- What is the business registration fee?

- Current BR fee structure and changes in 2025

- Waiver of business registration fee

- When and how to pay business registration fee in Hong Kong

- BR certificate issuance, renewal, and display obligations

- Consequences of non-compliance

- Exemptions and reduced BR fee eligibility in Hong Kong

- How BBCIncorp helps you manage business registration in Hong Kong

- Conclusion

Setting up a company in Hong Kong requires more than just a great business idea, it starts with proper registration. Every business operating in the city must obtain a Business Registration Certificate (BRC) from the Inland Revenue Department, serving as official proof of legal operation.

Along with this requirement comes the business registration fee in Hong Kong (BR fee), a compulsory payment tied to maintaining compliance with local regulations.

The business registration certificate fee may differ based on the registration period and government adjustments. Since April 2024, the Hong Kong government has introduced several updates affecting the BR fee and related waiver policies(1).

This article outlines the latest 2025 fee structure, explains the recent changes, and provides key insights to help business owners manage costs and ensure full legal compliance.

What is the business registration fee?

Definition and legal framework

The business registration fee (BR fee) in Hong Kong is a mandatory government charge required for all businesses operating in the region. Governed by the Business Registration Ordinance (Cap. 310), it ensures that every business entity is legally recognized by the Inland Revenue Department (IRD) through the issuance of a business registration certificate in Hong Kong.

This certificate acts as proof that the business is authorized to operate within the city.

Who is required to pay the BR fee?

Liability to pay the BR fee hong kong applies broadly to any person or organization carrying on business in the territory. Specifically:

- Sole proprietorships.

- Partnerships and limited partnerships carrying on business in Hong Kong.

- Locally incorporated limited companies.

- Branches of foreign companies.

Current BR fee structure and changes in 2025

The business registration fee in Hong Kong has been updated since April 2024, with the 2025 structure maintaining these revised rates. Businesses must now pay the full business registration certificate fee and levy as required by the Inland Revenue Department (IRD), marking the end of previous temporary waivers.

Breakdown of fees and levies

As of April 1, 2024, the business registration fee in Hong Kong was adjusted to reflect new government rates. The standard BR fee is now HKD 2,200 per year. This amount includes two key components:

- Registration fee: The fixed amount payable for issuing or renewing a business registration certificate; and

- Levy to the Protection of Wages on Insolvency Fund: A statutory contribution that supports employees in cases where their employers become insolvent.

These two parts together form the business registration certificate fee payable to the Inland Revenue Department (IRD). The updated rate replaces the temporary waiver that had previously reduced fees in earlier years, marking a return to the standard charge structure.

Businesses are required to pay this fee annually or every three years, depending on their chosen registration term.

Annual vs. three-year certificate fees

Businesses in Hong Kong can choose between an annual registration or a three-year registration certificate. The current one-year BR fee stands at HKD 2,200, while the three-year option costs HKD 6,020. Opting for a three-year certificate provides several advantages:

- Reduced administrative work by avoiding yearly renewals.

- Lower cumulative cost compared to paying the annual fee three times.

- Long-term convenience for businesses planning stable, ongoing operations in Hong Kong.

The business registration fee Hong Kong applies equally to all qualifying entities, but the flexibility of the registration period allows business owners to manage compliance more efficiently.

The BR fee table explained

The BR fee table provided by the Inland Revenue Department outlines fees based on the entity type:

- Business (sole proprietorship or partnership) cost HKD 2,200 for one year, HKD 6,020 for three years.

- Branch registration has the same rates as above, payable separately for each branch.

- Non-Hong Kong companies are also subject to the same fee structure.

In essence, the current business registration certificate fee ensures all businesses contribute equally to maintaining legal and regulatory standards. Understanding the latest BR fee structure helps business owners plan ahead, stay compliant, and operate smoothly in Hong Kong’s dynamic commercial environment.

Waiver of business registration fee

The waiver of business registration fee has been one of the Hong Kong government’s key temporary relief measures to support enterprises during challenging economic periods. It reflected the government’s effort to stabilize the business environment, preserve employment, and boost confidence among local entrepreneurs.

Previous waivers and government relief measures

According to official IRD announcements, Hong Kong’s business registration fee was fully waived in the financial years 2020–2021 and 2021–2022, while partial concessions were introduced in 2022–2023. During these periods, businesses were only required to pay the levy portion of the business registration certificate fee.

These relief measures formed part of broader economic stimulus packages aimed at mitigating the impact of COVID-19 and supporting long-term recovery. The temporary waiver of business registration fee benefited hundreds of thousands of registered businesses, helping them maintain compliance while managing cash flow during an unprecedented crisis.

Will there be future waivers?

Under the 2024–2025 Hong Kong Budget, the government confirmed that there would be no waiver of the business registration fee for the current and upcoming financial years. The BR fee Hong Kong has therefore returned to its standard rate of HKD 2,200 per year, effective from April 1, 2024.

This decision reflects the government’s shift toward fiscal normalization after several years of economic relief programs. Businesses must now pay the full business registration certificate fee and levy to the IRD upon registration or renewal to remain compliant with Hong Kong’s business regulations.

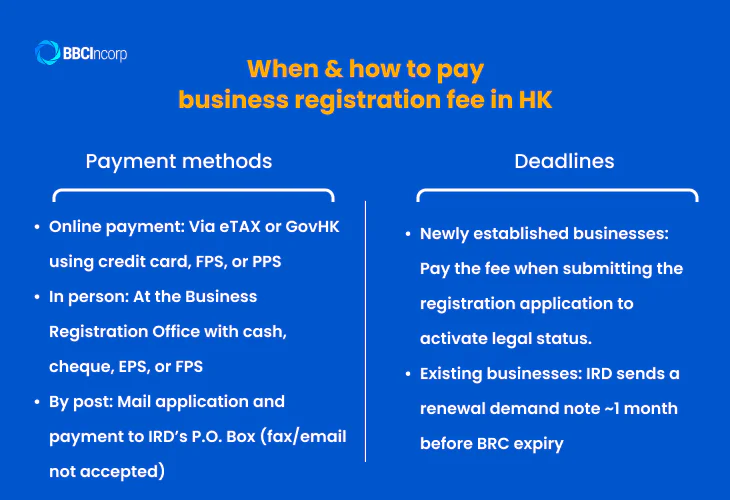

When and how to pay business registration fee in Hong Kong

The payment of BR fee in Hong Kong is a mandatory step when applying for or renewing a Business Registration Certificate.

Payment methods and platforms

Businesses can pay conveniently through several channels provided by the Inland Revenue Department.

- Online payment: Payment can be made via the eTAX platform by logging in with a digital certificate or eTAX password to view and settle the demand note. Accepted methods include credit card, Faster Payment System, and PPS). Businesses may also pay through the GovHK payment gateway, telephone or internet banking, or at designated bank counters.

- In person: Visit the Business Registration Office to pay using cash, cheque, EPS, or FPS.

- By post: Mail the application and payment to the IRD’s P.O. Box address with sufficient postage. Fax or email payments are not accepted.

- Authentication: Online payments require a digital certificate or secure eTAX login for verification.

Deadlines and late payment penalties

To remain compliant with Hong Kong’s business regulations, companies must carefully observe the payment deadlines for the Hong Kong BR fee. The timeline for payment varies depending on the business’s registration status.

- Newly established businesses: The business registration fee must be paid when submitting the registration application to the IRD. This payment confirms the issuance of the initial BRC and activates the business’s legal status.

- Existing businesses: The IRD sends a renewal demand note about one month before the current BRC expires. The fee must be settled within this one-month period to ensure the certificate remains valid. Even if the renewal notice is not received, the business owner is still legally required to complete payment on time. Payments made by midnight on the due date, whether online or in person, are recognized as on time.

BR certificate issuance, renewal, and display obligations

Discuss how the business registration certificate is issued and renewed, and the business’s obligation to display it.

Certificate validity and renewal process

A Business Registration Certificate confirms the legal existence of a business in Hong Kong and must be obtained within one month of commencing operations.

- Issuance: The certificate is issued after the business submits the required information and pays the business registration certificate fee.

- Validity options: Businesses can choose between a 1-year or 3-year validity period at the time of registration.

- Renewal: The Business Registration Office sends a renewal demand note about one month before the current certificate expires. Upon payment, the receipted demand note serves as the new valid certificate. Limited companies are renewed automatically once payment is completed, while sole proprietorships and partnerships must handle the renewal manually.

Display requirement under Hong Kong law

Under the Business Registration Ordinance, every business must:

- Display the valid BR certificate in a conspicuous place at its principal place of business.

- Produce the certificate upon request by Inland Revenue Department officers.

- Comply strictly with renewal and display obligations to avoid fines or prosecution.

*Note: Failure to comply, such as not renewing on time or failing to display the certificate is a statutory offence that can lead to financial penalties; and possible suspension of business registration.

Consequences of non-compliance

Failure to make timely payment can result in penalties and legal consequences. The IRD may impose a financial surcharge for overdue payments, and continued non-payment can lead to fines or prosecution. In more serious cases, the business’s registration may be suspended or declared invalid, preventing it from legally operating in Hong Kong.

Therefore, ensuring prompt and accurate business registration certificate payment is vital for maintaining a valid Hong Kong Business Registration Certificate and protecting your business from compliance risks.

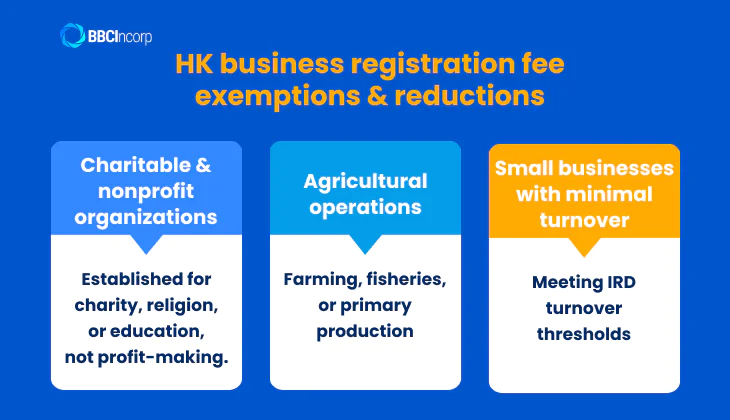

Exemptions and reduced BR fee eligibility in Hong Kong

Certain types of businesses in Hong Kong may qualify for a waiver of the business registration fee or a reduced BR fee, depending on their nature and activities as assessed by the IRD. These exemptions are designed to support organizations that contribute to public welfare or engage in non-commercial or essential economic activities.

Common categories eligible for exemption include:

- Charitable and nonprofit organizations: Entities established exclusively for charitable, religious, or educational purposes, and not engaged in profit-making activities, may qualify for exemption from the business registration fee.

- Agricultural operations: Specific farming, fisheries, or primary production activities may be exempt, reflecting the government’s commitment to supporting Hong Kong’s primary industries.

- Small businesses with minimal turnover: Enterprises that meet the IRD’s income threshold criteria can apply for a reduced BR fee in Hong Kong, helping them lower compliance costs while maintaining registration obligations.

How BBCIncorp helps you manage business registration in Hong Kong

Handling business registration in Hong Kong involves multiple steps. BBCIncorp simplifies the entire process with comprehensive, technology-driven solutions, allowing business owners to focus on growth instead of paperwork.

End-to-end support for BR and company setup

BBCIncorp provides a full suite of services covering every stage of Hong Kong company formation and business registration certificate management.

- One-stop solution: From company incorporation to obtaining and renewing your Business Registration Certificate (BRC).

- Expert fee guidance: Ensure accurate business registration fee payment and compliance with Inland Revenue Department (IRD) requirements.

- Flexible registration options: Assistance with choosing between 1-year and 3-year BRC validity periods based on your business needs.

- Error-free process: All applications and renewals are reviewed by professionals to prevent costly compliance mistakes.

Proactive monitoring and compliance reminders

BBCIncorp combines professional expertise with modern technology to help clients maintain business compliance in Hong Kong effortlessly.

- Automatic compliance alerts: Get timely reminders before renewal or filing deadlines to avoid penalties.

- Smart client dashboard: Manage all your corporate documents, view business registration certificate fee records, and download certificates anytime.

- Secure data management: All business details are protected with high-level encryption and stored safely in your account.

- Ongoing support: Continuous guidance to keep your company aligned with Hong Kong’s latest regulatory updates.

Conclusion

Ensuring compliance with the business registration fee in Hong Kong is essential for every business to remain legally recognized and operational. The BR fee represents a mandatory payment and key part of maintaining transparency and accountability under Hong Kong law.

With the 2025 updates to registration fees and renewal policies, staying informed and timely with payments is crucial to avoid penalties or disruptions in business operations.

To simplify BR compliance, businesses can rely on professional support from trusted providers like BBCIncorp. Our expert team ensures accurate fee management, renewal reminders, and seamless online handling of all registration matters, helping you stay compliant effortlessly while focusing on business growth.

References:

(1): https://www.ird.gov.hk/eng/pdf/br_budget_2425_eng.pdf

Frequently Asked Questions

Do I need to pay BR fee if not trading yet?

Yes. The business registration fee applies once you begin carrying on business in Hong Kong not only when you start earning income. Even if your business is not yet operational, registration is still legally required.

Is the fee the same for branches?

No. The business registration certificate fee for branches differs from that of the main business. You should refer to the latest IRD fee schedule for the applicable rates.

Can I pay online?

Yes. The payment of BR fee can be made conveniently through the IRD’s online systems, such as eTAX, GovHK, or supported banking channels like PPS and FPS.

Is a business registration fee a fixed cost?

Yes, the amount is fixed but depends on the type and validity period of your Business Registration Certificate types, which is 1-year certificate and 3-year certificate.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is the business registration fee?

- Current BR fee structure and changes in 2025

- Waiver of business registration fee

- When and how to pay business registration fee in Hong Kong

- BR certificate issuance, renewal, and display obligations

- Consequences of non-compliance

- Exemptions and reduced BR fee eligibility in Hong Kong

- How BBCIncorp helps you manage business registration in Hong Kong

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.