As one of the most dynamic financial markets globally, Hong Kong attracts ambitious investors and entrepreneurs worldwide. Succeeding in this competitive environment requires a thorough understanding of various factors, including the types of business entities.

To assist you in deciding on your business structure, this article discusses the most popular business structures in Hong Kong, including limited liability companies (LLCs), sole proprietorships, partnerships, branches, and representative offices.

Limited Liability Company in Hong Kong (Hong Kong LLC)

A Hong Kong LLC is a popular and flexible business structure governed by the Companies Ordinance. It offers various advantages such as limited liability, a separate legal identity, and ease of ownership transfer.

Main features of LLC

Limited Liability Companies (LLCs) in Hong Kong are categorized as

- Private Limited Companies by Shares

- Private Limited Companies by Guarantees

- Public Limited Companies by Shares

The classification of these business entity types is based on the following features:

Private Limited by Shares

Small and medium enterprises (SMEs) often choose this structure to conduct business and trade.

Company structure

-

- Required at least one shareholder, one natural director, Hong Kong local secretary, and a registered office

- A corporate director is allowed under strict circumstances

- A maximum of 50 shareholders

Share capital

-

- The liability of its members is limited up to the unpaid amount of shares held by each shareholder

- No requirement for minimum share capital

- No bearer shares & shares have no pare value

- Shares can be transferred but are subject to the company’s refusal to register the transfer of shares

The company’s profits can be distributed to its shareholders.

Recommended reading: All You Need To Know About The Hong Kong Private Limited Company

Public Limited by Shares

This entity type is mostly chosen by large corporations to conduct business and trade.

Company structure

-

- Required at least two directors, one member, a Hong Kong local secretary, and a registered office.

- Corporate directors are not allowed

- Can be more than 50 shareholders

Share capital

-

- The liability of its members is limited up to the unpaid amount of shares held by each shareholder

- No requirement for minimum share capital

- No bearer shares & shares have no pare value

- Shares can be freely traded.

- Shares of a public company may or may not be listed on the Hong Kong Stock Exchange.

The company’s profits can also be distributed to its shareholders.

Company Limited by Guarantee

Company Limited by Guarantee is especially preferred by charities, societies, clubs, or non-profit organizations to raise funds for humanitarian purposes.

Company structure

-

- Required at least two directors, one member, Hong Kong local secretary, and a registered office.

- Corporate directors are not allowed

- Can be more than 50 shareholders

Share capital

-

- Company limited by guarantee does not have share capital

- The liability of its members is limited to an amount agreed to contribute in the event of the company’s liquidation

The profits cannot be distributed among the members.

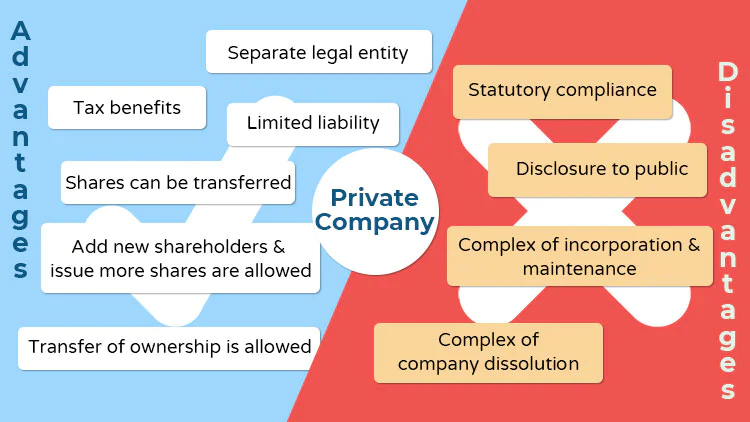

Advantages of private companies

The ongoing lines focus mostly on the Private Company Limited by Shares as it is a popular type for Hong Kong incorporation.

- Separate legal entity: A Hong Kong private company can acquire assets, go into debt, enter into contracts, sue, or be sued in its name, due to the distinction from its founders. Its shareholders are not responsible for paying off its debts.

- Limited liability: The shareholders’ liability to the company is limited by their respective investments.

- Company life cycle: Shares can be transferred (according to the company’s AA), so the membership amendment does not affect the entity’s existence.

- Raising capital after incorporation: Private companies can bring in new shareholders and issue more shares to expand their business.

- Transfer of ownership: Complete or partial transfer of ownership can be done by selling all or parts of its total shares or releasing new shares to the new investors.

- Tax benefits: The corporate tax regime in Hong Kong follows the territorial principles, which benefits its private companies with tax rates from 8.25% to 16.5% for incomes derived from Hong Kong, and tax exemption for profits gained from the outside.

Free ebook

Everything you need to start business in Hong Kong

Find out in a matter of minutes.

Disadvantages of private companies

- Statutory compliance: Hong Kong private companies must comply with obligations annually with the Companies Registry and Inland Revenue Department, which increases the management workload.

- Disclosure to the public: The identity of all shareholders and directors must be published according to the Hong Kong Company Ordinance.

- Complex incorporation and maintenance: It is more expensive to form and maintain a private company than a partnership or sole proprietorship.

- Time-consuming company dissolution: The closure of a private company is complicated, time-consuming, and costly compared to other entities.

Tips

Private companies are recommended if you are going to

- Limit members’ liability in the business operation

- Utilize the company to conduct the business as a separate legal body

- Maximize finance support from the bank by using the movable assets of the company as security

- Delegate your authority to other management personnel to conduct the business on your behalf

Sole Proprietorship

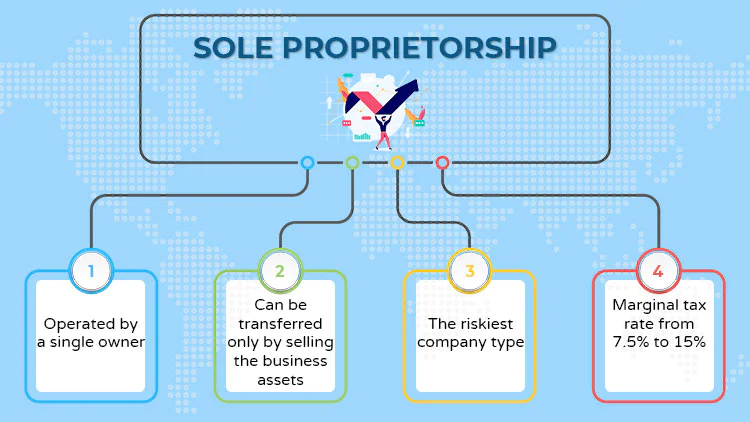

Main features of sole proprietorships

The sole proprietorship in Hong Kong is a basic business entity type. It is easy to register with the Business Registration Office. Operated by a single owner, this entity is connected fully with its sole investor. The business cessation is caused by the owner’s death.

The company can be transferred only by selling business assets. There is no protection of personal assets from liabilities, which makes it the riskiest company type.

The sole proprietorships in Hong Kong comply with the marginal tax rate from 7.5% to 15% depending on income level. Unlike private entities, the reporting requirements are light as the owner is obliged to file only an annual tax return with IRD (form BIR60).

Advantages of sole proprietorships

- Easy registration and maintenance: Within one month after the business commencement, the owner must only apply for a Business Registration Certificate of the sole proprietor with the Hong Kong Inland Revenue Department (IRD). Annual tax filing is required but audit task is exempted.

- Direct management: Decisions are made fast and easily as there is no need to discuss them with other members.

- Gaining all profits: the proprietor is the sole beneficiary of all business profits, so he should have a good incentive to grow the business.

Disadvantages of sole proprietorships

- Limited capacity to raise capital: The sole beneficiary’s personal wealth is the major source of capital; therefore, it might cause difficulty both at the beginning and the continuity stage of the proprietorship.

- No legal separation between personal and business assets: The company’s loss and debts are liable to the owner individually and unlimitedly. This person can be bankrupted by the court for being unable to pay off the debts.

- Heavy workload: The only founder of the sole proprietorship has the responsibility for decision-making, problem-solving, operational duty, and business development. This is why the working pressure is higher than the other entity categories.

- Limited business life cycle.

Tips

The sole proprietorship is recommended if you are going to

- Need an extremely simple registration and low cost of setting up & maintenance

- Operate a limited and small-scale business scope

- Have adequate funds to operate the business, without external financial support and expertise

- Run low-risk (or non-risk) business

Hong Kong Partnership

Main features of partnerships

According to the Partnership Ordinance in Hong Kong, a partnership is formed when a person joins with other people to do business with a common view of intention for profits. This business entity type involves at least 2 members.

There should be a partnership agreement, a mutual agreement among all the partners regulated by the Partnership Ordinance, to state and control their positions, rights, and obligations in the business.

The firm must apply for a Business Registration Certificate no later than one month after business commencement. Hong Kong partnerships are in charge of the annual tax return by filing form BIR52 and are subject to a profits tax rate from 7.5% to 15%.

A partnership can be limited or general. Below are the key elements of the two structures for you to consider:

Limited partnership

This type of partnership is based on an agreement between one or more persons as limited partners, and one or more persons as general partners:

- The limited partners are only liable for the contributed capital. They may not be allowed to participate in the partnership management.

- The general partners are personally liable for all debts and obligations of the firm. They have the power to make decisions related to the business’s day-to-day operation.

The Hong Kong limited partnership must be registered with the Companies Registry under the Limited Partnership Ordinance.

General partnership

The general partnership is based on an agreement between two or more persons, known as general partners.

These partners are individually liable for all the company’s debts and obligations. Additionally, they are also held liable for the actions of other partners.

If a partnership is not registered with the Companies Registry, it will take the form of a general partnership by default and be governed by the Partnership Ordinance.

Advantages of partnerships

- Shared responsibilities and works: All partners should have high motivation to deliver excellent services as they are liable for all the debts and obligations of the firm.

- Ease of setting up and maintaining: Procedures and costs for registration and maintenance are relatively low compared to other business entity types i.e. private companies.

- Flexible business structure: a partnership can easily expand by attracting new relevant people to join the partnership. Moreover, these partners can simply change the legal structure later if conditions change.

- Utilize the relevant expertise of each partner: Operating a business demands broad knowledge in different areas, which can be a hurdle for a business owner alone. Starting a business under a partnership allows you to take advantage of each partner’s proper experience and personal relationship.

Disadvantages of partnerships

- Personally liable for all the firm’s obligations: Jointly liable with other members, the partner’s liability is personally unlimited (except for the limited partner in the limited partnership).

- Profits sharing: Along with shared responsibility and workload, the interest is divided among the partners.

- Disagreement during business: Any significant decision must be made with the majority of existing members’ approval, which causes lengthy discussions.

- Disputes can disrupt the business, as a partnership is built on trust and belief. Each partner is the agent of the partnership and is responsible for the actions of other partners.

Tips

Partnerships are recommended if you are going to

- Involve more than one person in your business and do not necessarily demand limited liability.

- Have trustworthy and honest partners who can complement your lack of skills and knowledge to run a business.

- Share a common goal: a partnership works best when a shared goal exists among partners.

Branch in Hong Kong

A branch office in Hong Kong is not a separate legal entity under the Companies Registry. It is an extension of the parent company. Although a branch can undertake commercial activities, it has no ownership rights; subsequently, its parent company has full liability for all the debts and obligations of the branch.

A foreign corporation that wants to establish a branch in Hong Kong must register with the Company Registry to obtain a certificate of registration as a non-Kong Kong company. A branch must also be registered with the Business Registration Office of the Hong Kong Inland Revenue Department.

Like any other business entity, a branch office must have a local company secretary and a registered address.

A branch office is sometimes mistaken for a subsidiary. Investors often choose to have a subsidiary to be apart from their counterparts and to enter the market. Incorporating a subsidiary under the Companies Registry is impossible, so businesspeople usually set up private limited companies as their subsidiaries in Hong Kong.

Representative Office

A representative office or liaison office is an entity type designated only for companies formed outside of Hong Kong. A representative office must be named the same as its parent company. Only the Business Registration Office can handle the liaison office. Conducting business in Hong Kong is not allowed, but an annual tax return with “NIL” filing is required.

A liaison office must have a local representative to contact for government records. This entity type is chosen mostly for promotion, advertisement, and marketing research in Hong Kong. It also plays a role as the point of contact to reach potential and local customers (Customer Supporting Service Center), and to build relationships with Hong Kong suppliers.

When Simplicity or Specialised Functions Matter Most

For single-project financing, fundraising, or securitisation, a Special Purpose Vehicle—typically a limited company with restricted objects in its articles—offers bankruptcy-remote status that banks and investors favour, as confirmed in Companies Registry incorporation guidelines and common listing requirements of the HKEX.

In contrast, licensed Trust company service providers (regulated under the Trustee Ordinance Cap. 29 and the Anti-Money Laundering Ordinance) are required when establishing family trusts, employee share option schemes, or unit trusts, rather than using a standard limited company.

While a Holding Company or Special Purpose Vehicle can be set up within one day via the e-Registry, a Trust Company licence from the Companies Registry takes several months and ongoing compliance, making it suitable only for professional trustees rather than ordinary business operations.

Conclusion

In line with the above preparation among the Hong Kong business entity types, the regulations for sole proprietorship and partnership are simpler and increasingly most complicated for public companies.

Hong Kong company formation is highly in demand and entrepreneurs will need to choose an appropriate business entity type. Before following the trend of entering this open-oriented market, you should understand their business needs and investigate the pros and cons of each entity type.

If you are still confused about what structure to choose, please message us via service@bbcincorp.com for practical advice.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.