Table of Contents

Establishing a limited liability company (LLC) begins with a fundamental step: filing the Articles of Organization for LLC, which serves as the official record that brings an LLC into legal existence. Many states require filing to define an LLC’s name, address, ownership, and management structure.

The terminology, however, varies across jurisdictions, where some refer to it as the Articles of Formation, Certificate of Formation, or LLC Articles of Formation.

Understanding these distinctions is essential for ensuring compliance and proper registration. BBCIncorp provides comprehensive guidance through each stage of the process of creating articles of organization LLC to help entrepreneurs establish a strong legal foundation for their business.

Key Takeaways

- The Articles of Organization create the LLC’s legal identity and confirm that the business exists under state law.

- Every LLC must file this document to receive limited liability protection and operate legally. The filing normally includes the company name, business address, registered agent, management structure, and organizer details.

- Upon approval from the state, you will be issued a certificate that allows the LLC to open bank accounts, register for taxes, and enter into contracts.

- States may use different names for the same document, such as Certificate of Formation or Articles of Formation.

- An LLC does not use Articles of Incorporation since that document applies only to corporations.

What are the LLC Articles of Organization (AoO)?

When forming a limited liability company (LLC), one of the first legal requirements is to file a document with the state to create the business officially. Many refer to this filing as the LLC Articles of Incorporation (AoI), but the correct legal term is the Articles of Organization (AoO). Knowing what are articles of incorporation or organization are for an LLC is important because the document is the foundation of the company’s legal existence.

Definition and purpose

In other words, the Articles of Organization for an LLC are the functional equivalent of the Articles of Incorporation for a corporation.

After being filed and approved by the state, the document officially establishes the LLC as a separate legal entity, distinct from its owners (called members). The separation provides limited liability protection, meaning the members’ personal assets are generally protected from business debts and lawsuits.

The Articles of Organization must be filed with the state’s business filing agency, usually the Secretary of State. Typically, this document includes:

- The legal name of the LLC

- The business address

- The name and address of the registered agent

- The names of the members or managers

- The management structure (member-managed or manager-managed)

- In some states, such as Delaware or Texas, it may also include a statement of purpose or information about ownership.

Once the state reviews and approves the filing, it issues a LLC Certificate of Organization (or Certificate of Formation for LLC), confirming that the LLC is legally established.

Does an LLC need articles of incorporation?

Technically, an LLC does not file Articles of Incorporation. That document is used for corporations. Instead, an LLC files Articles of Organization, which accomplish the same legal purpose. The distinction is crucial when preparing state filings to ensure compliance with the correct procedure.

Do I need articles of organization for an LLC?

Yes. Every LLC must file Articles of Organization to exist legally. Without this filing, the business has no separate legal status and cannot access key benefits such as limited liability protection, business banking, or state tax registration.

Articles of Organization vs. Articles of Incorporation

Filing the correct foundational document is the first step in forming a legal business entity. Articles of Organization and Articles of Incorporation both create separate legal entities, but they apply to different structures and include distinct details.

Articles of Organization (AoO)

The Articles of Organization form a limited liability company (LLC). Filing this document with the state officially registers the LLC, establishing its legal existence.

It allows members to separate personal and business liabilities, gain access to business banking, and register for taxes. Some states also allow additional provisions, such as limitations on member authority or special management rules.

Articles of Incorporation (AoI)

The Articles of Incorporation, also called a Certificate of Incorporation, establish a corporation. Filing this document creates a legal entity separate from its shareholders. Key information generally includes:

- Corporation name: Must be unique in the state

- Registered agent: Designated recipient of legal documents

- Business purpose: A concise description of corporate activities

- Stock information: Number of shares authorized and par value

- Incorporators: Individuals filing the document

Corporations follow stricter formalities than LLCs, including maintaining a board of directors, holding annual meetings, and keeping detailed corporate records.

Listed below is a comparison table to give you a quick overview of the two:

| Feature | Articles of Organization (LLC) | Articles of Incorporation (Corporation) |

|---|---|---|

| Purpose | Form an LLC | Form a corporation |

| Ownership | Members | Shareholders |

| Management | Member-managed or manager-managed | Board of directors and officers |

| Liability | Limited to members | Limited to shareholders |

| Taxation | Pass-through by default, optional corporate | Corporate tax, S-Corp election possible |

| Formalities | Minimal reporting requirements | Annual meetings, minutes, corporate filings |

| Flexibility | Highly flexible for internal governance | More rigid due to corporate structure |

Both create legal entities with limited liability, but LLCs offer more operational flexibility and simpler compliance, whereas corporations provide structured management and clear ownership via shares.

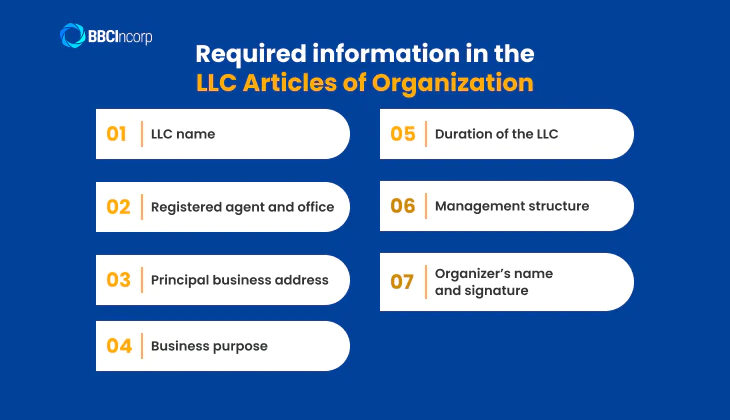

What information is required in the Articles of Organization?

Although the exact requirements may vary by state, most filings include a standard set of information that defines the legal and operational framework of the LLC. What are the articles of organization for LLC’s content in most jurisdictions?

LLC name

The company name must comply with state rules and include an indicator such as “LLC” or “Limited Liability Company.” It must be unique and distinguishable from existing business names in the state. Many states allow slight variations but may reject names that are too similar to other registered entities.

Can you register an LLC name in your state if the same name is already in use in another state? The answer depends on the state’s naming rules. Generally, LLC names are regulated at the state level, meaning that a name registered in one state does not automatically prevent someone from using the same name in a different state. Before filing, make sure to check your state’s naming guidelines and availability.

Read more to learn about can 2 LLC businesses have the same name in different states in our dedicated article.

Registered agent and office

A registered agent is a designated individual or business entity authorized to receive legal documents, government notices, and service of process on behalf of the LLC.

The registered office provides a physical street address in the state where official correspondence can be delivered. The information guarantees that the LLC can be reliably contacted for legal and administrative matters.

Principal business address

This is the physical location where the company conducts its operations. A post office box generally does not meet the requirement. Providing a verifiable principal address establishes the company’s primary place of business for state records, tax filings, and public information.

Business purpose

Although some states accept a broad statement, such as “to engage in any lawful business activity,” others request a more detailed description of the company’s operations.

For example, you might be required to include a North American Industry Classification System (NAICS) code, as it standardizes the company’s primary activity. Furthermore, using a NAICS code facilitates interactions with government agencies for licensing, permits, and tax reporting.

Duration of the LLC

Most LLCs choose a perpetual duration, meaning the entity continues indefinitely unless dissolved. States may allow founders to specify a limited duration if desired. Recording the duration provides clarity for ownership expectations and long-term planning.

Management structure

The Articles must indicate whether the LLC is member-managed or manager-managed. In a member-managed LLC, all members participate in daily operations and decision-making. In a manager-managed LLC, designated managers handle these responsibilities, and members maintain ownership interests.

Organizer’s name and signature

The organizer is the individual responsible for submitting the document. Most states require the organizer’s name and signature. Some jurisdictions allow optional clauses, such as limitations on member authority, special management rules, or indemnification provisions.

These additional clauses can provide tailored governance rules without requiring amendments to the operating agreement.

In summary, the article of organization for an LLC serves as the foundational record for the company’s legal existence. It identifies the LLC, designates a point of contact for official matters, defines its purpose, specifies management and duration, and records the organizer’s information.

How to get Articles of Organization for an LLC

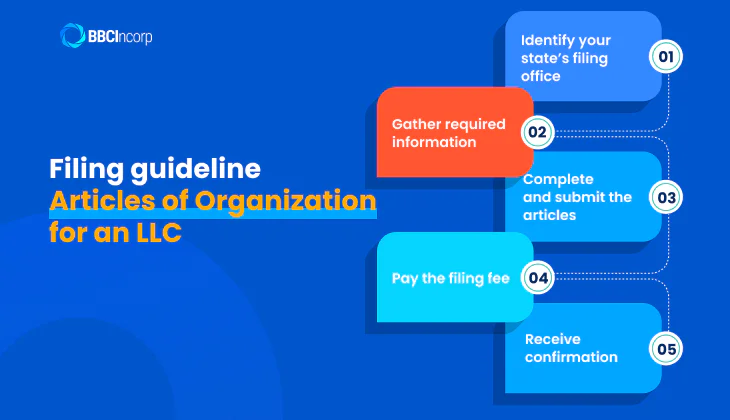

Below are the steps to complete the filing accurately:

Step 1: Identify your state’s filing office

Each state manages business registrations through a specific authority, usually the Secretary of State.

Visit the official state website to locate the filing office and review its guidelines, forms, processing times, and fees. Some states also provide instructions for online submissions or may require a publication notice for the LLC’s formation.

Step 2: Gather required information

Before completing the filing, assemble all necessary details:

- LLC name: Must be unique and include “LLC” or “Limited Liability Company”

- Principal business address: Physical street address for the company’s main operations

- Registered agent: Individual or business authorized to receive legal notices

- Management structure: Member-managed or manager-managed

- Business purpose: General or specific description of activities

- Organizer’s name and signature: Person filing the document

Some states allow optional clauses, such as special management rules or member limitations, which can be included if desired.

Step 3: Complete and submit the articles

Most states provide online or paper forms for the Articles of Organization. Accuracy is crucial — mistakes in names, addresses, or signatures can result in rejection or delays. Online filing is often faster and may provide immediate confirmation.

Step 4: Pay the filing fee

Filing fees differ by state, typically ranging from $50 to several hundred dollars. Many states accept credit card or ACH payments online.

On the other hand, mailed filings usually require a check or money order. In addition, expedited processing is available in some states for an additional fee.

Step 5: Receive confirmation

Once approved, the state issues a certificate confirming the LLC’s legal existence. The certificate is necessary to open business bank accounts, register for taxes, and enter into contracts. You can now start doing business.

State-specific requirements and differences

The requirements for the LLC articles of incorporation in the United States differ by state, with each jurisdiction defining specific filing requirements, fees, processing timelines, and filing authorities. In most cases, the organizer or incorporator is responsible for submitting the formation documents to the relevant authorities.

The following table highlights several key states, with their main requirements, filing authorities, and typical processing times.

| State | Key Requirements | Filing Authority | Expedited Options | Typical Processing Timeline |

|---|---|---|---|---|

| Delaware | Name of LLC, registered agent, business purpose, management structure | Delaware Division of Corporations | 24-hour, same-day, or 2-hour service (extra fee) | 1–3 business days |

| Wyoming | Name of LLC, registered agent, principal office address, duration | Wyoming Secretary of State | 24-hour processing $100 extra | 3–5 business days |

| Nevada | Name of LLC, registered agent, business purpose, managers/members, organizer info | Nevada Secretary of State, Commercial Recordings Division | Same-day $350 extra | 2–5 business days |

| California | Name of LLC, address, agent for service of process, management details | California Secretary of State, Business Programs Division | 24-hour $350 extra | 10–15 business days |

| Texas | Name of LLC, registered agent, purpose, governing authority, organizer info | Texas Secretary of State, Corporations Section | 24-hour $25 extra | 5–7 business days |

| Florida | Name of LLC, principal office, registered agent, members/managers | Florida Department of State, Division of Corporations | Same-day available $35 extra | 3–5 business days |

| New York | Name of LLC, registered agent, purpose, organizers | New York Department of State, Division of Corporations | 24-hour $25 extra | 7–10 business days |

| Illinois | Name of LLC, registered agent, principal office, management info | Illinois Secretary of State, Department of Business Services | Expedited 1–2 business days $100 extra | 5–7 business days |

| Georgia | Name of LLC, registered agent, principal office, members/managers | Georgia Secretary of State, Corporations Division | Same-day available $100 extra | 2–5 business days |

| Pennsylvania | Name of LLC, registered agent, purpose, members/managers | Pennsylvania Department of State, Bureau of Corporations and Charitable Organizations | 24-hour $50 extra | 5–10 business days |

| North Carolina | Name of LLC, registered agent, principal office, management info | North Carolina Secretary of State, Business Registration Division | 24-hour $50 extra | 5–7 business days |

| Washington | Name of LLC, registered agent, principal office, management structure | Washington Secretary of State, Corporations & Charities Division | 24-hour $100 extra | 3–5 business days |

| Massachusetts | Name of LLC, principal office, registered agent, managers/members | Massachusetts Secretary of the Commonwealth, Corporations Division | Same-day $200 extra | 5–10 business days |

Furthermore, processing timelines depend on the filing method, state workload, and whether expedited service is requested. States such as Delaware, Nevada, and Wyoming are often preferred for business-friendly regulations and faster processing.

On the other hand, California and New York include additional steps, higher fees, and mandatory publication for legal recognition.

What to do after filing LLC Articles of Organization

After receiving confirmation, several important steps are crucial to keep the LLC functioning effectively:

- Obtain an Employer Identification Number (EIN): Issued by the IRS, an EIN functions like a Social Security number for the business. It allows the LLC to open bank accounts, hire employees, and file taxes. Using an EIN instead of a personal Social Security number also provides a layer of privacy for the business owner.

- Draft an operating agreement: Even single-member LLCs benefit from an operating agreement, as it clarifies management authority, ownership rights, and procedures for future changes. This internal document prevents disputes and provides evidence of the LLC’s separate legal existence.

- Open a business bank account: Separating personal and business finances is critical for liability protection and clear accounting.

- Register for necessary licenses and permits: Depending on the industry and location, local, state, or federal licenses may be required to operate legally.

Furthermore, maintaining good standing requires ongoing attention:

- Annual or biennial reports: Many states, including California, Delaware, and New York, require periodic filings to update company information.

- Franchise taxes or fees: States may impose annual taxes, which must be paid to avoid penalties.

- Registered agent and address updates: The LLC must maintain a registered agent and make sure that the state has current contact information.

Failure to meet these requirements can result in late fees or, in severe cases, administrative dissolution of the LLC, which removes its legal protections and ability to operate.

Completing these steps after filing LLC Articles of Organization ensures the business is fully established, maintains legal compliance, and protects the owners’ limited liability while providing a clear framework for operations and growth.

How to find Articles of Organization for LLCs when in need

Accessing your LLC’s AoO may be necessary for a variety of business purposes, including opening a bank account, registering for taxes, or verifying legal existence with partners or clients.

Most states maintain an official business registry, often managed by the Secretary of State, where these documents can be retrieved. To access your LLC’s articles:

- Visit your state’s business filing website

- Search for your company by name or identification number.

- If the online portal is unavailable, you can request copies directly from the filing office by mail or in person.

Many states allow online downloads of the Articles of Organization or Articles of Incorporation, sometimes for a small fee.

In case the original documents are lost, you can obtain certified copies from the state as a legally recognized replacement. The certified copies can be used for official purposes such as opening business bank accounts, applying for licenses, or submitting tax forms.

Notably, it’s advisable to maintain easy access to your LLC’s Articles of Organization protects against delays in operations and fosters compliance with legal and financial requirements.

When and how to amend your Articles of Organization

Amending the Articles of Organization is a necessary step when an LLC undergoes changes. Common situations requiring an amendment include:

- A change in the company’s legal name

- An update to the registered agent or registered office address

- A relocation of the principal business address

- A modification to the management or ownership structure

To formally update these details, the company must file Articles of Amendment (also referred to in some jurisdictions as a Certificate of Amendment) with the relevant state authority. The process generally includes:

- Completing the amendment form issued by the Secretary of State or equivalent agency

- Paying the required filing fee

- Providing clear information about each change from the original filing

- Awaiting state confirmation of approval before the amendment becomes effective

Following approval, related updates may also be necessary, such as:

- Revising the company’s records with the Internal Revenue Service (IRS) regarding its Employer Identification Number (EIN)

- Updating business licenses or permits to reflect the changes

- Amending the LLC’s operating agreement or other internal documents

All amendments must remain consistent with the original Articles of Organization to prevent administrative discrepancies. That is why businesses tend to engage a professional corporate service provider like BBCIncorp to facilitate the filing and tracking of the process.

Let BBCIncorp simplify your LLC Articles of Organization filing process

BBCIncorp helps entrepreneurs and business owners establish their companies in the United States with confidence and ease. As a trusted corporate service provider, BBCIncorp combines practical expertise with modern technology to simplify the LLC filing process from start to finish.

Through our secure online portal platform, clients can manage every step in one place. You can check company name availability, set up your LLC, including filing the Articles of Organization for LLCs, and monitor compliance deadlines. Our system makes incorporation fast, transparent, and fully compliant with state regulations.

Furthermore, we also support international structures beyond the U.S., such as company formation services in key jurisdictions such as the Cayman Islands LLC, Cyprus LLC, and St. Vincent and the Grenadines LLC.

After formation, BBCIncorp continues to provide comprehensive services such as company secretary assistance, tax filing, and bookkeeping.

With extensive experience in U.S. and global company formation, BBCIncorp delivers a seamless LLC incorporation service built around accuracy, efficiency, and customer success. Visit our website and reach out to us today to learn more.

Conclusion

Filing the Articles of Organization for LLCs, sometimes referred to as the LLC Articles of Incorporation, is the essential first step in creating a legally recognized business entity.

Accurate filing establishes the LLC’s foundation and credibility, while following up with key actions such as obtaining an EIN, drafting an operating agreement, and maintaining compliance ensures long-term stability.

With expert support from BBCIncorp, business owners can complete each step correctly, avoid costly mistakes, and meet every regulatory deadline with confidence. A successful LLC begins with precise filing, and BBCIncorp makes that process simple and reliable. Contact us at service@bbcincorp.com for more assistance.

Frequently Asked Questions

Do LLCs need Articles of Incorporation or Articles of Organization?

LLCs do not file Articles of Incorporation but rather Articles of Organization. Once this document is approved by the state, your LLC officially exists as a separate legal entity. Understanding what are the Articles of Incorporation for an LLC helps clarify that “Articles of Organization” is the correct term for LLC registration across all U.S. states.

Are Articles of Incorporation and Articles of Organization the same?

Functionally, yes. Both establish a business’s legal existence. However, Articles of Incorporation are used for corporations, while Articles of Organization are specific to LLCs.

Each document provides similar details, including company name, address, registered agent, and management structure. The difference lies in the entity type being formed. Some states may use alternative names like “Certificate of Formation,” but the purpose remains identical.

Can I file Articles of Organization myself, or do I need help?

You can file Articles of Organization yourself through your state’s Secretary of State or equivalent agency, usually online or by mail. The filing requires a small fee and accurate business details.

Many entrepreneurs prefer using professional services to avoid errors and delays. For example, BBCIncorp assists with preparing and submitting the required documents, monitoring compliance deadlines, and maintaining proper records. If you are new to the process or managing multiple states, expert support streamlines filing and ongoing compliance.

When is my LLC officially active?

Your LLC becomes officially active when the state approves your Articles of Organization filing and issues a Certificate of Organization or similar confirmation. This document signifies that your business is now a legally recognized entity with authority to operate, open bank accounts, and enter into contracts.

Processing times vary by state but typically range from one to ten business days. Maintaining your company’s active status also requires regular compliance filings, such as annual or biennial reports and payment of applicable franchise taxes.

Do single-member LLCs need an operating agreement?

Yes. Even though a single-member LLC has only one owner, an Operating Agreement is still recommended. It formally outlines ownership, management structure, and business procedures, which reinforces the LLC’s status as a separate legal entity. This separation is essential for maintaining limited liability protection.

Banks, investors, and tax authorities may also request this document for verification purposes. Alongside the Articles of Organization for LLC, an Operating Agreement strengthens your legal foundation and demonstrates professionalism in business management.

Where can I get a copy?

You can obtain a copy of your Articles of Organization from your state’s Secretary of State office or online business registry. Most states provide online databases where you can search for your LLC and download a certified copy for a small fee. A certified copy may be required when opening business bank accounts, renewing licenses, or proving legal existence.

If you misplace your document, you can request a new copy by mail or electronically.

Does BBCIncorp provide LLC Articles of Organization service?

Yes. BBCIncorp provides a comprehensive LLC incorporation service that covers every stage of the process: from name availability checks and preparation of Articles of Organization to state filing and compliance management. Our service also includes registered agent support and automated reminders for report deadlines.

For clients managing entities across jurisdictions, BBCIncorp offers an all-in-one dashboard to streamline administration. Whether setting up a U.S. or offshore entity, BBCIncorp helps you file and maintain the company documents efficiently.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.