Table of Contents

Understanding the certificate of incumbency (also called an incumbency certificate) is essential for anyone needing proof of who legally represents a company. This document confirms the identity and authority of corporate officers—such as directors, secretaries, and authorized signatories.

Whether opening a bank account, completing legal transactions, launching business expansions, or entering international deals, banks, law firms, investors, and foreign partners often demand an incumbency certificate to verify who can act on behalf of the company.

In this blog post, we’ll unpack the certificate of incumbency meaning, explain its core contents and real‑world uses, and guide you through the process of obtaining one. Think of this as your essential companion to demystify what otherwise may feel like opaque corporate paperwork.

What is a certificate of incumbency?

When navigating corporate transactions, one document often requested by banks, legal advisors, and international partners is the certificate of incumbency. While it might sound technical, this certificate plays a key role in proving the internal structure and authorized representatives of a company.

Understanding its purpose, format, and usage helps ensure smoother operations, especially in cross-border or high-stakes scenarios.

Definition and function of an incumbency certificate

A certificate of incumbency, also referred to as an incumbency certificate, incumbency cert, or certificate of incumbency form, is an official corporate document. It is typically issued by the company’s corporate secretary or a registered agent.

The certificate confirms the identities, positions, and signing authority of individuals holding key roles within the business, such as directors, managers, or officers.

This document usually includes the legal name of the company, a list of current officers and directors, their official titles, and a statement certifying their authority to act on behalf of the organization. Some versions may also include specimen signatures, a company seal, or notarization, especially when used in formal transactions.

While the terms certificate of incumbency, letter of incumbency, and cert of incumbency are sometimes used interchangeably, they are not always identical in format or legal strength.

A certificate is generally more formal and recognized as an official corporate record. In contrast, a letter of incumbency may take a simpler format and is often used in less formal contexts.

Common uses of an incumbency certificate

Beyond internal recordkeeping, this document holds practical value in critical external dealings. Companies often present an incumbency certificate to demonstrate official authority in financial, legal, and operational settings.

Example

For example, banks usually request it when a company applies to open a corporate account or initiate cross-border transfers. Legal teams may need it when contracts are signed, ensuring the signatory is genuinely empowered to act. In offshore jurisdictions or international business environments, government agencies and banking partners frequently require the certificate to meet compliance and due diligence standards.

Whether you’re a startup or managing a global entity, having this document ready can save time, prevent administrative delays, and build credibility.

Why is the Certificate of Incumbency important?

While many corporate documents verify ownership or structure, the incumbency certificate uniquely confirms who holds actual authority. This document serves as a “snapshot” of the company’s leadership and helps avoid uncertainty or disputes over decision-making authority.

For businesses structured as an LLC or a trust, a tailored certificate of incumbency LLC or certificate of incumbency trust ensures transparency when roles may not follow standard corporate hierarchies. It’s a key component in legal compliance, anti-fraud measures, and building trust with third parties.

Whether dealing with local banks or international regulators, the certificate provides confidence that the people representing your business are officially recognized and authorized to act.

Who needs a certificate of incumbency and when is it required?

Understanding which business structures rely on an incumbency certificate and the situations in which this document is needed is essential for maintaining proper corporate compliance and smooth operations. This section outlines who typically uses the certificate and when it becomes necessary in business activities..

Entity types that use incumbency certificates

The certificate of incumbency is most relevant to formal business entities, particularly limited liability companies (LLCs), corporations, and offshore entities registered in jurisdictions such as the British Virgin Islands, the Cayman Islands, and Seychelles.

These organizations often require a certificate of incumbency LLC or incumbency certificate LLC to identify who holds management roles and who is authorized to act on the entity’s behalf.

This document is especially useful when responding to requests from banks, regulatory bodies, or legal counsel asking, for instance, “what is certificate of incumbency for your company?” It serves as a trusted declaration of internal authority.

In contrast, sole proprietorships and general partnerships rarely need to produce this certificate. These structures usually involve individual or shared decision-making without the formalized hierarchy that the certificate is designed to document.

Typical scenarios when it is required

There are several key situations where an incumbency certificate becomes essential. While your business may not need to produce one daily, specific events or transactions will require it as part of verification or compliance.

One of the most common uses is opening a business or investment account, particularly in international or offshore banking. Financial institutions require proof that the individuals signing documents or giving instructions have official authority.

Another frequent scenario involves mergers and acquisitions. During these complex processes, legal and financial teams will review documentation including a certificate of incumbency to verify that those representing the company are legally empowered to do so.

Compliance audits and due diligence checks also prompt the need for a certificate. Whether working with regulators, investors, or independent auditors, businesses must often provide a verified form of incumbency certificate to confirm leadership structure and control.

In the legal arena, businesses may need to present a letter of incumbency or full certificate when engaging in litigation or legal representation. This helps prove that the legal representative is acting under proper authority.

In summary, while not every business will require an incumbency certificate, it is a critical document for LLCs, corporations, and offshore companies in many official and regulated circumstances. Preparing and maintaining an accurate certificate ensures transparency, compliance, and trust across a wide range of professional interactions.

What does a certificate of incumbency include?

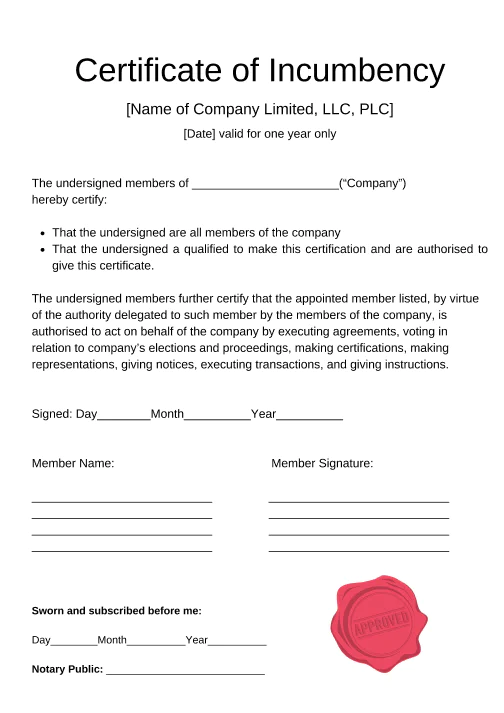

A certificate of incumbency is designed to confirm key corporate information and verify who has the authority to act on behalf of the company. While the format may vary slightly depending on the entity type or jurisdiction, most documents follow a structured layout.

Reviewing a certificate of incumbency sample provides a clear understanding of what information is typically required by banks, legal advisors, and regulatory authorities. Below are the typical details found in a properly structured incumbency certificate sample.

- Company name: The full legal name of the business, including any former or alternative names if applicable.

- Date of incorporation: The official date the company was registered as a legal entity.

- Registration number: A unique number assigned to the company by the corporate registry.

- Registered office address: The business’s official address as recorded with the registry.

- Business activities: A general description of the company’s primary operations or business scope.

- Capital details: Information on authorized and issued share capital, including classes of shares if applicable.

- Auditor details: The name and contact information of the company’s appointed auditor, if any.

- Charges incurred: Disclosure of any current legal or financial charges registered against the company.

- Shareholder information: Names and identification numbers of all current shareholders.

- Company officers: Names, roles, and identification numbers of directors, managing directors, and managers.

- Company secretaries: Names and identification numbers of individuals appointed as corporate secretaries.

- Statement of authority: A declaration confirming that the listed individuals are authorized to represent and act on behalf of the company.

- Filing history: The date of the company’s most recent annual return or financial statement filing.

- Company status: The company’s current legal standing, such as active, dormant, or dissolved.

- Signatures and seal: The signature of the company secretary or registered agent, often accompanied by the company’s official seal.

Certificate of incumbency vs. certificate of good standing

In many cross-border transactions, especially those involving offshore jurisdictions, companies are often required to provide a certificate of incumbency alongside a certificate of good standing.

While both are important corporate documents, they serve different purposes and are issued by different parties. Understanding the distinction is crucial to meeting legal, financial, and compliance obligations.

What does each certificate confirm?

A certificate of good standing confirms that a company is legally registered and in full compliance with its filing obligations. In Ireland, for example, this certificate—also called a Letter of Status—is issued by the Companies Registration Office (CRO). It certifies that the company is active, not under liquidation, and has submitted all required annual returns.

In contrast, a certificate of incumbency focuses on the individuals who are authorized to act on behalf of the company. This includes current directors, company secretaries, and shareholders. Unlike the certificate of good standing, the incumbency certificate is usually issued by the company secretary or registered agent—not by a government office.

When is each certificate used?

The certificate of good standing is commonly required when registering a company in another jurisdiction, applying for a license, or confirming legal compliance during a merger. On the other hand, the certificate of incumbency is used when opening corporate bank accounts, applying for a loan, or signing contracts where proof of authority is needed.

In many offshore jurisdictions like the British Virgin Islands, Cayman Islands, or Seychelles, companies often prepare both documents together as a standard corporate set. This combination proves that the company is not only compliant but also represented by duly authorized individuals.

To help you quickly distinguish between these two documents, here’s a simple table outlining the core differences between a certificate of good standing and a certificate of incumbency:

| Feature | Certificate of Good Standing | Certificate of Incumbency |

|---|---|---|

| Issuer | Government registry (e.g. CRO) | Company secretary or registered agent |

| Purpose | Confirms legal status and compliance | Confirms authority of company officers |

| Includes Officers | No | Yes |

| Includes Shareholders | No | Yes |

| Typical Use | Regulatory filings, business registration | Bank account setup, signing authority |

If you’re unsure which one is required for your transaction, reviewing a certificate of incumbency example or speaking with your legal advisor can help clarify the next steps.

Both documents serve vital but distinct roles and in many international dealings, having both on hand shows that your company is not only compliant but also well-organized and ready to operate.

Countries where incumbency certificates are commonly used

In global business and offshore structuring, certain jurisdictions stand out for their frequent use of incumbency documents. These locations often require a formal certificate of incumbency as standard practice for banking, compliance, and legal matters. Below are the most common jurisdictions:

- British Virgin Islands (BVI): Widely regarded as a go‑to offshore hub, its corporate framework for BVI offshore companies simplifies administration by incorporating incumbency certificates into routine banking and corporate services.

- Seychelles: Known for rapid issuance—often within 24 to 48 hours—Seychelles companies frequently produce incumbency documents alongside proof of good standing.

- Cayman Islands: Standard offshore incorporations in Cayman include both incumbency and good standing certificates, often bundled as part of a corporate service package

- Belize: Similar to BVI and Cayman, Belize also issues these certificates quickly for legal and banking validation

- Delaware: As a prominent U.S. state for incorporation, a certificate of incumbency Delaware is often obtained for opening bank accounts or external transaction

- Hong Kong: A certificate of incumbency in Hong Kong is frequently required for international banking, notarization, or dealings with government entities

- Singapore: Though considered a “mid‑shore” jurisdiction, Singapore also uses certificates of incumbency in its incorporation and corporate services

In short, jurisdictions such as the British Virgin Islands, Seychelles, Cayman Islands, Belize, Delaware, Hong Kong, and Singapore continue to rely on incumbency certificates as part of standard corporate governance and international business practice.

How to get a certificate of incumbency

Whether your business is onshore or offshore, understanding how to get a certificate of incumbency

helps ensure smooth communication with financial institutions and legal authorities. This certificate formally verifies the identity and authority of company officers or shareholders and may be requested at various stages of your business lifecycle.

Who issues it and where to request it

A certificate of incumbency is not issued by government agencies. Instead, it is typically prepared by an authorised party within the company. This may include the corporate secretary, a registered agent, or an appointed legal professional.

For international or offshore companies, the certificate is often provided by a corporate service provider that manages the company’s legal documents and filings.

You can request the certificate from your company’s registered agent or secretary, or through a legal or compliance firm that handles your corporate affairs. Many providers also offer templates or assistance with preparing the document as part of their standard company secretarial services.

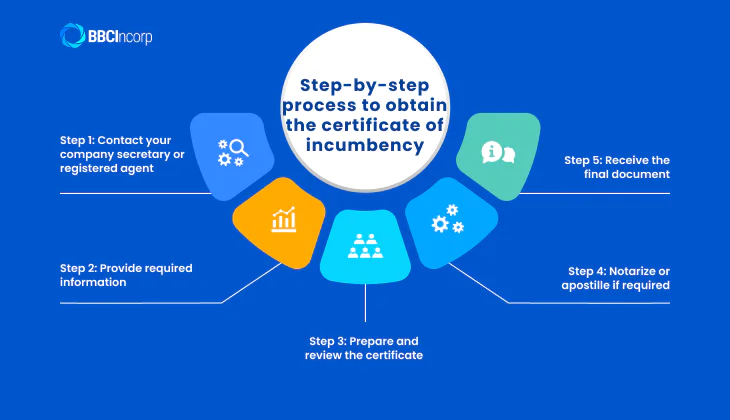

Step-by-step process to obtain for cert of incumbency

If you are wondering how to obtain a certificate of incumbency quickly and correctly, follow this step-by-step guide.

Step 1: Contact your company secretary or registered agent

Initiate the request by reaching out to your designated corporate service provider or internal officer responsible for compliance and documentation.

Step 2: Provide required information

You’ll need to submit accurate and up-to-date details such as:Most certificates of incumbency can be issued within one to two business days. If notarization or apostille is required, it may take three to five business days. Working with a company secretary ensures faster and more accurate processing.

- Full legal company name

- Company registration number and date of incorporation

- Names and positions of directors, officers, and sometimes shareholders

Step 3: Prepare and review the certificate

The certificate of incumbency form

is drafted based on this data. Carefully review the draft for accuracy before proceeding to the next step.

Step 4: Notarize or apostille if required

If the certificate is to be used internationally or presented to a bank, notarisation or apostille may be required for legal validity.

Step 5: Receive the final document

The final version is typically delivered either as a hard copy via courier or as a digitally certified PDF, depending on your needs.

Knowing how to obtain a certificate of incumbency properly ensures you’ll have the right document in hand when required for due diligence, compliance, or banking procedures.

How BBCIncorp helps you obtain a certificate of incumbency

At BBCIncorp, we understand that securing corporate documents such as a certificate of incumbency can be a complex task especially for international and offshore companies. That is why we offer tailored company secretary services designed to simplify compliance, particularly in jurisdictions like BVI, Cayman Islands, Seychelles, Hong Kong, and Singapore.

Whether you need a certificate of incumbency for offshore companies or for an entity incorporated in Hong Kong, our team ensures that your documents are properly prepared, legally compliant, and ready for formal use.

Comprehensive company secretary support

As part of our company secretary Hong Kong and offshore service packages, we prepare and deliver a full range of corporate documents. This includes the certificate of incumbency, which outlines current directors, officers, and shareholders, along with their authority within the company.

We ensure all documents are formatted correctly, signed, and sealed, with the option for notarization or apostille where necessary. Our services also cover resolution documents and the certificate of good standing when required.

Simplifying compliance for international clients

Our digital platform allows clients to submit information and receive documents efficiently. Whether you operate in BVI, Seychelles, or Cayman, we streamline the process to help you obtain a certificate of incumbency quickly and without hassle.

We are committed to making offshore compliance easy and secure for businesses worldwide.

Conclusion

For any business operating locally or across borders, understanding the certificate of incumbency meaning is essential. This document serves as official confirmation of a company’s key officers and directors, ensuring clarity in roles and authority. It is often requested by banks, legal entities, and regulators, making it a crucial part of corporate documentation.

Maintaining an accurate and updated incumbency certificate reinforces your company’s credibility and supports smooth transactions, especially when dealing with international partners or opening financial accounts abroad.

If you are unsure how to get a certificate of incumbency, BBCIncorp offers trusted support with streamlined services and professional guidance. With experience in offshore jurisdictions, BBCIncorp helps ensure your document is prepared accurately and meets compliance standards across borders.

Frequently Asked Questions

What are the primary advantages of possessing a certificate of incumbency?

A certificate of incumbency confirms who is authorized to act on behalf of a company, such as directors or officers. It supports bank account openings, contract signings, and regulatory filings. The document enhances business credibility and is especially important for international transactions.

What's the typical processing time for obtaining a certificate of incumbency?

Most certificates of incumbency can be issued within one to two business days. If notarization or apostille is required, it may take three to five business days. Working with a company secretary ensures faster and more accurate processing.

How can I legally obtain a certificate of incumbency from a different organization?

You can request a certificate of incumbency from the company’s registered agent or secretary. Supporting documents may be required. Once verified, the provider will issue the certificate, with options for notarization or legalization if needed.

Are certificates of incumbency and corporate resolutions interchangeable documents?

No. A certificate of incumbency confirms who holds official positions in a company, while a corporate resolution records decisions made by directors or shareholders. Both serve different legal functions and are often used together.

What distinguishes a certificate of incumbency from a certificate of good standing?

A certificate of good standing proves a company is active and compliant with regulations. A certificate of incumbency identifies the company’s current officers and their authority. They serve different purposes but are often used together for due diligence.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.