Explore company formation Hong Kong in finance to see how financial businesses can incorporate efficiently and meet regulatory requirements in the sector.

Where the fusion of cultures and boundless business prospects captivate expat entrepreneurs, understanding the intricacies of currency exchange in Hong Kong is the cornerstone of success in this dynamic realm of commerce.

Mastering currency exchange will provide you with a significant advantage when it comes to starting a new venture or expanding your existing operations here. In this article, we’ll provide all the insider tips and practical advice you need as a global entrepreneur.

An overview of currency exchange in Hong Kong

Positioned as a prosperous international hub, Hong Kong’s financial ecosystem offers a wide range of options for currency exchange and business transactions.

What to keep in mind when conducting currency exchange here

Firstly, Hong Kong’s strategic location and strong infrastructure make it a beneficial spot for investors and businesses looking for reliable currency exchange services. Whether you prefer traditional banks, licensed money changers, or modern fintech platforms, Hong Kong caters to the varied needs of aspiring entrepreneurs.

Another key aspect is the main currency, the Hong Kong Dollar (HKD), has been tied to the US Dollar (USD) since 1983 regarding the Hong Kong exchange rate. This connection brings stability to the currency market here, making it easier for businesses and individuals to plan their finances confidently.

Moreover, this financial landscape is highly responsive to global market shifts and geopolitical developments. By comprehending currency exchange Hong Kong, you will be able to keep up with the market cost-effectively.

Is cash or cards more common in Hong Kong?

Both cash and cards are widely used in the region, but the trend has been shifting towards electronic payments, including credit, debit cards, and mobile payment systems.

To add more details, credit cards are very popular, particularly for online shopping, dining out, and larger purchases, as they are accepted in most establishments, from high-end restaurants to chain stores.

Additionally, mobile payment platforms like Octopus, AlipayHK, and WeChat Pay HK are also prevalent. The Octopus card, which started as a payment method for public transportation, has expanded to become a common contactless payment method across various retail settings, including convenience stores, supermarkets, and fast-food restaurants.

While digital payment methods are highly favored, especially among the younger demographics, cash is still used in smaller businesses, local markets, and some taxis. Hence, it’s always a good idea to carry some cash, even in foreign currency, when exploring Hong Kong.

If you’re visiting Hong Kong from overseas, you should convert some of your funds into Hong Kong Dollars upon arrival or withdraw them from local ATMs.

Where can expats exchange money in Hong Kong?

Hong Kong expats indeed have several locations for exchanging money here. Among the most popular options are:

Local Hong Kong banks

As a leading financial center, Hong Kong boasts a sophisticated banking system. This provides a wide range of currency exchange services to accommodate the diverse needs of both residents and visitors. Major Hong Kong banks such as HSBC, Standard Chartered, and Bank of China have extensive networks of branches spread across the city.

Currency exchange services

These dedicated exchange counters are conveniently located in high-traffic areas frequented by tourists and expatriates, including major shopping centers and vibrant neighborhoods such as Central, Tsim Sha Tsui, and Causeway Bay. They cater to busy individuals who need to exchange currency on the go.

Airport support centers

At the Hong Kong Airport, travelers can stop by several currency exchange counters located in both the arrivals and departures areas. These facilities are placed around the airport to cater to incoming and outgoing passengers who exchange money as part of their travel itinerary.

ATMs around the region

Withdrawing HKD directly from ATMs is one of the easiest and most common methods. Given their widespread density, ATMs are a popular choice among locals and travelers alike for performing currency transactions.

Hotel receptions (for tourists)

Many hotels in Hong Kong provide foreign money exchange services directly at the reception. This option adds a layer of convenience, especially for those who may not have the time or desire to seek out alternative exchange facilities upon arrival or during their stay.

Licensed money changers

The benefits of licensed money changers over traditional banks when it comes to currency exchange are particularly prevalent in Hong Kong. Since these establishments offer more competitive rates, you will likely receive greater value for the same amount.

For this option, you can seek out licensed money service operators authorized by the Hong Kong Monetary Authority (HKMA). It’s also advisable to peruse online reviews and seek recommendations from locals or fellow expatriates to locate trustworthy money changers.

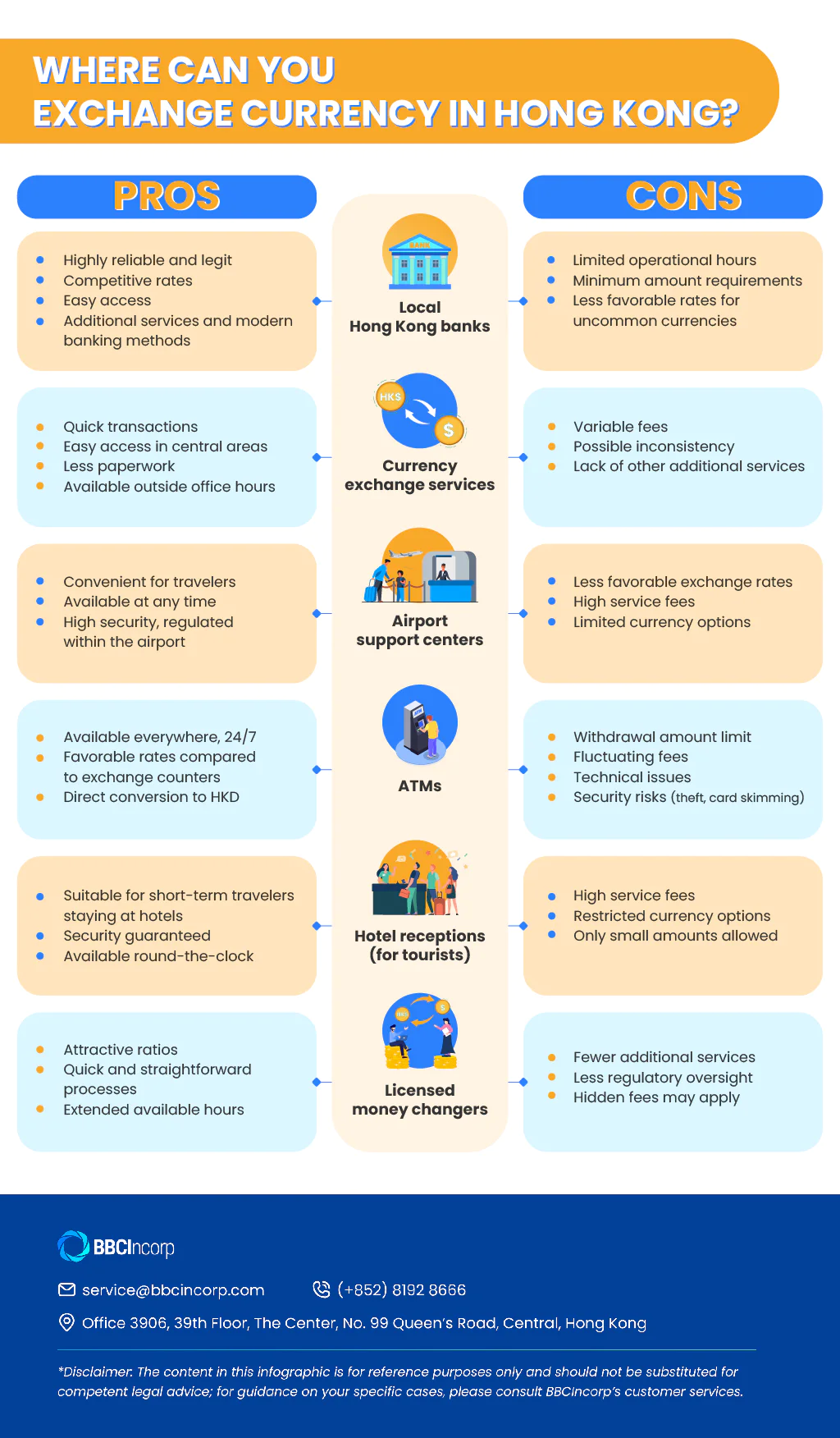

You may find it helpful to look at the following table for the pros and cons of each option:

Additionally, expats residing in Hong Kong or those planning an extended stay may find it advantageous to open a bank account (either traditional or electronic). This allows for direct deposit of salaries in HKD and easier management of local expenses.

Top 4 locations for best money exchange Hong Kong

Here are the top five locations known for reliable and favorable currency exchange centers:

Central District

Central is the financial heart of Hong Kong and home to the headquarters of major banks and financial institutions. This area offers diverse service providers, from reputable banks to independent licensed money changers.

The competition among service providers in this area means you’re likely to find some of the best Hong Kong exchange rates. You can visit several money changers to compare various ways before making a transaction, especially along streets like Des Voeux Road and Queen’s Road Central.

Tsim Sha Tsui

In Tsim Sha Tsui, the Kowloon peninsula’s main retail and tourism district, currency exchange outlets can be found scattered among its shops and eateries. The high competition among the numerous exchange counters here generally leads to very favorable rates.

For this area, you should check out Nathan Road and adjoining streets where smaller outlets might offer better transactions. In addition, Chungking Mansions and Hankow Center are also known for their beneficial exchange ratios.

Causeway Bay

Known for its vibrant shopping scene, Causeway Bay is another excellent place for currency exchange. Many tourists and shoppers pass through, making it a hotspot for financial services. This region is accessible directly via the Causeway Bay MTR station.

At Causeway Bay, a great tip is to explore the side streets and minor malls apart from the main thoroughfares like Hennessy Road to find the best money exchange hong kong

Mong Kok

Mong Kok features an eclectic mix of markets, shopping streets, and residential units, creating a fertile ground for the money-changing service industry. This area offers some of the most valuable rates in Hong Kong due to its high density and the diverse needs of its clients.

It’s advisable to focus on areas near Nathan Road and Shantung Street. If you have foreign currencies other than USD, consider converting them to USD before your trip and then to HKD in Mong Kok for greater exchange amount.

Additional tips for managing your exchange transactions

To enhance your financial outcomes when managing Hong Kong currency exchange transactions, you need to employ effective strategies. Below are some tips you should consider:

Making use of timing strategies

Timing is crucial for currency exchange Hong Kong, as the rates can fluctuate throughout the day based on market conditions. Typically, it’s wise to conduct transactions during periods of stability when rates in Hong Kong are advantageous.

One common method is to monitor market trends and news updates to identify opportune moments. For example, consider exchanging currency during off-peak times or on weekdays, when demand may be lower, for better rates.

Exploring alternative solutions

In addition to traditional money changers and banks, your business can also opt for alternative banking solutions such as digital currency platforms and fintech solutions. These options bring efficient ways to exchange currency with preferential rates and cost-effective fees.

Another viable option is the peer-to-peer (P2P) exchange network. P2P platforms enable direct connections with individuals seeking to exchange currencies. However, since P2P transfers are dependent on the availability of buyers and sellers at the moment, there may be a delay in the processing, and the rate may change.

Mitigating hidden costs

Make sure to remain mindful of potential fees that may not be immediately apparent. These could include unexpected service fees, commission charges, and other expenses that can erode your funds.

To minimize these costs, consider comparing rates and fees from various providers before making a decision. Additionally, bundling multiple smaller transactions into a single larger exchange can help secure bulk rates and reduce overall costs.

Utilizing forward contracts

With a forward contract, you can agree to buy or sell a set amount of currency at a predetermined rate on a specified future date. This strategy offers assurance regarding future Hong Kong exchange rates, shielding your business from unfavorable situations.

For instance, if your business regularly deals with international suppliers and wants to safeguard against potential currency depreciation, entering into a forward contract can be a smart choice.

Opting for natural hedging (for businesses)

This presents a unique approach by aligning cash flows across different currencies without solely relying on external hedging instruments. Instead, it seeks to match revenues and expenses in various currencies, effectively managing currency risk.

Here’s an example: if your Hong Kong business earns revenue in multiple currencies, natural hedging involves synchronizing foreign currency revenues with corresponding expenses. This practice serves as a built-in mechanism to offset unwanted changes.

To wrap up

In summary, the insights shared in this guide underscore the importance of currency exchange proficiency for entrepreneurs in Hong Kong. From leveraging licensed money changers to timing strategies and alternative solutions, each tip empowers businesses to navigate the complexities of currency markets effectively.

If you’re planning to launch your business in Hong Kong and have inquiries about conducting business here, simply reach out to us today! Let us be your partner in optimizing your financial operations and maximizing opportunities in this dynamic city.

Don’t hesitate to leave a message via email at service@bbcincorp.com or chatbox, our support team is here to assist you.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.