Table of Contents

When starting a business, incorporating in the right state is a crucial decision that can impact your company’s financial and operational future. Factors such as taxation, legal protections, and overall business-friendliness make choosing the best state to incorporate a key step for entrepreneurs and small business owners.

For some, incorporating in their home state makes sense. For others, incorporating out-of-state may provide significant advantages in the areas of taxes, privacy, and legal frameworks. This guide will walk you through key factors to consider, highlight popular states for incorporation, and help you decide the best state to incorporate a business based on your objectives.

Understanding the term “State of Incorporation”

Before we dive into the details, it’s important to understand what is meant by “state of incorporation.”

What is the state of incorporation?

A state of incorporation refers to the state where you officially register and establish your business entity, such as a corporation or limited liability company (LLC).

Your state of incorporation does not necessarily have to match the location where you operate your business. For example, you can incorporate a technology firm in Delaware for its business-friendly laws while selling your software in California.

Your choice of incorporation state greatly influences your business’s tax obligations, legal protections, and operational processes.

Home state vs. Out-of-state incorporation

When determining where to incorporate, you have two main options: your home state or a different state. Both choices have their own set of advantages and challenges that can significantly impact your business operations.

- Home state: Incorporating in your home state is often straightforward. There’s no need for additional compliance, such as registering as a foreign entity, and filing fees may be lower. Additionally, being incorporated in your home state ensures that you’re already familiar with local laws and regulations that govern your operations.

- Out-of-state incorporation: Incorporating in a different state, often referred to as out-of-state incorporation, is a popular choice for businesses looking to take advantage of certain states’ business-friendly environments. However, incorporating out-of-state often means registering as a foreign entity in your home state, which can incur extra fees and compliance requirements.

Factors to consider when choosing the best place to incorporate

In this section, we’ll dive into the primary considerations for selecting the best states to incorporate a business for your.

Taxation

Taxes have a significant impact on your bottom line, making them a key consideration when choosing where to establish your business. Some states offer lower corporate tax rates, while others eliminate corporate or personal income taxes altogether.

- States with no corporate income tax: Nevada, Wyoming, South Dakota, and Texas.

- High-tax states: States such as New York and California often come with heavier tax burdens.

Legal protections and frameworks

A strong legal system ensures smoother operations, dispute resolution, and privacy. Choosing a state with strong legal protections can provide stability and peace of mind for your business.

- Strong legal frameworks: Delaware stands out for its Court of Chancery, which handles business disputes efficiently without juries.

- Privacy laws: States such as Nevada and Wyoming offer strong corporate privacy protections, shielding personal information from public company filings.

States with clear legal precedents provide stability and reduce risks, giving businesses confidence to operate seamlessly.

Regulatory environment

Choosing where to incorporate your business depends heavily on the regulatory environment. States with simple business licensing and minimal red tape reduce administrative burdens.

States with simpler licensing and less red tape, like Texas, make it easier for startups to get started quickly. In contrast, states like New York and Illinois often have stricter compliance requirements, adding complexity for businesses in regulated industries such as finance or healthcare.

Costs and fees

When choosing a state for incorporation, consider both initial and ongoing costs. Here’s a quick breakdown:

- Incorporation costs: Vary by state, from $45 to $520.

- Recurring expenses

- Annual report fees: Many states require businesses to file reports to stay in good standing, from $300-$800 annually.

- Franchise taxes: Some states levy franchise taxes, either as flat fees or based on revenue (e.g., $300 in Delaware).

- Registered agent fees: $100–$300 annually if outsourced.

- Additional costs: Certain states have unique requirements, such as publication fees or business license renewals.

Business structure

Certain states are ideal for specific business structures due to their policies.

Best states to incorporate C corp

- Delaware: Popular for venture capital and public companies.

- Nevada: No corporate income tax and strong privacy protections.

Best states for LLCs

- Florida: No personal income tax and low maintenance costs.

- Texas: No personal income tax and business-friendly regulations.

Best states for partnerships

- Wyoming and South Dakota: No state income tax and favorable policies.

Investor and business perception

Where you incorporate impacts how stakeholders view your business. Florida’s entrepreneurial growth attracts investors, while Texas offers credibility for high-growth startups as a leading economy.

New York, with its global financial status, is ideal for businesses targeting international or institutional investors. Illinois stands out for supply chain-heavy industries due to its central location and infrastructure.

Choosing the right state incorporation can enhance your business’s credibility and align with your goals.

What state is best to incorporate a company in?

Choosing where to incorporate your business is a critical decision that can impact everything from taxes to legal protection. If you’re wondering what are the best states to incorporate in, it’s important to consider factors like your business goals, structure, and where you plan to operate. Let’s explore the top options to help you find the best fit.

Delaware

Often referred to as the “corporate capital of the world,” Delaware is the go-to state for incorporation, especially for C corporations and businesses seeking venture capital or planning to go public.

Benefits

- Business-friendly legal system with the Court of Chancery, which specializes in corporate law.

- Flexible corporate laws that favor management and investors.

- No state corporate income tax for businesses that don’t operate in Delaware.

- Strong privacy protections for business owners.

Drawbacks

- Franchise taxes can accumulate quickly.

- Double taxation may apply for businesses operating outside Delaware.

Best for

Large corporations, startups seeking funding, and companies planning to scale or go public.

Nevada

Nevada offers significant tax advantages, including no corporate or personal income taxes. Additionally, its legal framework includes powerful privacy protections for business owners.

Benefits

- No state corporate income tax or personal income tax.

- Strong liability protections for directors and officers.

- No information-sharing agreement with the IRS.

Drawbacks

- Higher initial filing fees than some other states.

- Limited reputation compared to Delaware for complex entities.

Best for

Businesses seeking tax advantages and strong liability protections.

For a detailed comparison, check out our guide on Nevada vs. Delaware LLC to see which state fits your business needs best.

Wyoming

Wyoming is perfect for startups or small businesses seeking minimal costs paired with strong privacy protections. It offers no corporate or personal income taxes, much like Nevada.

Benefits

- No state income tax or franchise tax.

- Low filing and annual fees.

- Strong privacy protections (no requirement to disclose members or managers).

Drawbacks

Though cost-effective, Wyoming lacks established corporate law infrastructure like Delaware, which makes it less ideal for larger corporations. Additionally, it imposes a state business license fee of $50 per year.

Best for

Small businesses, LLCs, and those seeking a cost-effective and private incorporation option.

To explore the differences in depth, visit our article on Wyoming vs. Delaware LLC.

Your home state

For businesses operating exclusively in one state, incorporating locally can be the simplest and cheapest approach. You can avoid registering as a foreign entity, which comes with additional fees and bureaucracy.

Benefits

- Reduced administrative hassle and potential costs.

- Simplified tax filings for local operations.

Drawbacks

May not provide the tax savings or legal protections offered by statzles like Delaware, Nevada, or Wyoming.

When to incorporate in your home state

- If your business primarily serves customers in your home state, incorporating there is usually the best choice.

- For small businesses and LLCs, the cost and simplicity of incorporating locally often outweigh the benefits of incorporating elsewhere.

- If you’re not planning to raise significant funding or go public, the advantages of incorporating in states like Delaware may not apply.

Still unsure where to start?

Choosing the best state to form an LLC depends on your business goals, budget, and future plans. To help you evaluate all your options, check out our full guide on the best states to form an LLC.

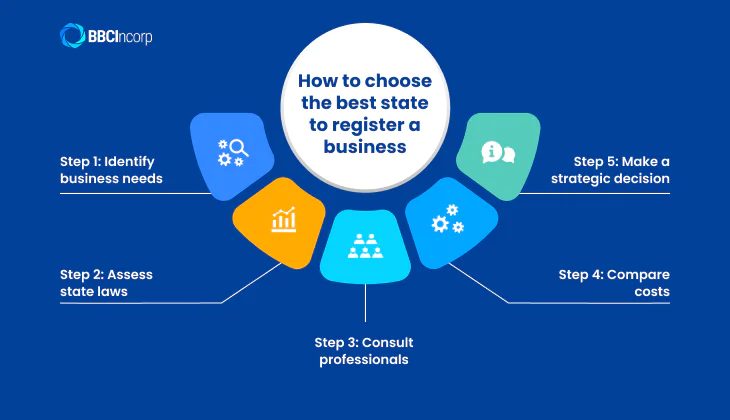

How to choose the best state to register a business

Follow these steps to choose the best place to incorporate your company based on your business needs and goals.

Step 1: Identify business needs

Start by defining your key objectives to ensure your decisions align with your company’s goals.

Consider what matters most to your business:

- Do you prioritize low taxes to maximize profitability?

- Are you focused on strong legal protections to safeguard your operations?

- Is your priority enhancing your company’s overall reputation to attract clients and investors?

Clearly outlining these priorities will help guide your decision-making process and ensure your choices align with your long-term goals.

Step 2: Assess state laws

Take time to thoroughly explore each state’s tax systems, corporate governance frameworks, and filing requirements to make an informed decision about where to establish your business. Each state has unique regulations that can significantly impact your bottom line and day-to-day operations.

Start by examining key factors such as:

- Understand how much of your company’s earnings will go toward taxes and whether the state offers any deductions or incentives.

- Review how sales tax is calculated and collected, especially if your business involves selling products or services to consumers.

- Determine whether the state imposes franchise taxes or other fees on businesses and how these costs will affect your finances.

Additionally, review filing and reporting requirements to ensure they align with your business goals and operational needs. This research will help you choose the best state to support your company’s growth and compliance.

Step 3: Consult professionals

Get expert advice to avoid costly mistakes and make better decisions. At BBCIncorp, our team specializes in company formation and compliance services. We offer personalized consultations to help you choose the right state for your business needs, ensuring informed decisions for growth.

With experience across various jurisdictions, we can guide you through complex legal requirements and regulations. With BBCIncorp, you’ll have everything you need to establish and maintain a successful business presence.

Step 4: Compare costs

Incorporation costs involve more than just filing fees, so it’s important to consider the full financial picture. Take into account one-time expenses, such as initial registration fees, legal assistance, or document preparation costs.

Additionally, factor in recurring costs like annual report fees, franchise taxes, and any state-specific compliance charges.

Understanding these costs upfront will help you plan better and avoid unexpected financial surprises down the road.

Step 5: Make a strategic decision

After evaluating your business needs, state laws, costs, and professional advice, weigh all factors to choose the best place to incorporate your company. Remember, while states like Delaware, Nevada, and Wyoming have distinct advantages, incorporating in your home state often simplifies compliance and minimizes additional fees. Select the option that aligns best with your business goals and growth plans.

By following these steps, you’re well on your way to selecting a state that supports your business’s success.

How to add a state to your corporation?

Adding a state to your corporation opens new opportunities for growth, but it’s essential to follow essential steps to maintain legal compliance.

Below, we’ll guide you through the key steps to add a state to your corporation effectively.

Determine the need for Foreign Qualification

If your corporation plans to conduct business in a new state, you’ll likely need a foreign qualification.

Foreign qualification means registering your corporation in a different state to operate legally there. While each state defines “operate legally” differently, here are common indicators that foreign qualification is required:

- Opening an office or physical location.

- Hiring employees in the new state.

- Signing property leases or contracts.

- Providing services or selling products locally.

File a Certificate of Authority

To register in a new state, you’ll need to file a Certificate of Authority or its equivalent with the state’s Secretary of State office. This document allows your corporation to operate legally within that state’s jurisdiction.

Once filed and approved, the Secretary of State’s office will issue confirmation, making your corporation official in the new state.

Update business documents and licenses

Adding a state to your corporation might also require updating business licenses or permits, depending on your industry. Verify what’s necessary to legally operate and update any marketing or operational materials to include your new location.

Launch business in your desired country with BBCIncorp

Need help incorporating your business or registering in your desired jurisdictions? BBCIncorp

offers specialized services for seamless company formations, including in popular states like Delaware.

Our services include:

- Delaware company formation: We help entrepreneurs set up a business in Delaware with speed and accuracy. With our expertise, we ensure all legal requirements are met and provide ongoing support for the company’s growth.

- Offshore incorporation services: Set up your offshore company with ease in leading international jurisdictions. Popular choices include company incorporation in Hong Kong, Singapore, and the British Virgin Islands. Our team will assist you with company registrations and provide ongoing support for maintaining compliance in these jurisdictions.

We make incorporation stress-free, so you can focus on growing your business. Contact us via service@bbcincorp.com to get started.

Conclusion

Choosing the best state to incorporate is a critical decision with long-term implications for your company. Whether it’s Delaware’s corporate laws, Nevada’s tax advantages, Wyoming’s affordability, or the simplicity of your home state, your choice should align with your specific goals and needs.

Take your time, consult experts, and make a strategic decision that supports your vision for success.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.