Table of Contents

Mauritius has steadily evolved into one of the most business-friendly destinations in the region, supported by a stable political climate, competitive tax policies, a multilingual workforce, and a strategic location between Africa and Asia. These advantages make the island not only a secure base for global expansion but also a fertile ground for high-growth investment opportunities.

Beyond its structural strengths, the country offers an impressive range of business ideas in Mauritius, spanning financial services, global business companies (GBCs), tourism, technology, logistics, and renewable energy. Backed by modern infrastructure and supportive regulations, Mauritius continues to attract entrepreneurs seeking a scalable and cost-efficient environment.

In this article, we explore the key benefits of doing business in Mauritius and highlight some of the most promising business ideas for investors looking to launch or expand their ventures.

Key points

- Mauritius offers compelling advantages for foreign investors, including political stability, attractive tax policies, strategic location, and a skilled multilingual workforce.

- The jurisdiction presents strong potential across multiple sectors, with many promising business ideas in Mauritius such as finance, tourism, ICT, e-commerce, agribusiness, and real estate.

- Key benefits of doing business in Mauritius include its pro-business regulations, modern infrastructure, and strong access to regional markets.

- While the incorporation process involves several regulatory and compliance steps, it remains straightforward and transparent with the right professional guidance.

- BBCIncorp supports businesses with a comprehensive, end-to-end incorporation service that simplifies registration, enhances compliance, and ensures a smooth setup experience in Mauritius.

Benefits of doing business in Mauritius

As Mauritius attracts more global entrepreneurs, understanding the fundamentals behind its growing appeal becomes essential.

Much of its success stems from structural advantages that shape a stable and supportive environment for business activity.

These core benefits provide the groundwork that makes operating in Mauritius both practical and strategically rewarding.

Political and economic environment

Mauritius is a small island nation located in the Indian Ocean with a population of approximately 1.27 million people, considered one of Africa’s most politically and economically stable countries.

Understanding the environment is essential for individuals and organizations that operate within a jurisdiction or seek to do business with it. To give you some points of reference, here are a few helpful analyses:

Stable political environment

Mauritius is a parliamentary democracy, with a president as the head of state and a prime minister as the head of government. The country has a long tradition of political stability, respect for human rights, and a multi-party system, so you can expect consistent policies and predictable economic conditions.

The jurisdiction typically projects lower levels of risk. For example, there is less risk of sudden policy changes or regulatory shifts that could negatively impact a business. This allows them to plan for the long term, make informed investment decisions, along with avoiding conflicts that could affect cooperation with foreign partners.

A growing economy with consistent GDP growth

Mauritius has a diverse and thriving economy with a 7.4% GDP Annual Growth Rate (2022). The GDP in Mauritius was worth 11.53 billion US dollars in 2021, according to official data from the World Bank.

As the country’s economy grows, people’s incomes generally rise, leading to an improved standard of living, including better access to healthcare, education, and other essential services. The reputation of Mauritius eventually attracts foreign investors, attracting more funds flowing into the country.

Finance, investment capital, and other financial services are available in the country through a well-developed financial and banking sector. Mauritius’ banking sector has received several international awards and accolades in recent years, which comes as no surprise.

Access to many double taxation treaties with other countries

Mauritius has signed over 45 tax treaties with other countries, including India, China, and South Africa. These treaties provide reduced withholding tax rates on dividends, interest, and royalties, and offer protection for enterprises against double taxation.

With its location at the crossroads of maritime trajectories, and proximity to influential markets. Mauritius has bilateral and regional trade agreements such as:

- With the US through the United States-African Growth and Opportunity (AGOA)

- With Africa as a member of the COMESA, SADC, Indian Ocean Commission (IOC), IORA, African Continental Free Trade Area (AfCFTA)

- With the European Union (EU) under the EU-East Africa Interim Economic Partnership Agreement

- Mauritius-China Free Trade Agreement

- A beneficiary of the Generalized System of Preferences (GSP) Schemes

- Network of Investment Promotion Protection Agreements (IPPAs) with over 29 countries

- Duty-Free Access to the UK market under the Economic Partnership Agreement

- Agreement for preferential market access with India (Comprehensive Economic Cooperation and Partnership Agreement)

Often, international trade agreements include provisions that are intended to improve the business environment, such as intellectual property protections, better labor standards, and more access to dispute resolution mechanisms.

These agreements allow Mauritian businesses to access new markets with reduced tariffs and trade barriers. This can help your company increase sales while being able to import raw materials, goods, and services for production at a much lower cost.

Favorable taxation for doing business in Mauritius

Ideal taxation rates

The standard corporate tax rate for most companies is 15%, one of the world’s lowest, and can be reduced to 3% if the company’s primary business is related to export.

What’s great is that the effective tax rate for a company can be lower due to various exemptions and incentives. There is no inheritance tax, tax-free dividends, and no property tax or capital gains tax for offshore entities.

Moreover, offshore companies centrally managed and controlled outside Mauritius (e.g. no business bank account or physical office in Mauritius) are not considered tax residents. Therefore, they will only be taxed on income derived from Mauritius.

Various tax incentives

The government of Mauritius has implemented many incentives for investors, including tax holidays, duty-free access to imports, and reduced corporate taxes. These can help to offset the costs of doing business in Mauritius, including labor costs.

Eligible new businesses can benefit from a tax holiday of four years if they:

- Are holders of a registration certificate issued by SME Mauritius

- Have an annual turnover of fewer than 30 million rupees

- Are not involved in providing Information and communication technology services under the Information and Communication Technologies Act; or Financial services under the Financial Services Act

In short, the tax incentives for offshore companies in Mauritius are designed to attract foreign investment and promote economic growth, so it would be a smart decision to consider setting up an offshore Mauritius company to enjoy various advantages from the jurisdiction.

Strategic location

Gateway to Africa and Asia

Mauritius is an island nation located in the Indian Ocean, approximately 2,000 kilometers off the southeast coast of Africa. Despite its small size, Mauritius is a vibrant and diverse country with a rich cultural heritage and a thriving economy. This has helped position Mauritius as a hub for trade and investment between the continent and the rest of the world.

Ideal location for businesses looking to expand globally

Mauritius has also played an important role in regional diplomacy. The country has a history of engagement with other African countries and has sought to promote regional integration and economic cooperation through various initiatives.

Owing to the trade agreements and tax treaties mentioned above, your enterprise is facilitated with the best conditions to grow and collab with worldwide empires to strive for success when doing business in Mauritius.

Excellent port facilities, access to major shipping lanes

Mauritius is located on important shipping routes in the Indian Ocean. Its deep-water port is a hub for trade and commerce in the region, especially for cargo and food. The country has a well-developed international airport, and modern telecommunications facilities, which facilitate the movement of goods and people.

Services such as ship repair, bunkering, cargo handling, container terminal services, etc. are present at all times to accommodate even large cruise ships, so rest assured that efficient cargo and passenger support are ensured for your operations.

Skilled workforce

Well-educated and multilingual workforce

The country has a well-educated and multi-lingual workforce, and its proximity to major emerging markets such as India and China has helped to facilitate trade and investment flows. The government has placed a strong emphasis on education and implemented several policies to promote human capital development.

This is a valuable asset for businesses looking to expand their operations into other countries or regions. Thus, workers in Mauritius are often committed to delivering high-quality work that meets international standards.

Availability of skilled professionals in different fields

Mauritius focuses on technical and vocational education and training, with a range of programs designed to equip people with the practical skills they need to succeed in the workplace.

The government has also established several training centers and institutes to provide specialized training in areas such as hospitality, tourism, and the maritime sector.

Competitive labor costs compared to other countries

The cost of labor in Mauritius is generally lower than in developed countries, while still maintaining a high level of quality and productivity. However, it is important to note that wages in Mauritius have been rising in recent years due to the country’s economic growth and low unemployment rate.

Mauritius’s workforce can provide businesses with a competitive advantage by helping to drive innovation, improve productivity, and provide access to specialized expertise. The knowledge gained can be applied to other regions and industries as well, providing long-term benefits for the company.

Infrastructure

Modern telecommunications networks and reliable internet services

Mauritius has a modern telecommunications network, with high-speed internet access and mobile phone coverage available throughout the country. The government has encouraged the growth of the ICT sector and has implemented policies to attract technology companies.

The growth of e-commerce in recent years has been driven by factors such as increasing internet penetration, consumer demand for online shopping, and the emergence of new technologies and platforms, resulting in new opportunities for businesses and consumers alike.

Availability of high-quality office spaces

The jurisdiction offers high-quality office spaces for doing business in Mauritius, including modern buildings and business parks that are equipped with the latest technology and amenities.

These spaces are designed to meet the needs of both local and international companies, and many of these office spaces are equipped with leading-edge security systems.

If you are looking to establish a physical office here, the high-quality spaces shall provide a professional and efficient environment to work in, enabling your team’s productivity, creativity, and collaboration enhancement.

Efficient transportation system

Mauritius has a well-developed transportation system, which includes a network of highways, modern airports, and a deep-water port. The country has also invested in public transportation, including buses and taxis, to provide affordable and efficient transportation for its citizens.

Car rental services are available throughout Mauritius, and they offer an excellent option for both locals and foreigners to travel.

How about sustainability in Mauritius?

Mauritius has a reliable supply of electricity and clean water. The government has invested in renewable energy sources, including solar and wind power, to reduce reliance on fossil fuels and promote sustainability.

A few restrictions when business in Mauritius

Mauritius is generally a very welcoming country open to people from around the world. However, like all countries, there are certain restrictions that foreign entrepreneurs and residents must abide by. Below are some setbacks worth noticing:

Aging population

Even though the population of Mauritius has a relatively young age profile, with a median age of around 35 years old, it is showing signs of shifting steadily into a high aging trend with people over 65 accounting for 13% of the population.

Not only is the local market size rather small, but there will be increasing demand for products and services for the provision of healthcare, and caretaking along with social support.

Small domestic market

Mauritius has a small domestic market, which means that businesses may need to look to export markets to achieve growth. This can be challenging for some businesses, particularly those in niche markets.

Limited natural resources

Mauritius has limited natural resources, which means that the country is heavily dependent on imports to meet its energy and resource needs. Some industries, such as mining and oil exploration, can not be well-developed. Even freshwater and mineral resources are insufficient.

Despite these limitations, Mauritius has developed a diversified economy that includes many industries such as tourism, financial services, and technology. The government has implemented policies to motivate business operations while promoting sustainability, including investments in solar power and wind energy.

Note

While the jurisdiction offers an attractive fiscal environment for foreign investors, accessing these tax advantages is contingent upon strict adherence to local compliance standards.

To qualify for the reduced tax rates and exemption schemes, your company must satisfy the Mauritius Economic Substance Regulations.

This framework requires entities to demonstrate a legitimate physical presence and core income-generating activities within the country, ensuring that the business is not merely a ‘shell’ operation

Top business ideas in Mauritius

Mauritius is much more than a scenic beachfront locale, it has evolved into a vibrant, business-ready ecosystem where investors ask: what business can I start in Mauritius?

Driven by its diversified economy, supportive regulations and strategic geographic position, the country offers a range of viable sectors. Below are ten of the most compelling business ideas in Mauritius, each chosen for its market readiness, scalability and alignment with global trends.

Financial & Corporate Services

Mauritius boasts a well-regulated framework for fund administration, corporate structuring and investment services, making it one of the best business in Mauritius for firms targeting high-net-worth clients, hedge funds or international trade.

According to the World Bank, the financial services sector contributes approximately 14% of GDP(1). With multilingual professionals and favorable legislation in place, this sector supports reliable, recurring-revenue business models.

Tourism, Hospitality & Ecotourism

Tourism remains a cornerstone of Mauritius’s economy, and entrepreneurs can tap into emerging niches like wellness retreats, adventure tourism and eco-lodges. In the fiscal year 2023 – 2024, the island welcomed over 1.31 million air arrivals(2).

For business owners looking for best small business ideas in Mauritius, this area offers high-margin possibilities in a demand-rich market.

ICT, Software & Digital Services

As global demand for digital platforms and service delivery grows, Mauritius is positioning itself as a regional tech hub. The information-and-communication technology (ICT) sector alone contributed Rs 33.9 billion (~US$735.6 million) in 2024, about 5.6% of gross value added(3).

Startups and SMEs entering SaaS, cybersecurity, mobile apps or digital marketing can benefit from low cost base, government incentives and multilingual talent.

E-commerce & Online Retail

Internet penetration and digital payment adoption are rising, making e-commerce among the most flexible entry points for new ventures. Whether launching niche online stores, subscription services or import-aligned retail platforms, investors will find a market ready for innovation. For smaller operators, this ranks among the best small business ideas in Mauritius thanks to lower upfront capex and scalability.

Agribusiness, Food Production & Processing

Mauritius remains a net-importer of many food products, meaning opportunities abound in organic farming, hydroponics, value-added food products and supply to the hospitality sector. Entrepreneurs combining eco-friendly methods with local demand can capture this business ideas in Mauritius niche and position themselves for growth as sustainability trends increase.

Real Estate & Property Development

Investment in housing, resorts and commercial space remains steady. With tourism growth and steady foreign capital inflows, real-estate ventures continue to rank high among best business in Mauritius for long-term value creation.

Services such as property management, rental operations and mixed-use developments offer attractive returns.

Renewable Energy & Environmental Solutions

Mauritius’s commitment to transitioning to clean energy has created a demand for solar installations, waste-to-energy systems, water-saving technologies and consulting services focused on environmental compliance.

For investors focused on future-proofing, this sector offers a blend of public support and commercial viability.

Logistics, Trade & Export-Import

Located at the crossroads of Africa and Asia, Mauritius serves as a natural trade gateway. Freight forwarding, warehousing, specialized export-import operations and freeport services all qualify as strong business ideas in Mauritius.

With regional trade corridors expanding, logistics represents a durable area for both SMEs and larger firms.

Health, Wellness & Lifestyle Services

As global wellness trends accelerate and Mauritius hosts both tourists and expats, lifestyle-oriented ventures such as boutique spas, premium fitness studios, organic product retail and specialized clinics are thriving.

These count among the best small business ideas in Mauritius given their high-margin profile and growing demand.

Education & Professional Training

With a multilingual workforce and strong emphasis on skills development, Mauritius offers entrepreneurship opportunities in training centres (for IT, languages, vocational skills) and niche educational services. Predictable demand, low infrastructure requirements and scalability make this a smart area for business entry.

Whether you’re exploring what business can I start in Mauritius or comparing sectors for expansion, this list of business ideas in Mauritius illustrates both timely opportunities and future-oriented choices.

By aligning investment with the island’s structural strengths, governance, infrastructure and regulatory support, entrepreneurs can tap into some of the best business environments in Mauritius for growth, profit and sustainability.

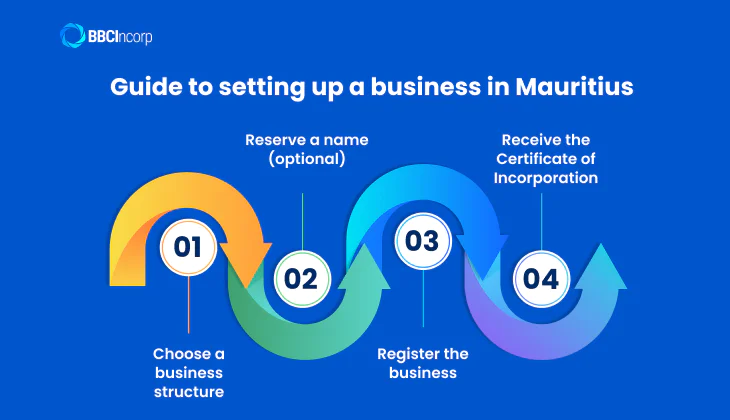

Guide to setting up a business in Mauritius

Once you have decided on operating business in Mauritius activities in this prosperous jurisdiction, it’s time to go into the incorporation process.

In Mauritius, forming a company entails several steps, such as registering the business, obtaining necessary licensing and permits, and complying with regulations. A brief overview of the process follows:

- Choose a business structure: Mauritius’s most common type of structure is the Authorized Company (AC) for operating offshore only, or the Global Business Company (GBC) if you want to conduct business both inside and outside Mauritius.

- Reserve a name (optional): This can be done by submitting an “Application for Reservation of a Company Name” to the Registrar of Companies.

- Register the business: The next step is to register the business with the Registrar of Companies. This involves submitting the necessary documents, such as the company’s memorandum and articles of association.

- Receive the Certificate of Incorporation: After paying fees and upon compliance with the related regulations, the Registrar will issue you an Electronic Certificate of Incorporation and other necessary identifications. Your business can start operating now!

Read more detailed instructions on how to start a company in Mauritius and the full steps involved in the incorporation process.

Based on the structure and the actual scale of your company, the incorporation could take from 5 working days to a few weeks if additional documents or statements are required, but the process is straightforward, so it will not be too difficult for your enterprise.

It is recommended to consult with a local lawyer or business advisor who can guide the specific requirements and regulations for setting up a business in Mauritius.

Other information about doing business in Mauritius

Overall, Mauritius is a relatively easy place to do business. However, it is important for businesses to understand the local business culture and etiquette and to be aware of the potential challenges and limitations of the market. Several notes you might need:

- Permits and Licenses: If you are conducting business in or from within Mauritius, you may need permits and licenses from various government agencies. For example, if you are starting a restaurant, you may need to obtain a food handling permit accordingly.

- Employment laws: Mauritius has strict employment laws that govern the hiring and firing of employees. You might want to note the regulations down if you plan to hire more local human resources. Mauritius won’t tolerate any offenses against the Workers’ Rights Act, and you could risk being imprisoned if violating the rules.

- Business culture: Mauritians prefer formal business relations and are more concerned about the details than becoming friends with partners. Business cards, brochures, and price lists should be used, and be punctual in meetings.

- Wide range of potential investments to consider: Mauritius has some beneficial business niches where you may set up a business, including financial services, e-commerce, life sciences, research and development, construction, real estate, tourism, agriculture, etc.

The point is that conducting business in Mauritius requires careful planning, a deep understanding of local laws, and an appreciation for the culture and customs. By keeping these factors in mind, you shall establish a successful Mauritian enterprise.

Setting Up in Mauritius: How BBCIncorp Makes It Easier

BBCIncorp supports global entrepreneurs and companies looking to establish operations in Mauritius through a clear, compliant, and well-coordinated incorporation process.

By combining jurisdiction-specific knowledge with reliable corporate services, we help clients navigate regulatory requirements with confidence and reduce the complexity typically associated with entering a new market.

Technology-enabled support for smooth incorporation

Digital tools play a central role in how we assist clients. Our secure platform simplifies the exchange of documents, progress tracking, and communication throughout the setup process. Automation helps reduce manual handling and filing errors, while enhanced security controls and data protection measures ensure that sensitive corporate information remains safe and confidential.

Mauritius-focused services for a complete setup

BBCIncorp offers a structured package of services that supports every essential stage of company formation in Mauritius. These services go beyond basic registration to meet both compliance and operational needs:

- Formation of an Authorized Company (AC): end-to-end support from structure selection to full registration.

- Bank account opening coordination: guided onboarding with partner banks to speed up approval.

- Certified true copies of documents: compliant certification for regulatory and banking requirements.

- Legal and administrative handling: assistance with filings, procedural documentation, and statutory requests.

- Nominee director and shareholder solutions: safeguarding privacy while maintaining regulatory compliance.

- Corporate document retrieval: fast access to official filings and company records.

- Secure physical delivery of corporate documents: global shipping with tracking and confidentiality.

- Additional essentials: Company Chop and Seal, plus advisory on merchant account setup.

This comprehensive service set allows clients to work with a single, dependable provider, reducing the risk of delays and ensuring that all requirements are covered efficiently.

A practical, client-centered approach

We take a straightforward and responsive approach to every engagement. Clients receive clear guidance, timely updates, and support that adapts to their business model and operational needs. Our focus is on making the incorporation process predictable, transparent, and aligned with regulatory expectations, without adding unnecessary complexity.

Through our wider international presence, BBCIncorp also assists businesses exploring multi-jurisdictional expansion.

Clients looking to compare structures or diversify their global footprint can leverage our offshore formation company services to build a cohesive, multi-country setup.

Conclusion

Mauritius offers many advantages for businesses looking to establish a presence or operate within the region, including its strategic location, favorable tax regime, political stability, skilled workforce, business-friendly environment, and quality of life.

Taken together, these factors represent some of the key benefits of doing business in Mauritius and make the jurisdiction an attractive choice for both new ventures and expanding enterprises.

Doing business in Mauritius requires compliance with several legal requirements, including registration with the relevant authorities, obtaining necessary permits and licenses, and more. Professional advice can ensure that these requirements are met correctly and efficiently and that the business fully complies with all relevant laws and regulations.

Contact our team via the chat box or send a message to service@bbcincorp.com for practical advice on incorporation or any questions regarding doing business in Mauritius. We are glad to lend you a hand.

Soucer:

(1) https://www.worldbank.org/en/country/mauritius/overview

(2) https://tourism.govmu.org/Documents/publication/Tourism_Annual_Report_on_Performance_FY_2023%20_2024.pdf

(3) https://www.intracen.org/news-and-events/news/mauritius-builds-a-digital-future-with-stronger-ict-trade-data

Frequently Asked Questions

Can a foreigner start a business in Mauritius?

Yes, foreigners are allowed to start a business in Mauritius. The government of Mauritius actively encourages foreign investment and has put in place policies and regulations to facilitate and attract foreign entrepreneurs to invest in the country.

It is advisable to seek the assistance of a local attorney or business consultant who can guide you through the legal and regulatory requirements for starting a business in Mauritius.

Is it easy to incorporate a Mauritius business?

Incorporating a business in Mauritius will be a straightforward process if you have all the necessary information and document, and if you follow the proper procedures.

Here are some steps of incorporating a Mauritius business: choose a business structure, decide on a name, register the business with the Registrar of Companies, pay necessary fees, receive your Certificate of Incorporation, and start operating while complying with legal regulations.

What key factors make Mauritius a good business place?

Mauritius is a popular jurisdiction due to its strategic location, stable political and economic environment, skilled workforce, business-friendly policies, modern infrastructure, and high quality of life. These factors make it an attractive location for companies looking to expand into Africa, Asia, and beyond.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.