Table of Contents

Cayman Islands consistently stand out as an exceptional jurisdiction for global business incorporation. This jurisdiction facilitates a politically stable environment, an English common law framework, and world-class infrastructure.

These advantages are supported by a tax-neutral model with no corporate, income, capital gains, or withholding taxes.

In this context, the Cayman Islands exempted company emerges as the premier corporate structure. Particularly, this structure enables incorporation in as little as a day, requires no Cayman resident directors or public records of shareholders, offers flexible share capital arrangements, and provides long-term tax-free certainty.

In this article, we explore the structure, benefits, and practical steps for using exempted companies to support international operations.

Understanding the Cayman Islands Exempted Company

The Cayman Islands exempted company is one of the most recognised and trusted corporate structures in the global business landscape, valued for its flexibility, tax efficiency, and legal certainty.

What is a Cayman Exempted Company?

Under the Companies Law 2020 (Revision), a Cayman Exempted Company (also called Cayman Islands Ltd. or Cayman Ltd. company) is a legal entity that conducts the majority of its business outside of the Cayman Islands. It possesses a separate legal personality, enabling it to perform the functions of a full capacity natural person and enjoy perpetual succession.

As the most common type of offshore company, this corporate structure is ideal for international operations and reflects the Cayman Islands exempted company definition many global investors rely on alongside Cayman LLCs.

Types of Exempted Companies

Within the exempted company framework, there are two notable variations:

- Limited Duration Company (LDC): An LDC is designed with a defined lifespan of up to 30 years, after which it automatically initiates winding up unless earlier dissolved by its members. The entity must have “LDC” or “Limited Duration Company” in its name and typically requires at least two members.

- Segregated Portfolio Company (SPC): An SPC is a single legal entity that can establish multiple segregated portfolios, each with assets and liabilities separate from the company’s general assets and each other. It must include “SPC” or “Segregated Portfolio Company” in its name and file distinct returns reporting all movements across those portfolios.

Why Choose an Exempted Company in the Cayman Islands

Choosing an Cayman Islands Ltd. structure brings significant advantages for global ventures seeking an efficient and reputable base for operations. The jurisdiction is well established as a vibrant financial hub, supported by political stability, modern infrastructure, and a respected legal system.

Key advantages of a Cayman Islands exempted company

- Tax efficiency: No corporate income tax, capital gains tax, or withholding taxes. Businesses can apply for a government-issued tax exemption undertaking, typically lasting 20 to 30 years.

- Strong legal environment: Based on English common law, with the highest appeals going to the Privy Council in London. The environment fosters predictability and confidence in legal outcomes.

- Operational flexibility: No requirement for shareholder or director meetings in the Cayman Islands. Resident directors are not mandatory, and companies may issue shares in any currency, with or without par value.

- Privacy protection: Shareholder and director details remain confidential, and there is no public inspection of company registers.

- Fast incorporation process: Standard registration is swift, while express services can complete incorporation in as little as one business day.

The combination of zero direct taxes, governance standards, and ease of operation makes the exempted company a preferred choice for entrepreneurs, investment funds, and multinational businesses seeking a stable base for cross-border activities.

It also supports a wide range of structures, from holding companies to special-purpose vehicles, without the need for a physical presence in the Islands.

Minor drawbacks to consider

Regardless, there are a few aspects worth preparing for in advance.

- Local business scope: Trading with Cayman residents requires an additional license, as the jurisdiction primarily serves global commerce.

- Annual government fees: Regular renewal fees apply, but they help preserve the company’s good standing and uphold a respected regulatory system.

- Ongoing compliance: Even without corporate tax, companies must meet annual filing and reporting requirements, including accurate record-keeping.

- Economic substance rules: Certain industries need to show local management and operational presence, which can enhance credibility.

With forward-looking planning, these considerations can be turned into strengths, reinforcing both the company’s legitimacy and its ability to operate confidently in the global market.

Constitutions of the Cayman Islands Ltd. company

An exempted company in the Cayman Islands operates under a distinct constitutional framework designed to provide clarity, certainty, and operational flexibility for its owners.

This framework is primarily established through two key instruments: the Memorandum of Association and the Articles of Association. Together, these documents define the entity’s legal identity, structure, governance principles, and operational scope.

Memorandum of Association

Memorandum of Association serves as the company’s foundational charter. It sets out essential information such as the entity’s name, registered office location, objectives, share capital details, and any limitations on liability.

The Memorandum of Association encompasses the following information:

- The name of the company must not be identical or deceptively similar to an existing name.

- The names of initial subscribers (incorporators), who may be the registered office provider and who need not be Cayman residents.

- The stated objects or purposes of the company, often unrestricted for business flexibility.

- The registered office address must be within the Cayman Islands.

- A declaration of limited liability, ensuring shareholder liability is limited to unpaid share amounts.

- The authorised share capital, which may be in any currency and may allow fractional and multiple share classes.

Once executed, the Memorandum, together with the Articles, must be filed with the Registrar and bind the company and its members.

Articles of Association

The Articles of Association act as the internal rulebook governing the company’s day-to-day operations. The document covers a wide range of matters, including:

- The rights and responsibilities of directors

- The process for holding general meetings

- Voting procedures

- Dividend policies

- Transfer of shares

- Rules for voluntary dissolution and asset disposition, and

- The handling of company records

- Procedures for appointing and removing directors, and

- How conflicts of interest are to be managed.

Although the Companies Act provides default rules, the articles let shareholders to adapt these provisions to better suit the company’s particular needs, giving them control over internal governance.

The Articles act as a contractual agreement between the company and its members and may be amended via a special resolution, followed by filing with the Registrar

Important Note

Copies of the Memorandum and the Articles of Association (the M&A) must be available upon request of all the shareholders.

Registered Office

Every exempted company in the Cayman Islands must have a registered office within the jurisdiction, provided by a licensed service provider.

This address is the official point of contact for all government correspondence and legal notices. It also serves as the location where certain statutory records must be kept and made available for inspection by authorities.

The address must be notified to the Registrar and published in a public notice. In addition, any change to the registered office requires a formal resolution, with a certified copy of the new address filed with the Registrar within 30 days of the resolution date.

Even though your company may operate its business activities across borders, the registered office provides a formal local presence that supports compliance with Cayman company law.

Company Name Requirements

Deciding the right name is a critical step in registering a company in the Cayman Islands, as the Registrar applies strict rules to protect the public and prevent confusion. Key requirements include:

- The name must not be identical to that of an existing company, or so similar that it could mislead or deceive.

- Certain sensitive words are restricted and may require the Registrar’s consent, such as bank, trust, insurance, or royal. In some cases, these words cannot be used at all.

- There is no obligation for an exempted company to include suffixes like Ltd, Limited, or Inc. However, unless it is a limited liability company, it cannot use the abbreviation “LLC” or the phrase “limited liability company” in its name.

Directors

You must appoint at least one director, who may live anywhere in the world and need not be a Cayman Islands resident. Shareholders appoint the first director(s), and future appointments or removals follow the procedures outlined in the company’s Articles of Association.

Directors are responsible for managing the business, and their duties include:

- Acting in the company’s and its members’ best interests

- Exercising powers for proper purposes

- Avoiding conflicts and improper personal gain

- Performing duties with appropriate care, skill, and diligence

- Maintaining confidentiality and upholding integrity

These fiduciary and common law obligations are supported by the Companies Act. Breaching these duties can expose directors to personal liability to the company

Share capital

This refers to the maximum amount of stock that your exempted company may issue, which can be increased by a shareholder’s ordinary resolution.

There are no thin capitalization rules in Cayman, and there is no requirement for an exempted company to have more than one shareholder or to issue more than one share.

The Articles allow an exempted company to issue fractional shares, enabling the share capital to be divided into classes with varying rights.

Dividends

Dividends may be declared and paid from profits or the share premium account, subject to passing a solvency test. Directors may issue dividends via board resolution, either in writing or during a board meeting, without needing separate shareholder approval.

In some cases, dividends are paid in specie, which is assets rather than cash. Directors must make sure that dividend payments do not undermine the company’s ability to meet its liabilities, as unlawful distributions carry both civil and criminal penalties

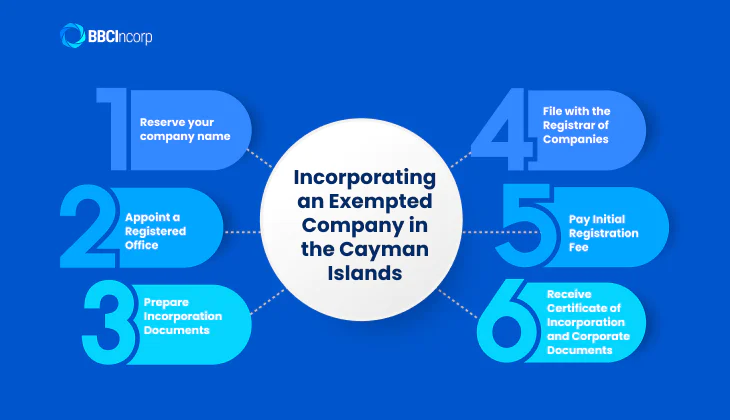

Incorporating an Exempted Company in the Cayman Islands

Setting up a Cayman Islands exempted company is a well structured process supported by a robust legal framework and efficient administration. Under the Cayman Islands exempted company law, the procedure can be completed quickly, often within a few days, provided all requirements are met.

Below are the key steps to guide you from planning to incorporation.

Step 1: Reserve your company name

Your journey begins with securing a unique company name through the Cayman Islands Registrar of Companies. The name must be distinct and should not closely resemble that of an existing company to avoid confusion. Certain sensitive words, such as “bank” or “insurance”, require prior approval from the Registrar.

Step 2: Appoint a Registered Office

Every exempted company Cayman Islands structure must have a registered office located within the jurisdiction.

This address, provided by a licensed service provider, is the official point of contact for government correspondence and where statutory records are maintained for inspection by authorities. The appointment of a registered office must be completed before filing incorporation documents.

Step 3: Prepare Incorporation Documents

The core documents required are the Memorandum of Association and the Articles of Association, which together form the company’s constitution.

These details essential elements such as the company name, objectives, share structure, and governance rules. Additionally, the names of the initial subscribers and the registered office address must be included. Other supporting information may include details of the first directors and share capital.

Step 4: File with the Registrar of Companies

Once the incorporation documents are complete, they are submitted to the Registrar along with the prescribed forms and supporting identification information for due diligence checks. This step is critical, as accuracy in documentation allows for smooth processing and compliance with the law.

Step 5: Pay Initial Registration Fee

Incorporation requires payment of government registration fees, which are based on the authorised share capital of the company. These fees secure the company’s initial standing and are separate from the annual renewal costs that apply thereafter. Timely payment is essential to avoid delays in issuing corporate documents.

Step 6: Receive Certificate of Incorporation and Corporate Documents

After being approved, the Registrar issues the Certificate of Incorporation, officially recognising your business as a Cayman Islands exempted company. Your service provider will also supply certified copies of the Memorandum and Articles, share certificates, and statutory registers.

By following these steps carefully, you can establish your exempted company in the Cayman Islands with confidence and ease. It’s advisable to engage with professional company service providers like BBCIncorp to streamline your processes more efficiently.

Annual Compliance and Maintenance for Exempted Company Cayman

Here’s what you need to know to keep your Cayman Exempted Company in good standing.

Maintaining Company Records and Registers

Every exempted company must maintain several statutory registers at its registered office:

- Register of directors, which records names, addresses, and appointment or resignation dates. This register must be accessible to the Registrar for official inspection.

- Register of members, which lists shareholder names, their shareholdings, voting rights, and changes in membership. This can be kept outside Cayman unless the company is licensed to trade locally.

- Register of beneficial owners (BOs), maintained at the registered office and managed by the corporate services provider. It must accurately reflect all registrable beneficial owners, unless an approved alternative compliance route applies.

Accounting Records

A Cayman exempted company must keep proper accounting records that clearly reflect its financial position: income, expenses, assets, and liabilities. These records do not need to be stored in Cayman, but they must be accessible upon request by authorities.

There is no statutory requirement to file accounts or appoint auditors, although companies regulated in Cayman may follow additional rules.

Annual Filing

Each January, exempted companies must submit an annual return to the Registrar. This filing confirms whether any changes occurred in the Memorandum or Articles of Association and provides details of activities carried out outside the Islands. At the same time, the company must pay the annual renewal fee to preserve its good standing.

Taxation

One of the defining advantages of a Cayman exempted company is its tax-neutral status. These companies are exempt from corporate income tax, capital gains tax, and withholding tax, and there are no taxes on dividends or estate inheritance. This setup is central to the distinct entity and remains a key draw for global investors.

Beneficial Ownership Transparency

Cayman law requires exempted companies to maintain a Beneficial Ownership Register (BOR) with up-to-date details of registrable beneficial owners.

Certain regulated entities, like licensed funds or listed companies, may follow alternative compliance protocols. These can be appointing a fund administrator or other CIMA-registered contact person instead of maintaining a full BOR.

Economic Substance Requirements

Where a Cayman Islands exempted company carries out relevant activities, it must meet the economic substance test.

This includes conducting core income-generating activities locally, being directed and managed in Cayman, and maintaining adequate local expenditure, premises, and personnel. These rules align with international tax cooperation standards.

Global Compliance Rules

Additionally, if you are a US resident or operating across borders, additional reporting requirements may apply:

- Controlled Foreign Corporation (CFC) rules

- Cayman Economic Substance (ES) rules

- FATCA (Foreign Account Tax Compliance Act) and FBAR (Foreign Bank Account Report) which require disclosure of foreign accounts and investments.

These rules impose responsibilities on shareholders and company managers to ensure transparency across jurisdictions.

Establish your Cayman Islands Exempted Company with BBCIncorp

At BBCIncorp, our expert team makes setting up your Cayman company simple, fast, and seamlessly aligned with Cayman Islands Ltd. law. With extensive expertise in global incorporation, our team brings both local insights and a global perspective to guide you through every step, from initial application to a fully compliant business operation.

Our process is fully online, removing geographical constraints and streamlining every stage. In many cases, your entity can be incorporated and ready to operate within just 24 hours—saving you both time and effort.

What BBCIncorp offers:

- Full-service company registration and formation support

- Ongoing statutory compliance guidance

- Access to diverse international banking solutions

- Optional services such as nominee directors, virtual offices, and document legalisation

Partnering with BBCIncorp means having a single, dedicated team managing your company setup and ongoing administration, minimizing compliance risks and maximizing resource distribution.

For more information about Cayman Islands company formation, please visit our Cayman company formation service site, or feel free to contact us directly in the chatbox to see how we can help.

Conclusion

In short, an Cayman Islands exempted company combines privacy, minimal reporting obligations, and a tax-neutral environment, making it ideal for international entrepreneurs. Its flexible structure, full foreign ownership availability, and exemption from local corporate tax create significant advantages for cross-border operations.

With a registered office in the Cayman Islands and straightforward requirements for directors and shareholders, the entity shall enable smooth global business management while meeting compliance standards for your global expansion.

Have you decided to get started? Contact us today at service@bbcincorp.com for any questions you may have and receive practical solutions.

Frequently Asked Questions

What is the difference between an Exempted Company and an LLC in the Cayman Islands?

An Exempted Company is a corporate entity structured with issued shares and governed by directors, while a Cayman LLC operates under a more flexible partnership-style system with members rather than shareholders and does not issue share capital.

An LLC offers adaptable governance and profit distribution to suit joint ventures or investment structures, whereas an Exempted Company provides a traditional corporate framework with clear share and board governance.

An Exempted Company is a corporate body with shares and directors, while a Cayman LLC has members and a more flexible management structure similar to a partnership, without share capital.

How long does it take to incorporate a Cayman Islands Ltd.?

Incorporating a Cayman Islands exempted company is a swift process, typically completed within one to three business days. The exact timing depends on the completeness and accuracy of the submitted documents and the Registrar’s workload.

If all incorporation documents, including the Memorandum and Articles of Association, are properly prepared and the initial registration fee is promptly paid, many companies receive their Certificate of Incorporation within 24 hours.

Is information about directors and shareholders publicly available?

No, information about directors and shareholders of a Cayman Islands-exempted company is not publicly available. The Register of Members and the Register of Directors are kept confidential and are not open for public inspection.

However, the company must maintain a Beneficial Ownership Register, which records the ultimate beneficial owners. This register is not public but is accessible to competent authorities such as regulators and law enforcement agencies to ensure compliance with anti-money laundering and transparency requirements.

Can a Cayman Exempted Company trade within the Cayman Islands?

Answer: Under the Companies Act (2020 Revision), an exempted company cannot carry on business within the Cayman Islands without obtaining the necessary trade license or authorization. Doing so without a license violates the law and can lead to penalties or cancellation of the company’s registration.

This is because Cayman Islands exempted companies are primarily designed for conducting business outside the jurisdiction

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.