Table of Contents

Cyprus continues to attract global investors, entrepreneurs, and professionals with one of Europe’s most favorable tax systems. Its low tax rates, broad treaty network, and transparent regulations make it a preferred destination for both residents and non-residents. However, navigating income tax in Cyprus requires more than surface knowledge.

Understanding who qualifies as a tax resident, what income is taxable, and which exemptions apply can unlock crucial financial advantages. Let’s explore the key aspects with BBCIncorp and see how Cyprus’s tax landscape can help you build a more efficient and globally connected business venture.

Who must pay income tax in Cyprus?

Cyprus has built a reputation as a tax-efficient jurisdiction with clear laws and consistent administration. Before diving into residency rules or exemptions, it is important to know what the Cyprus income tax actually is and how it applies.

What is income tax in Cyprus?

Income tax in Cyprus is a direct tax levied on the earnings of individuals and legal entities under the income tax law Cyprus. It covers income generated from employment, self-employment, business activities, rents, pensions, dividends, and other financial gains.

The system is progressive, with tax rates ranging from 0 percent to 35 percent for annual income above €60,000. What sets Cyprus apart is its relatively low effective tax burden, extensive network of double tax treaties, and a clear distinction between residents and non-residents.

The combination has made the island a preferred destination for entrepreneurs, investors, and professionals seeking stability and efficiency in tax planning.

Cyprus tax residency criteria

An individual is regarded as a tax resident if they meet either the 183-day or the 60-day rule within a given calendar year. The 183-day rule applies when a person spends at least 183 days in Cyprus during that year.

The 60-day rule, introduced in 2017, applies to individuals who do not reside in any other country for more than 183 days and meet all of the following conditions:

- They stay in Cyprus for at least 60 days during the year.

- They maintain a permanent home in Cyprus, either owned or rented.

- They conduct business, are employed, or hold an office in a Cyprus company.

Resident vs non-resident taxpayers

Residents of Cyprus are taxed on their worldwide income, including employment, rental, dividends, and capital gains. Non-residents, on the other hand, are taxed only on income arising from Cyprus sources such as local employment or property rentals.

Understanding this difference is essential for anyone planning to relocate, invest, or work in Cyprus.

Taxable individuals and exempt groups

Under the personal income tax Cyprus framework, the following individuals are generally subject to income tax:

- Employees working in Cyprus for local or international companies.

- Self-employed persons generating income from activities within the country.

- Pensioners receiving income from Cyprus sources.

- Company directors earning management or service fees from Cyprus entities.

Certain groups and income categories are exempt from taxation. Diplomats and foreign officials under reciprocal agreements are not liable for the income tax. Pensions received from abroad are usually taxed at a reduced rate of 5 percent on amounts above €3,420 per year, with the option to choose normal rates if more favorable.

Several types of investment income, such as dividends or interest, are exempt from income tax but may fall under the Special Defense Contribution if the individual is both tax resident and domiciled in Cyprus.

In short, the Cyprus income tax system offers clarity, consistency, and a high level of transparency. Its residency-based approach gives international taxpayers flexibility, while its exemptions and double tax treaties strengthen its appeal as a global business hub.

Cyprus personal income tax rates and brackets

Cyprus maintains one of the most straightforward and competitive personal tax systems in the European Union. Let’s delve into how Cyprus tax rates apply.

Current tax brackets in Cyprus

As of 2025, personal income in Cyprus is taxed based on progressive income brackets. The higher the income, the higher the applicable rate.

| Annual taxable income (€) | Tax rate (%) |

| 0 – 19,500 | 0 |

| 19,501 – 28,000 | 20 |

| 28,001 – 36,300 | 25 |

| 36,301 – 60,000 | 30 |

| Above 60,000 | 35 |

Under this model, the first €19,500 of an individual’s annual income is exempt from taxation. This exemption provides significant relief for low to middle-income earners and encourages talent mobility into Cyprus.

Progressive taxation means that only the income within each bracket is taxed at the corresponding rate, rather than applying a single rate to total income.

Special income tax rates and exemptions

One of the most notable is the 50 percent exemption for expatriates. Individuals earning above €55,000 per year who were not Cyprus tax residents for at least ten consecutive years prior to commencing employment can claim a 50 percent reduction on their employment income for up to 17 years.

For those who began employment before 2022, a similar exemption remains available under the previous €100,000 threshold, provided they meet certain residency and employment criteria. This incentive strengthens Cyprus’s position as a hub for multinational operations and international headquarters.

Other income categories

Not all income types are subject to the same rules. Dividends and most forms of interest income are exempt from income tax in Cyprus. Regardless, they may be subject to the Special Defense Contribution if the individual is both resident and domiciled in Cyprus.

Rental income is partially exempt, with 20 percent of gross rent automatically deducted before taxation.

How to calculate your income tax in Cyprus

Calculating income tax in Cyprus is a clear process once the key figures are clear. Individuals can use online calculators or perform manual estimates to find their annual tax liabilities accurately.

Using the Cyprus income tax calculator

Taxapp.cy is one reliable tool for taxpayers to figure out their tax amount in seconds. Users can enter their gross annual income, applicable deductions such as pension or social insurance contributions, and any exemptions available under expatriate or investment rules.

Once these figures are submitted, the calculator produces an instant estimate based on the latest rates and exemptions. It also offers a practical view of how to pay your income tax throughout the fiscal year.

Manual calculation example

Consider an employee earning €50,000 per year in Cyprus. Based on current personal income tax rates:

- The first €19,500 is tax-free.

- The next €8,500 (from €19,501 to €28,000) is taxed at 20 percent, giving €1,700.

- The next €8,300 (from €28,001 to €36,300) is taxed at 25 percent, giving €2,075.

- The remaining €13,700 (from €36,301 to €50,000) is taxed at 30 percent, giving €4,110.

The total payable income tax equals €7,885 for the year.

In addition, employees contribute 8.8 percent of their salary to the Social Insurance Fund, while employers contribute 9.8 percent. For a €50,000 salary, the employee’s contribution amounts to €4,400. The amounts are separate from income tax and cover healthcare, pensions, and social security benefits.

It’s important to note that although manual calculation is useful for clarity, online tools such as taxapp.cy makes the process faster and more precise.

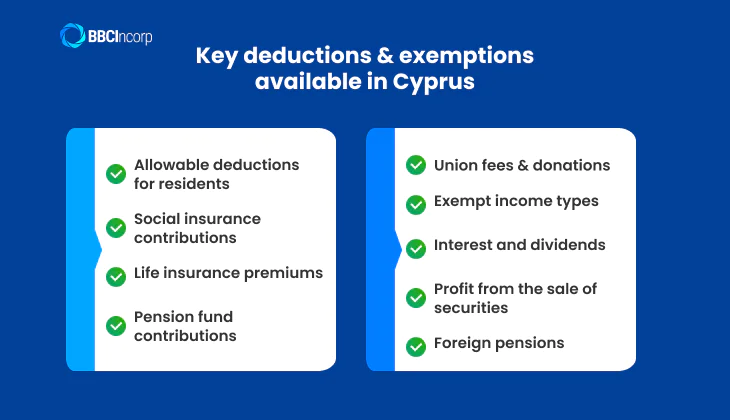

Key deductions and exemptions available

Cyprus provides a range of deductions and exemptions that reduce overall tax liability under the income tax law Cyprus as follows.

Allowable deductions for residents

Residents may claim specific deductions approved by the Cyprus Tax Department to lower their taxable income.

Social insurance contributions

Payments to the Social Insurance Fund are fully deductible. Employees contribute 8.8 percent of their gross salary, and employers pay 9.8 percent. These payments support healthcare, unemployment, and pension systems.

Life insurance premiums

Premiums paid for approved life insurance policies are deductible up to seven percent of the insured amount. However, the total deduction for life insurance and pension contributions cannot exceed one-sixth of taxable income.

Pension fund contributions

Employee contributions to recognized pension, provident, or retirement funds qualify for deduction, provided they stay within the same one-sixth cap when combined with life insurance premiums.

Union fees and donations

Membership fees to registered trade unions or professional associations are deductible. Donations to approved charities or public-interest organizations are also deductible if supported by receipts.

Exempt income types

Certain income sources are excluded from personal income tax in Cyprus to encourage investment and attract international residents.

Interest and dividends

Interest and dividend income are exempt but may fall under the Special Defense Contribution (SDC) if the taxpayer is both resident and domiciled in Cyprus. Non-domiciled residents are fully exempt from SDC, giving them a tax advantage on global investment returns.

Profit from the sale of securities

Profits from selling shares, bonds, and similar financial instruments are entirely exempt from income tax, supporting Cyprus’s appeal as an investment destination.

Foreign pensions

Pension income from abroad is taxed at a flat rate of five percent on amounts above €3,420 per year. The first €3,420 remains tax-free, providing retirees with a cost-efficient structure compared to many European jurisdictions.

How to pay Cyprus income tax

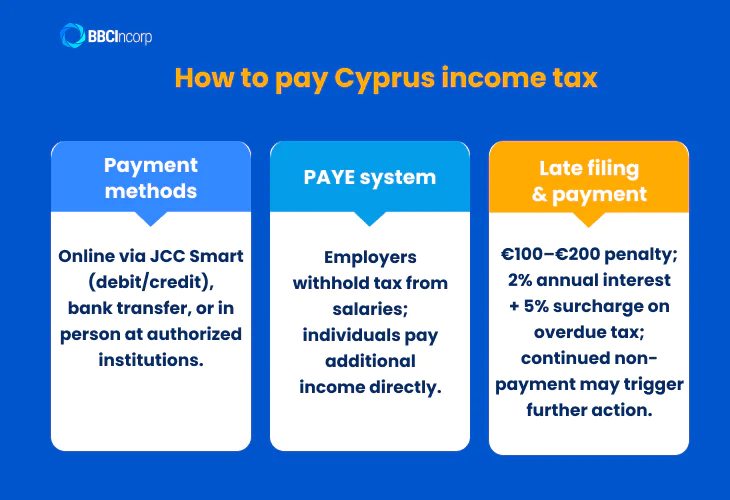

The process for settling income tax in Cyprus is clearly defined under the guidelines of the Cyprus Tax Department. Both residents and non-residents with taxable income must complete annual filing and payment within the official deadlines.

Filing deadlines and process

The Cyprus tax year runs from 1 January to 31 December.

For individual taxpayers, the deadline to submit the income tax return through the Tax For All (TFA) platform is usually 31 July of the following year. Any tax due must also be settled by this date. Employees whose income tax is deducted through the Pay As You Earn (PAYE) system typically have no further action unless they earn additional income.

For businesses and self-employed persons who prepare audited accounts, the deadline is 31 March of the second year following the tax year. Companies must file Form TD4 through the TFA system by the deadline. Provisional tax payments are made in two equal installments, on 31 July and 31 December of the tax year. The final payment is due by 1 August of the next year.

All tax submissions take place through the Tax For All (TFA) online platform, which replaced TAXISnet in 2023. Registration requires a valid Tax Identification Code. The process involves:

- Logging into the TFA portal.

- Entering personal and income details, including salary, investment, or rental income.

- Declaring eligible deductions and exemptions.

- Reviewing the calculated tax liability.

- Submitting the form electronically.

Payment methods and late penalties

After submission, payments can be made online through the JCC Smart portal, which accepts both debit and credit cards. Payments may also be processed through bank transfers or in person at authorized financial institutions.

As stated, employers generally withhold tax through the PAYE system. Individuals with additional income must pay any outstanding amount directly.

Late filing results in an administrative penalty of €100 or €200, depending on the type of declaration. In addition, delays in payment trigger interest at 2 percent per year, calculated monthly according to the rate set by the Ministry of Finance, and an additional 5 percent surcharge on overdue tax.

Continued non-payment can and will result in further administrative action by the Tax Department. Hence, following the correct filing schedule and using recognized payment channels is the most efficient way to stay compliant under the income tax Cyprus system.

Tax treatment for non-residents and expatriates

Non-residents are taxed only on income derived from sources within Cyprus. This includes employment performed in the country, profits from a business operating in Cyprus, and rental income from local property. Income earned abroad is not taxable in Cyprus, which benefits foreign investors and entrepreneurs with global operations.

Residency criteria: 183-day and 60-day rule

An individual becomes a Cyprus tax resident if they meet either the 183-day or 60-day rule.

- Under the 183-day rule, a person qualifies as a resident after spending at least 183 days in Cyprus during the tax year.

- The 60-day rule applies when a person resides in Cyprus for at least 60 days, maintains permanent residence or business ties in the country, and is not a tax resident elsewhere.

Non-domicile rule and SDC exemption

The non-domicile rule grants exemption from the Special Defense Contribution (SDC) for 17 years after obtaining Cyprus tax residency. Non-domiciled individuals do not pay SDC on dividends, interest, or rental income, making the jurisdiction highly attractive to investors and high-net-worth individuals.

Why expatriates choose Cyprus

Cyprus combines lifestyle advantages with financial benefits. Its moderate Cyprus tax rates, reliable infrastructure, and residency programs attract digital nomads, retirees, and professionals. The digital nomad visa, for example, allows individuals to live in Cyprus while working remotely for foreign employers.

These incentives position Cyprus as one of Europe’s most appealing and efficient tax environments for non-residents and expatriates.

Tax treaties and avoiding double taxation

Cyprus has built one of the broadest double taxation agreement (DTA) networks in Europe, covering more than 65 countries across all major continents.

The network includes key trade and investment partners such as the United States, the United Kingdom, Germany, France, China, India, Singapore, the United Arab Emirates, and other EU and OECD members. New treaties and updates are regularly negotiated to keep the system consistent with evolving global tax standards, including the OECD Model Convention.

Overview of Cyprus DTAs

Under the income tax law of Cyprus, a DTA allocates taxing rights between Cyprus and another contracting country to prevent the same income from being taxed twice. The agreements apply to both individuals and legal entities that are residents of one or both contracting jurisdictions.

The treaties generally cover taxes on income, capital gains, and certain corporate profits. They also include mechanisms for resolving disputes through mutual agreement procedures, creating a stable and predictable environment for cross-border business and personal income management.

Main benefits of DTAs

Cyprus DTAs typically grant relief through three mechanisms: tax credits, exemptions, or reduced withholding tax rates.

- A tax credit lets taxpayers who have paid foreign income tax to offset that amount against their Cyprus income tax liability.

- An exemption may apply when specific types of income, such as employment or pension income, are taxable only in one jurisdiction.

- Reduced withholding tax rates often apply to dividends, interest, and royalties, depending on the treaty..

Examples of treaty benefits

The Cyprus–UK DTA exempts dividends and interest payments from withholding tax when certain ownership or residency conditions are met. The Cyprus–India DTA offers foreign tax credit relief, allowing Cyprus residents to offset tax already paid in India.

Similarly, treaties with Germany and Singapore provide low or zero withholding tax rates on dividends and royalties, supporting cross-border investment flows.

Top Cyprus tax pitfalls and how to steer clear of them

Even with its business-friendly environment, Cyprus has specific tax rules that demand careful attention. Common mistakes often arise from unclear residency status, incorrect filings, or missed payment deadlines.

Tax residency misconceptions

One of the most frequent pitfalls is misapplying the 183-day or 60-day rule. Many individuals incorrectly assume that short visits or temporary stays make them residents, leading to dual taxation risks. Determining residency under income tax in Cyprus depends on time spent in the country and the presence of a permanent home or business connection.

Missing reporting or payment deadlines

Late filings or underpayments can trigger administrative penalties and interest charges. Individual taxpayers must submit electronic returns by 31 July, while companies and self-employed individuals with audited accounts have until 31 March of the following year.

As a result, payments made after these dates accumulate fines and interest as defined under how to pay Cyprus income tax regulations.

Lack of professional guidance

Cyprus tax law can be complex for new residents and international businesses. Working with qualified advisors helps clarify obligations, reduce compliance risks, and keep tax filings accurate and on time. Thus, partnering with BBCIncorp provides access to experienced professionals who understand both local regulations and international tax principles.

Future trends and updates in Cyprus tax landscape

Cyprus is reshaping its tax environment to maintain competitiveness and meet international expectations. Key developments include:

Expanded incentives for high earners

Authorities are reviewing the existing 50% income tax exemption for foreign professionals earning above €55,000. Proposed amendments may extend eligibility and introduce new benefits to attract skilled workers and investors.

Ongoing tax reform and green initiatives

Discussions on a new green tax system are underway, focusing on energy, transport, and emissions. The goal is to align Cyprus’s fiscal system with EU sustainability standards while maintaining balanced Cyprus tax rates.

Stronger global compliance

Cyprus continues to align with the OECD’s BEPS (Base Erosion and Profit Shifting) framework and CRS (Common Reporting Standard) to promote integrity following the income tax law.

Digitization of the tax system

The Tax For All (TFA) platform is expanding to simplify e-filing, automate income tax assessments, and improve user access. This transition reflects the government’s aim to make tax management faster, more accurate, and secure for both individuals and businesses.

Collectively, the latest initiatives confirm Cyprus’s dedication to maintaining a fair and efficient tax system.

Partnering with BBCIncorp for stress-free Cyprus tax compliance

At BBCIncorp, we simplify every step of doing business in Cyprus. By combining international tax expertise and local knowledge, we ensure you remain compliant and structure your company effectively at all times.

Our key services include:

- Company formation: We handle the entire incorporation process, from name checks and document filing to government fees.

- Registered support: One year of company secretarial service, registered agent, and local registered address included.

- Corporate documents: We provide digital company documents, with options for notarized or apostilled copies when needed.

- Bank account assistance: Our team supports banking applications, helps open accounts remotely, and advises on suitable alternatives if the first is not approved.

- Tax and compliance support: We assist with tax residency registration, filings, and strategic tax planning for both individuals and expatriates.

- Dedicated assistance: Expect fast responses and regular updates throughout your incorporation and banking process.

- Streamlined client portal platform: Manage all your entities, track filings, and access key documents in one secure online hub powered by our tech team.

Don’t hesitate to explore our Cyprus offshore company incorporation service today or chat with BBCIncorp team to receive support on any questions you may have on operating in Cyprus.

To conclude this article

Cyprus stands out as a leading destination for individuals and businesses seeking a transparent and efficient tax environment. With clear residency rules, competitive Cyprus tax rates, and generous exemptions, the island offers a modern framework for global earners and investors.

Understanding income tax in Cyprus is essential for optimizing your financial position and avoiding unnecessary liabilities.

BBCIncorp provides complete assistance with company formation, tax planning, and compliance, helping businesses operate confidently within Cyprus company tax rate regulations. Whether you are relocating, expanding, or managing cross-border operations, our team ensures your structure remains compliant and tax-efficient.

Contact us today at service@bbcincorp.com to receive expert guidance and start building your success in Cyprus.

Frequently Asked Questions

What is the tax-free threshold in Cyprus?

In Cyprus, the tax-free threshold for personal income is €19,500 per year. Income up to this amount is not subject to personal income tax. Income above this threshold is taxed at progressive rates starting at 20 percent and increasing with higher income brackets.

The threshold applies to all tax residents, including individuals employed, self-employed, or receiving pensions in Cyprus.

This provision allows residents to retain a portion of earnings without tax liability, forming the basis of Cyprus’s personal income tax structure and providing clarity on the minimum level of taxable income under Cyprus income tax law.

What types of income are taxable in Cyprus?

Taxable income in Cyprus includes employment wages, pensions, rental income, royalties, and business profits.

Individuals who are tax residents are generally subject to tax on worldwide income. Meanwhile, non-domiciled residents benefit from exemptions on dividends, interest, and capital gains under the non-dom regime.

This includes foreign-sourced dividends and interest, which are exempt from the Special Defense Contribution. Other income categories remain fully taxable. Notably, the rules apply uniformly to residents, self-employed individuals, and company directors.

How does Cyprus tax foreign income for residents?

Tax residents in Cyprus are liable for tax on worldwide income, including salaries, dividends, interest, and rental income earned abroad. Foreign income may qualify for relief under Cyprus’s double taxation treaties with over 65 countries.

Residents can claim foreign tax credits or exemptions to avoid being taxed twice on the same income. These treaties cover employment income, pensions, business profits, and investment returns. In the case of non-residents, they are generally taxed only on Cyprus-sourced income.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.