Table of Contents

Many global investors and entrepreneurs recognize the value of offshore banking for improving financial flexibility and asset protection. However, the process of opening an offshore bank account can seem complex without proper guidance. In reality, establishing one is entirely manageable with a clear understanding of regulatory requirements and reliable professional support.

This article provides a practical, step-by-step overview of how to open an offshore account, highlighting the essential documents, verification procedures, and considerations involved. With reputable providers such as BBCIncorp, you can navigate the process efficiently, compliantly, and gain access to the best offshore banking opportunities.

What is an offshore bank account?

An offshore bank account is a bank account held in a jurisdiction outside your country of residence. Rather than using a domestic bank, you establish and maintain the account in a foreign banking centre. This setup allows individuals or businesses access to financial services outside their home country’s legal and tax environment.

Such accounts are frequently used to access multi-currency holdings, benefit from stable banking systems, and align with global business or investment operations. In many cases, offshore accounts provide a way to diversify assets, manage international payments, or hold funds in currencies that create protection against domestic currency fluctuations.

It is important to note that while opening an offshore bank account is legal when properly declared, it is subject to household, national and international reporting and compliance obligations.

In short, an offshore bank account offers an alternative banking channel beyond your home country, enabling international currency management, cross-border transfers and potential strategic financial flexibility within the bounds of law and regulation.

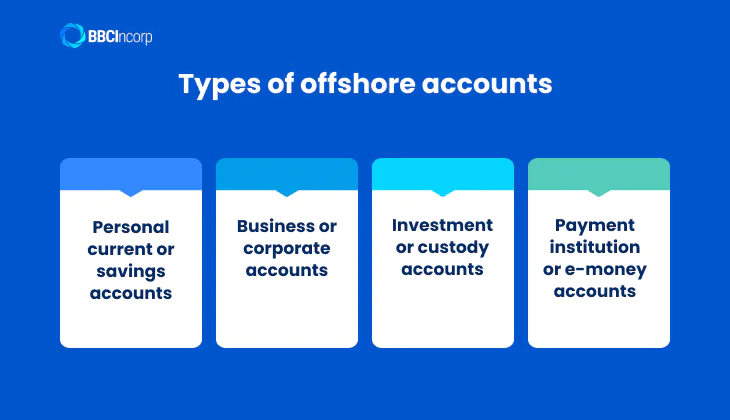

Types of offshore accounts

When exploring how to open an offshore bank account, it is essential to understand the main types available. Offshore banking options generally fall into four categories, each serving different financial needs and goals.

Personal current or savings accounts

These accounts suit individuals who wish to manage funds in multiple currencies, access global banking services, and maintain privacy in transactions. They are often chosen by expatriates or professionals with income sources across countries.

Business or corporate accounts

Designed for companies involved in international operations, these accounts enable cross-border payments, supplier management, and multi-currency support for global trade.

Investment or custody accounts

These accounts are ideal for holding financial assets such as bonds, stocks, or funds. They provide access to international markets and asset diversification opportunities.

Payment institution or e-money accounts

Often used by e-commerce businesses or digital entrepreneurs, these accounts allow online transactions and payments but are subject to different regulations than traditional banks.

Selecting the right account type depends on your banking goals, operational scale, and compliance obligations.

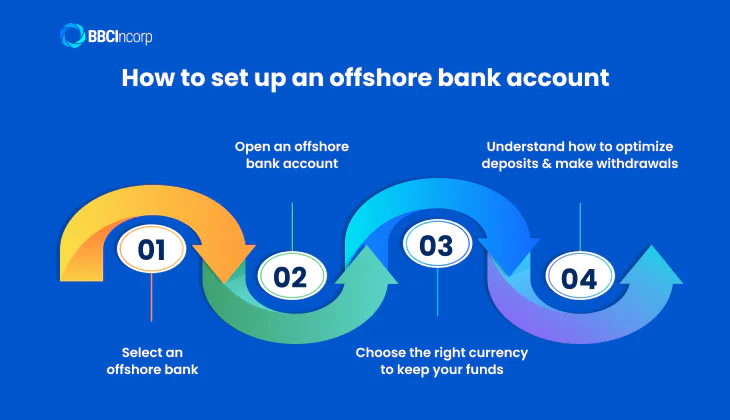

How to set up an offshore bank account

Setting up an offshore bank account is a straightforward process. Here’s a streamlined four-step guide to opening and accessing an offshore account.

Step 1: Select an offshore bank

Choosing the right offshore bank is crucial for a successful venture. Here are some tips to help you select the best-suited institution:

Choose a stable offshore jurisdiction

Opt for an offshore jurisdiction known for its economic and political stability. For instance, Switzerland’s CIM BANQUE is among the top countries with the best offshore bank accounts. This choice minimizes risks like corruption, insecurity, bankruptcy, and other financial crises that may plague your home country.

Singapore is also a perfect choice for startups that want to open a business account in a global setting. If you’re considering a corporate bank account in Singapore, ensure you are familiar with practical tips for the bank application process.

Consider tax obligations

Each jurisdiction has specific tax regulations for opening accounts and conducting foreign wire transfers. Research thoroughly to ensure compliance with local tax laws and ascertain if you can legally optimize taxes due to your offshore status.

Narrow down your options

Different offshore banking systems offer unique advantages. Some require a low minimum initial deposit, saving your company money, while others excel in customer service. Narrowing down your options according to your company’s strategy will help you make a more informed decision efficiently.

Decide on the best-suited offshore bank

With a shortlist of potential candidates, select the bank that aligns best with your financial situation and needs. Key parameters to consider include set-up fees, maintenance fees, and minimum initial deposits, especially if cost is a top priority.

Step 2: Open an offshore bank account

In this section, we provide a comprehensive step-by-step guide on how to open an offshore bank account.

Requirements for a personal bank account

To verify your identity, please prepare the following documents:

- Personal information: Full name, date of birth, current address, citizenship, and occupation

- Passport: A copy of your passport

- Proof of residence: Examples include a driver’s license, utility bill, or other government-issued identification

- Financial references: Recent personal bank statements and/or a bank reference letter. Offshore banks typically require financial references to verify account balances and ensure legitimacy. A bank statement covering the past 6 to 12 months is generally sufficient.

- Source of funds: Documentation to verify the origins of funds in your account. Acceptable documents might include wage slips, proof of investment income, sales contracts, transaction-related materials, or an insurance payout letter.

- Additional documents: This could include a KYC form, CVs of shareholders and directors, business reviews, sales contracts, etc.

All documents must be notarized to confirm their authenticity. Most offshore banks will request either certified copies of these documents or an “apostille” stamp, which specifically verifies the authenticity of foreign documents.

Corporate account requirements

Banks generally have different criteria for opening corporate accounts, but certain documents are universally required. Standard prerequisites for corporate accounts include:

- Certificate of Incorporation: Issued by the appropriate regulatory authority.

- Certificate of Good Standing: Required if the corporation has been operational for over a year.

- Bank recommendation letter: Each signatory must provide a letter of reference from their bank. These letters should be on the bank’s letterhead and briefly describe the nature and duration of the banking relationship. Most banks have their own specific formats for these recommendations.

- Professional recommendation letter: One letter from a professional, such as a lawyer, accountant, or business reference is necessary.

- Identification: A clear, apostilled copy of the passport for each authorized signatory, beneficial owner, and director associated with the account.

- Proof of address: A recent utility bill, credit card statement, mortgage statement, or local government tax bill.

- Business plan: An overview of the company, as most banks require a brief business plan.

Step 3: Choose the right currency to keep your funds

Setting up an offshore bank account allows you to choose the currency in which you hold your funds. This offers a distinct advantage over local bank accounts, which typically restrict you to the domestic currency, often unstable and prone to devaluation.

Notably, opting for a foreign currency in an offshore account may subject you to foreign tax liabilities and incur significant costs when converting the offshore currency back to your domestic one. Therefore, careful consideration is crucial to determine which foreign currency will benefit you the most.

For instance, investors with funds in US dollars often find the Hong Kong dollar to be an ideal choice for their offshore accounts. This is because the Hong Kong dollar is pegged to the US dollar, minimizing conversion costs between the two currencies. Best banks in Hong Kong provide a wide range of currency options, allowing you to select the one that best suits your needs.

Step 4: Understand how to optimize deposits and make withdrawals

Account holders typically fund their offshore accounts through international wire transfers. However, it’s important to note that transfer fees vary depending on the foreign bank. Furthermore, most offshore banks do not accept domestic checks or cash deposits.

When it comes to withdrawing funds, offshore banks offer several options similar to domestic accounts. You can use an ATM or debit card, though this method often incurs high fees. While writing checks is an option, it is less common and compromises privacy. Cash withdrawals are possible and recommended in larger amounts to minimize fees.

Another effective method for accessing funds is linking your offshore account with a domestic one. This approach reduces fees, brings greater convenience, and privacy for wire transfers between the two accounts.

Open your offshore bank account with BBCIncorp

With vast network of reputable banks around the world, we connect you with the best banking solutions for your offshore needs. Our team at BBCIncorp is dedicated to helping you open an offshore bank account seamlessly. Contact us today!

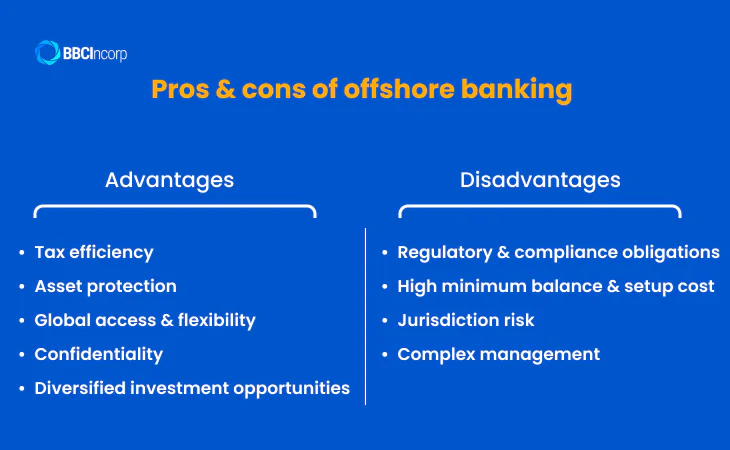

Advantages and disadvantages of offshore banking

Offshore banking provides access to international financial systems, advanced banking services, and potential tax advantages. Regardless, it also requires a strong understanding of legal compliance and operational responsibilities. The following breakdown helps you assess whether offshore banking aligns with your financial objectives.

Advantages of offshore banking

First, let’s discover the key benefits of offshore banking, including tax benefits, asset protection, global access, and other features.

Tax efficiency

Many offshore jurisdictions, such as the Cayman Islands, Singapore, and Hong Kong, offer reduced or zero corporate tax rates. Properly structured offshore accounts enable businesses to optimize global tax exposure and preserve profits within legal boundaries.

Asset protection

Offshore banks operate under strong legal frameworks that secure funds against lawsuits, political instability, or domestic asset seizure. In countries with volatile economies, holding assets abroad ensures greater financial continuity and control.

Global access and flexibility

Offshore banks support multi-currency transactions, international payments, and remote management through advanced online platforms. This flexibility is valuable for companies operating across multiple jurisdictions or managing clients and suppliers worldwide.

Confidentiality

Top offshore centers enforce strict privacy regulations that protect account holder identities and transaction details. Confidentiality remains a core principle, though transparency requirements such as CRS and FATCA ensure compliance with international tax standards.

Diversified investment opportunities

Offshore accounts often grant access to global capital markets, alternative investment products, and multiple currencies. Diversification allows businesses and investors to spread risk and capture stronger returns from emerging or stable economies.

Disadvantages of offshore banking

Regulatory and compliance obligations

Offshore banking is closely monitored under global frameworks. Account holders must comply with anti-money laundering (AML) rules, tax reporting standards, and know-your-customer (KYC) requirements enforced by both local and international authorities.

High minimum balance and setup cost

Opening an offshore account usually requires a significant initial deposit and annual maintenance fees. Some banks also charge for due diligence, document authentication, and compliance reviews.

Jurisdiction risk

Choosing an unregulated or low-reputation jurisdiction exposes clients to legal uncertainty, weak deposit protection, and potential reputational damage. Selecting a well-established jurisdiction is essential to mitigate risks.

Complex management

Maintaining an offshore account demands ongoing administration, accurate tax filings, and professional oversight. Failure to manage reporting or documentation can lead to penalties and compliance breaches.

Summary comparison:

| Category | Advantages | Disadvantages |

| Taxation | Low or zero corporate tax rates enhance profitability | Complex reporting under CRS, FATCA, and AML laws |

| Asset protection | Legal safeguards secure assets from domestic risks | Lower protection in poorly regulated jurisdictions |

| Global access | Multi-currency banking and remote management | Additional time and cost for setup and compliance |

| Confidentiality | Strong data protection and banking privacy | Transparency rules require disclosure to authorities |

| Cost | Potentially higher returns from global investments | High initial deposit and ongoing service fees |

| Investment | Broader access to international markets | Risk exposure to unfamiliar or volatile assets |

To gain the full advantages of offshore banking, choose a reputable, well-regulated jurisdiction and work with professionals who understand global compliance requirements. This ensures financial transparency, long-term asset protection, and consistent growth across markets.

Best countries to open offshore bank account

Selecting an appropriate jurisdiction is a crucial step in establishing an offshore account. The best offshore banks combine economic stability, modern financial infrastructure, and favorable legislation that supports global wealth management. Each location offers distinct strengths suited to different objectives, and here are some potential options:

Belize

Belize provides an efficient banking framework supported by strict confidentiality rules and a straightforward setup process. Its cost-effective environment, multi-currency services, and remote account access appeal to entrepreneurs seeking international diversification. Through Belize company formation with bank accounts, investors gain access to robust online platforms and reliable financial protection under local banking regulations.

British Virgin Islands (BVI)

The BVI stands out for its sound regulatory structure and reliable economic governance. Establishing a BVI offshore bank account enables efficient cross-border transactions and zero corporate taxation on non-resident earnings. Its global recognition enhances credibility for companies engaged in trade or asset management.

Cayman Islands

The Cayman Islands feature one of the most respected financial systems in the world, supported by a clear legal environment and trusted institutions. Cayman Islands offshore banking offers access to international capital markets, exceptional liquidity, and advanced client safeguards.

Other jurisdictions such as Singapore, Hong Kong, and Switzerland also deliver sophisticated digital services and consistent regulatory reliability.

Careful selection of location depends on business priorities such as tax efficiency, wealth protection, or international expansion. And with BBCIncorp, you gain access to expert guidance, reliable partnerships, and complete support throughout the process, so you can choose the right jurisdiction and open an offshore bank account that fits your long-term objectives.

Contact us today or visit our website to start building a secure and efficient global banking strategy.

Free ebook

New to offshore business landscapes?

All the essential information you need is right here.

Conclusion

In this article, we have provided a complete overview of how to open an offshore account and the advantages it can bring to your business. The growing number of entrepreneurs and multinational companies choosing offshore banking reflects its strong appeal in reducing taxes, protecting assets, and managing multiple currencies with greater flexibility and privacy.

Opening an offshore bank account is a seamless process when guided by experienced professionals. With the right jurisdiction and banking partner, you can access global financial opportunities and strengthen your company’s international presence.

Contact BBCIncorp today at service@bbcincorp.com to begin setting up your offshore account and take the next step toward ease of global banking.

Frequently Asked Questions

How to withdraw money from an offshore account?

Withdrawing funds from an offshore account is usually simple and secure. Most banks issue debit or ATM cards that allow international withdrawals in multiple currencies. Online banking platforms also let you transfer money to domestic accounts, often at competitive exchange rates. However, it’s important to understand the withdrawal rules before proceeding.

Some banks charge higher fees for frequent or small withdrawals, while others limit large transactions for security reasons. Certain banks also offer wire transfers or cheque drafts, though these options may take longer to process. Please always confirm the fees and transfer methods with your bank first.

How much money do you need to open an offshore account?

The minimum deposit to open an offshore account varies depending on the bank, location, and account type. Some entry-level options start at around US$500, but most reputable offshore banks require between US$5000 and US$10000. Premium or private banking services, often designed for high-net-worth clients, may ask for deposits exceeding US$500000. The required balance also depends on whether the account is personal or corporate. In reality, business accounts usually demand higher initial funding to cover compliance checks and administrative fees.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.