

- Accounting Services: Accurate and compliant financial reporting aligned with IRAS requirements

- Corporate secretarial services: Maintaining statutory registers, preparing resolutions, filing annual returns, and more

Take the first step toward building your Singapore business today. Contact us or visit our site to get expert guidance and the tools you need for a smooth incorporation process in Singapore.

Conclusion

Learning how to start a business in Singapore requires careful planning, choosing the right business structure, registering with ACRA, selecting a unique company name and local address, and opening a corporate bank account.

Foreign entrepreneurs enjoy complete ownership, a flat corporate tax rate of 17 percent, and strong legal protections. After incorporation, ongoing compliance such as appointing key personnel, managing taxes, and filing returns is crucial. Singapore’s efficient processes and supportive business environment make starting a company smooth and rewarding.

For expert guidance on registration, banking, and compliance, kindly send BBCIncorp a message at service@bbcincorp.com , or start a chat with our support team today. Let us help you launch your Singapore business confidently and without hassle.

Frequently Asked Questions

How much does it cost to start a business in Singapore?

To begin your business in Singapore, you will need to open a company and a corporate account. If you are a non-local, our Foreigner Basic package for incorporation will cover you on both matters.

How can I start a small business in Singapore?

You can quickly form a business in Singapore by taking the following steps:

- Pick the type of company you want

- Choose the company name

- Use a service for company setup

- Make a payment for the service

- Supply the required information

- Get your company’s certificate of incorporation

- Apply for a bank account

- Start your business

Is it easy to start a business in Singapore?

Yes, it is, with the help of our professional service. We will take care of everything for you. All you need to do is provide us with the necessary documents.

Is it possible to establish a company in Singapore without a nominee director?

Yes, it is possible if you hold an Employment Pass and relocate to Singapore to fulfill the role of the company’s director.

However, if you do not meet this condition, the use of a nominee director will still be necessary.

How can you start a business in Singapore with no capital?

Starting a business in Singapore without significant initial capital is entirely feasible by leveraging available government support and efficient business strategies:

- Apply for government grants such as Startup SG Founder, which provide both mentorship and funding to eligible first-time entrepreneurs.

- Benefit from non-dilutive grants that provide capital without requiring equity.

- Utilize a lean startup approach by minimizing costs and using cloud-based digital tools.

- Outsource essential services like accounting and corporate secretarial work to reduce upfront expenses.

- Prepare a detailed business plan to attract angel investors and venture capitalists.

- Take advantage of networking opportunities and government schemes to access additional funding and resources.

With the right planning and support, new entrepreneurs can confidently establish their Singapore business even without upfront capital.

How long does company registration in Singapore usually take?

Company registration in Singapore typically takes between 1 and 3 business days when all required documents are complete and no additional licenses are needed.

However, if your business activity requires special permits or regulatory approvals, the registration timeline can extend to 1 or 2 weeks. Notably, engaging a professional service provider can help ensure your documentation is accurate and complete. Overall, Singapore has one of the fastest company registration processes globally.

Is a foreigner allowed to serve as the local director of their own company?

A foreigner can serve as the local director of their Singapore company only if they meet specific residency requirements. Singapore law mandates that every company appoint at least one director who is ordinarily resident in Singapore. This means the local director must be a Singapore citizen, permanent resident, or a foreigner holding a valid Employment Pass or EntrePass.

If you do not hold such a work pass or do not reside in Singapore, you cannot fulfill the local director role yourself. In these cases, foreign entrepreneurs typically appoint a nominee director, a trusted local resident who acts as director solely to meet legal requirements.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- Why opening a business in Singapore is a smart move

- Can a Foreigner start a business in Singapore?

- How to start a business in Singapore

- Step 1: Initial planning before starting a business in Singapore

- Step 2: Choose the right business structure

- Step 3: Choose the name of your company

- Step 4: Choose a registered business address

- Step 5: Register your company with ACRA

- Step 6: Obtain your Certificate of Incorporation and Business Profile

- Step 7: Open a Corporate Bank Account in Singapore

- Essential requirements after setting up a business in Singapore

- Leveraging BBCIncorp’s Expertise for Business Setup

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.