- What is an Investment Holding Company in Singapore?

- Key tax considerations for investment holding companies

- Why set up an Investment Holding Company in Singapore?

- What is the most suitable business structure for an Investment Holding Company in Singapore?

- How to reduce taxes for your Investment Holding Company?

- How do you register an Investment Holding Company in Singapore?

- Conclusion

Singapore has long been recognized as a trusted jurisdiction for businesses and investors seeking stability, efficiency, and clear regulatory frameworks. Among the various corporate structures available, the Investment Holding Company (IHC) has become a preferred option for those aiming to organize and safeguard their assets effectively.

By offering a central structure to manage diverse holdings, it allows enterprises and individuals to streamline administration while maintaining compliance with Singapore’s robust financial regulations.

In this article, BBCIncorp explores the essential considerations around IHCs in Singapore, from tax treatment and allowable expenses to incorporation procedures and strategic benefits. The insights provided will help decision-makers evaluate whether this structure aligns with their long-term business and investment goals.

Key takeaways:

- Investment Holding Companies (IHCs) are established primarily to hold long-term investments and generate passive income, providing a strategic vehicle for managing assets.

- The tax treatment of IHCs is distinct, with specific rules on deductible and non-deductible expenses, as well as limited eligibility for exemptions.

- While IHCs do not qualify for the Start-Up Tax Exemption, they remain eligible for the Partial Tax Exemption and certain foreign-sourced income exemptions.

- Singapore offers a business-friendly environment with clear tax frameworks, making it an attractive jurisdiction for IHCs seeking efficient investment structures.

- Selecting the appropriate business structure and complying with regulatory obligations, including GST and reporting requirements, ensures legal and operational efficiency.

- Registration requirements are straightforward but must be carefully followed to ensure regulatory compliance from the outset.

What is an Investment Holding Company in Singapore?

An Investment Holding Company (IHC) in Singapore is a corporate structure established primarily to hold long-term investments, such as shares, real estate, bonds, or other financial assets, and to derive non-trade income from these assets, including dividends, interest, and rental income. Its principal activity is investment holding, distinct from an investment dealing company, which actively trades assets to generate profit through sales or disposals.

This distinction is critical: whereas an investment dealing company earns trade income from frequent transactions, an IHC focuses on the passive accumulation of wealth through stable, non-operational income streams.

Singapore’s tax authority (IRAS) assesses IHCs on their financial year’s investment income, submitted via Singapore’s corporate tax filings. Companies must prepare tax computations that accurately reflect passive income generation.

Key tax considerations for investment holding companies

The operational nature of an Investment Holding Company (IHC) is fundamentally shaped by the kind of income it generates and the expenses it incurs.

Unlike trading businesses, which rely on sales and services, IHCs primarily deal with long-term investments and passive income streams. This focus on holding and managing assets influences how Singapore’s tax authority determines what counts as deductible, what must be excluded, and where exemptions may apply.

Exploring these features in detail helps clarify the obligations and opportunities available to such entities under Singapore’s corporate tax framework.

Long-Term Investments & Non-Trade Income

Unlike trading entities, companies set up in Singapore as IHCs are generally expected to hold assets such as shares, bonds, or investment properties over an extended period rather than engaging in frequent buying and selling. These are classified as long-term investments, aligning with the IHC’s role as a vehicle for asset preservation and growth.

The income streams typically derived from such holdings are considered non-trade income, which may include:

- Dividends from shares;

- Interest from loans or fixed deposits;

- Rental income from investment properties.

According to IRAS, these sources remain distinct from trading profits, and the classification has direct implications on how tax is assessed. Importantly, if the business intent shifts toward actively buying and selling assets, such as trading stocks or flipping properties, the entity would no longer be treated as an IHC but rather as an investment dealing company.

Allowable Expenses for Investment Holding Companies

One of the most important aspects of managing an Investment Holding Company in Singapore is understanding which costs qualify as deductible. Under IRAS guidelines, deductions are permitted only when they are incurred in the production of investment income, ensuring that only genuine business-related expenses reduce the tax base.

To make this clearer, allowable expenses can be grouped into three main categories: direct expenses, statutory and regulatory expenses, and other permissible costs.

Direct Expenses

These are costs directly tied to generating investment income, particularly rental income or interest income.

- Interest on loans for income-generating properties: Interest expenses are deductible if the borrowing is used to acquire or maintain an income-producing property.

- Repair and maintenance expenses: Costs incurred to restore an asset to its original condition (e.g., repairing building structures or servicing equipment in a rental property). Note: improvement or enhancement works are not deductible.

- Property management costs: Fees paid to property managers or agents responsible for tenant relations, rent collection, or day-to-day oversight of rental properties.

Statutory and Regulatory Expenses

As corporate entities, IHCs must comply with statutory obligations. Expenses associated with such compliance are deductible.

- Audit and accounting fees: Professional fees incurred in preparing audited financial statements and ensuring accurate records of income and expenses.

- Corporate secretarial fees: Costs related to maintaining corporate records and submitting annual filings to the Accounting and Corporate Regulatory Authority (ACRA).

- Tax compliance fees: Fees paid to tax agents or professionals for preparing and filing corporate tax returns with IRAS.

Other Permissible Expenses

Certain other expenses may also qualify as deductible, provided they are necessary for maintaining income-yielding assets.

- Insurance premiums: Premiums paid to insure investment properties against risks such as fire or damage, thereby protecting income streams.

- Legal fees: Costs associated with drafting tenancy agreements, resolving tenant disputes, or enforcing rental contracts. Legal expenses incurred for property acquisition or capital transactions are not deductible.

- Valuation and professional advisory fees: Charges for professional valuations to determine fair rental value or advisory services related to effective property management.

Non-Deductible Deductions/Claims

Investment holding companies in Singapore are subject to specific restrictions on what can be deducted or claimed for tax purposes. Unlike trading entities, these companies primarily generate passive income, which limits the scope of allowable reliefs. Below is an overview of the main categories that are not deductible or transferable.

Capital Outlays and Non-Income Producing Investments

Expenses considered capital in nature, or tied to investments that have yet to generate income, cannot be deducted.

- Initial acquisition of assets: Purchases such as refrigerators, air-conditioners, or furniture for an investment property fall under capital expenditure and therefore do not qualify. Only replacement costs for assets in income-producing properties may be deductible.

- Transaction costs: Stamp duties and legal fees incurred during the acquisition of investments are treated as capital outlays and are not deductible.

- Interest on non-yielding investments: Borrowing costs to acquire shares that have not produced dividends are disallowed, as the investment is not considered income-generating at that stage.

Excess Expenses Attributable to a Single Source

Tax rules require expenses to be matched with the income source they relate to.

- For example, property taxes paid on a rental property may only be offset against rental income from that same property.

- If such costs exceed the income earned, the excess cannot be applied against dividends, interest, or other types of returns.

- As a limited concession, deficits from one block of shares may sometimes be offset against dividend income from other blocks within the same group of shares.

Capital Allowance Restrictions

Since an investment holding company is not treated as carrying on a trade, it is generally not entitled to capital allowance claims. The only exception applies where fixed assets are purchased to replace existing ones used in income-generating properties.

Treatment of Unutilised Losses

Losses that remain unused within a given Year of Assessment cannot be carried forward to offset income in future years, reflecting the non-trading nature of IHCs.

Group Relief Limitations

Current year unutilised losses cannot be transferred to other companies within the same group. However, certain items such as Industrial Building Allowance, Land Intensification Allowance, and approved donations may still be shared under the Group Relief system.

Start-Up Tax Exemption Ineligibility

Investment holding companies do not qualify for the start-up tax exemption available to new businesses. Nevertheless, they may benefit from the partial tax exemption scheme, which provides some level of tax relief on chargeable income.

GST Charging and Collection Rules

For most Investment Holding Companies (IHCs), GST obligations are limited because their income usually comes from exempt sources such as dividends, interest, or rental proceeds. These do not qualify as taxable supplies and therefore fall outside the GST scope.

An exception arises when an IHC provides management or administrative services to subsidiaries. If such services push annual taxable turnover above IRAS’s registration threshold, GST registration becomes mandatory. Even in cases of voluntary registration, input tax claims are often restricted, as many expenses relate to exempt supplies.

In essence, IHCs seldom charge or collect GST, but where active services are provided, compliance with IRAS rules is essential.

Tax Exemption for IHCs

As discussed under Start-Up Tax Exemption Ineligibility, Investment Holding Companies are not eligible for the Start-Up Tax Exemption (SUTE) that is reserved for trading entities.

However, IHCs remain eligible for the Partial Tax Exemption (PTE) Scheme, which lowers the effective tax payable on a portion of chargeable income each Year of Assessment. The current tax exemption thresholds are as follows:

- 75% exemption on the first SG$10,000 of chargeable income.

- 50% exemption on the next SG$190,000 of chargeable income.

In addition, IHCs may also enjoy foreign-sourced income exemptions, provided the income has already been subject to tax in a foreign jurisdiction with a headline corporate tax rate of at least 15% before being remitted to Singapore.

These measures ensure that while IHCs cannot access the same incentives as trading companies, they still benefit from reliefs that support Singapore’s attractiveness as a hub for investment holding structures.

Why set up an Investment Holding Company in Singapore?

The restriction to carry out business activities may leave you to wonder “Why would anyone ever consider starting an investment holding companies (IHC) instead of a normal one?”. The simple answer to this is protection from losses. Your IHC won’t be affected if there’s a crisis in your subsidiary company.

- If Holiday Pte Ltd goes bankrupt, you will experience a capital loss and a decline in revenue.

- However, your Jolly Golly Group will not be legally liable and creditors cannot pursue you for remuneration.

- If, on the other hand, Holiday Pte Ltd performs well and brings more profits, your IHC will benefit as well.

Along with the protection from losses, setting up an IHC in Singapore means you’ll have access to the advantageous business climate and tax regime of the country.

Business climate of Singapore

Singapore’s business climate creates a hotspot for IHC incorporation.

The country’s government has put efforts to reduce entry barriers for foreign investors and global businesses.

Whether you’re local or a foreigner in Singapore, you can register for an IHC in no time. Also, the whole incorporation process can be done online with little trouble.

Tax regime

Tax saving is undoubtedly one of the biggest benefits of starting an IHC in Singapore.

Singapore follows a territorial tax regime. This means you only pay tax on income arising from sources inside Singapore.

The foreign-sourced income can be tax exempted, as long as your company satisfies certain conditions.

In some cases, you also pay tax on income remitted and received in Singapore.

- Corporate tax

The corporate income tax rate in the city-state is 17%. This is relatively low compared to other global financial hubs.

However, this rate does not reflect your exact payable tax. In fact, the actual amount of tax you have to pay is lower. This is due to certain tax reliefs and beneficial schemes in Singapore.

For example, you can apply for the Partial Tax Exemption for Companies (PTE) for a low tax rate of only 4,25%.

Also, foreign-sourced income can be exempted from Singapore income tax, as long as your company can satisfy certain conditions.

- Double Tax Agreement

Singapore has a network of tax treaties with more than 80 countries.

These treaties offer favorable tax rates and benefits between Singapore and the signed countries.

Let’s say you have a subsidiary in Mauritius – a country that has signed a tax treaty agreement with Singapore. Then, the dividends, interests, and royalties paid from this subsidiary to your IHC in

Singapore is subject to a reduced tax rate or is even exempt from tax obligations.

For a better idea of the reasons to incorporate in Singapore, simply read our article for practical advice.

What is the most suitable business structure for an Investment Holding Company in Singapore?

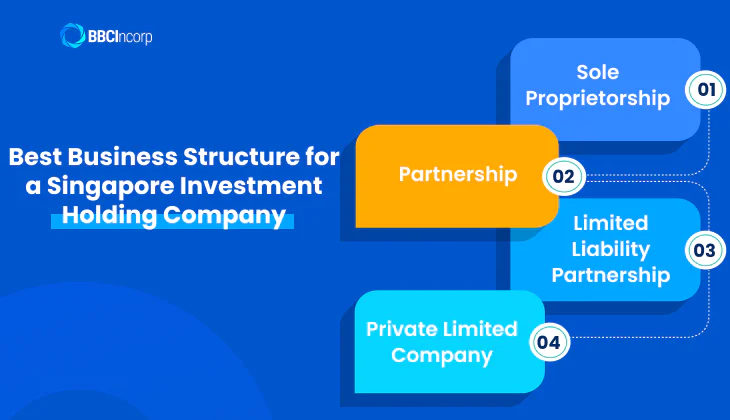

Selecting the right business structure is a crucial step when establishing an Investment Holding Company (IHC) in Singapore, as it influences liability exposure, tax treatment, compliance requirements, and long-term flexibility.

Singapore provides several types of business structures for incorporation, each with distinct legal and tax implications. The most common options include:

- Sole Proprietorship: A simple structure owned by a single individual, with no legal separation between the owner and the business.

- Partnership: Similar in simplicity, but jointly owned by two or more persons who share profits and liabilities.

- Limited Liability Partnership (LLP): Offers some degree of liability protection, but partners remain closely tied to the business’s obligations.

- Private Limited Company (Pte. Ltd.): A separate legal entity with limited liability for shareholders, perpetual succession, and stricter compliance requirements.

For most investors, the Private Limited Company (Pte. Ltd.) remains the preferred vehicle. It offers limited liability protection, a separate legal identity, perpetual succession, and access to Singapore’s extensive tax treaty network.

This framework ensures that shareholders’ personal assets are safeguarded, while the company itself can continue operations even if ownership changes. Furthermore, corporate governance requirements under the Companies Act provide credibility and transparency, which is often essential when dealing with banks, regulators, or cross-border partners.

In practice, while smaller investors may consider simpler structures for ease of administration, the private limited model remains the preferred framework for most Investment Holding Companies due to its balance of legal protection, operational continuity, and tax efficiency.

How to reduce taxes for your Investment Holding Company?

Singapore offers a highly favourable framework for Investment Holding Companies (IHCs) to reduce corporate tax liabilities through a mix of exemptions and deductions.

A key advantage lies in the absence of capital gains tax, ensuring that profits from selling shares, properties, or other capital assets are not subject to corporate income tax—an important benefit for companies focused on long-term asset growth.

IHCs may also utilise the foreign-sourced income exemption under Section 13(8) of the Income Tax Act. This allows dividends, branch profits, and service income earned overseas to be received tax-free in Singapore, provided certain conditions are met. Together with Singapore’s network of over 100 Double Taxation Agreements (DTAs), this significantly reduces exposure to withholding tax and double taxation.

Additionally, deductions for allowable expenses, such as interest on loans used for investments, audit and secretarial fees, and a limited portion of indirect costs like directors’ fees, can further lower taxable income. According to IRAS guidelines, indirect expenses are typically capped at 5% of gross investment income.

By combining these measures, IHCs can optimize their tax position while staying fully compliant with Singapore’s regulations.

Your IHC in Singapore can apply the following methods to lower the payable income tax.

Expense deductions

Your company can deduct three types of expenses against its assessable income.

Those are direct expenses, statutory and regulatory expenses, and other allowable expenses.

Direct expenses are the expenses that result in investment income.

Let’s say you have rental properties, your deductible expenses include costs for collecting income, insurance, property tax, maintenance, and repair cost.

The interest paid on loans is also a deductible expense.

Statutory and regulatory expenses are the expenses spent to keep your company compliant with local laws (e.g. Singapore Companies Act and other related laws).

Some typical examples are:

- Fees for accounting, auditing, and tax service

- Secretarial fees

- Bank charges

Additionally, there are other allowable expenses that your investment holding company in Singapore can deduct. These include:

- Administrative and management fees

- Directors fees

- Office fees (rental, charges for telephone, water, and light for example)

- Salaries, bonuses, and allowances for employees

- Other general expenses

Note

According to IRAS, the deducted amount of these other expenses cannot go higher than 5% of the gross income of your company.

Group relief system

Group Relief allows members of a group of companies to transfer certain Corporate Tax losses to other members of the group.

The two companies are considered in the same group when satisfying all of the following conditions:

- They are both incorporated in Singapore

- 75% of the ordinary share capital of one company is held by the other, or 75% of each company is held by a third Singapore-incorporated company

- Both companies have the same financial year period

Your Singapore investment holding company can transfer unutilized funds to other companies in the same group, including

- industrial building allowance

- land intensification allowance

- donations

For current-year unutilized losses caused by expenses exceeding investment income, your company cannot transfer these losses to another company within the same group.

Also, it cannot carry forward any losses to the following years to offset future accessible income.

And since your Singapore IHC does not carry out any trade, it’s not allowed to claim capital allowance.

Fixed assets are considered deductible expenses only when they are bought to replace other existing ones.

Tax exemption and rebate

If your IHC is a new start-up, you cannot apply for tax exemption.

However, your company is still eligible for the Partial Tax Exemption (PTE) Scheme.

With the PTE scheme, your company will be entitled to:

- A 75% tax exemption on the first $10,000 of income, and

- Another 50% tax exemption on the next $190,000 of income.

After the PTE scheme, your company will continue to benefit from an annual tax rebate (with a given cap).

Every year since 2013, the Singapore government has rebated taxes on all Singapore companies. The tax rebate rate in 2019 was 20%, with a given cap of $10,000. In 2020, the figures were 25% and $15,000.

To know more about how to reduce income tax in Singapore, take a look at our exclusive article, which summarizes everything you need to know.

Foreign-sourced dividend exemption

As mentioned above, if your IHC receives dividends from foreign subsidiaries, it can be subject to income tax.

Yet, you don’t have to pay these taxes if you meet the following conditions:

- Your dividends have already been paid/payable in the foreign jurisdiction (where the dividends arise)

- The headline tax rate in the foreign jurisdiction is no less than 15% when the dividends are remitted to Singapore

- The exemption benefits the resident taxpayers in Singapore.

View a basic format of tax computation for a Singapore investment holding here

Discover the full list of conditions for foreign-sourced income tax exemption in Singapore and gain your entrepreneurial edge instantly!

How do you register an Investment Holding Company in Singapore?

You can register your Singapore investment holding company (IHC) as a private limited company or a limited liability company.

The setup process is quite simple and straightforward. Yet, you’ll need to satisfy certain requirements and follow procedures to avoid costly mistakes.

Requirements to register your IHC

In most cases, you’ll need the following requirements in place:

- Minimum of one shareholder – who can be an individual or a company

- At least one director – must be a Singapore resident and be over 18 years of age

- At least one resident company secretary

- Minimum initial paid-up capital of S$1

- A registered company address (not a P.O box address)

- A corporate bank account

Procedure to register your IHC

Follow these simple steps to register your IHC:

- Choose a company name and submit it for name approval

- File your application with the ACRA to formally register your IHC

You can wrap up everything online using the ACRA Business Filing portal. The whole process can take up to 3 working days.

Make sure you fill out your application form and documents properly. If there’s any issue or mistake with your application, it’ll take much longer to form your IHC.

If you feel overwhelmed with all these requirements and procedures, remember it’s not just you.

Paperwork and back-office tasks are not everyone’s strong suit. And you certainly won’t save more money handling them all by yourself.

Why not leave all the stressful, boring paperwork to us? So you’ll have more time to crush your goals and build a business that you’re proud of.

You can always rely on our skillful team for an automated, hassle-free Singapore company formation.

Our packages are purposely designed to fit your style, and budget and to expand your confidence as you go.

Conclusion

Navigating the setup and management of an Investment Holding Company in Singapore requires careful consideration of regulatory requirements, allowable expenses, and tax implications. By understanding the specific rules applicable to IHCs, businesses can make informed decisions to optimize their investments while remaining fully compliant.

Singapore’s stable business environment and favorable tax framework continue to make it an attractive jurisdiction for long-term wealth management and strategic asset holding.

To ensure your Investment Holding Company is structured effectively and compliant with all regulations, reach out to BBCIncorp at service@bbcincorp.com for professional guidance and tailored solutions.

Frequently Asked Questions

What types of income can an investment holding company earn?

An investment holding company (IHC) in Singapore typically derives passive income, such as dividends from shares, interest from deposits or loans, and rental income from investment properties. It does not engage in active trade, as its primary purpose is to hold and manage long-term investments.

Is an investment holding company allowed to conduct trading activities?

No. If a company actively buys and sells assets with the intention of generating trading profits, it is classified as an investment dealing company rather than an IHC. This distinction is important because the tax treatment and compliance obligations differ between the two.

What are the tax benefits of incorporating an investment holding company in Singapore?

While IHCs are not eligible for the Start-Up Tax Exemption (SUTE), they may benefit from the Partial Tax Exemption, foreign-sourced income exemptions under Section 13(8) of the Income Tax Act, and Singapore’s extensive Double Taxation Agreements (DTAs). Additionally, capital gains are not taxed in Singapore, which is advantageous for companies holding long-term assets.

Are there any restrictions for foreign investors in establishing an IHC?

Foreign investors may establish and wholly own an IHC in Singapore; however, they must satisfy statutory requirements such as appointing at least one Singapore-resident director, completing registration formalities with ACRA, and complying with any sector-specific licensing or disclosure obligations that may apply.

How long does it take to incorporate an investment holding company in Singapore?

In most cases, incorporation can be completed within one to two business days, assuming all required documents are in order and regulatory approvals are straightforward. More complex cases, such as those requiring additional licensing or review, may take longer.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is an Investment Holding Company in Singapore?

- Key tax considerations for investment holding companies

- Why set up an Investment Holding Company in Singapore?

- What is the most suitable business structure for an Investment Holding Company in Singapore?

- How to reduce taxes for your Investment Holding Company?

- How do you register an Investment Holding Company in Singapore?

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.