- What is a certificate of incumbency in Hong Kong?

- What is included in the certificate of incumbency?

- Why do companies need a certificate of incumbency in Hong Kong?

- How to get a certificate of incumbency in Hong Kong?

- Differences between a certificate of incumbency and other company documents

- Tips and best practices when using a cert of incumbency

- Get your certificate of incumbency hassle-free with BBCIncorp

- Conclusion

A certificate of incumbency in Hong Kong is an official document that verifies the identity of a company’s directors, shareholders, and other key officers. It also confirms the company’s legal structure and current standing.

In Hong Kong’s competitive and highly regulated business environment, this certificate is often required for opening bank accounts, entering into contracts with international partners, and complying with due diligence procedures. It serves as credible proof of corporate authority and is frequently requested by financial institutions and legal bodies.

This blog will guide you through the key aspects of a certificate of incumbency, including its purpose, the typical contents, how to obtain it in Hong Kong, and the situations in which your business might need one.

What is a certificate of incumbency in Hong Kong?

What is a certificate of incumbency, and why do so many banks, law firms, and international partners request it—especially in Hong Kong? This important document confirms who holds key positions within a company and whether they are authorised to act on its behalf.

In a global business hub like Hong Kong, where corporate transparency is essential, the certificate of incumbency plays a vital role in legal, financial, and compliance processes. The following section explains its definition, purpose, and when your company may need one.

Definition of a certificate of incumbency

A certificate of incumbency in Hong Kong is an official document issued by a company’s corporate service provider, company secretary, or legal representative. It confirms the identity and roles of a company’s current directors, officers, and in some cases, shareholders. This document outlines who has the authority to act on behalf of the company in official capacities.

Typically, a certificate of incumbency includes the following details:

- The full names and positions of current directors and officers

- Authorized signatories of the company

- Company name, registered office address, incorporation date, and share structure

For companies incorporated in Hong Kong, this certificate is frequently requested when opening corporate bank accounts, conducting due diligence, or entering into cross-border agreements. It plays a key role in helping external parties verify that the individuals acting for the company are legally authorized to do so.

As a financial and legal gateway for international business, Hong Kong requires high levels of corporate transparency. The certificate of incumbency in Hong Kong supports this standard by providing a verified source of information about a company’s leadership.

Whether dealing with banks, investors, or legal entities, presenting an incumbency certificate builds credibility and minimizes the risk of fraud or misrepresentation.

Alternative names and terminology

While certificate of incumbency is the standard term in Hong Kong, the document is also known by several other names, depending on the jurisdiction and use case. These include:

- Incumbency certificate

- Form of incumbency

- Certificate of officers

- Register of directors

- Secretary certificate

Each of these terms refers to the same type of document that confirms a company’s internal authority structure. Although the terminology may differ, especially across jurisdictions or depending on a firm’s internal policies, the core function remains unchanged.

Whether labeled a form of incumbency or certificate of officers, the document is used to confirm that specific individuals are officially authorized to act on behalf of the company. In Hong Kong, all these terms are generally understood and accepted in legal and professional settings.

What is included in the certificate of incumbency?

The contents of a certificate of incumbency are designed to formally confirm a company’s internal structure and the authority of its key personnel.

In Hong Kong, this document must present clearly defined information to meet compliance and verification standards, especially when dealing with banks, legal professionals, or international partners. Below are the typical elements included in a certificate of incumbency Hong Kong format.

What information does the certificate include?

A standard certificate of incumbency Hong Kong typically includes the following information:

- Full company name and business registration number;

- List of current directors and officers, including names, roles, and titles such as CEO, CFO, or Secretary;

- Details of shareholders, if required, particularly in situations involving ownership confirmation;

- Signature authority, showing who is officially authorized to sign documents on the company’s behalf;

- Company secretary’s certification, signature, and the company’s official stamp or seal

- Declaration of authority, confirming that the listed individuals are validly appointed and currently hold office.

This structure ensures that third parties can verify the company’s leadership and make decisions based on accurate and up-to-date information.

Who should be authorised in the certificate of incumbency

The certificate should list individuals who hold executive roles or have official signing power within the company. This typically includes directors, the chief executive, the company secretary, and other senior officers.

Employees or representatives without formal authority are generally excluded to avoid confusion or legal risk. Only those with the power to make binding decisions for the company should appear on the document.

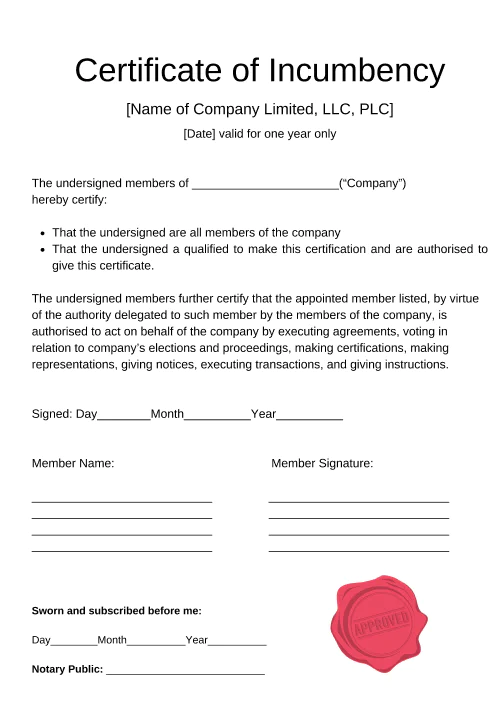

Example of a certificate of incumbency

A certificate of incumbency may begin with a formal statement from the company secretary, followed by a table listing each officer’s name, title, appointment date, and specimen signature. It concludes with the secretary’s signature and the company seal, confirming the document’s authenticity. This format is commonly used in corporate filings and bank applications.

Why do companies need a certificate of incumbency in Hong Kong?

If your company plans to open a bank account, work with overseas partners, or expand into new markets, you will likely be asked to provide a certificate of incumbency. In Hong Kong’s international business environment, having a valid incumbency certificate ready can save time, avoid delays, and build trust with banks, investors, and regulators.

Below, we’ll walk through the most common situations where this certificate is required and explain how it helps protect and support your operations.

When is a certificate of incumbency required?

A cert of incumbency becomes essential in several scenarios:

Opening or maintaining a corporate bank account

Banks in Hong Kong and overseas commonly request a certificate of incumbency to verify that the individuals acting on behalf of a company are duly authorized. This document plays a key role in meeting Know Your Customer (KYC) and anti‑money laundering (AML) requirements.

If you’re looking to open a bank account in Hong Kong, be prepared to provide this certificate as part of the standard documentation. For a step-by-step overview, see our guide on How to open a bank account in Hong Kong.

Working with foreign business partners or investors

Investors and foreign partners rely on the document to confirm a company’s decision‑makers and avoid potential disputes over authority. It reinforces trust in cross‑border deals.

Submitting documents for due diligence or compliance checks

Whether applying for loans, bidding for contracts, or undergoing legal review, external parties may request a certificate of incumbency to verify that signatories are correctly empowered.

Registering for overseas operations or branches

In many jurisdictions, a Hong Kong entity wanting to register a branch or office abroad must provide a cert of incumbency to authenticate its governance and signatory authority .

In each of these cases, presenting a valid certificate of incumbency Hong Kong reduces friction and builds credibility, confirming that the individuals involved are legally recognized.

Legal and operational benefits

Issuing an incumbency certificate provides a range of legal and operational advantages:

Establishes legitimacy of representatives

The document formally identifies directors and officers, so third parties can trust they are dealing with legitimate representatives of the company.

Helps protect against fraud

By listing authorized signatories, a certificate of incumbency reduces the risk of unauthorised persons entering into contracts or financial transactions under the company’s name.

Speeds up international transactions and onboarding

When organizing cross‑border banking or partner agreements, a pre‑prepared certificate can significantly reduce delays and streamline procedures.

Required in jurisdictions where HK companies are expanding

Many foreign regulators, banks, and official bodies insist on a certificate of incumbency for registration or compliance purposes, particularly in strictly governed regions.

Overall, the certificate of incumbency in Hong Kong acts as a foundation of operational integrity. It confirms authority, strengthens trust, and empowers companies to move quickly and securely in global markets.

How to get a certificate of incumbency in Hong Kong?

Whether you’re preparing for an international bank application or entering a new market, knowing how to get a certificate of incumbency is essential for any Hong Kong business.

This section explains everything you need to know—from requirements to the full process—so you can obtain your certificate quickly and with confidence.

Eligibility and prerequisites

Before requesting a certificate of incumbency in Hong Kong, your company must meet specific legal and operational criteria. These conditions ensure the certificate accurately reflects your company’s current leadership and structure.

To be eligible, your business must be a Hong Kong-registered company with at least one appointed director and one company secretary. These roles must be officially recorded with the Companies Registry Hong Kong.

Additionally, all statutory records—such as the register of directors, shareholders, and company resolutions—must be up to date. If your records are outdated or incomplete, your request may be delayed or rejected.

Ensuring full compliance with these prerequisites not only allows you to move forward but also helps establish your credibility with banks, legal professionals, and foreign regulators.

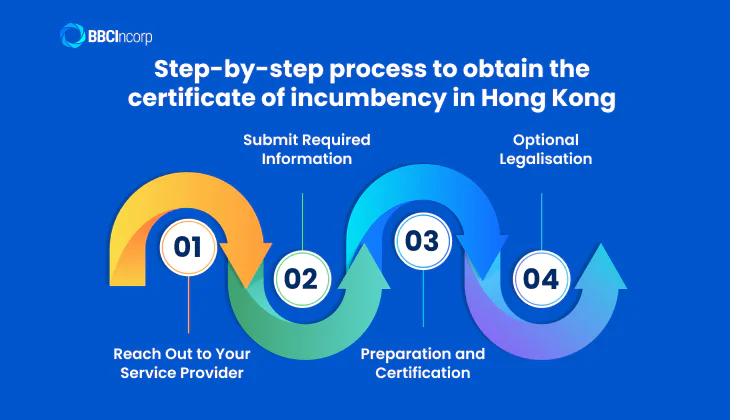

Step-by-step process to obtain the certificate

Once your company meets the eligibility criteria, the next step is to follow a simple but structured process to request and receive your certificate of incumbency Hong Kong.

Step 1: Reach Out to Your Service Provider

Contact your company secretary, legal adviser, or corporate service provider. These professionals are authorized to issue the certificate.

Step 2: Submit Required Information

Provide key details such as your company registration number, full legal name, list of directors and officers, shareholder information (if applicable), and details of who has signature authority.

Step 3: Preparation and Certification

Your provider will draft the incumbency certificate, confirming who currently holds positions of authority. It is then signed by the company secretary and stamped with the official company seal.

Step 4: Optional Legalisation

If you plan to use the document outside of Hong Kong, you may request notarisation or an apostille. These steps validate the certificate in foreign jurisdictions and are often required for international compliance or registrations.

This process is generally quick and ensures that your business can present valid proof of authority wherever necessary.

How long does it take and what does it cost?

Time and cost are often top concerns when learning how to obtain a certificate of incumbency—but both are straightforward.

Most providers in Hong Kong can issue the certificate within 1 to 3 business days. However, if you request notarisation or an apostille for international use, allow for additional time.

Fees typically range from HKD 500 to 1,500, depending on your service provider and whether you need any additional certification. Notarisation and apostille services will cost more but are only necessary if required by a foreign authority.

With proper planning, getting your certificate of incumbency in Hong Kong can be a smooth and affordable process that keeps your operations globally compliant.

To avoid unnecessary delays or mistakes, it is recommended to work with a reliable professional. BBCIncorp’s company secretary services in Hong Kong are designed to guide you through the process efficiently, whether for local use or international requirements.

Differences between a certificate of incumbency and other company documents

It’s easy to mix up corporate documents especially if you’re working across jurisdictions. To avoid delays or miscommunication, it’s important to understand how this document differs from others commonly issued to or by a Hong Kong company.

| Feature | Certificate of Incumbency | Business Registration Certificate | Certificate of Good Standing | Certificate of Incorporation | Annual Return |

| Purpose | Confirms current company officers, directors, and signatories | Confirms legal business registration and licensing | Confirms compliance with all legal and regulatory obligations | Proves the legal formation and existence of a company | Provides updated company structure for regulatory compliance |

| Issuer | Company Secretary / Registered Agent | Inland Revenue Department (IRD) | Companies Registry or Company Secretary | Companies Registry | Companies Registry |

| Public/Private | Private (internal) | Public | Public or private (upon request) | Public | Public |

| Key Contents | List of directors, officers, authorized signatories | Legal name, registration number, business nature | Company status, up-to-date filings, valid registration | Company name, incorporation number, date of incorporation | Shareholders, directors, registered office, share capital |

| Use Case | Bank account opening, legal transactions, KYC compliance | Required to operate a business in Hong Kong | International business dealings, due diligence, reputation assurance | Opening a company, legal proof of existence | Mandatory yearly filing for compliance |

Understanding these distinctions ensures you provide the correct company certificate Hong Kong authorities or business partners may ask for helping your operations run more smoothly and professionally.

Tips and best practices when using a cert of incumbency

For any company operating in Hong Kong or engaging in international business, using a certificate of incumbency correctly is essential. When managed properly, this document helps establish trust, meet compliance requirements, and speed up transactions. The following tips will help you use your certificate of incumbency in Hong Kong more effectively.

Keep information accurate and updated

Always make sure your incumbency certificate reflects your company’s current structure. This means the listed directors, officers, and authorized signatories must be up to date.

If changes occur, such as a new appointment or resignation, request a new certificate promptly. Providing outdated information can cause delays, especially when dealing with financial institutions or overseas regulators.

Choose a reliable service provider

Only certified company secretaries or trusted corporate service providers should issue your cert of incumbency. Their credibility lends weight to the certificate, making it more likely to be accepted by banks, investors, and government bodies. Working with a reputable provider also ensures that the document is formatted correctly and contains all the necessary legal details.

Include official signatures and company stamp

A valid certificate of incumbency Hong Kong must be signed by the company secretary and affixed with the official company stamp or seal. These elements confirm the certificate’s authenticity. Without them, the document may be rejected or questioned by third parties.

Prepare for international use

If the certificate will be used outside of Hong Kong, you may need to legalize it. This usually involves notarisation or obtaining an apostille, depending on the destination country. It is important to check requirements in advance, especially when dealing with banks or public authorities abroad.

Track expiry and keep copies

Most institutions require a certificate issued within the last three to six months. Keep a record of the issue date and store both digital and printed copies securely. When needed, request a fresh certificate to avoid unnecessary disruptions.

By following these tips, you can ensure your certificate of incumbency in Hong Kong remains accurate, credible, and ready for any situation.

Get your certificate of incumbency hassle-free with BBCIncorp

At BBCIncorp, we help startups and SMEs in Hong Kong with everything from company formation to securing a certificate of incumbency quickly and accurately. Whether you need the document for banking, compliance, or international expansion, our experienced team ensures the process is smooth from start to finish.

Fast and accurate certificate issuance

With our company secretary services, we can issue your certificate of incumbency in Hong Kong within one to three business days, depending on the complexity of your request. We verify all details carefully, including director and shareholder records, so your certificate is accepted without delay by banks, legal professionals, and overseas institutions.

Optional notarization and apostille

If your certificate will be used in a foreign jurisdiction, we can assist with notarization and obtain an apostille through the Hong Kong High Court. This extra layer of validation is often required for cross-border use and adds credibility when presenting your cert of incumbency to international authorities.

Professional support from legal and compliance experts

BBCIncorp’s team of legal and compliance specialists will guide you through the process. We help ensure your certificate meets both local and international standards and reflects your company’s true internal structure. With our support, you can feel confident submitting your certificate of incumbency Hong Kong to third parties.

Easy access through our digital dashboard

With our secure online platform, you can request, manage, and download your documents with ease. You will also receive real-time updates and alerts, making it simple to track the progress of your certificate and maintain visibility over your compliance documents.

Additional support for business compliance

As your dedicated company secretary in Hong Kong, we also provide:

- Ongoing maintenance of director and shareholder registers

- Timely handling of statutory filings and annual returns

- Documentation support for banking, due diligence, and investor onboarding

- Full assistance with regulatory compliance for cross-border operations

BBCIncorp is proud to be a trusted corporate service provider in Hong Kong, helping businesses stay compliant and ready for growth. If you need a certificate of incumbency, we are here to help you obtain it quickly, accurately, and with complete peace of mind.

Conclusion

Understanding the role of the certificate of incumbency in Hong Kong is essential for companies involved in international banking, legal agreements, or cross-border operations. This document verifies your internal leadership and signature authority, making it a key part of your compliance toolkit.

Whether you need an incumbency certificate for due diligence or business expansion, knowing when and how to obtain it helps you operate with flexibility and confidence. To avoid errors or delays, always rely on experienced professionals who can prepare a properly certified cert of incumbency.

At BBCIncorp, we offer fast, accurate, and fully compliant issuance of your certificate, along with dedicated support from legal and corporate experts. Reach out today to secure your certificate with confidence.

Frequently Asked Questions

What is a certificate of incumbency used for?

A certificate of incumbency confirms the identities, roles, and authority of a company’s current directors, officers, and sometimes shareholders. It’s used extensively in international business for activities such as opening bank accounts, securing loans, finalizing contracts, applying for visas, or conducting overseas transactions. The document gives third parties confidence that the person they’re dealing with is legally authorised to act on the company’s behalf

How to get a certificate of incumbency in Hong Kong?

To get a cert of incumbency, you typically:

- Ensure your company’s directors, officers, and shareholder details are up to date.

- Request the document from your company secretary, registered agent, or corporate service provider in Hong Kong.

- The secretary drafts the certificate, affixes the company seal, and signs it.

- If you plan to use it abroad, you can arrange for notarisation and apostille through a notary public and the HK High Court

Where to get certificate of incumbency in Hong Kong

You can obtain a certificate of incumbency in Hong Kong directly from your company by asking your company secretary. You may also use reputable corporate service providers, registered agents, lawyers, or certified public accountants. They prepare, certify, and deliver the incumbency certificate, often including optional notarisation or apostille services

How long is a certificate of incumbency valid?

There is no official expiry date; however, most banks and institutions typically require the certificate to be dated within the past three to six months to ensure information remains current. Since company structures can change, a fresh certificate may be needed after any change in directors or officers.

Does the certificate of incumbency need to be notarised?

In Hong Kong, notarisation is optional for local use—the company secretary’s signature and company seal are sufficient. However, for use in foreign jurisdictions, especially under the Hague Convention, you may need to have the certificate notarised and apostilled to satisfy international legalisation requirements.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is a certificate of incumbency in Hong Kong?

- What is included in the certificate of incumbency?

- Why do companies need a certificate of incumbency in Hong Kong?

- How to get a certificate of incumbency in Hong Kong?

- Differences between a certificate of incumbency and other company documents

- Tips and best practices when using a cert of incumbency

- Get your certificate of incumbency hassle-free with BBCIncorp

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.