Representative Office, Branch Office, and Subsidiary are the most widely used options for foreign companies who wish to register their presence in the Hong Kong market. Unlike a branch office or subsidiary, a representative office in Hong Kong is much simpler in its registration procedure.

This blog will shed light on key features and registration procedures for a Hong Kong representative office!

What is a Hong Kong representative office?

A representative office in Hong Kong (RO) is a common registration option for non-Hong Kong incorporated companies to have a place of administrative office in Hong Kong.

A representative office is considered to be an effective vehicle for any foreign investor to test the business environment, at the same time, examine the potential of doing business before penetrating.

Representative office in Hong Kong and many other places usually lies under the restriction for only conducting specific activities.

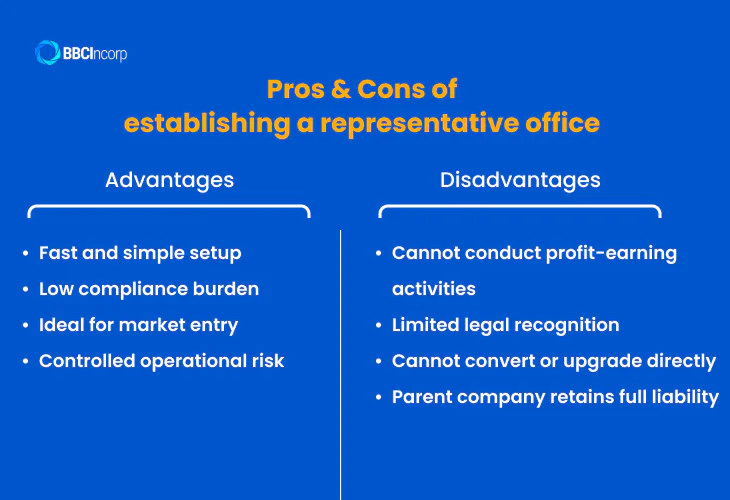

Pros and cons of establishing a representative office in Hong Kong

Establishing a representative office (RO) in Hong Kong offers strategic benefits for foreign businesses entering the market, but it also has important limitations. Here’s a balanced analysis:

Advantages of establishing a Hong Kong RO

Fast and simple setup

ROs can be established quickly with minimal upfront cost. There is no need to register with the Companies Registry or inject share capital. Only a Business Registration Certificate from the Inland Revenue Department is required, typically within one month of commencing operations .

Low compliance burden

ROs are exempt from filing audited financial statements and statutory returns (aside from an annual “nil” profits tax return). They don’t need to maintain directors’ or shareholders’ registers or hold AGMs .

Ideal for market entry

ROs allow companies to conduct market research, establish local connections, and build visibility without engaging in commercial activities or revenue-generating operations.

Controlled operational risk

Because ROs have no separate legal personality, liabilities are limited to the foreign parent. This reduces regulatory exposure while exploring the Hong Kong market .

Challenges of establishing a Hong Kong RO

Cannot conduct profit-earning activities

ROs are restricted from trading, entering contracts, or issuing invoices. Any commercial activity is strictly prohibited, meaning ROs cannot generate local revenue .

Limited legal recognition

As extensions of the parent company rather than independent entities, ROs cannot access business benefits tied to Hong Kong corporate status — such as local legal recourse or government support schemes.

Cannot convert or upgrade directly

If you decide to start commercial operations, you must dissolve the RO and form a new entity (branch or subsidiary), or register a branch separately. There is no straightforward path to convert an RO into an incorporated structure .

Parent company retains full liability

All liabilities, including rent, staff costs, and debts, are borne by the foreign parent company, increasing potential exposure.

In summary, a representative office is a cost-effective, low-risk way to enter the Hong Kong market, but it is suitable only for non-commercial presence. If you intend to trade or generate income in Hong Kong, establishing a branch or subsidiary may be more appropriate. Let me know if you’d like a detailed comparison of all three structures.

Features of a Hong Kong representative office

Before establishing a presence in Hong Kong, it’s essential to understand the unique characteristics of a representative office. This structure is often chosen by foreign companies looking to explore the Hong Kong market without committing to full-scale operations. Below are the key features of a Hong Kong representative office.

Legal status

A representative office has no independent legal standing in Hong Kong. It is considered an extension of the foreign parent company rather than a separate legal entity. As a result, the parent company assumes full responsibility for all actions, debts, and liabilities incurred by the representative office.

Scope of activities

A representative office functions strictly as a liaison office. It is prohibited from engaging in any profit-making activities in Hong Kong. Examples of prohibited activities include trading, issuing invoices, providing paid services, and negotiating contracts.

Instead, it focuses on market research, promotional activities, and acting as a communication channel for the parent company.

Noticeably, a subsidiary as a private limited company in Hong Kong is considered the most common type of business entity for foreign entrepreneurs.

Naming

A Hong Kong representative office must operate under the same name as the foreign parent company.

Officer appointment

Typically, the parent company appoints one manager, usually from headquarters, to oversee the representative office, along with optional local support staff.

Registration procedure

Establishing a representative office in Hong Kong is relatively simple. There is no requirement to register with the Companies Registry, and there is no minimum capital requirement. However, the office must apply for a Business Registration Certificate from the Inland Revenue Department.

Compliance requirements

Since a representative office cannot conduct business activities, it does not need audited accounts or standard tax filings. It may still be required to file a tax return with a “NIL” declaration and must maintain a valid Business Registration Certificate.

The table below compares the key features of a representative office, branch, and subsidiary in Hong Kong to help you choose the most suitable structure for your business goals.

Comparison: Representative Office vs Branch Office vs Subsidiary

| Feature | Representative Office | Branch Office | Subsidiary (Private Limited) |

|---|---|---|---|

| Legal status | Not a separate legal entity | Not a separate legal entity | Separate legal entity |

| Parent company liability | Fully liable | Fully liable | Limited to share capital |

| Allowed activities | Non-commercial (liaison, research) | Full commercial activities | Full commercial activities |

| Profit-making | Prohibited | Allowed | Allowed |

| Name | Same as parent | Same as parent | Can be different |

| Registration | Only with IRD for BRC | With Companies Registry & IRD | With Companies Registry & IRD |

| Minimum capital | None | None | Usually HKD 1 or more |

| Tax obligations | NIL filing | Full tax filing | Full tax filing |

| Compliance burden | Low | Medium | Higher (statutory audits, AGM) |

Read more: Branch vs. Subsidiary vs. Representative Office In Hong Kong: Key Differences

How to register a representative office in Hong Kong

Who can register?

Any business owner who meets the following two conditions will be eligible to register a representative office in Hong Kong:

- Owns a non-Hong Kong incorporated company; and

- Has a place of business in Hong Kong

What documents are required?

Below are the basic documents for the registration procedure for a representative office:

- Completed Application Form (Form 1(b))

- The registered name and the address of the non-Hong Kong company (translation to applicable languages – English or Chinese, or both – may be required)

- A place of business address in Hong Kong

- Particulars of the Manager or Chief Officer of the representative office

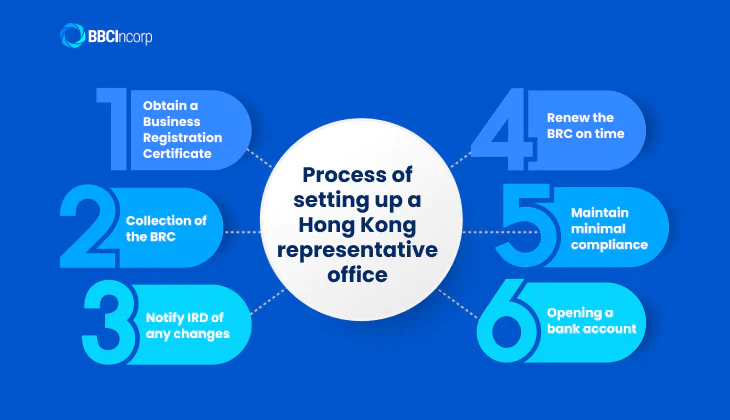

How does the Hong Kong representative office proceed?

Once you’ve decided to set up a representative office in Hong Kong, you’ll need to follow a few simple but important steps to ensure compliance and smooth operation. Below is an overview of how the process works:

- Obtain a Business Registration Certificate (BRC)

Every representative office must apply for a Business Registration Certificate from the Inland Revenue Department (IRD) within one month of starting operations. This certificate serves as proof of registration for tax purposes, even though the office does not engage in profit-making activities.

- Collection of the BRC

Once approved, the BRC is usually ready for collection on the next working day. It must be picked up in person at the IRD. The certificate must then be displayed at the representative office premises in Hong Kong at all times.

- Notify IRD of any changes

If any registered details of the representative office change, such as the office address, appointed manager, or parent company details, the IRD must be notified within one month of the change by submitting the appropriate forms.

- Renew the BRC on time

The BRC is valid for either one year or three years, depending on the option chosen during registration. The renewal must be done one month before the expiry date to avoid penalties and maintain good standing.

- Maintain minimal compliance

Although not required to file profits tax returns (unless specifically issued), a representative office must maintain a valid BRC and ensure it does not engage in any prohibited activities that would violate its status.

- Opening a bank account

As part of the post-registration steps, many foreign companies choose to open a bank account in Hong Kong for their representative office. Although the office itself cannot receive income locally, having a local account makes it easier to cover operating expenses, such as rent, salaries, and marketing costs, without relying on personal or overseas accounts.

In addition, banks in Hong Kong usually require the parent company’s incorporation documents, proof of the representative office’s registration, and details of the appointed manager. Working with a trusted corporate service provider can help streamline this process efficiently.

Free ebook

Everything you need to start business in Hong Kong

Find out in a matter of minutes.

Why professional support simplifies the process?

From notifying the IRD of cessation (if the office closes) to maintaining proper records of the parent company’s board resolution authorising the office, the appointed representative—or outsourced company secretary services—serves as the essential local point of contact for all official matters. For a full explanation of these continuing responsibilities, see our detailed guide Company Secretary In Hong Kong: What Is Its Role?.

This arrangement not only satisfies statutory requirements but also provides peace of mind to the overseas headquarters, as the company secretary services provider typically bundles representative office compliance with other corporate services at minimal additional cost.

By delegating these obligations to an experienced local firm, foreign businesses can focus on market research and liaison activities without worrying about accidental breaches of Hong Kong regulations.

In summary

- A representative office is one of the popular registration options for foreign companies in Hong Kong. It is a good option for testing the market before penetration.

- Representative offices in Hong Kong can only conduct restricted activities like promotion, liaison office or market, and research. It has no legal status and cannot engage in any business activity that earns profits.

- Setting up representative offices in Hong Kong is easier than a branch office or a subsidiary. Reasons for this include no minimum capital requirement, no filing or accounting requirement, no need to register with the Companies Registry, etc.

- Required documents for the registration of a Hong Kong representative office include an application form, particulars of the chief officer, place of business in HK, and identity proof for the non-Hong Kong company.

There are two other options for overseas investors to establish their presence in Hong Kong: a branch office and a subsidiary. It’s advised that you make a comparison of the pros and cons of each and select the best-suited business structure for your foreign company.

Frequently Asked Questions

Can an RO open a business bank account in Hong Kong?

A Hong Kong Representative Office (RO) can open a business bank account, even though it cannot conduct profit-making activities locally.

After securing its Business Registration Certificate from the Inland Revenue Department within one month of starting operations, the RO can apply to any local or international bank in Hong Kong.

Banks typically request the original BRC, proof of office address, a certified copy of the parent company’s incorporation certificate, details of the Hong Kong manager, and identification for authorized signatories.

Additional requirements, including in-person meetings or further KYC documentation, may apply. Account opening usually takes 2-6 weeks, with digital options potentially faster. A local account streamlines managing essential operating expenses like rent and salaries.

What happens when an RO's operations are shut down?

When a Hong Kong Representative Office (RO) ceases operations, it must formally deregister within one month.

This involves notifying the Business Registration Office of the Inland Revenue Department that it has officially ceased functioning, which formally terminates its obligation to hold a Business Registration Certificate.

Prior to filing for deregistration, the RO should:

- Settle all outstanding liabilities, including rent or staff costs.

- Close its local bank account.

- Return its company seal if one was in use.

Although formal deregistration with the Companies Registry is not required for an RO, you should report the cessation of operations to the Business Registration Office in a timely manner to avoid legal complications.

Are ROs required to keep any filings or statutory documents/registers?

In Hong Kong, a representative office (RO) is not an incorporated entity, so it’s not required to maintain the usual statutory registers (like directors’ or members’ registers), minutes of meetings, or audited accounts, which apply to incorporated companies.

However, if the RO engages employees locally, it must retain payroll and employment records in compliance with labor regulations. Moreover, the RO must:

- Apply for and display a valid Business Registration Certificate with the Inland Revenue Department (IRD)

- Submit a nil profits tax return or declare exemptions annually, as the RO does not generate taxable income

- Notify the IRD within one month of any changes to its registered particulars, such as the office address, or the chief officer

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.