Table of Contents

The Cayman Islands has implemented important modifications to align with the fair taxation policies introduced by the OECD and EU. These changes emphasize the importance of Economic Substance (ES) for both existing and newly formed entities within the jurisdiction. ES ensures that businesses in the Cayman Islands maintain transparency and fair taxation practices, promoting a level playing field in the global financial landscape.

In this article, BBCIncorp provides detailed guidance on Cayman Islands Economic Substance, including in-scope entities, compliance procedures, and related considerations.

Understanding Cayman Economic Substance

What is Economic Substance in the Cayman Islands?

Economic Substance Cayman Islands refers to a legal framework introduced to align with global tax transparency standards established by the OECD and G20.

Under the Economic Substance Act, all legal entities registered or domiciled in the Cayman Islands must file an annual Economic Substance Notification (ESN), disclosing whether they conducted any defined “Relevant Activities” in the previous financial year.

Entities that engage in these activities, referred to as “Relevant Entities,” must meet an Economic Substance Test (ES Test). This test assesses whether the entity has substantial economic presence in the Cayman Islands, including local management, core income-generating activities, and adequate physical assets or staff.

Entities that are tax resident elsewhere must file a Tax Residency Outside Cayman (TRO) Form. The Department for International Tax Cooperation (DITC) oversees compliance. These regulations support international efforts to curb base erosion and profit shifting (BEPS), ensuring companies pay taxes in jurisdictions where real business value is created.

Overview of Cayman Islands Economic Substance Law

Having drawn much attention probably was the implementation of the OECD Forum on Harmful Tax Practices, aka FHTP. The forum came up with the global standard regarding substantial activity requirements to no or only nominal tax jurisdictions in November 2018.

As a member of the OECD BEPS Inclusive Framework, the Cayman Islands were among the very first ones to start their domestic law to meet the standard.

The International Tax Co-operation (Economic Substance) Law (2020 Revision), or Cayman “ES Act”, entered into force on 1 January 2019. The Act was then amended several times to further modify the requirements of ES notification, sharing of information, and other issues.

The Cayman ES (Amendment) Law, 2020 (Law 7 of 2020) published on 12 February 2020 is currently the latest version of the ES Act.

Other supplemented regulations and guidance, namely the Guidance on ES for Geographically Mobile Activities, and Cayman ES Regulations, 2020 were thereafter issued, on 13 July 2020 and 11 August 2020, respectively.

Accordingly, ES law requires in-scope entities with geographically mobile activities in the Cayman Islands to demonstrate ES as an annual requirement. For each relevant activity as prescribed in the law, entities must satisfy an ES test, including the CIGAs test, direction, and management test, and adequacy test.

Concerning filing obligations for those entities, the two primary duties are to submit an ES notification to the Authority and to file an ES return to the Authority.

The Tax Information Authority (the ‘Authority’), a functional unit of the Department for Internal Tax Co-operation in the Cayman Islands, supervises the ES law in the Cayman Islands and guarantees compliance with the law.

In what follows, we will delve into the ins and outs of how to comply with the Cayman Islands Economic Substance Requirements!

Importance of Economic Substance Legislation Cayman Islands

Cayman Islands Economic Substance legislation is more than a compliance requirement; it is a strategic framework that reinforces the jurisdiction’s global credibility and commitment to responsible tax practices.

Introduced to align with OECD and EU standards, the regime ensures businesses in Cayman contribute real value to the local economy while maintaining access to international markets and avoiding the reputational risks of being seen as a tax haven.

Upholding global compliance and reputation

The legislation ensures Cayman remains compliant with international standards, avoiding inclusion on EU or OECD blacklists. It reinforces investor confidence by demonstrating that businesses operating in Cayman have genuine local presence and operations, not merely a post-box address.

Preserving access to international markets

Many jurisdictions and institutions now require economic substance proof for cross-border transactions involving Cayman entities, ensuring continued access to global finance networks. Without substance, entities risk being disregarded for tax and regulatory purposes in foreign jurisdictions.

Deterrence of tax abuse and artificial structures

By requiring actual economic activity such as meetings, personnel, expenses, and premises, Cayman’s regime effectively counters tax avoidance strategies that rely on artificial shifting of profits to tax-neutral territories.

Strengthening regulatory oversight

Mandatory filings such as the Economic Substance Notification and Economic Substance Return provide detailed insight to the Cayman Tax Information Authority (TIA) into entity activities and substance levels. The TIA reviews these submissions, issues directions when deficiencies arise, and enforces penalties for non-compliance or failure to file.

Promoting sustainable business presence

Entities must justify their economic footprint relative to their relevant income by demonstrating operating expenditure, physical presence, and qualified local staff. This encourages sustainable operations within the Cayman Islands, creating value beyond mere tax benefits.

Entities that must comply with Cayman Economic Substance

Relevant Entities under Cayman Economic Substance Law

Under Cayman ES Act, in-scope entities, or relevant entities under ES law refer to:

- A company incorporated under the Companies Law (2020 Revision), or

- A Cayman limited liability company (LLC) registered according to the Limited Liability Companies Law (2020 Revision); or

- A limited liability partnership (LLP) registered according to the Limited Liability Partnership Law, 2017; or

- A company incorporated outside of the Cayman Islands and registered under the Companies Law (2020 Revision).

Entities excluded from Economic Substance Law Cayman

There are certain out-of-scope entities, and these cases don’t need to observe the ES test in the Cayman Islands.

Excluded cases are:

- A domestic company;

- A company as an investment fund;

- A company as a tax resident in an overseas jurisdiction

To be regarded as a tax resident in another jurisdiction outside Cayman, your company should provide evidence to the Authority that the company is subject to corporate tax on all of its income in another jurisdiction because of its tax residence, domicile, or other similar reasons.

And this same requirement goes for foreign branches of a relevant entity.

Example

You own a Cayman-incorporated company conducting on a relevant entity from a Hong Kong branch. Since the Hong Kong branch pays corporate taxes on all of the branch’s income in Hong Kong relating to the relevant entity, the branch is regarded as a tax resident outside Cayman.

Relevant activities under Economic Substance Law

Under the Economic Substance Act in the Cayman Islands, specific types of business activities are classified as “Relevant Activities.” Entities that conduct any of these must assess their compliance obligations, including whether they are considered Relevant Entities and subject to the Economic Substance Test. Understanding the scope of these activities is essential for proper classification and reporting.

The ES Act outlines the following nine categories of Relevant Activities:

- Banking Business: Involves receiving and holding money repayable on demand, such as deposits or savings, and investing it by advancing funds to customers. A banking licence is typically required.

- Insurance Business: Includes accepting risk and issuing insurance contracts, as well as managing claim settlements and run-off business. Entities must hold a valid insurance licence.

- Fund Management Business: Covers managing securities for clients, involving discretionary authority, under a licence or authorisation from CIMA as per the Securities Investment Business Act.

- Finance and Leasing Business: Entails providing credit facilities for compensation. It excludes land leasing, banking, insurance, and fund management activities.

- Headquarters Business: Consists of providing senior management services, risk control, or strategic guidance to related group entities. It does not include other defined Relevant Activities.

- Distribution and Service Centre Business: Involves purchasing goods or components from group companies for resale abroad or providing related services to group entities outside the Cayman Islands.

- Shipping Business: Encompasses operating ships for transporting goods, people, or mail internationally, chartering ships, container use, and seafarer placement services. It excludes pleasure yachts and holding company business.

- Holding Company Business: Defined as companies that only hold equity interests in other entities and derive income solely from dividends and capital gains.

- Intellectual Property Business: Includes holding, exploiting, or earning income from IP assets such as copyrights, patents, trademarks, and design rights.

Entities engaged in any of these activities are encouraged to evaluate their structure and operations to determine their obligations under the Economic Substance regime.

Uncertain whether your company is subject to the Cayman ES rule? Try our Economic Substance Self-Assessment Tool.

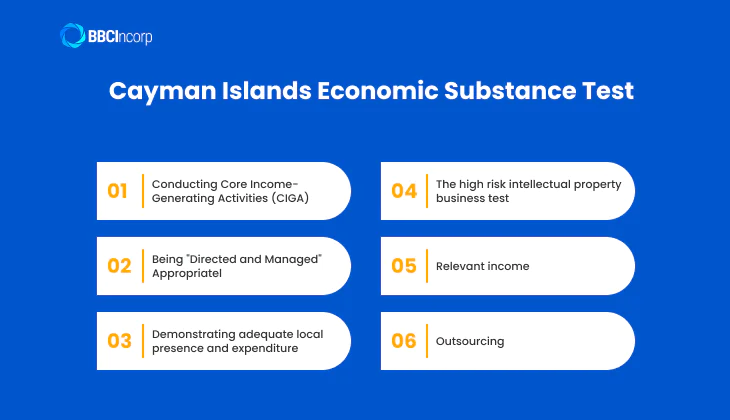

Cayman Islands Economic Substance Test

The Economic Substance Test is a key requirement under the Cayman Islands regime, applying to Relevant Entities engaged in defined Relevant Activities.

Introduced as part of global efforts against Base Erosion and Profit Shifting, the ES Test ensures entities demonstrate real economic presence in Cayman by conducting core income-generating activities locally, being appropriately directed and managed, and maintaining adequate expenditure, physical presence, and qualified personnel in the jurisdiction.

Conducting Core Income-Generating Activities (CIGA) in Cayman

Core income-generating activities (CIGA) are activities that are central to generating income from a Relevant Activity. These activities must be carried out in the Cayman Islands and may differ depending on the specific type of business the entity engages in.

For example, in a finance and leasing business, CIGA might include negotiating funding terms, setting lease terms, and managing credit risks. For intellectual property businesses, CIGA could involve research and development or managing legal protections for the IP.

The ES Act recognizes that not every entity will perform all CIGA listed for a particular Relevant Activity. However, the activities that an entity does undertake must be performed locally. The Cayman Islands authorities do not require a rigid checklist but instead adopt a “principles-based approach” that considers the nature and scale of each entity’s business.

Entities may outsource CIGA to service providers located in Cayman, but they must retain control and oversight. The outsourcing arrangement must be verifiable, and the service provider must register with the Department for International Tax Cooperation to confirm the authenticity and scope of the services provided.

Being “Directed and Managed” appropriately

An entity must also be directed and managed in an appropriate manner in relation to the Relevant Activity, and this direction and management must occur in the Cayman Islands. This requirement is focused on ensuring that strategic decision-making is not simply rubber-stamped offshore but is genuinely executed within Cayman.

Key elements to consider include:

- The board of directors should collectively possess sufficient expertise relevant to the activity being conducted.

- Meetings of the board must be held in the Cayman Islands with adequate frequency and a quorum of directors physically present.

- Strategic decisions must be clearly documented in meeting minutes, which should also be kept in the Cayman Islands.

- Other appropriate records and corporate documents should be maintained locally.

Even for entities with minimal activity, the expectation is that at least one board meeting is held in Cayman annually. This component of the ES Test emphasizes the importance of having genuine oversight and strategic control based in the jurisdiction.

Demonstrating adequate local presence and expenditure

The third pillar of the ES Test requires an entity to demonstrate an adequate level of economic presence in the Cayman Islands, commensurate with the relevant income it generates. This includes three key factors:

- Operating Expenditure: Entities must incur adequate operating costs in or from within the Cayman Islands. This includes expenses such as rent, utilities, payroll, and service fees that are proportionate to the scale of the business.

- Physical Presence: Entities should have a tangible physical presence in Cayman. This can include a registered office, owned or leased premises, or equipment relevant to the business operations. Virtual offices or mail-forwarding setups are insufficient for satisfying this requirement.

- Qualified Personnel: The entity must employ or contract with a sufficient number of qualified individuals located in the Cayman Islands. These employees should have the skills and experience necessary to carry out the core income-generating activities of the business.

Importantly, there is no fixed formula for determining what is “adequate” or “appropriate.” The determination depends on the size, complexity, and nature of the business. Relevant Entities are expected to keep records that justify their internal assessment of adequacy, in good faith, based on their operations and income levels.

The high risk intellectual property business test

Entities engaged in “high risk intellectual property business” face a heightened burden under the ES Test. A business is classified as high risk if, for instance, it holds IP that it did not create, and derives income from licensing it to affiliated group entities or as a result of the work of other group entities.

Such entities are presumed not to meet the ES Test unless they can provide compelling evidence to the contrary. This includes:

- Demonstrating that control over the development, exploitation, and maintenance of the IP is exercised in Cayman.

- Employing a sufficient number of full-time, qualified staff who permanently reside in Cayman or conduct their activities there.

- Providing comprehensive documentation of the entity’s IP management and operations.

The DITC will only consider the presumption rebutted if all required evidential thresholds are met, reflecting the significant scrutiny applied to IP-heavy business models under the Cayman regime.

Relevant income

“Relevant income” refers to all gross income derived by a Relevant Entity from its Relevant Activities, recorded according to applicable accounting standards. The amount of relevant income is used to determine what constitutes “adequate” operating expenditure, physical presence, and personnel.

If a Relevant Entity is conducting a Relevant Activity but has no relevant income during a given financial year, it is not required to satisfy the ES Test for that period. However, it must still meet notification and reporting obligations by submitting a “nil return” to the DITC. This ensures transparency even when income is not being generated.

Outsourcing

Outsourcing can be a legitimate way for entities to satisfy certain elements of the ES Test, particularly the conduct of CIGAs. However, outsourcing is only acceptable if:

- The service provider is located in the Cayman Islands.

- The Relevant Entity can demonstrate effective control and monitoring over the outsourced activities.

- The service provider is registered with the DITC and can independently verify the engagement and the nature of the services provided.

Outsourcing to service providers outside the Cayman Islands is not permitted for purposes of meeting the ES Test. Additionally, any domestic outsourcing must be backed by timely verification from the provider—within 30 days of reporting to the DITC—to ensure credibility and prevent abuse.

Outsourcing does not absolve the Relevant Entity of its responsibilities. Ultimate accountability for meeting the ES Test remains with the entity itself, even if operations are delegated to a local partner.

Filing requirements under Cayman ES (What to report)

According to Cayman Economic Substance Law, a relevant entity that carries on one or more relevant activities must satisfy certain filing obligations.

Particularly, these entities must:

- Send a notification of Economic Substance to the Authority;

- File an Economic Substance Return to the Authority.

Keep in mind, that notification and reporting are two key compliance duties for any relevant entity according to the Cayman ES guidance. And you must do this annually.

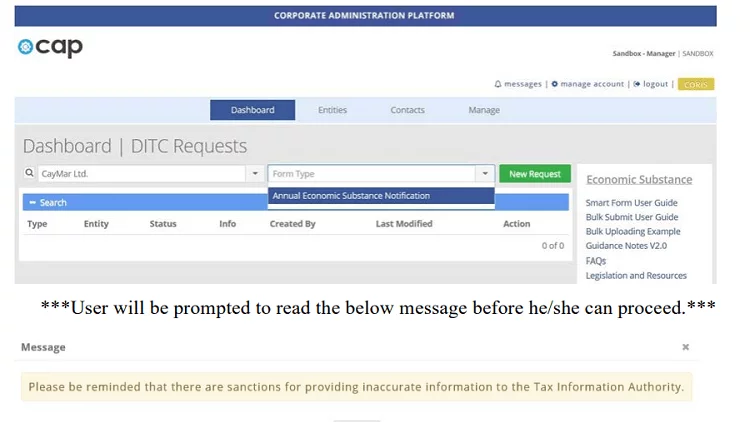

Economic Substance Notification

CAP system – the gateway for all legal entities in the Islands to file ES notifications

What Economic Substance Notification is

Economic Substance Notification (ESN) is an annual notification requirement for all entities. And this is not excluding any legal persons registered with the General Registry.

A key to mention is that ES notification acts as a sine qua non for filing the annual ES return for applicable entities.

How to file Economic Substance Notification

Typically, there are two popular systems via which entities can file their ES notifications:

- CAP system (The General Registry’s Corporate Administration Platform)

- CBP system (Cayman Business Portal): applicable for certain cases (those submitting ESNs on CBP will need to confirm whether they are connecting to a relevant activity as per request)

Important update

According to the latest Practice Points on Economic Substance (11 Jan 2021 updated), entities with the financial year which starts in 2020 and 2021 can now submit their ES notifications via CAP. Meanwhile, the submission gate for filing ESNs via CBP is currently only open for the financial year starting in 2020.

What are Economic Substance Notifications included

Entities should involve the following information when submitting their ESNs to the Authority:

- Whether the entity is conducting a relevant activity;

- Whether the entity is a relevant entity (in case the entity is connecting with a relevant activity);

- When the entity is conducting a relevant activity and is NOT tax resident inside the Islands (below details will ONLY be required for those which have its owners classified as an immediate parent, ultimate parent, and ultimate beneficial owners):

- Name, address, and other verification details of the entity’s immediate parent, ultimate parent, and ultimate beneficial owners;

- Date from which the entity’s financial year ends; and

- The jurisdiction where the entity is tax resident, along with related supporting evidence

- When the entity is a relevant entity conducting a relevant activity:

- Date from which the entity’s financial year ends; and

- Name, and address of the representative notifying and providing the Authority with supporting documentation if required.

When to file Economic Substance Notification

The deadline for ESNs submission is the same as the due date for filing the Annual Return, normally falling into 31 March annually. Note that the ES notifications will depend on your entity’s financial year.

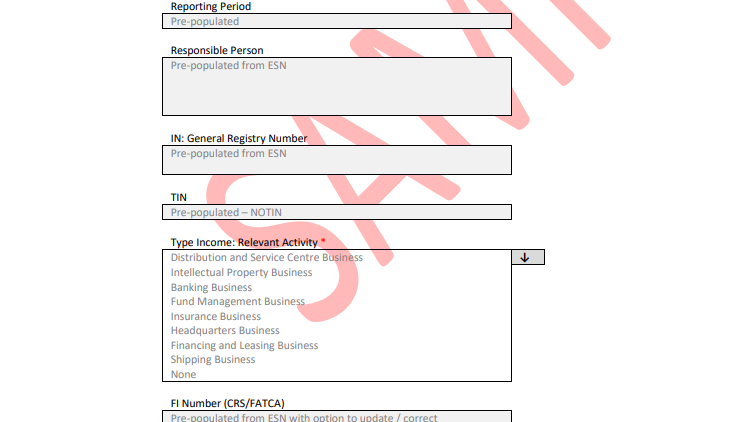

Economic Substance Return

A part of the ES return sample

What Economic Substance Return is

Relevant entities conducting a relevant activity must meet the requirements of the ES test, and file an Economic Substance Return (ESR) to the Authority yearly. The main purpose of this reporting obligation is to identify if your entity satisfies the ES test.

How to file Economic Substance Return

Cayman ES Return, or simply a form, is done electronically via a DITC Portal.

The Responsible Person (who can be your entity’s director or register office) confirmed on the ES notification will receive the link to access this portal via email. This Person can also appoint other secondary users via the DITC Portal to help finish the filing obligation.

Wish to get a sample of the ES return for your reference? You can get it here.

What to be included in Economic Substance Return

Below are the fundamental documents you should prepare for reporting to the Authority:

- Type of relevant activity that the entity has conducted;

- Amount and type of relevant income concerning that activity;

- Amount and type of costs, properties relating to that activity;

- Information about premises, equipment, or property served for that activity in the Islands;

- Number of qualified employees for that activities;

- Description of CIGAs in relation to that activity;

- Information about any MNE Group (Groups with total consolidated revenue of at least US$850 million) (if applicable);

- Other prescribed information, as the case may be, for that relevant activity falling into a high-risk or non-high-risk intellectual property business;

- Additional documents as per request (on a case-by-case basis).

When to file Economic Substance Return

All entities domiciled or registered in the Cayman Islands must submit an Economic Substance Notification to the Cayman Islands Registrar prior to 31 January each year.

Relevant entities that carried out one or more relevant activities must submit an Economic Substance Return to the Cayman Islands Tax Information Authority (TIA) within 12 months after the financial year end.

Example

If your financial year ends on 31 December 2022, you must file your ES return by 31 December 2023 for the 2022 reporting period.

For entity claims to be a tax resident overseas and is engaged in relevant activities, it must submit an Economic Substance Return – tax resident in another jurisdiction form (TRO Form) to the TIA through the DITC Portal within 12 months after the financial year end.

Record keeping and exchange of information

Under the ES Law (2020 Revision), the Authority shall share information collected by the Authority under the Economic Substance Law with other competent authorities as per signed agreements and associated global standards.

Accordingly, the entity will need to conduct the information exchange if the entity falls into the following cases:

- The relevant entity failed to fulfill the ES test regarding its relevant activities;

- The relevant entity relates to a high-risk IP business.

Be advised that information will also be shared between the Authority and the relevant authority of the jurisdiction in which the entity in question is proven to be a tax resident, and where the parent company, ultimate parent company, and ultimate beneficial owner of the relevant entity resides (as the case may be).

In the Cayman Islands, entities conducting relevant activities must maintain records demonstrating compliance with the Economic Substance Test. These records must be kept for six years following the end of the relevant financial year and should include information provided in the Economic Substance Returns. Failure to maintain proper records can result in penalties.

Penalties for Non-compliance cases of Cayman Islands Economic Substance

Non-compliance with the ES test under Cayman Economic Substance Law can lead to a penalty of up to US$100,000.

Section 4(d), International Tax Co-operation (ES) (Amendment) Law, 2020 also clarified the fine of US$5,000 (plus US$500 for each day when the non-compliance continues) for those subject to ES test but then fail to comply with ES return submission during the prescribed time frame.

Furthermore, if one entity is determined to follow the ES test, but provides misleading information to the Authority during the process, that entity shall be subject to a financial penalty of US$10,000 or be jailed for 5 years, or even both (as the case may be).

Important notice

On 31 March 2022, the Cayman Islands Tax Information Authority (TIA) issued new Economic Substance (ES) Enforcement Guidelines, setting out the principles for taking enforcement action in relation to infringements under the Cayman’s ES framework.

This includes the imposition of administrative penalties for various breaches of an entity’s reporting obligations under the ES Act. Noticeably, a penalty of US$ 12,195 would be imposed for relevant entities that fail to meet the ES test in the first year of assessment.

On 14 April 2022, the TIA announced that it will begin enforcement actions in the coming weeks for the ES frameworks.

For more information, refer to the ES Enforcement Guidelines.

BBCIncorp supports your Economic Substance Compliance in the Cayman Islands

At BBCIncorp, we assist businesses in navigating the complexities of Economic Substance compliance in the Cayman Islands. With a deep understanding of local regulations and international tax standards, we offer reliable support so your business remains fully compliant while focusing on growth.

Our team assists Relevant Entities in assessing whether their activities fall under the scope of the Economic Substance Act, and if so, guides them through the preparation and submission of Economic Substance Returns. We also help clients maintain the proper documentation required to demonstrate core income-generating activities, local management, and adequate presence within the jurisdiction.

In addition to compliance, BBCIncorp offers a full suite of offshore business services. If you are looking to verify your company’s good standing status, visit our guide to the Cayman Islands Certificate of Good Standing. For those interested in incorporation or learning about the Cayman Islands company registry, we provide detailed resources and ongoing support.

Should you need more information regarding the Cayman Islands Economic Substance requirements for your company, drop us a message via service@bbcincorp.com for practical advice!

Frequently Asked Questions

What is the difference between an ESN and an ESR?

An Economic Substance Notification (ESN) and an Economic Substance Return (ESR) are distinct but related filings required under the economic substance regulations. The ESN is a preliminary notification that confirms whether an entity is conducting “relevant activities” and collects basic information. The ESR, on the other hand, is a more detailed report that demonstrates how the entity satisfies the Economic Substance Test for those relevant activities.

What happens if my company fails the Economic Substance Test?

If your company fails the Economic Substance Test in the Cayman Islands, it may face serious financial and legal consequences. An initial failure can result in a penalty of up to US$12,195. If the failure continues in a subsequent year, the fine may rise to US$121,950, and the Registrar must apply to the Grand Court for further action, including possible strike-off.

Failure to file required reports may incur additional fines, starting at US$6,098 with daily penalties of US$610. Companies that misclassify themselves or ignore requests from the DITC risk maximum penalties or even imprisonment for non-compliance.

What are the specific CIGA for my business activity?

To determine the specific Core Income-Generating Activities (CIGA) for your business, you must identify the key functions that contribute to your company’s revenue and ensure they are carried out within the relevant jurisdiction. The exact CIGA depends on your business activity.

For example, a financing and leasing business would include activities such as negotiating funding terms, acquiring assets, setting lease conditions, and managing financial risks. A shipping business might involve managing the crew, maintaining vessels, overseeing deliveries, and organizing voyages.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.