Table of Contents

Are you considering Mauritius as an option for offshore company incorporation? If you are exploring how to start a company in Mauritius, this guide covers the essential points you need to know.

We explain why Mauritius is an attractive jurisdiction, outline the full procedure for setting up a company, and highlight important post-incorporation requirements. With these insights, you will be better equipped to determine whether Mauritius aligns with your business goals.

Key Takeaways

- Mauritius remains an attractive jurisdiction thanks to its stable business environment, competitive tax regime, and strong regulatory framework.

- The jurisdiction offers multiple business structures for investors to choose from, including GBC, AC, and DC.

- The incorporation process follows four core steps, from selecting an entity type to receiving the Certificate of Incorporation.

- Companies must meet ongoing compliance requirements, including annual filings, record keeping, and tax obligations.

- BBCIncorp supports investors with essential post-setup services, such as AC formation, bank account coordination, document certification, and legal administrative assistance.

Why incorporation a company in Mauritius

Mauritius has steadily established itself as a reliable, well-regulated hub for international business. For entrepreneurs exploring how to form a company in Mauritius, understanding the jurisdiction’s core advantages is key to assessing its suitability. The factors below highlight why Mauritius continues to attract global investors.

Favourable tax system

Mauritius’s tax system is competitive, including a low corporate tax rate of 15%. If your company is a non-resident for tax purposes, meaning it is centrally managed and controlled outside Mauritius, you’ll be exempted from corporate tax, withholding tax, interest, royalties, or any capital gains tax.

Strategic location

Mauritius is located in the Indian Ocean, making it an ideal trade, investment, and tourism hub for companies doing business in Africa, Asia, and the Middle East. Mauritius is in the GMT+4 time zone, allowing it to do business with Asia in the morning and Europe and Africa in the afternoon.

Business-friendly environment

The government of Mauritius has taken many steps to create a business-friendly environment, including reducing bureaucracy and streamlining the process of registering and operating a company.

Since Mauritius has signed Investment Promotion and Protection Agreements with many African member states, this is truly a promising destination for investors targeting the market

Political stability

Mauritius provides a sense of security for investors and businesses. The modern system of law is a combination of French civil law and common law, while civil and criminal proceedings are based on British practice. Thus, the country has consistently been ranked as one of Africa’s most politically stable countries.

Double taxation treaties (DTAs)

Mauritius has signed double taxation treaties with over 45 countries (updated February 2023). Under the DTAs, residents of the contracting states are provided relief from double taxation in the form of tax credits, exemptions, or reduced tax rates.

Reputation

Mauritius is recognized as a well-regulated and transparent financial center, with a robust regulatory framework and a commitment to preventing money laundering and terrorist financing. The jurisdiction is famous for its high level of confidentiality in business and financial operations.

In-depth details on the advantages of establishing a company in Mauritius might provide you with a better understanding of why this jurisdiction remains popular for business.

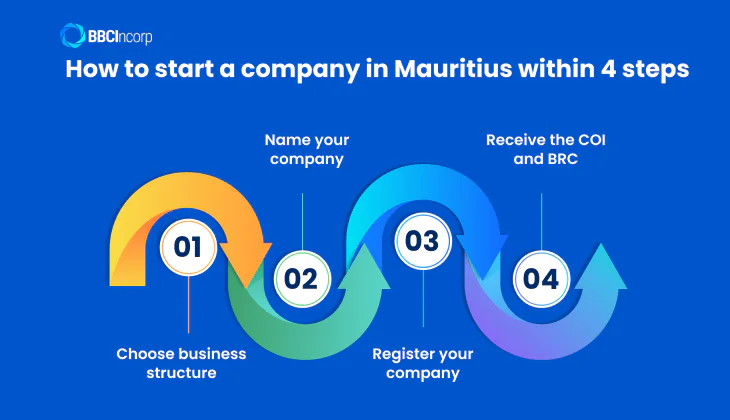

How to start a company in Mauritius within 4 steps

Wondering how to set up a business in Mauritius? Whether you’re a local entrepreneur or a foreign investor, the four steps below will guide you through the essential procedures and help you navigate the jurisdiction’s business environment with confidence.

Step 1: Choose a compatible business structure

The first step is to decide on a business entity that best suits your needs, such as a Global Business Company (GBC), or an Authorised Company (AC).

Several types of companies can be set up in Mauritius by foreign entrepreneurs. Take time to consider their features thoroughly and make the right choice for your business!

Global Business Company (GBC)

Previously known as the Global Business Category 1 (GBC1), the GBC allows foreigners to set up a company that predominantly derives income from outside Mauritius and still utilizes all tax treaties and regional agreements.

A resident corporation whose majority of shares or voting rights or the beneficial interest is held or controlled by a non-Mauritius citizen should apply for the GBC model. If you’re conducting or proposing to conduct business principally outside of Mauritius, you need to apply for the compatible Global Business License as well.

If you haven’t received an update on the requirements of a Global Business Company, do go through the necessary information on the GBC regime.

Authorised Company (AC)

Authorised Companies (or GBC2) are commonly used for international trade, investment, and asset protection purposes. An Authorised Company has its business activities, control, and management carried out outside of Mauritius.

Simply put, it is a non-tax-resident offshore Mauritian company, exempted from corporate tax, withholding tax, interest, royalties, or any capital gains tax. It comes with a fast and transparent incorporation process, hence why many entrepreneurs chose to establish an AC in Mauritius.

Overall, Authorised Companies in Mauritius provide a flexible and efficient vehicle for conducting international business while benefiting from the country’s favorable tax and regulatory regime.

Benefits of Mauritius Authorised Company you don’t want to miss

Visit our dedicated article on the benefits and requirements of a Mauritius Authorised Company to decide if this popular entity type is suitable.

Domestic Company (DC)

Unlike Authorised Companies, which are licensed by the Financial Services Commission for offshore activities, Domestic Companies are primarily intended for conducting business within the country as local businesses.

A Domestic Company in Mauritius is incorporated and registered under the Companies Act of Mauritius. Apart from being subject to a corporate tax rate of 15%, they are also eligible for other tax incentives and exemptions, particularly in sectors such as tourism and manufacturing.

It’s crucial to discuss your situation with a professional in Mauritius to determine the best type of company structure for your specific business needs and goals, as regulations can be pretty confusing for non-residents.

Step 2: Name your company

Choose a brand name for your business and ensure it complies with the Companies Act. The availability of a word can be checked online and is free of charge.

To reserve a name, you must complete an “Application for Reservation of a Company Name” form and submit it to the Registrar of Companies.

Step 3: Register your company

Conveniently, the registration can be completed remotely through a form for certain cases, or directly by submitting the required documents at the office of the Registrar of Companies.

By filling out the relevant application form and uploading the necessary documents, you can incorporate your company online through the Companies and Business Registration Integrated System (CBRIS).

Generally, the online form (Form 1: “Application for incorporation of a company“) will include:

- The name, address of the registered office, incorporation/ registration number of the corporate body

- The business name, type, and date or proposed date of incorporation

- The full name, address, and national identification number of the applicant

- Identification of the company’s directors and secretaries

- The date or proposed date of commencement of business

- Evidence that your company is active outside Mauritius and has central management and control outside Mauritius

You will likely need to prepare the Memorandum and Articles of Association, which define the objectives, share capital, and management structure of the company.

Payment of the necessary annual registration fee shall be made following the form submission.

Additional note:

Other essential forms (e.g., confirming the consent of every director, secretary, or shareholder of the proposed company) can also be requested, so be prepared.

Depending on the type of business, you may need to obtain additional licenses or permits from the relevant authorities. For example, a Mauritius Freeport operator’s license is required to set up a company in any Free Zone.

Step 4: Receive the Certificate of Incorporation and a Business Registration Card (BRC)

Upon payment of the prescribed fee and compliance with the related regulations (e.g. the Companies Act 2001), the Registrar will issue you an Electronic Certificate of Incorporation and a Business Registration Card (BRC).

The certificate of incorporation in Mauritius is legal proof of the existence of the company and contains fundamental details about the company, including the name of the company, its registration number, and the date of incorporation.

By completing these steps, entrepreneurs gain a structured pathway to establishing their presence in Mauritius. For those evaluating how to form a company in Mauritius, the process is ultimately designed to be transparent and accessible, even for first-time foreign investors.

With each requirement clearly defined, Mauritius offers a dependable framework that supports efficient business setup and long-term operational growth.

Post-registration tips for a smooth incorporation

Open a bank account

Once your company is registered, you should start applying for a business banking account. Mauritius companies are not required to open business accounts in the jurisdiction. Offshore banking is allowed.

Regarding a local reputable banking service provider, here are a few potential choices: Mauritius Commercial Bank, Bank One Limited, HSBC Bank (Mauritius), Investec Bank, etc.

It will save you a lot of time and effort to discuss the instructions on opening a business bank account in Mauritius with us and receive practical advice.

Comply with necessary regulations

As a company operating in Mauritius, you must fulfill annual compliance including tax obligations, labor laws, and other compliance requirements.

For instance, under the current laws of Mauritius, an Authorised Company is required to:

- Prepare and file a Financial Summary within 6 months of the financial year-end with the Financial Services Commission (FSC)

- Report an Annual Return of Income with the Mauritius Revenue Authority

- Depending on the directors’ decision, financial records, and supporting documents can be kept at an address inside or outside Mauritius.

- If the above papers are not kept in Mauritius, certain accounts and returns for the operations of the company must be sent back to a local address in Mauritius. A notice of the place where all the accounting records are shall be given to the Registrar.

In contrast, a Global Business Company must maintain and keep the full financial statements, not just simplified versions. A GBC is also expected to file an auditor’s opinion on the financial statements in addition to the above requirements of an AC.

Late filing of accounts and failure to payment of taxes timely are bound to result in financial penalties of up to MUR 20,000 with the cumulative amount increasing significantly over time.

Several regulations on annual general meetings (AGM):

The first AGM of a Mauritius company must be held within 18 months from the date of incorporation.

Mauritius companies are required to hold an AGM of their shareholders at least once per calendar year within 6 months from the date of filing the balance sheet of the company. The gap between each AGM must be no longer than 15 months.

Starting a Business with BBCIncorp’s Process Outsourcing Services

Setting up a company in Mauritius requires careful coordination, from selecting the right entity type and preparing statutory documents to navigating local compliance requirements.

For many investors starting a business in Mauritius, BBCIncorp provides structured support throughout these stages, helping both new and experienced founders manage administrative obligations with greater clarity and efficiency.

Through a combination of regional expertise and technology-enabled processes, we ensure that the incorporation of company in Mauritius remains smooth, compliant, and aligned with regulatory expectations.

Why Choose BBCIncorp

With more than ten years of experience in multi-jurisdictional corporate services, BBCIncorp assists clients across Asia, the Caribbean, and major offshore hubs in navigating their incorporation and compliance obligations. What differentiates our approach is the emphasis on precision, transparency, and operational consistency. These qualities are essential when dealing with cross-border regulatory environments.

Our key strengths include:

- Regional insight and specialized teams: Extensive experience in offshore company formation in jurisdictions such as Cyprus, Seychelles, and Mauritius ensures full compliance with local regulations while maintaining global best practices.

- End-to-end support: From entity selection to filing, document preparation, and post-registration maintenance, processes are handled with defined workflows and clear timelines.

- Technology-driven efficiency: Secure digital platforms streamline communication, document submission, and compliance tracking, reducing administrative delays.

- Clear service structure: Transparent pricing and well-outlined deliverables allow investors to plan with confidence and avoid unexpected complexities.

Instead of simply processing documents, BBCIncorp focuses on helping clients establish a solid operational foundation. This approach is especially valuable in a jurisdiction like Mauritius where regulatory clarity is essential.

BBCIncorp’s Business Process Outsourcing Services in Mauritius

BBCIncorp provides a comprehensive suite of business process outsourcing in Mauritius, tailored to the jurisdiction’s legal and regulatory framework. These solutions support businesses from the moment of incorporation through ongoing operations and allow them to outsource compliance-heavy and administrative functions with confidence.

Our Mauritius-focused services include:

- Authorised Company (AC) formation

- Open a bank account

- True copy certification

- Legal administrative

- Nominee director or shareholder

- Document retrieval

- Physical shipping of corporate documents

- Other services: Company Chop and Seal, Consulting on Merchant Account

Conclusion

Setting up a company in Mauritius can be a smart choice for many entrepreneurs thanks to its stable business environment, favorable tax regime, skilled multilingual workforce, and well-developed infrastructure, including modern telecommunications and efficient port facilities.

However, understanding how to start a company in Mauritius requires careful attention to various legal and regulatory requirements, especially for offshore structures.

Feel free to reach out to our professional team via the chatbox for timely assistance or contact service@bbcincorp.com for incorporation information and advice.

Frequently Asked Questions

How much does it usually cost for a Mauritius offshore company formation?

There are quite a few expenses you should expect to pay:

- Company registration fee

- Annual fee

- Office maintenance fees

- Compliance taxes (if any)

- Accounting service fees

- Bank account opening fee

The amount will differ depending on the needs and requirements of your company, but for starters, it should cost you MUR 13,500 (about USD 292) for the registration fee at the time of application.

Feel free to contact us for support in working out your budget efficiently.

How long does it take for company incorporation in Mauritius?

The company incorporation process in Mauritius can take anywhere from a few days to a few weeks, depending on the circumstances. Incorporating a domestic company typically takes around five to seven working days from the submission of the application.

However, a Global Business Company or an Authorised Company may take a bit longer, usually around two to three weeks, as these entities are subject to additional scrutiny from the Financial Services Commission.

What is the process for certifying or notarizing the documents required for incorporation in Mauritius?

If you do not submit the original document, it must be certified as a true copy. The copies must be certified by a lawyer, notary, actuary, accountant, or any other professional with a recognized qualification.

Certifications must contain the signature of the certifier, as well as their full name, address, and position, or they should be enclosed with contact information.

Can a foreigner own 100% of a company in Mauritius?

Yes. A foreigner can own 100% of a Domestic Company in Mauritius. The jurisdiction welcomes foreign investment, and the setup process for non-citizens is relatively straightforward. Below are the key requirements for establishing a domestic company as a foreign individual:

- No minimum capital requirement applies.

- At least one shareholder is required, and this shareholder may be a non-resident.

- The company must appoint at least one resident director in Mauritius.

- An annual declaration must be filed with the Registrar of Companies, and financial statements must be audited if annual revenue exceeds MUR 50 million.

- Domestic companies are subject to a corporate income tax rate of 15%.

With the right guidance, foreign investors can establish and operate a Mauritius domestic company smoothly while remaining compliant with statutory obligations.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.