Table of Contents

The fundamental decision of structuring your business as either incorporated vs. unincorporated carries significant weight. This choice dictates crucial aspects such as taxation, the level of your liability for business debts, and the extent of regulatory oversight. Considering that small and medium-sized enterprises (SMEs) are a vital engine of the global economy, as a business owner, it is critical to make a well-considered choice about business structure for long-term success and stability.

In this article, we will delve into the key features of these structures, the difference between unincorporated and incorporated businesses, and provide you with the knowledge to determine which legal framework best aligns with your specific business objectives.

Overview of unincorporated vs. incorporated business

When deciding how to structure your business, both as incorporated or unincorporated, you must consider their definitions and how they affect liability, taxation, and long-term growth into consideration.

What is an incorporated business?

An incorporated business operates as a distinct legal entity, separate and apart from its owners. This legal separation provides a crucial shield, limiting the personal liability of the owners for the business’s debts and legal obligations.

The two most common forms of incorporated businesses are:

Corporation

Corporations are characterized by a formal structure with ownership held by shareholders and governance overseen by a board of directors. They are often the preferred structure for businesses with ambitious scaling plans or those seeking to attract significant capital investment.

Generally, there are two types of corporations: C corporations and S corporations.

Limited Liability Company (LLC)

Limited Liability Companies (LLCs) provide a valuable combination of strong liability protection along with the option for pass-through taxation (or the flexibility for owners to choose their preferred tax treatment), simplified management structures, and fewer regulatory complexities. This makes LLCs a favored choice for many small to mid-sized businesses..

What is an unincorporated business?

Conversely, an unincorporated business meaning lacks a separate legal identity from its owner. While easier to establish and manage initially, the owner(s) bear full personal responsibility for all business-related debts and obligations.

Common examples of unincorporated businesses include:

-

- Sole Proprietorship: A sole proprietorship is the simplest and most common structure, where a single individual directly owns and operates the business..

- Partnership: A partnership involves two or more individuals who share in the ownership, responsibilities, and profits and losses of the business, which are typically passed directly to the partners.

Ultimately, the best choice between an incorporated and unincorporated business structure depends on your long-term vision, your risk tolerance, and your growth objectives. As you weigh these options, you may also find it useful to read our related articles discussing the intricacies of each business structure.

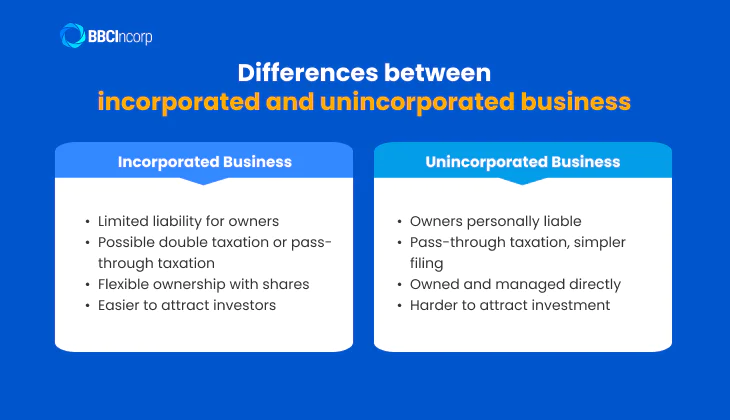

What is the difference between an incorporated and unincorporated business?

Below, we compare the difference between incorporated and unincorporated under four critical categories: liability, taxation, ownership and management, and investment potential.

Liability

As stated, an incorporated business is a separate legal entity from its owners, and this limited liability is a main benefit of incorporation. The owners are not personally responsible for business debts or legal claims.

In contrast, an unincorporated business, like a sole proprietorship or partnership, does not give this protection. The owner or partners are personally liable for all debts and duties, which may expose your assets to joint business risks.

Taxation

Tax treatment shows a large variance in the incorporated vs. unincorporated business comparison.

Incorporated businesses follow varied regulations based on their type:

- A C corporation pays corporate income tax apart from its owners. Profits given as dividends face tax again at the personal level.

- S corporations and LLCs can be taxed as pass-through entities, avoiding double taxation while still giving liability protection.

Nevertheless, incorporated structures often involve more complex tax filings and compliance needs, though they also allow more deductions and reinvestment chances.

Unincorporated businesses tend to leverage pass-through taxation. This means business income is reported on the owner’s personal tax return, which simplifies filing and implies a lower overall tax burden.

Ownership and management

Incorporated businesses allow flexible ownership. Shares can go to founders, investors, or employees. These businesses are managed through a formal structure that may include directors and officers, with set roles and governance.

Unincorporated businesses are usually personally owned and managed directly by the individual or partners. While this can speed up decisions, it lacks the formality needed for scaling or transferring ownership.

Investment potential

Incorporated businesses typically find it easier to attract investment. Their ability to issue shares to raise capital, coupled with their perceived stability and transparency by financial institutions and investors.

On the other hand, unincorporated businesses encounter limits when seeking funding. Their inability to offer equity in a similar manner can make them appear riskier to potential investors, thus restricting their access to capital for expansion.

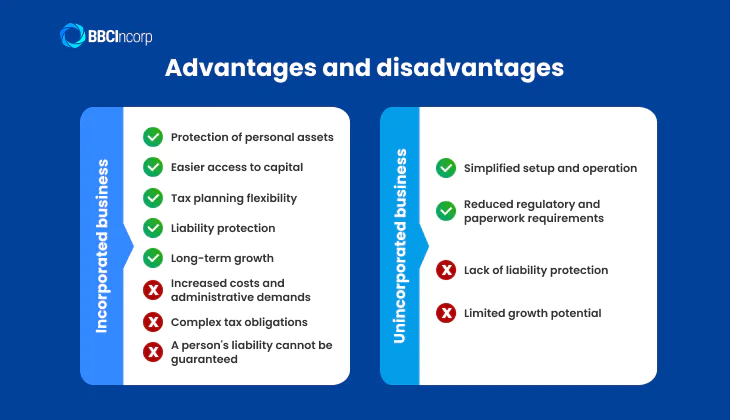

Incorporated business vs. unincorporated business: Pros and cons

Let’s break down the advantages and disadvantages of each setup in order to decide which is right for you based on your goals.

Incorporated Business: Key Pros and Cons

Pros of an incorporated business

Protection of personal assets

Incorporation creates a legal distinction between the business and its owners. For instance, when a property sold by a corporation was later found to have defects, the business founder was shielded from personal liability. The court held the corporation, not the individual, responsible, thereby protecting his assets.

Easier access to capital and business continuity

Incorporated entities can raise funds through the sale of shares and are generally viewed as more credible by investors and lenders. Additionally, corporations have perpetual existence, ensuring business continuity beyond the involvement of the original owners.

Tax advantages of incorporation

Incorporation offers businesses significant tax planning flexibility. It enables access to a wider range of eligible deductions, the potential to retain earnings taxed at potentially lower corporate rates, and the strategic distribution of profits through dividends. This structural advantage can lead to a reduced overall tax liability for the business owners. For companies operating in tax-favorable jurisdictions, these benefits are amplified even more.

Liability protection and enhanced credibility

Incorporation as a limited liability entity establishes a distinct legal separation between your personal assets and your business. This crucial distinction safeguards your personal wealth from business debts and legal challenges. Furthermore, operating as a corporation often enhances your company’s credibility with investors, strategic partners, and customers.

Perpetual existence and long-term growth

Unlike unincorporated business structures, a corporation possesses perpetual existence. Its lifespan is not tied to the ownership or management of the business, ensuring continuity beyond personnel changes. This inherent stability is vital for fostering long-term growth strategies, facilitates smoother succession planning, and provides reassurance to investors and clients regarding the business’s longevity and reliability.

A well-known example is Ben & Jerry’s, which started as a small partnership but was incorporated in the 1980s to expand and attract outside capital. This move laid the foundation for its eventual acquisition by Unilever, while preserving its brand mission until now.

Cons of an incorporated business

Increased costs and administrative demands

Incorporation necessitates registration fees, continuous adherence to regulatory requirements, and the maintenance of formal procedures like regular meetings and detailed record-keeping.

Complex tax obligations

Navigating corporate tax filings presents greater complexity than personal tax filings, and depending on the chosen structure (e.g., a C corporation), business owners may face the issue of double taxation. In such instances, you should start seeking professional support from business experts within the target market.

A person’s liability cannot be guaranteed

While incorporation aims to provide limited liability, this protection is not absolute. In situations where the corporation lacks sufficient assets to secure financing, lending institutions may require personal guarantees from its owners. This stipulation bridges the gap between the corporation’s financial standing and the lender’s risk assessment, potentially exposing personal assets to liability in the event of default.

Unincorporated: Key Pros and Cons

Pros of an unincorporated business

Simplified setup and operation

An unincorporated business with one owner, like a freelance copywriter or independent consultant, can commence operations swiftly without formal registration. This appeals to individuals testing a business concept or operating on a smaller scale.

Reduced regulatory and paperwork requirements

Unincorporated businesses face fewer compliance obligations, making them easier and more cost-effective to maintain. For example, a sole proprietor reports business income directly on their personal tax return, avoiding the need for separate corporate filings.

There’s no requirement to file annual corporate reports, maintain board meeting minutes, or comply with formal governance rules, freeing up your time and resources.

Imagine a bakery owner who began as a sole proprietor, focusing on local farmers’ markets and community catering. Without partners or employees, the unincorporated model provided full control and minimal administrative burden while she built her brand. Only after achieving stable revenue did she consider incorporation to facilitate expansion and manage liability effectively.

Cons of an unincorporated business

Lack of liability protection

Personal assets, such as savings, homes, and other investments, are potentially at risk if the business incurs significant debt or faces lawsuits. If your business defaults on a loan or is found liable in a legal dispute, the owner’s personal finances could be directly impacted to satisfy those obligations.

Limited growth potential

Your structure lacks the capacity to issue shares or offer equity, which are common mechanisms for raising capital in incorporated entities. Additionally, the informal governance structure of unincorporated entities may be viewed as less stable or transparent by potential investors, making them hesitant to provide substantial funding.

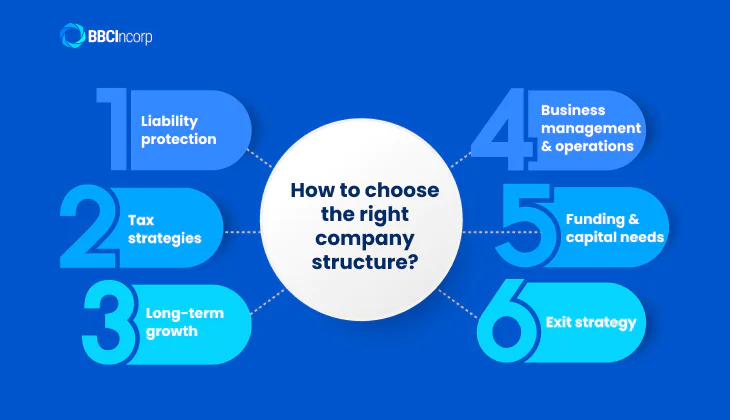

How to choose the right structure?

Aligning your choice with your current needs and future aspirations is crucial when choosing the right structure for your venture.

Consider liability protection

If you’re prioritizing maximum personal liability protection, launch an incorporated business. Unincorporated structures, such as sole proprietorships and partnerships, do not offer a legal separation between the owner and the business. In contrast, incorporation creates a separate legal entity, shielding your personal wealth from business liabilities.

Evaluate your tax strategies

If you’re evaluating your tax strategies, then pick the unincorporated option if you prefer simpler tax filing through pass-through taxation, where business income is reported on your personal tax return. This often results in a lower overall tax burden for smaller operations.

Conversely, if you anticipate more complex financial structures, but more tax incentives and potential tax planning opportunities, form an incorporated business.

Aim for long-term growth

Unincorporated businesses are often well-suited for small-scale operations with limited expansion plans. In contrast, incorporated businesses possess the ability to issue shares and attract investors, making them advantageous for startups and businesses with scaling ambitions.

If your vision includes substantial growth and external funding, incorporation provides a more flexible framework.

Assess business management and operations

Unincorporated businesses generally involve simpler management and fewer regulatory requirements, lacking the need for detailed financial records, formal board meetings, or complex compliance reporting.

Incorporated businesses, however, come with increased administrative responsibilities, including more stringent reporting and compliance obligations. Consider your capacity and willingness to handle these demands.

Examine funding and capital needs

Your initial and ongoing capital requirements should be factored in. Unincorporated businesses are often more practical for low-cost ventures with limited initial capital.

Incorporated businesses, while potentially requiring more significant upfront capital for formation and ongoing compliance, have greater potential to attract substantial investment.

Plan your exit strategy

If you’re planning your exit strategy already, then set up an incorporation for a more straightforward and clear process. The business can be sold as a whole entity or through the transfer of shares.

Unincorporated entities, being closely tied to the owner, are typically more challenging to transfer or sell.

Start your incorporated business with BBCIncorp

Embarking on global incorporation can seem daunting, but with the right support, forming your incorporated entity becomes a seamless process. At BBCIncorp, we specialize in international company formation, guiding you through every step to establish your business presence internationally in the most business-friendly jurisdictions.

Our company services encompass:

- Company incorporation: Expert support through the entire process of forming your company in your targeted market (e.g., Hong Kong, Singapore, Delaware, Belize, etc.)

- Multicurrency bank account opening: Facilitating the establishment of your business global banking account, both traditional and EMIs options.

- Annual compliance and reporting with the relevant regulatory authorities

- Accounting and auditing, company secretarial services, and so on!

Aiming for international business formation but still navigating the nuances of incorporated vs. unincorporated structures? Visit our site or contact BBCIncorp team today for a detailed consultation.

In conclusion

Deciding whether to incorporate or remain unincorporated is a key step with significant long-term effects on your business. As we’ve discussed, each structure has its pros and cons regarding how it handles liability, taxes, operations, and growth. To make the best choice for your business’s future, you must carefully consider these aspects concerning your specific goals and how much risk you’re willing to take.

If you’ve concluded that incorporating your business is the right move to support your growth, or if you are aiming to set up a company internationally, BBCIncorp is here to assist. We offer full support, from initial questions to getting your company incorporated and keeping it compliant at all times. Send us a message now at service@bbcincorp.com for timely support on incorporation.

Frequently Asked Questions

How to change from an unincorporated to an incorporated business?

Changing from an unincorporated to an incorporated business involves several key steps, and the specifics depend on your current structure and desired corporate form:

- Determine your new corporate structure: Decide if an LLC, S Corp, or C Corp best suits your needs.

- Register your new entity: File the necessary formation documents with the relevant state or jurisdiction.

- Find EIN tax ID: Apply for a new Employer Identification Number from the IRS (for most corporations and LLCs).

- Transfer assets and liabilities: Decide how to move existing business assets and debts to the new entity.

- Update licenses and permits: Ensure all business licenses and permits are in the new company name.

- Inform stakeholders: Notify customers, suppliers, and financial institutions of the change.

You can refer to a detailed example on changing from sole proprietor to LLC in our dedicated article for more information as well.

What is the difference between incorporated and corporation?

“Incorporated” (often abbreviated as “Inc.”) refers to the status of a business that has gone through the legal process of incorporation, meaning it has become a legal entity separate from its owners. An incorporated entity can be an LLC, an S corp, a C corp, etc.

A “corporation” is a specific type of incorporated business structure. So, while all corporations are incorporated, not all incorporated businesses are necessarily called “corporations” in their legal name (e.g., a Limited Liability Company is incorporated but usually denoted as “LLC”).

Is an LLC incorporated or unincorporated?

A Limited Liability Company (LLC) is considered an incorporated business structure. They can be single-member or multi-member LLCs.

Although the term “incorporated” is often associated with corporations (like C corps or S corps), LLCs are also legally registered entities separate from their owners.

Key features of an LLC that make it an incorporated entity:

- Separate legal status from the owner(s)

- Registered with the state or relevant authority through official formation documents

- Limited liability protection for its members (owners)

- Ability to enter into contracts, sue or be sued, and own property in the business’s name

However, LLCs are more flexible and simpler to manage than corporations. They often allow for pass-through taxation, meaning profits are taxed on the owners’ personal returns rather than at the company level.

How do taxes work for unincorporated businesses vs. incorporated?

Unincorporated businesses typically use pass-through taxation, where profits/losses are taxed on the owner’s personal return, and self-employment tax applies.

Incorporated businesses have more complex taxation:

- C corporations face double taxation (corporate tax and then dividend tax).

- S corporations and LLCs can elect pass-through taxation to avoid this, with income/losses taxed at the owner level.

While filings can be more complex for incorporated entities, they may offer more tax planning flexibility.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.