- What is A Business Registration Number (BRN)?

- What are the differences between a Business Registration Number (BRN) and a Company Registration Number (CRN) in Hong Kong?

- Why is it important to have a Business Registration Number in Hong Kong?

- How to obtain and check the Business Registration Number (BRN) in Hong Kong?

- Conclusion

In Hong Kong, businesses are required to register and obtain a Business Registration Number (BRN). The BRN is different from the Company Registration Number (CRN) and is issued by the Inland Revenue Department (IRD). The BRN is important, as it allows the IRD to track businesses and collect taxes.

The article will walk you through the definition, importance, and ways to obtain BRN in Hong Kong.

What is A Business Registration Number (BRN)?

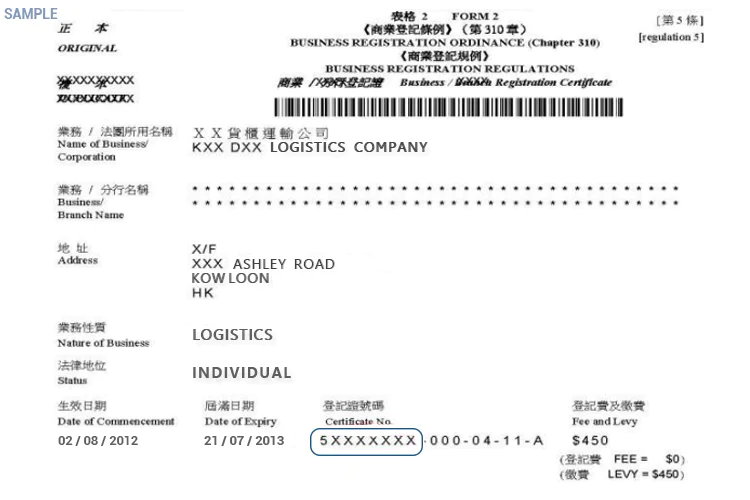

Your Business Registration Number (BRN) is distinct from your Company Registration Number (CRN) – while the 8-digit CRN appears on the certificate of incorporation Hong Kong issued by the Companies Registry upon successful company setup, the BRN is separately assigned by the Inland Revenue Department when you apply for business registration within one month of incorporation.

The BRN is used for business identification in Hong Kong for legal and administrative purposes. It is mandatory for your Hong Kong business to have the number on Business Registration forms and tax returns.

Note

Any trade, commerce, craftsmanship, professions, callings, or any other activity your business engages in for-profit gain is considered “businesses”. The term also encompasses a club.

Companies incorporated, or registered under Hong Kong Companies Ordinance are also viewed as persons conducting businesses, therefore are required to register under the Business Registration Ordinance (Cap. 310).

Find out more via our article 5 Questions To Ask About Business Registration Certificate Hong Kong

Format of a Hong Kong business registration number: 12345678-XXX-XX-XX-X

The process of obtaining a Hong Kong business registration number is simple and can be done online. Business owners can also check their BRN status online to ensure that it has been issued correctly.

What are the differences between a Business Registration Number (BRN) and a Company Registration Number (CRN) in Hong Kong?

There are some differences between a Business Registration Number (BRN) and a Company Registration Number (CRN) in Hong Kong.

What is it for?

CRN is a seven-digit number issued by the Companies Registry, serving as your company’s social security number, and an important signal of identification for your business in Hong Kong. CRN is often shown in the top left corner of your Certificate of Incorporation.

Who needs it?

BRN is required for almost all types of businesses, except for those only holding an office or employment that is not deemed to be conducting any business.

If you are a limited company or foreign company incorporated as a branch in Hong Kong, you will also be advised to go for a CRN.

Note

The Business Registration Number (BRN) is essential for daily operations and tax compliance in Hong Kong, but when foreign banks, investors, or regulators request formal proof of your company’s active status and current officers, they typically require both a Certificate of Incumbency (detailing directors, shareholders, and secretary) and a Certificate Of Good Standing (confirming full compliance with the Companies Registry).

How long is it valid?

The business registration number doesn’t expire, but the company registration number does.

Why is it important to have a Business Registration Number in Hong Kong?

There are a few reasons why it is important to have a Business Registration Number in Hong Kong.

Firstly, the number is used to identify your business and distinguish it from others. This is especially helpful if you are doing business in Hong Kong, as it will help other businesses and organizations to easily find your company information.

Secondly, it is required for company registration in Hong Kong. Without a BRN, you cannot complete the company registration process. The number can be used as a reference number for other official documents related to your business. This makes it easier for you to track and manage your company’s information.

Finally, you need the number to face different government agencies – i.e, filing annual returns or tax payments in Hong Kong.

Note

If your business engages in regulated financial activities such as securities dealing, asset management, or advising on investments, you must obtain an additional Hong Kong SFC license from the Securities and Futures Commission on top of your regular BRN.

How to obtain and check the Business Registration Number (BRN) in Hong Kong?

Obtaining BRN

There are two common ways to obtain a business registration number in Hong Kong: online or in-person application.

For online applications, businesses will need to pay fees and send applications online via the eTAX portal. Note that this method is only applicable to the registration of sole proprietorships, partnerships, and branches.

For in-person applications, submit and pay fees to the Business Registration Office of the Inland Revenue Department at the following address:

Business Registration Office

4/F Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong

You’ll need to prepare below basic documents to complete the registration:

Required documents for local companies:

- Incorporation Form (NNC1 or NNC1G)

- Notice to Business Registration Office (IRBR1)

- Articles of Association (if applicable)

- Mandatory fee payment

Required documents for non-Hong Kong companies:

- Application Form (Form NN1), and additional documents (if any)

- Notice to Business Registration Office (IRBR2)

- Mandatory fee payment

Please be aware that the business registration should be processed concurrently when registering a Hong Kong or non-Hong Kong company with the Companies Registry.

After submitting the application, it will take several working days for consideration. The Registry will send an email notification once your business registration number is issued.

Checking BRN

For online checking, businesses can refer to the following steps:

- Have a valid email address and access to the internet

- Visit the Business Registration Number Enquiry

- Input your business name in full English or Chinese

Many businesses therefore store both the Business Registration Certificate and the Significant Controllers Register together to streamline compliance checks and audits.

Conclusion

To conduct business in Hong Kong, enterprises must have a Business Registration Number. You can apply online to the IRD to obtain this number and check it via the e-tax service of the Hong Kong government. BRN is like a tax number identification for Hong Kong entities, meanwhile, the Company Registration Number acts like your Hong Kong company’s social security number.

Engaging professional company secretary services ensures your BRN is correctly reflected across all filings, annual returns, and government correspondence without you having to track every annual compliance detail yourself.

There might be more things you’ll need to know before incorporating your Hong Kong company. Feel free to message us through the chatbox or via service@bbcincorp.com for more detailed advice on your Hong Kong business.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is A Business Registration Number (BRN)?

- What are the differences between a Business Registration Number (BRN) and a Company Registration Number (CRN) in Hong Kong?

- Why is it important to have a Business Registration Number in Hong Kong?

- How to obtain and check the Business Registration Number (BRN) in Hong Kong?

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.