Table of Contents

Cyprus has steadily built a reputation as one of Europe’s most business-friendly jurisdictions. With a corporate tax rate of 12.5%, it stands among the lowest in the European Union, reflecting a long-term commitment to attracting capital and rewarding enterprise. Investors value not just the numbers but the principles behind them: clarity, consistency, and credibility.

Yet, as any seasoned investor knows, understanding the rules is just as important as seizing the opportunity. Corporate tax in Cyprus is central to how the island sustains its competitive edge while remaining compliant with international standards.

In today’s article, BBCIncorp will delve into the Cyprus taxation rates, exemptions, ongoing reforms, and common pitfalls businesses face so you can navigate the system with confidence.

Overview of corporate tax in Cyprus

Corporate tax in Cyprus is a central part of the island’s economic system and a major factor behind its global reputation as a trusted business hub. It applies to both domestic companies and foreign entities that qualify as tax residents. A company is considered resident when its management and control are exercised within Cyprus, which determines where its profits are taxed. This approach makes the jurisdiction attractive for international headquarters and holding structures.

The standard corporate income tax rate

The corporate income tax in Cyprus stands at 12.5%, one of the lowest rates in the European Union. The figure has remained unchanged for years. Further, Cyprus’s consistent tax policy demonstrates its long-term commitment to investment, legal adherence, and growth.

Evolution and EU alignment

The Cyprus corporate tax framework has evolved over decades, especially since the country’s accession to the European Union in 2004. In accordance with EU directives and OECD guidelines, Cyprus has developed a system that emphasizes fairness, transparency, and anti-avoidance. The nation’s extensive double tax treaty network further enhances its competitiveness by preventing double taxation and encouraging cross-border trade.

Administration and compliance

The Tax Department of the Ministry of Finance administers corporate tax in Cyprus. It is responsible for tax assessment, collection, and policy updates. Companies must obtain a Tax Identification Code, keep accurate financial records, and submit annual returns. In recent years, digital reforms have modernized the system, enabling smoother communication and convenient electronic filing.

Why Cyprus remains attractive

The stable Cyprus company tax rate, clear compliance requirements, and commitment to international standards continue to position Cyprus as a preferred base for multinational enterprises and investors seeking both growth and regulatory certainty.

Key Cyprus corporate taxation rates and structure

Cyprus has developed a balanced and transparent tax system that rewards legitimate enterprise, at the same time staying aligned with international standards.

Standard and special tax rates

The Cyprus corporate tax rate is currently 12.5%. This rate applies to both resident companies and foreign entities operating through a permanent establishment in Cyprus. Authorities have discussed a potential rise to 15% for large multinational enterprises to comply with the OECD BEPS 2.0 Pillar Two framework, though no official change has been made as of 2025.

In addition to corporate income tax, companies may be subject to the defence contribution tax in Cyprus (SDC). The levy applies to certain types of passive income, including dividends, interest, and rental income earned by Cyprus tax-resident and domiciled shareholders. Non-resident companies and non-domiciled investors are generally exempt from contribution, making the regime particularly favorable for international business owners.

Capital gains and withholding taxes

Cyprus applies a 20% capital gains tax only to profits from the sale of immovable property situated within Cyprus or shares of companies that own such property. Other disposals, such as shares or overseas real estate, are excluded from capital gains tax, providing flexibility for investors managing global portfolios.

The withholding tax regime is another competitive feature. Generally, Cyprus imposes no withholding tax on outbound payments of dividends, interest, or royalties to non-residents. However, since 2022, limited withholding taxes have been introduced for payments to entities in non-cooperative jurisdictions or those not subject to taxation in their home countries.

Types of taxable income

Tax-resident companies in Cyprus are taxed on their worldwide income, while non-resident entities pay tax only on income derived from Cyprus sources. The distinction between active and passive income remains important, especially for companies generating investment or intellectual property income.

Exemptions and deductions

The Cyprus taxation rates include several incentives. Dividend income is exempt from corporate income tax if specific participation and activity conditions are met. Interest income unrelated to trading activities is also exempt, though it may fall under the SDC regime. In addition, profits from the sale of securities, such as shares or bonds, enjoy full exemption from corporate tax.

Cyprus also offers the Notional Interest Deduction (NID) to encourage equity financing, allowing companies to deduct a notional interest expense on new equity capital. Businesses can benefit from group relief and loss carry-forward for up to five years, improving tax efficiency across corporate groups.

Taxation of offshore companies in Cyprus

Cyprus holds a unique position in the global business landscape. It combines international accessibility with transparent regulation, offering legitimate advantages for cross-border operations. While often labeled as a corporate-friendly jurisdiction, it does not function as a Cyprus offshore tax haven. The country complies fully with EU directives and OECD principles, maintaining high standards of integrity and substance.

Offshore company tax treatment

Under Cyprus law, a company’s tax residency depends on where management and control take place. This means an offshore company incorporated in Cyprus but managed abroad is not automatically considered a tax resident. Conversely, when strategic decisions are made within Cyprus, the company becomes a tax resident and pays the standard Cyprus company tax rate on global profits.

For non-resident companies, the tax rate for an offshore company registered in Cyprus applies only to profits generated from Cyprus-based activities. Income earned abroad generally falls outside Cyprus’s taxing rights, making the jurisdiction particularly attractive for holding, trading, and investment structures.

Offshore structure advantages

Offshore structures in Cyprus benefit from a combination of competitive rates and flexible regulations. Dividend distributions to non-resident shareholders are typically exempt from withholding tax, ensuring profit repatriation. Income from the sale of securities, such as shares or bonds, also enjoys full exemption from corporate taxation, supporting capital mobility and reinvestment.

Cyprus’s evolving intellectual property framework continues to attract knowledge-based industries. Although the former IP Box regime was phased out, policymakers are developing new incentive models to facilitate the island’s competitive edge.

Furthermore, tax relief on foreign dividends and capital gains provides an additional advantage for multinational enterprises seeking operational efficiency.

Cyprus’s system emphasizes credibility and compliance, not secrecy. The alignment of its offshore tax regime with global standards has created a sustainable model, reinforcing Cyprus’s position as a respected international base.

Compliance requirements and filing obligations

Cyprus has a well-structured tax system that guides companies through predictable compliance steps each year.

Tax year and return submission

The tax year in Cyprus follows the calendar year, ending on 31 December.

Every company subject to corporate tax in Cyprus must submit an annual income tax return, known as Form TD4, electronically through the Tax Department’s online platform. The standard deadline is 15 months after the tax year-end, meaning returns for 2024 income should be filed by 31 March 2026, unless the authorities announce an extension.

Provisional and final payments

Cyprus uses a provisional tax system to collect corporate income in advance. Companies are required to make two provisional payments based on estimated profits:

- One by 31 July, and

- Another by 31 December of the current year.

A final balancing payment is due by 1 August of the following year to settle any difference between estimated and actual liability.

Financial statements and audits

All companies must keep proper books of account and prepare audited financial statements in line with International Financial Reporting Standards. Audits must be carried out by certified auditors registered in Cyprus. These reports not only confirm financial accuracy but also form part of the company’s tax filing documentation.

Employer responsibilities

Businesses with employees have additional duties under the Cyprus taxation rates system. Employers must operate the PAYE (Pay As You Earn) system for withholding income tax on salaries. In addition, you must make monthly contributions to social insurance and other statutory employment funds.

Transfer pricing documentation

As aforementioned, Cyprus enforces transfer pricing regulations aligned with the OECD framework. Companies engaged in transactions with related parties must maintain proper documentation supporting the arm’s length principle.

Depending on size and turnover, they may need to prepare a master file, a local file, and a summary table detailing intra-group transactions.

Recent and upcoming tax reforms in Cyprus

Cyprus is entering a new phase of tax modernization designed to align with global developments and reinforce its role as a responsible business hub.

Corporate tax reform and OECD alignment

In 2025, Cyprus continues implementing the OECD’s Pillar Two initiative, introducing a global minimum corporate tax of 15% for large multinational groups with annual revenues above €750 million. The standard corporate income tax Cyprus rate remains at 12.5% for smaller companies.

Green and digital taxation

The government is preparing new green levies on sectors with high carbon output and exploring a digital services tax aimed at technology-driven activities. These measures reflect an effort to modernize the tax base and promote sustainable and innovation-led growth.

Transfer pricing and anti-avoidance expansion

Transfer pricing rules now require detailed documentation and closer oversight of intra-group transactions. Updated anti-avoidance provisions target profit shifting and artificial arrangements, ensuring that companies pay tax based on genuine business activity within Cyprus.

Business implications and preparation

Companies should assess how the reforms affect their tax position and reporting processes. Both local and foreign investors are encouraged to evaluate their group structures, substance presence, and transfer pricing policies to stay compliant with the evolving corporate tax Cyprus system.

Offshore structures, in particular, must adapt to the global minimum tax requirements and greater scrutiny.

Opportunities ahead

The Cyprus corporate tax rate remains among the lowest in the European Union, sustaining its competitive edge. The upcoming reforms create opportunities for companies to optimize their structures and benefit from Cyprus’s double tax treaty network.

Common tax planning strategies in Cyprus

Tax planning remains an important part of managing corporate tax Cyprus obligations effectively. Below are several legal mechanisms to consider:

Using the Notional Interest Deduction (NID)

The Notional Interest Deduction allows a company to claim a notional interest expense on new equity introduced after 2015, reducing its taxable base. The deduction is linked to the yield of ten-year government bonds of the country where the investment originates, plus a fixed premium. To qualify, the equity must be fully paid and applied for business purposes.

The approach encourages equity financing over debt, improving a company’s tax efficiency and balance sheet strength.

Leveraging group relief

Cyprus permits group relief, allowing one company’s taxable profits to be offset by another’s current-year losses within the same group, provided there is at least 75% common ownership. Although full tax consolidation does not apply, this system enables groups to manage Cyprus taxation rates more efficiently across subsidiaries operating under one umbrella.

Utilizing the double tax treaty network

Cyprus has over 65 double tax treaties that help reduce or eliminate withholding taxes on dividends, interest, and royalties. These treaties also minimize double taxation on cross-border income and capital gains. For instance, dividends received from a treaty partner may be exempt from or subject to reduced withholding tax when conditions are met.

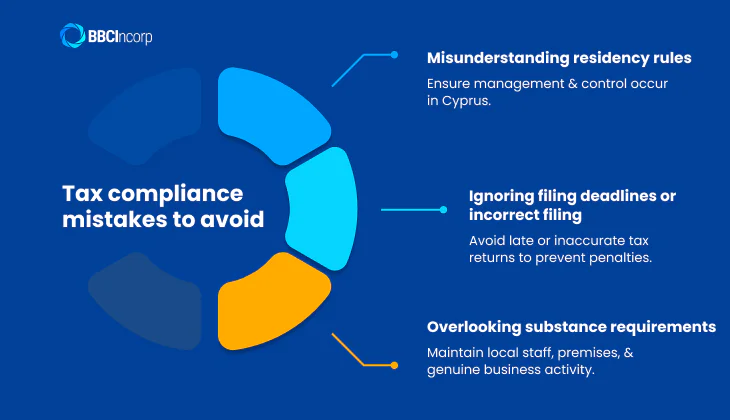

Tax compliance mistakes to avoid

Even with a favorable Cyprus company tax rate, businesses risk financial and legal issues when they neglect key compliance duties.

Misunderstanding residency rules

Tax residency depends on where management and control occur, not simply where a company is incorporated. Decisions by directors, board meetings, and strategic oversight must take place in Cyprus. If the authorities determine that control is exercised abroad, the company may lose resident status and associated treaty benefits, leading to double taxation or reclassification of income in another jurisdiction.

Ignoring filing deadlines or incorrect filing

Late or inaccurate returns are among the most common and costly errors. The Tax Department imposes a fixed administrative penalty of €100 or €200, depending on the type of return, and interest on unpaid tax currently at 1.75% per year.

Persistent delays or misreporting can trigger audits, denial of deductions, or suspension of reliefs available under the Cyprus company tax rate. Thus, keeping proper accounting records and audited financial statements is a must to stay compliant and avoids disputes with the authorities.

Overlooking substance requirements

Substance remains crucial for maintaining tax benefits under international standards. Offshore entities in particular must demonstrate genuine operations through local staff, premises, and business activity within Cyprus.

Insufficient substance can lead to loss of treaty advantages and exposure to defence contribution tax Cyprus on certain passive income such as dividends or interest.

Accurate filings, genuine management presence, and sufficient substance are key to preserving Cyprus’s tax advantages and fostering credibility with regulators and partners.

How BBCIncorp can help with Cyprus tax compliance

Managing corporate tax Cyprus requirements is easier with expert guidance. Our company services let businesses transform compliance into opportunity through practical, and forward-looking support.

From company formation and bank account opening support to corporate secretarial and registered agent services, we make setting up your entity seamless. We handle accounting, auditing, and tax filing, ensuring that every return, report, and financial statement meets local regulatory standards.

If you are an international client, you may register your Cyprus offshore company with our virtual office solution, which offers you a credible local presence. Furthermore, we also guide clients on eligible deductions, group structuring, and double tax treaty benefits.

With BBCIncorp as your partner, you gain a full-service team dedicated to simplifying compliance, optimizing tax outcomes, and helping your business thrive in one of Europe’s most respected financial centers.

Chat with our team or visit our service site for more details today!

To conclude this article

Cyprus remains one of the most attractive destinations for businesses seeking a stable, low-tax environment. Its competitive corporate tax system and extensive treaty network create advantages for both local and international investors. Companies benefit from the favorable corporate tax Cyprus rates and a transparent system that supports efficient operations.

BBCIncorp provides complete assistance with company formation, tax planning, and compliance, helping businesses operate effectively within Cyprus company tax rate regulations. For personalized support or more information about doing business in Cyprus, contact us at service@bbcincorp.com to receive timely and professional guidance.

Frequently Asked Questions

How much tax do you pay on dividends in Cyprus?

Dividends received by a Cyprus tax-resident company from another Cyprus company are exempt from corporate tax. Dividends from foreign subsidiaries are also exempt if certain participation and activity criteria are met.

However, the Special Defense Contribution (SDC) may apply to dividends received by Cyprus tax-resident and domiciled individuals or companies at a rate of 17%. Non-resident shareholders and non-domiciled residents are exempt from the SDC.

This combination of exemptions supports the country’s reputation as a business-friendly location for corporate and investment activities.

What is the 50% exemption rule in Cyprus?

The 50% exemption rule allows individuals who become tax residents of Cyprus and earn annual employment income exceeding €55,000 to be exempt from income tax on 50% of their remuneration for up to 17 years.

This incentive aims to attract high-earning professionals and executives relocating to Cyprus. It applies to both local and foreign employers, provided the individual was not a Cyprus tax resident for at least ten years before starting employment.

What types of companies are subject to corporate tax in Cyprus?

All companies that are tax-resident in Cyprus are subject to corporate tax on their worldwide income at the standard rate of 12.5%. A company is considered Cyprus-resident when its management and control take place within Cyprus, meaning key decisions and board meetings are conducted locally.

Non-resident companies are only taxed on income arising from sources within Cyprus, such as local business operations or property income. This distinction makes the jurisdiction particularly appealing for multinational holding and trading structures.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.